Total EV Registrations

There are 67,656 registered EVs as of July 1, an increase of 11.8% from January. This level of increase is kind of “meh,” and won’t keep pace with the expansion of the fleet that is needed to meet the goals set by the state. The interim goal was between 125,000 to 150,000 by 2025. That’s plainly not happening, though we are expecting a sales burst in Q3 due to the pull-forward demand created by the expiring federal incentive.

Soft Tesla Growth

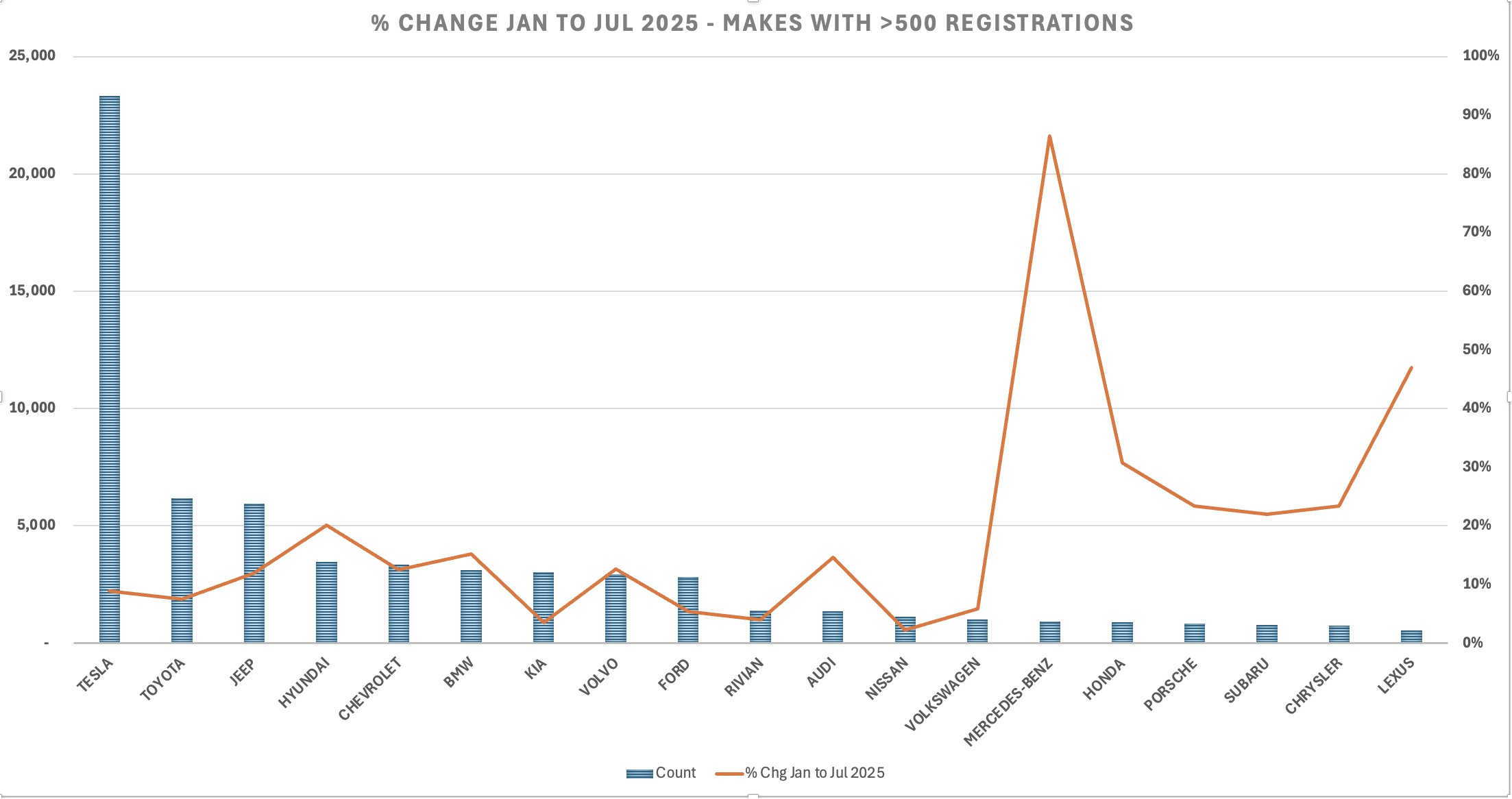

Tesla registrations led the pack. This is not surprising since the incumbency advantage is baked into the registrations data. There are now 23,320 Teslas. The runner-up makes are Toyota with 6192, Jeep with 5936, Hyundai with 3460, and Chevrolet with 3354. These numbers include BEVs and PHEVs. The chart at the top of the post is registered EVs for all makes with a minimum of 150 registrations.

Rate of Growth

The rate of growth for Tesla was 8.9%, in other words, lower than the average growth rate for all EV marques (11.8%, as noted above). Note that the growth rate is affected not only by new vehicle sales, but by turnover, i.e. people getting rid of their cars. The degree to which Tesla underachieved in its growth, coupled with the tepid overall growth, implies that Tesla’s weakness is holding back the market. Other brands are making progress, but not enough to carry the market. Tesla share of registered EVs is now 34.5%, down from 35.4% in January 2025 and 38% in January 2024. Below is a chart of the percent change from January to July of this year, along with counts, for all makes that have at least 500 registered vehicles.

