CHEAPR Changes a Bad Idea – Op-Ed in Hartford Business Journal

Changes to CHEAPR = large decline in rebates

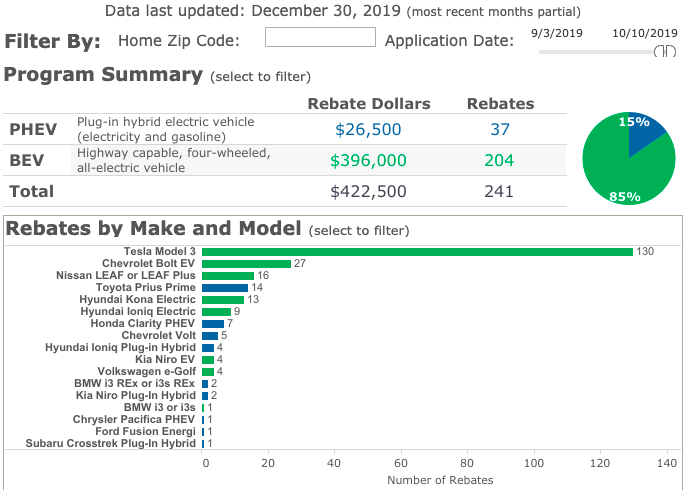

Club-member, Barry Kresch, penned an Op-Ed that was published in the Hartford Business Journal that discusses the early data regarding the impact of the way DEEP changed the parameters of the CT CHEAPR EV incentive program, and why rebates declined 71%. (This blog has also posted a couple of earlier entries about it here and here.) The incentive was lowered to a maximum of $1500 for a BEV and $500 for a PHEV, and eligibility restricted only to vehicles with an MSRP of no more than $42,000. The lower MSRP cap caused rebates for the Tesla Model 3 to practically disappear, but the effect goes deeper (pun intended).

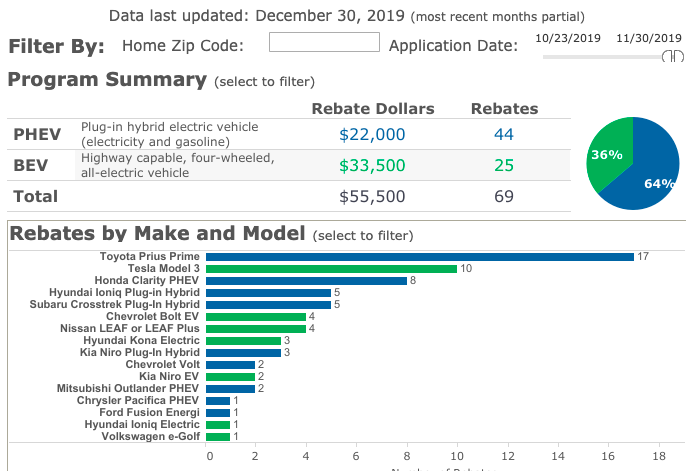

The word count is constrained for these Op-Eds and the format does not permit graphical exhibits, so this post will be used to expand on a few points. First, these are the graphics from the CHEAPR stats page reflecting the pre and post periods relative to the date of the incentive changes (the incentive change was 10/15). The date range appears in the upper right portion of the image.

While most of the decline was Model 3 related, other vehicles were also affected. We note the steep falloff in the Chevy Bolt. The premium version of the 2020 Bolt begins at $41,985. Bolt rebates declined from 27 to 4. The BMW i3 no longer appears, and it had 2 rebates in the “pre” period. The Nissan Leaf declined from 16 to 4, and it is possible to exceed $42,000 with a Leaf Plus.

If the lowering of the price cap was intended to avoid subsidizing more affluent buyers, this is belied by the fact that the cap on fuel cell vehicles was raised to $60,000.

Massachusetts Incentive Program

As a point of comparison, the Massachusetts incentive program (back online after a brief hiatus) has incentives that are more generous than CHEAPR before the changes. The max incentive for a BEV is 67% higher at $2500. The PHEV rebate is triple CT at $1500 but the vehicle must have an electric range minimum of 25 miles to be eligible, which we think is a sensible requirement. Importantly, there is a price cap and it is $50,000, the same as CT before October 15th.

Current Incentive Structure Penalizes BEVs

We would like to underscore an important point. Batteries are the most expensive part of an EV and the lowering of the price cap, based on the above data, clearly tilts the incentives toward PHEVs, which have increased from 15% to 64% of the rebates. This works against maximizing the reduction of greenhouse gas emissions.

Do Incentives Work?

We have been asked this question. Perhaps what is still the best (and most extreme) example occurred in Georgia. At one time, GA had the fourth-highest number of EVs on the road of any state in the country, circa 2015. And it was due to one of the most generous incentives of any state: a $5000 state tax credit for the purchase or lease of a new EV. Not only was the incentive repealed in its entirety, but a $200 road-use tax was imposed on EVs. The result? Between June and August of 2015, EV sales plunged 89%. The road-use tax exceeds the amount of money paid in gas taxes by a typical ICE driver. And, of course, there are too few EV drivers to compensate for the decreasing ability of gas taxes to fund needed road improvements. It was clearly punitive toward EVs. It worked, but it also underscores the value of incentives. (Source: WSB-TV) The EV road use fee is reported to be the brainchild of the American Legislative Exchange Council (ALEC), the organization of conservative state legislators that writes draft legislation and often supports fossil-fuel interests. See this article in Consumer Reports.

Budget

With respect to DEEP managing its budget, there is one new item on the horizon, namely an incentive for used EVs. This was authorized by the legislature in the same bill that provided the new funding stream for CHEAPR. There has been no announcement from DEEP regarding when this may be implemented, how much the incentives would be, or whether there is any means-testing involved. This could conceivably be what caused DEEP to be concerned about their budget. Given that they were on track to be within their allotment, we think a data-gathering phase before implementing changes would have made for better-informed decisions.