EV Registration Data Update – Top Makes and Models

CT Hits 36K Registered EVs As Of July 1

We have not yet received a file from the DMV in response to our Freedom of Information Act Request. This information is pulled off the public web.

There are 2 numbers out there. One is from DEEP and it is 36,269 registered EVs. Atlas Public Policy has updated its dashboard and cite the number of registered EVs as 35,884. Both DEEP and Atlas source the information from DMV. It looks to me like DEEP is including electric motorcycles and the handful of fuel-cell vehicles that are registered here. Atlas clearly is not.

Please keep in mind that the data are net registrations, not sales. Net registrations include new registrations over the past 6 months (including people moving into the state who already own an EV), plus previously registered vehicles, less vehicles that have turned over (sold, donated, junked, or owners left the state). Consequently, you will see examples of discontinued vehicles in these charts, a few of which have a fair number of lingering registrations.

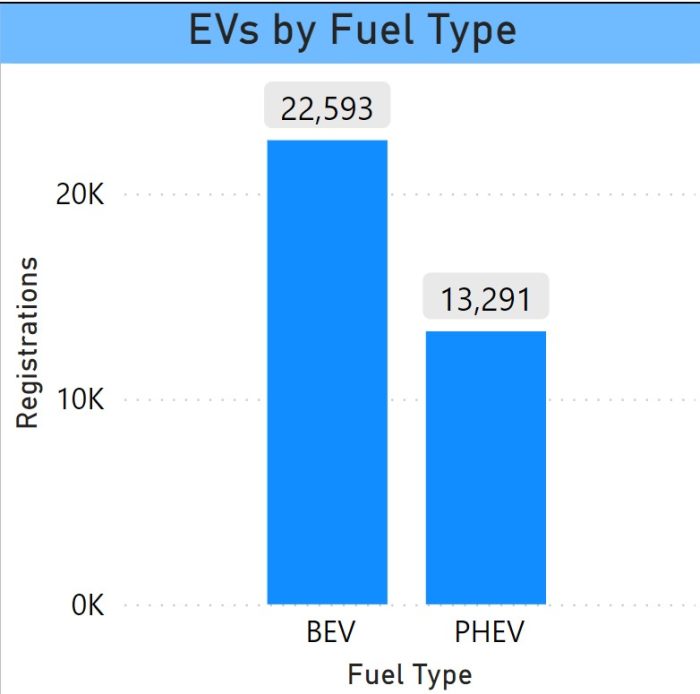

Fuel Type

The market continues trending toward fully electric Battery Electric Vehicles (BEV). The shift appears gradual in a trend line, which is because each new number is on top of an existing base. BEVs now account for 63% of EV registrations, up from 60% one year ago.

EVs by Make

The number of registered EVs by make are in the photo at the top of the post. Make is not the same as parent company (e.g. Chevrolet vs GM, Jeep vs Stellantis).

Tesla still retains a commanding lead with 14,408 or 40% of all EVs and 64% of BEVs. Tesla share of overall EVs is right at where it has been for years, while its share of BEVs is a little lower reflecting increased competition.

The second most widely registered moniker is Toyota with 4301, followed by Chevrolet (2204), Jeep (2078), Ford (1822), Hyundai (1817), BMW (1664), and Volvo (1393). All other makes are under 1000 and there is quite a long tail.

