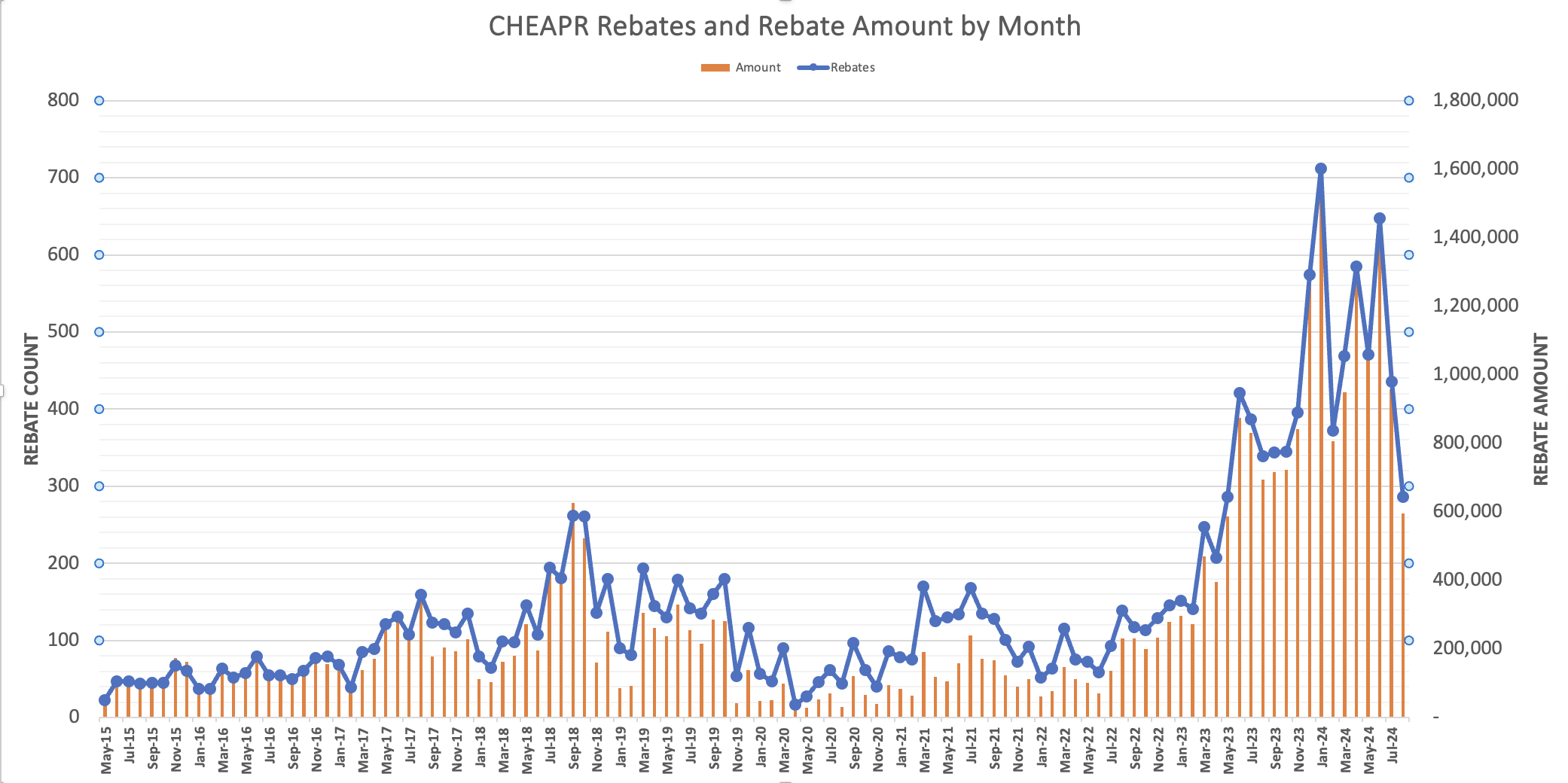

The chart at the top of the post shows the number of rebates and amount of funds awarded monthly through August 2024. The reason for the dip in August is that there is only partial-month reporting available at this time.

This information is based on recent the CHEAPR board meeting.

CHEAPR Program Running Hot

As can be seen in the chart, the CT EV purchase incentive program has been running hot over the past 16 or so months. Between price cuts on the Tesla Models 3 and Y, along with new models being introduced by the legacy manufacturers, CHEAPR has dispensed $7.9 million worth of rebates this calendar year through July 30 with another $600 thousand in the processing pipeline. Last year, $8.9 million was dispensed in total and this year will clearly exceed that. Fortunately, there have been carryover funds from past under-performance, but those will be burned through by next year.

