The Chevy Blazer, pictured above, is one example of a vehicle losing the incentive.

Most EVs Lose Federal Incentive Eligibility

Unsurprisingly, as we have been forecasting for months, many EVs lost eligibility for the federal IRA incentive. This is due to the step-up in battery critical minerals sourcing and battery component manufacturing requirements, as well as the first half of the implementation of the foreign entities of concern rule. EV advocacy groups, manufacturers, and others have provided input to the Treasury Department during the public comment periods as this was all foreseeable. But not many changes were made.

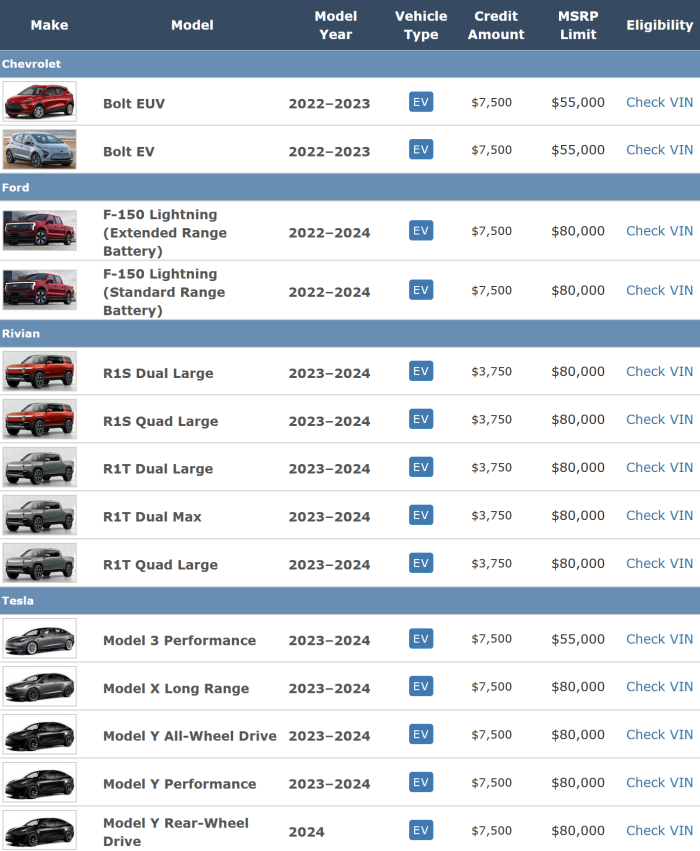

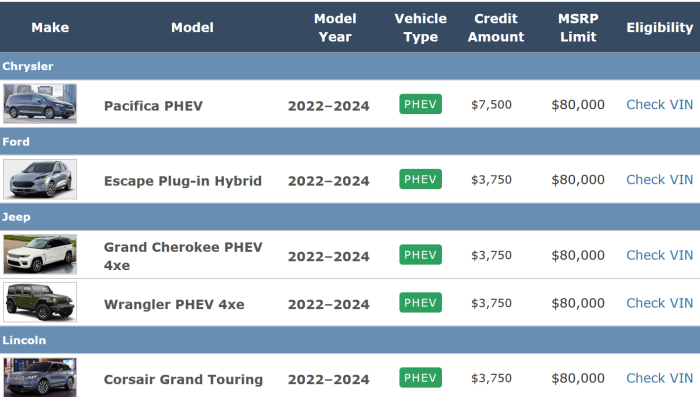

Below is the list of every BEV and PHEV that is incentive-eligible as of January 4. This is fluid, and vehicles that have lost eligibility can regain it at any time. Manufacturers are wrangling their supply chains to become IRA-compliant as quickly as they can. These are screenshots directly from the Department of Energy (DOE) Website. We advise checking the DOE website for updates if you are in the market as it is updated continuously. We expect to be in this period of volatility for a couple of years.

BEVs

PHEVs

There are some notable absences here, such as the two less expensive trim levels of the Tesla Model 3, every GM vehicle not named Bolt, and the Ford Mustang Mach-E to name a few.

Notice what is listed to the right of each MSRP: “Check VIN.” The DOE website is intended as a general guide, but the determination for a specific vehicle is made at the level of, well, the specific vehicle. Manufacturers must register eligible VINs with the Treasury. Consumers must list the VIN on their tax return and are able to check VIN eligibility on the DOE website.

Same Model, Different Incentive

Different vehicles of the exact same make/model/model year can have different incentive eligibility. It could be due to changes in manufacturing supply chains during the model year. It could be timing, as model years are most frequently introduced in the fall, but the requirements change on January 1. The eligibility is also based on the “date placed in service,” which is the date the consumer takes possession. An eligible vehicle on December 31 may no longer be eligible on January 1. (Part of our input was to align the requirements with model year to minimize this. Manufacturers suggested at least basing it on the date of manufacture.) Finally, as foreign automakers stand up manufacturing in North America, there can be a mix of imported and domestically produced vehicles of the same model, potentially on the same dealership lot.

Yellow Flag

If a vehicle is purchased from inventory, there is a VIN. But for build to order purchases, there will not be a definitive incentive eligibility determination until the VIN is available, which is often a short time before delivery. In a dealership environment, where salesperson EV knowledge can be lacking, consumers will need to be vigilant. We wish there were an easier answer.

GM Workaround

GM lost incentives for all its EVs other than the soon to be discontinued Bolt but is discounting those previously eligible vehicles by $7500 until they regain eligibility, as reported by Reuters and others. GM attributed the incentive setback to minor components which are being re-sourced and expected fairly soon. Anyway, a discount is even better than an incentive because it also reduces the sales tax.

Reminders

None of this incentive mishegoss applies to leased vehicles. However, the seller has discretion regarding whether to pass along the incentive.

The transfer provision goes into effect this month. Tax credits can be transferred to the seller with the consumer receiving a point of purchase rebate. It also benefits buyers who would not otherwise have enough tax liability to burn off a tax credit.