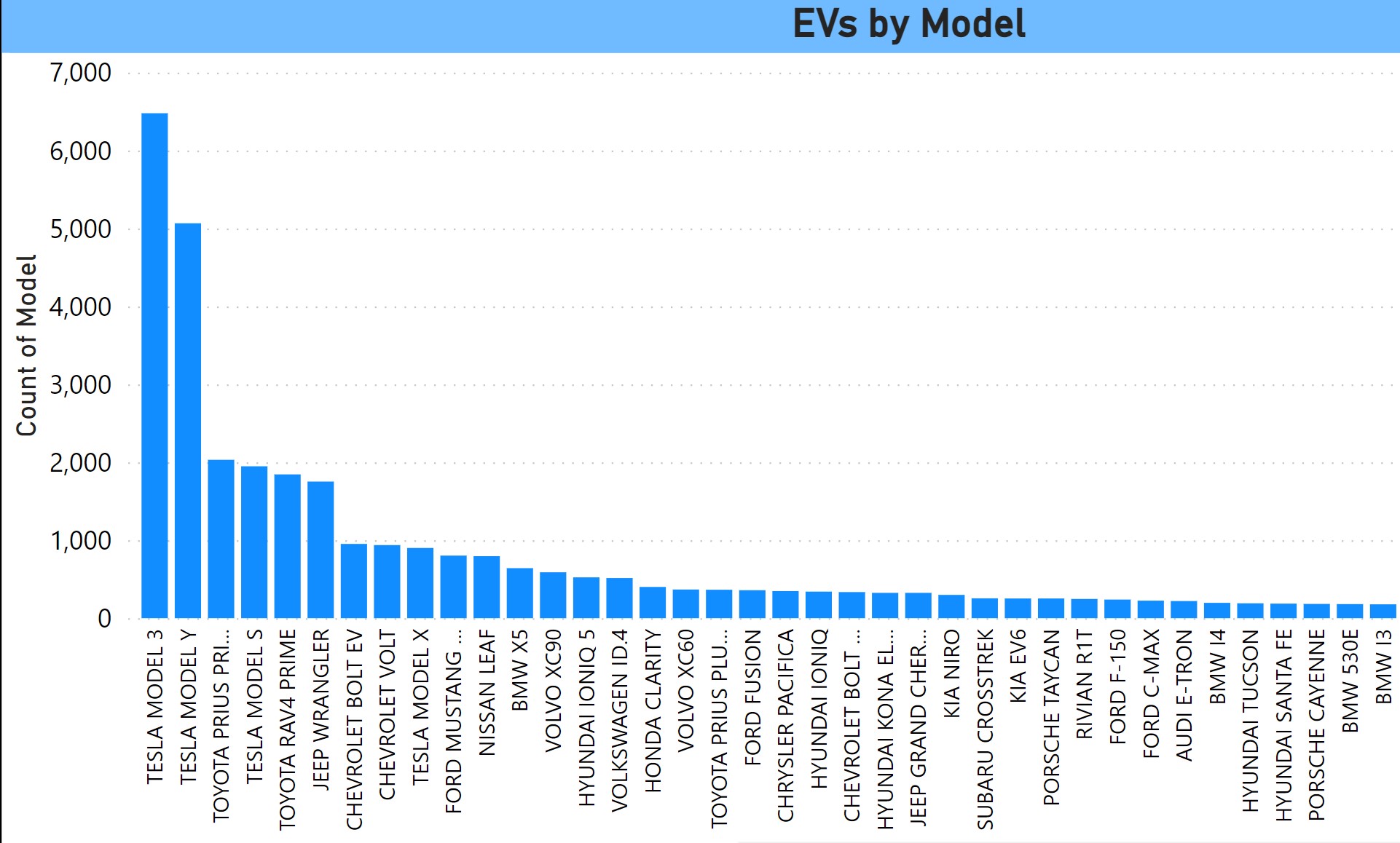

Model

There are a total of 111 different models in the dataset. This is summarized to the model level and does not separately break out different trim levels within model. Due to this large number, the graphic below is just an excerpt. Below are some of the manufacturers displayed separately.

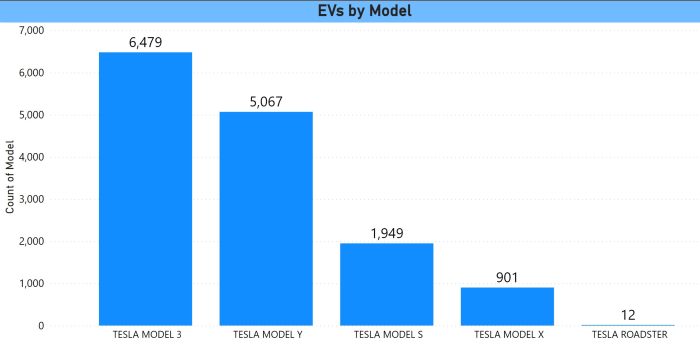

Tesla

The Model Y is the fastest-selling EV out there by a mile and it has almost caught up to the Model 3 in terms of net registrations. The Y and the 3 have clearly taken share from S and X sales. There are still a few Roadsters hanging on.