Cuts Looming

The Department of Energy and Environmental Protection has budgeted $9.2 million annually for incentive payments. Incentive payouts follow consumer demand and rebate levels, and 87% of the expenditures have been going to the Battery Electric Vehicle (BEV) standard incentive. The remainder is divided amongst PHEV rebates, along with supplemental rebates and used EV rebates for income limited individuals. A cut to the size of the standard rebate for BEVs will be used to slow the burn rate. While final action has not yet been taken, it is expected that the $2250 standard BEV rebate will be rolled back to $1500 as of January 1. Based on the first quarter run-rate, a further cut to $1000 is possible for July.

EVs are currently in over-supply and discounts are widely available. It might make sense to take advantage of the full rebate while it is still here.

Increases for Plus Rebates

If cuts are made to the standard rebate, the tentative plan is to increase the size of the plus rebates. These rebates are for people who have a household income of no more than 3 times the federal poverty rate, or are enrolled in a qualifying state or federal government assistance program, such as food stamps or free school lunches, or live in an environmental justice community or distressed municipality. (This is the page that details these criteria.) For a new BEV, the Plus incentive would increase to $3000 from $2000, for a total incentive of $4500, assuming the standard incentive is rolled back to $1500. There would be increases in the PHEV incentive, and used BEV/PHEV incentives as well.

Increasing the Plus rebates will not break the bank as there are relatively few of them.

The legislature authorized increasing the size of the Plus rebates to up to 200% of the standard rebate level, which is what this would be if the standard rebate were to be cut to $1500. It is not clear to us how the Plus incentive could be further increased without exceeding the 200% threshold.

The same legislation called for a program goal to dispense 40% of the funding to EJ/distressed communities by 2030. Currently, the closest proxy we have to that number, the Plus rebates, sits at about 6%, looking at the data since the end of June. That is a lot higher than it used to be, but nowhere near 40%. Clearly, a direction has been set for the program and we should expect to see changes between now and then.

One of the changes that has driven higher participation in the Plus rebate process is the option of a pre-qualification voucher. That way, the buyer knows they’re approved before the purchase, and the incentive can come off the invoice price (as opposed to a post-purchase reimbursement which is what it was initially).

Will The Marketplace Change In A Way That Affects This?

Much of the non-Tesla part of the manufacturing side of the industry has announced pullbacks in their BEV expansion plans and a revived emphasis on plug-in hybrids. The numbers in the CHEAPR program aren’t showing this to this point, though there is a lagging effect in terms of announcements relative to consumer adoption. The point is that if PHEVs gain market share, it will slow the burn rate. Unlike in the Inflation Reduction Act, PHEV incentives in CHEAPR are much lower than BEV incentives, $750 vs $2250 at current rates.

Fleet Incentive Postponement

A major program enhancement passed in the 2021 legislation and codified in Public Act 22-25 is the implementation of a very inclusive incentive for fleets – commercial, non-profit, municipal, and tribal. There had been $2 million budgeted for this in 2024, but the program is still in the design phase and will not launch this year. As indicated by the $2 million (which is not necessarily the number going forward), this is a finite resource. Equity will be prioritized for fleets, but it is not the only consideration. The tentative rubric that was developed for prioritizing the submissions is described in this earlier blog post from the time of the legislative session.

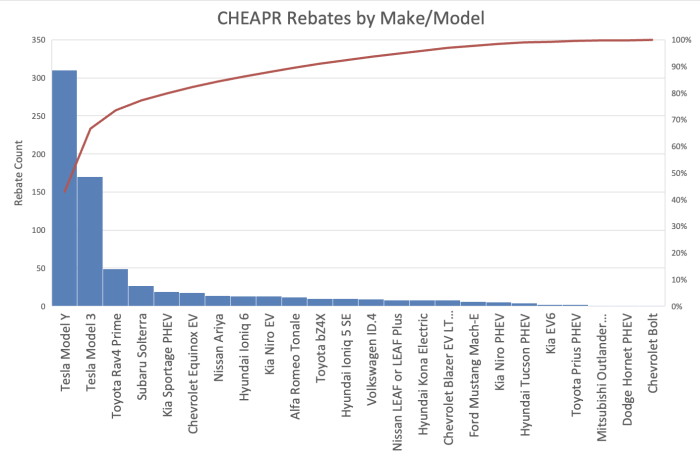

Rebates by Make/Model

This is the number of rebates by make/model for available Q3 data. Keep in mind that qualifying vehicles must have a base trim-level MSRP of no more than $50,000. (This is different than the Inflation Reduction Act federal incentive MSRP definition, where the price cap includes factory-installed options.)