CHEAPR Update and COVID Outlook

CHEAPR Rebates – The Doldrums Continue

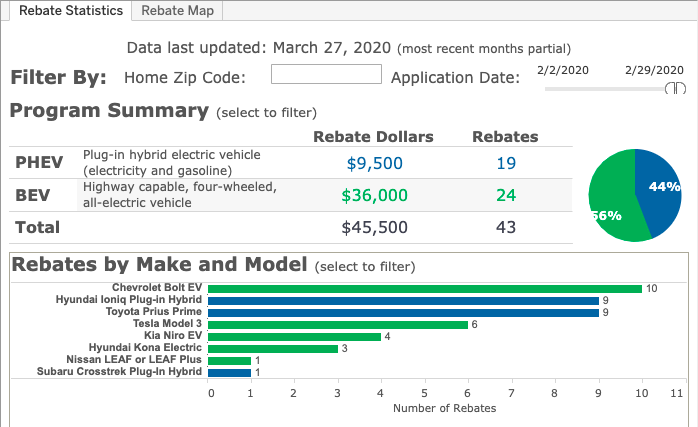

Given the after-effects of the change in rebate parameters, the numbers seen in the graph were not a surprise. This information dates through the end of February, which is the latest that has been released on the CHEAPR stats page.

The detail for the month is below:

February saw low rebate numbers, continuing the trend from January and Q4, due to the lack of improvements in the CHEAPR rules. The economic impact of COVID-19 has yet to be visible in this timeframe

The balance tipped slightly to BEVs because Bolt rebates increased while both Ioniq PHEV and Prius Prime rebates decreased. Tesla remains at a very low level since all but the most basic trim level of the Model 3 are now excluded. Deliveries of the Model Y have begun, though we don’t know how long it will be before volume ramps. That vehicle runs a few thousand dollars more than the Model 3 so we don’t expect it will qualify for rebates.

Last we heard, the new CHEAPR board was not completely filled, but they have a quorum. All that’s been done has been to extend the same parameters that were in effect in Q4 2019 into 2020. One-quarter of the way into the new year, there is still no news on promised revisions or on used EV purchase incentives.

As can be seen on the screenshot from the CHEAPR stats page, there was a total of $45,500 in rebates that were disbursed. This works out to $546,000 annually on a straight-line basis, against a budget of $3 million.

It is likely to be a difficult road ahead for at least the next few months. We can’t rule out the possibility that federal aid meant to counteract the impact of the recession on state finances will be inadequate. Early signs point to that being the case, as evidenced by what Governor Cuomo of NY had to say at a recent press conference. Budget cuts are inevitable and we wonder if CHEAPR will fall victim to that.

Plummeting Oil and Gas Prices

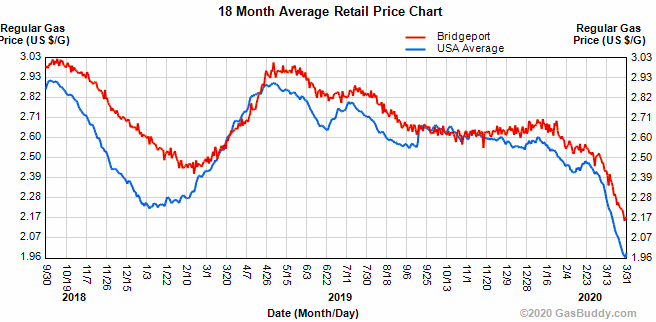

Part of this environment is plummeting gasoline prices. This is a recent chart from Gas Buddy and, well, you get the idea. The blue line is national and the red line is Bridgeport, CT.

Gas prices, or more specifically, the price per barrel of oil, are falling not only because of reduced demand from a recessionary economy exacerbated by social-distancing measures but also because of a price war between Russia and Saudi Arabia. Either one of those things would have caused this, but in this instance, demand began to fall, OPEC wanted to implement production cuts, Russia did not go along with it, and now Saudi Arabia is aggressively cutting prices, presumably to pressure Russia. This has accelerated the fall in the price per barrel. Absent some interim mediation, the next OPEC meeting is in June.

This could have knock-on effects for American (and other) shale oil, which according to Investopedia, has a floor price of anywhere from $40 to $90 per barrel. (This could be part of why Russia wants to do this.) Below is a chart of oil price trends. Shale oil is a heavily leveraged industry, so the impact could conceivably be felt in the bond market.

This blog is not a fan of shale oil. Fracking is environmentally destructive and produces a tremendous amount of natural gas, most of which is being flared at the well, spewing greenhouse gas emissions.

This week we also had the news of the administration formally implementing the rollback of phase 2 CAFE, though the question of whether the CARB states can return to a separate standard is still being litigated. This move will please the fossil-fuel industry. The rest of us lose. Even the automakers are less than enthused. It will accelerate carbon emissions, cause more sickness and death from air pollution, and, according to a report in the NY Times, and based on the administration’s own data, it will impose an economic cost on society as high as $22 billion.

Opportunity, Should Policy Makers Choose to Make Something of it

Despite the headwinds, there is likely more stimulus to come and this could be an opportunity. The first packages rightly focused on stanching the bleeding with unemployment insurance and support for small businesses. When the outbreak wanes, there will still be a need for fiscal stimulus. It is an opportune moment to craft such legislation so that it includes renewable energy infrastructure and purchase incentives. Wouldn’t it be nice to replace lost shale oil production with renewables and stationary storage?

Renewables and energy efficiency measures were a successful aspect of the 2009 stimulus legislation. And from that previous experience, it follows that there are data. They know what worked. This could help policy-makers to understand how to best incorporate long-term climate change objectives within short-term stimulus needs. Also, the energy-efficiency part of the 2009 stimulus did not include building infrastructure to better defend against severe storms and rising sea levels, which have now become a fact of life. This supports both resiliency and job creation. If this administration does not have the foresight to understand this, then perhaps we’ll have to wait and see if there’s a new sheriff in town in 2021. The passing of more legislation will almost certainly continue into next year.

In the meantime, it falls to us to accelerate EV adoption, one person at a time.