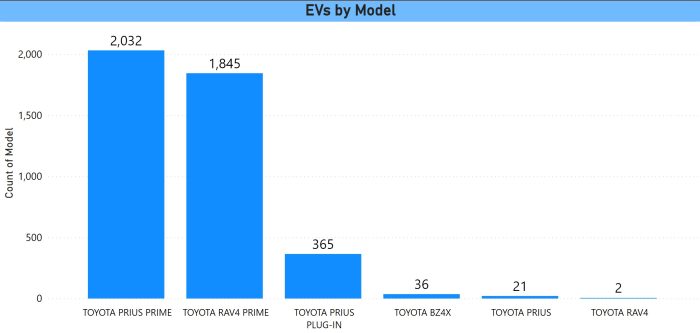

Toyota

Toyota surpassed Chevrolet, following the cancellation of the Volt and the introduction of the RAV4 Prime, to be the second most widely registered marque. Toyota’s new BZ4X has yet to make much of an impact. The chart separately shows the Prius Prime and its progenitor, the Plug-in Prius, which was Toyota’s first plug-in vehicle. It looked like the original Prius and was a very low-range PHEV. The 2 units labeled RAV4 are the all-electric RAV4 that was built about 10 years ago as a compliance car (using a Tesla powertrain). There weren’t that many built and very few of them made it out of California. There are also 21 Prius vehicles in the file where the model isn’t noted. That is just life with these files.

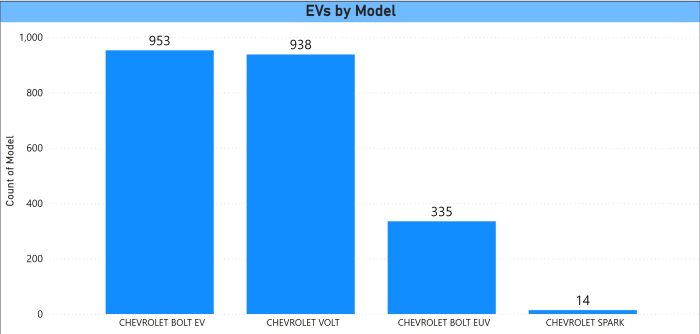

Chevrolet

Chevy, at one time the most widely registered make, has slipped to number 3 with 2240 registered EVs, barely above Jeep. The Bolt finally overtook the Volt which was canceled in 2019. GM had a hit with the recently introduced EUV version of the Bolt. The Bolt was recently canceled by GM, but in the face of consumer outcry, it was announced that the model will be coming back using the new Ultium platform. No date is yet announced. Chevy has upcoming BEV versions of the Silverado pickup (fall 2023), Equinox SUV (spring 2024), and Blazer SUV (spring 2024).

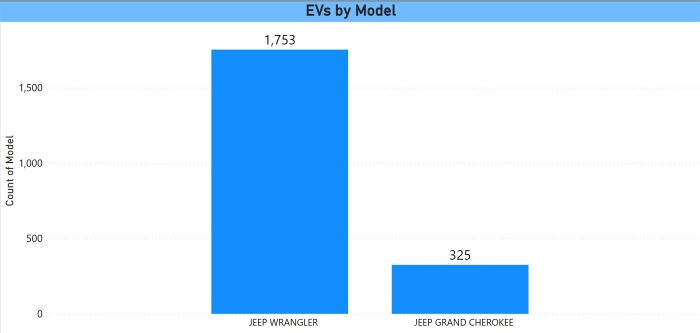

Jeep

Jeep places fourth with 2078 registrations. Most of these are the Wrangler PHEV. The Grand Cherokee is also a PHEV. Stellantis has developed a new EV platform for future vehicles.