The reasons are more jumbled than usual. These changes reflect not only demand (and turnover), but also in some cases, supply constraints with a healthy dose of tariffs.

Top Models

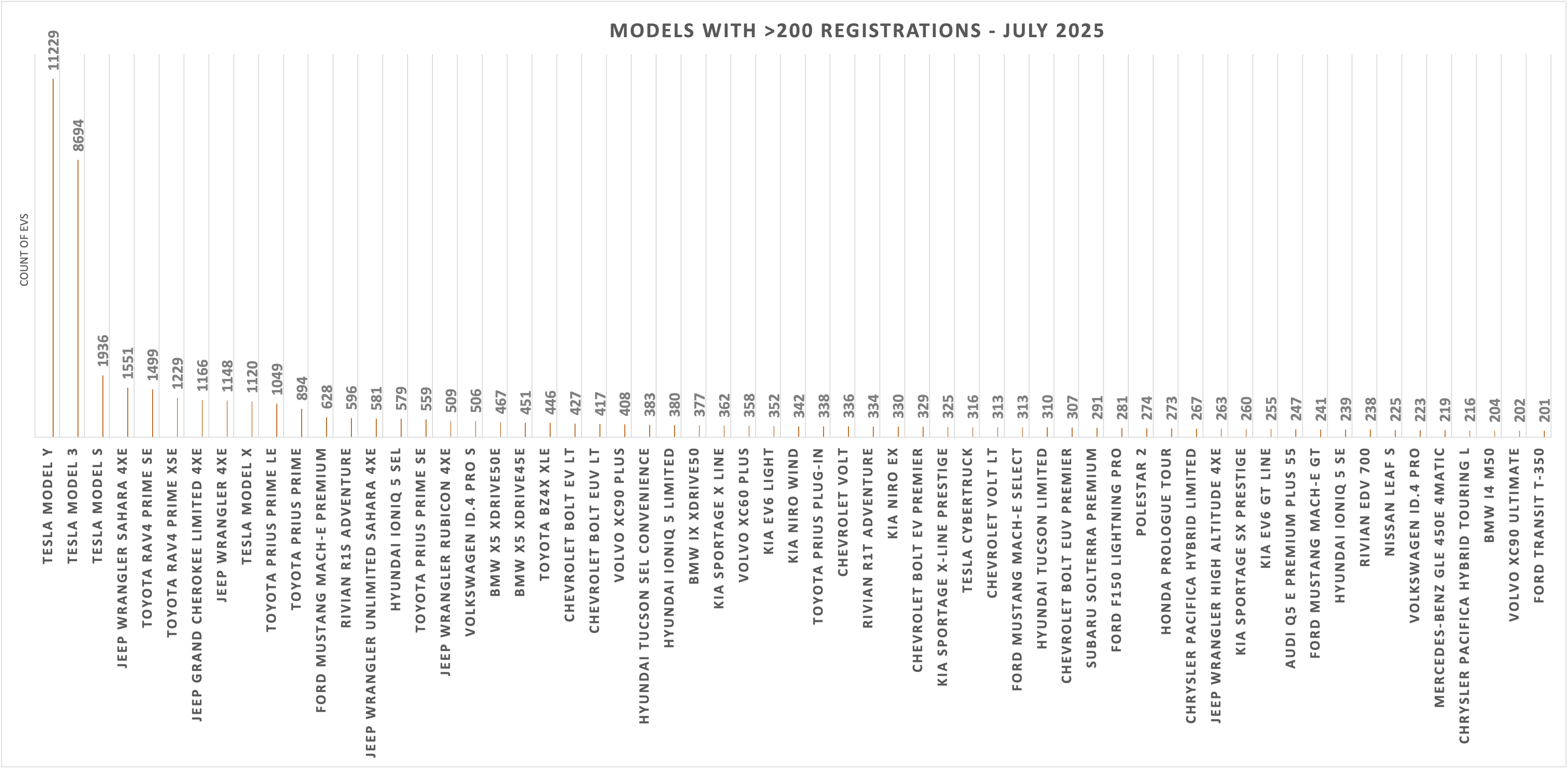

The Model Y leads with the Model 3 being the runner-up. The chart below displays all models with at least 200 registrations. There are some models that appear on multiple lines as the file breaks out trim levels in some cases and we have not cleaned this up. This is not a mistake. The third place vehicle in the chart is the Model S, but if you add the two RAV4 Prime lines, that becomes the third place vehicle, trailing the Model Y and Model 3. There are some newer models that are doing well but are not in the chart, such as the Chevrolet Equinox and Cadillac Lyriq. These have exceeded the 200 threshold but not at the individual trim level that is in the chart.

We will clean these things up when we get the raw data file, assuming we do get it since it has become less than a sure thing.

If anyone is curious about a make or model and don’t see the number, please let us know.