Federal Tax Credit for Buying/Installing EV Chargers

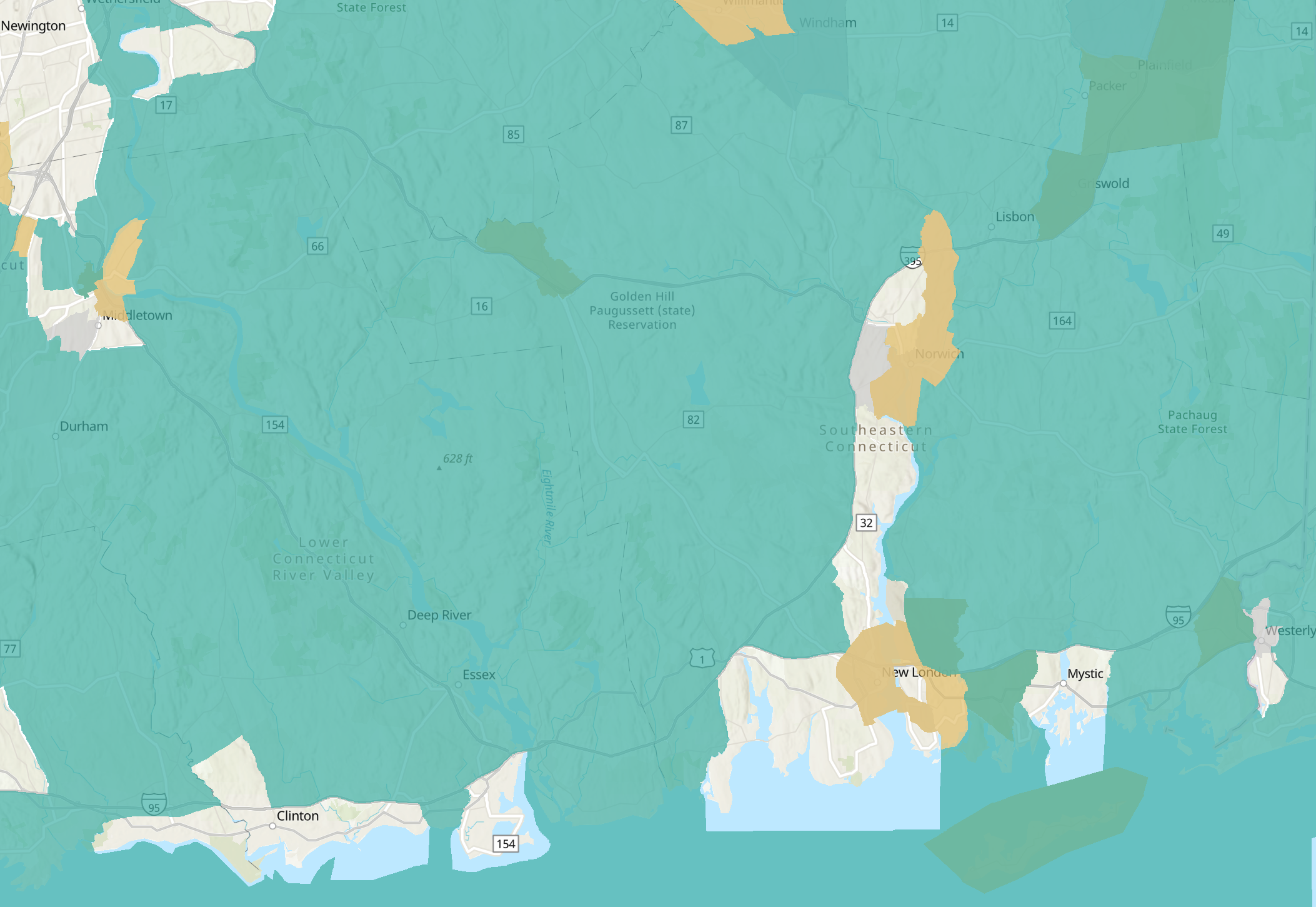

Before the passage of the Inflation Reduction Act, every residence was eligible for a tax credit of 30% of the cost of the purchase and installation of residential EV chargers up to a cap of $1000. That old credit expired but the Inflation Reduction Act brought it back in a geographically restricted form. (There is a separate program for commercial.) Eligibility is restricted to distressed and non-urban census tracts. After waiting a good long time, and just in time for 2023 tax filings, the IRS has only recently completed its rule-making regarding exactly which census tracts are eligible. Below are the map key and static screenshots, zoomed in to show as much detail as possible. These came from this Department of Energy interactive map. There are different types of tracts denoted and color-coded, which expire at different points in time. The IRA is around through 2032 but all of these expire by the end of 2030. Note to self: find out why. Perhaps due to the new census, though it feels too soon.

Map Key

Southwest CT

Northwest CT

Northeast CT

Southeast CT

Whew, thank goodness MY side of the street is “rural”, but the opposite street is “urban”. I get when implementing this sort of thing there’s always an arbitrary dividing line, but it would certainly be nice if the government could get it together enough to actually define the rules before they go into effect.