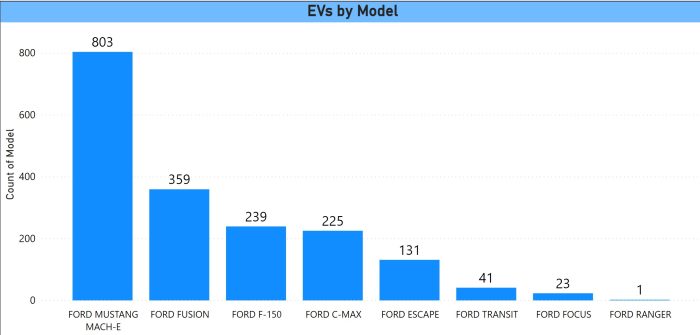

Ford

Ford, and its highly visible CEO Jim Farley, has been aggressive in pivoting toward EVs, as well as open about the challenges it presents for a legacy automobile manufacturer. He has made some big moves, such as the controversial Ford-e program to push dealerships to focus on EV sales and inking a deal with Tesla to access its Supercharger network as well as moving toward NACS connectors for Ford vehicles beginning in 2025. Ford’s recent vehicle efforts have been the launches of the high profile Mustang Mach-E and F-150 Lightning BEVs, extending 2 of the company’s iconic brands into electric propulsion. Ford has also recently refreshed its Escape PHEV, though the vehicle has not caught on and only registers 131 registrations after 4 years.

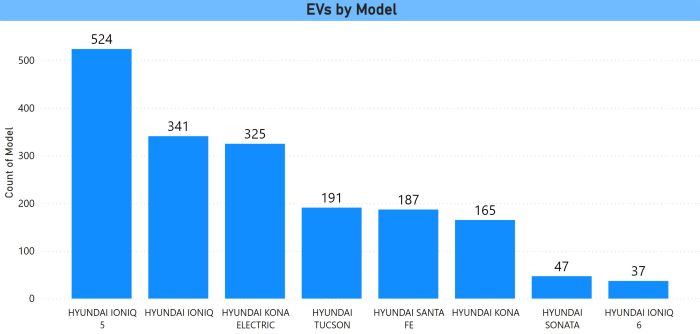

Hyundai

The Ioniq 5, a well-received recent entry, has quickly climbed to the top of the Hyundai registrations. Its newest entry, the Ioniq 6, has only recently begun shipping.

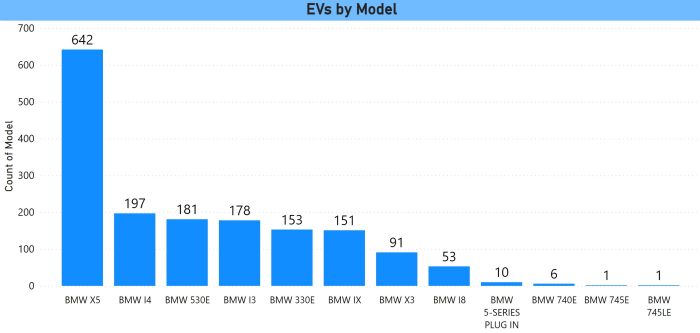

BMW

BMW was one of he earliest of the legacy manufacturers to build EVs, starting with the somewhat stubby i3 and its REx range extender variant with a small gasoline engine. The REx is not a true PHEV. The feature is intended to enable you to get to a plug. Since then, BMW introduced PHEV versions of some of its popular models, with the X5 having gotten the most positive reception. More recently, the company has debuted BEVs with ~300 miles of range, the i4, i5, i7, and iX.

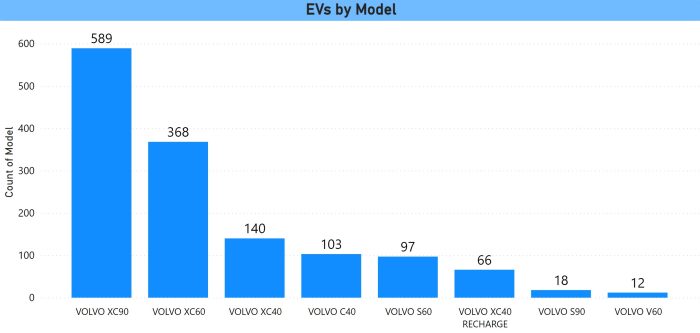

Volvo

Volvo entered the EV space by making PHEV versions of some its popular ICE vehicles but has since begun manufacturing BEVs. The XC40 and C40 are the first of the BEVs. Since then, it has announced the EX30 compact SUV and EX90 SUV. The other models below are PHEVs.

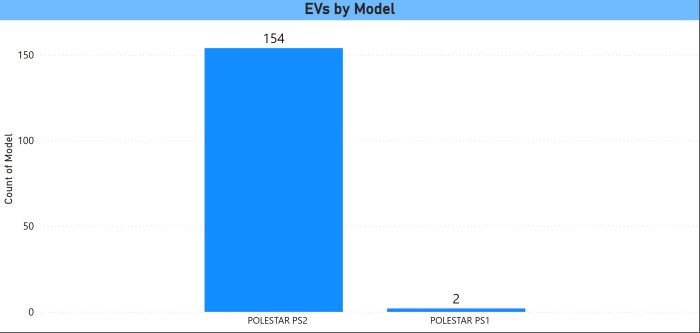

Polestar

Polestar is Volvo’s corporate sibling, both owned by the Chinese company Geely, dedicated to manufacturing only electric vehicles. The company’s main entrant to date is the Polestar 2, an upscale sedan. The Polestar 1 is a high-performance PHEV sportscar that was discontinued in 2022. It was very expensive and never intended as a mass market entry. To the best of our knowledge, it had the longest electric range of any PHEV ever manufactured at 58 miles. The company has now introduced the Polestar 3, an SUV that will begin deliveries in the second quarter of 2024.

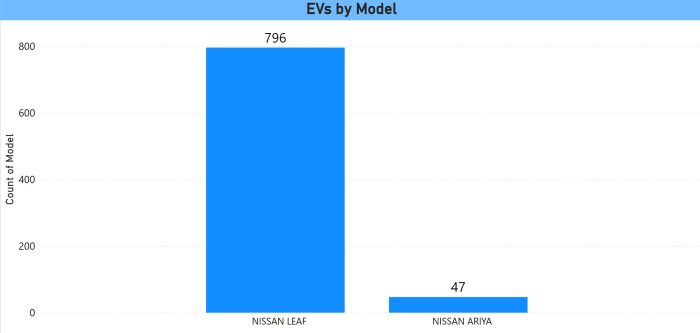

Nissan

Nissan was an early EV-mover with its Leaf. The numbers for that vehicle haven’t moved much in years. Now the company has introduced only its second EV, the SUV Ariya.

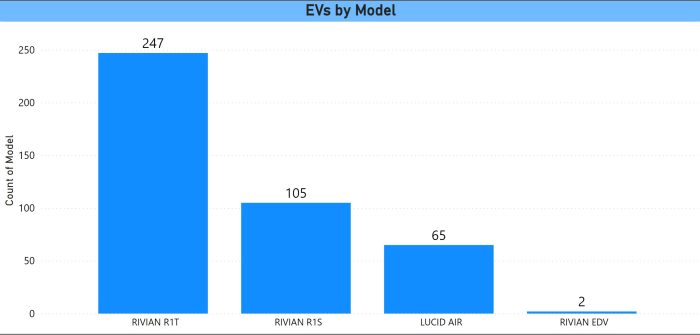

Rivian and Lucid

These 2 companies are the first of a new wave of EV-exclusive manufacturers that are using a direct sales model like Tesla. Deliveries began last year. The R1T is a pickup. The R1S is an SUV that uses the same frame as the R1T. The EDV with only 2 vehicles is the Electric Delivery Van the company is producing for Amazon, which is a part owner of Rivian. Lucid makes a very expensive sedan that in its longest-range trim level exceeds 500 miles.

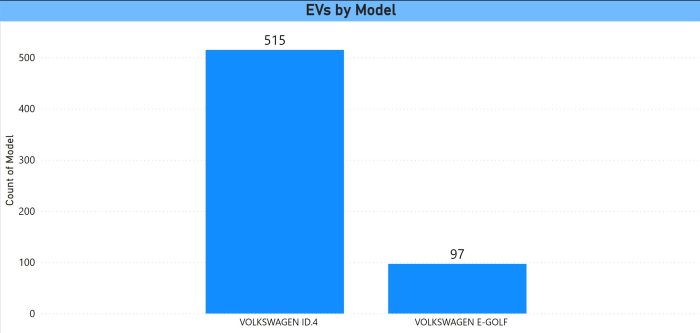

Volkswagen

This is the final manufacturer that I am breaking out. The E-Golf is a discontinued model. The ID.4 was VW’s pivot to its new platform. The ID.3 was a success in Europe. This small vehicle was not offered in the USA. VW has had struggles with software and CEO turnover. The ID.4 hasn’t generated a lot of momentum since deliveries began at the end of 2020.