The Half-Hearted Incentive in the OBBB

It is old news by now that the federal legislation did away with the purchase incentives for EVs as of October 1, but standing sheepishly in its place is a tax deduction for up to $10,000 of interest on automobile loans. It is available for all vehicles, not just EVs. And it comes with a lot of restrictions.

- First off, it is a deduction and not a transferable tax credit like the IRA, so it is worth a lot less.

- It will apply to the 2025 through 2028 tax years before it sunsets.

- Vehicle final assembly must be in the USA. Unlike the IRA, it excludes vehicles assembled in Canada or Mexico.

- It is an above the line deduction, meaning it can be used by people who don’t itemize.

- This is for new vehicles only.

- There are income restrictions. The benefit begins to phase out at a rate of $200 per $1000 of income when the income level exceeds $100,000 for single filers or $200,000 for joint filers. It goes away altogether for single filers above $150,000 and couples above $250,000.

Between the more limited utility of a tax deduction relative to a credit, many lower income households likely not able to get much use out of it, the applicability to financed vehicles only (assuming the purchaser did not get a 0% financing deal), the USA-only assembly requirement, no provision for used cars and the relatively low income caps, we don’t foresee this doing that much. It seems calculated to be an ornament to be displayed until the next presidential election. But if the shoe fits, keep it on your radar.

CHEAPR

The CT CHEAPR standard rebate, after having been lowered 3 times this year, from $2250 to $500 for a BEV, was raised on October 1, the day after the expiration of the federal EV incentive, to $1000. The PHEV incentive remains at the $500 level to which it was lowered in August. Based on the discussion during the CHEAPR board meeting of December 11th, it looks like the current levels will remain in place at least for the first half of 2026.

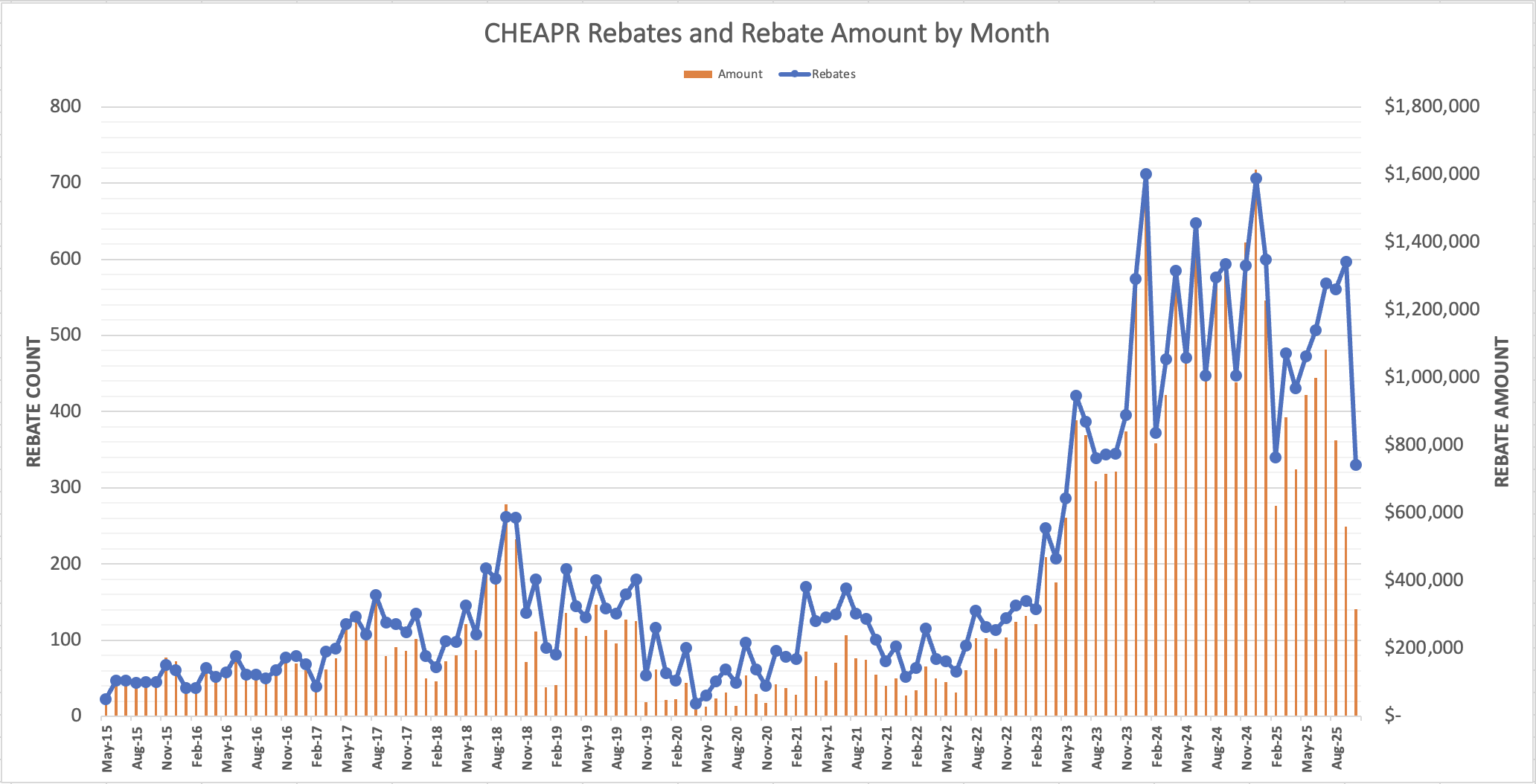

The run-rate for the incentive has flirted with exceeding available funds in recent years, hence the earlier changes, especially the lower levels for August and September when EV sales were expected to spike (they did) due to the impending loss of the federal incentive.

The bulk of the incentive funds in CHEAPR are distributed for the standard BEV incentive, which, as noted, was raised to $1000 as of October. As can be seen in the blue line in the chart at the top of the post, rebates dramatically dropped as soon as the federal incentive ended, and which is why DEEP is adopting a watchful waiting approach for now.

Rebate+ incentive levels for lower income individuals or those residing in distressed communities were increased earlier this year. DEEP reports these incentives as seeing increasing utilization, though the numbers remain small and not likely to impact the budget anytime soon. Current levels:

Rebate+ new BEV – $4000

Rebate+ new PHEV – $2000

Rebate+ used BEV – $5000

Rebate+ used PHEV – $3000

Changes to Utility Charging Incentives

Beginning in January, eligibility for residential customers will be restricted to those with incomes of no more than 3 times the federal poverty level (FPL) or who live in live in a concentrated poverty census tract (a census tract where at least 30% of the households have an income below the FPL). This isn’t exactly the same criteria used by CHEAPR to determine eligibility for the higher Rebate+ incentive levels, but it is a similar idea.

These cuts are not utility-driven. Legislation enacted this past July cut the available funding. This came about in the aftermath of the controversy that flared in the summer of 2024 over the Combined Public Benefits Charge (CPBC), described in more detail in this earlier post. The legislation moved the expense out of the CPBC and funded it at a lower level via general obligation bonds. The bill was SB4, “An Act Concerning Energy Affordability, Access and Accountability.”

The current incentive qualifications will apply to any fully completed application submitted by the end of the year, even if the funds disbursement will occur in 2026.

Managed Charging

The managed charging portion of the program remains and is not subject to the budget cuts. Anyone already in the program will continue to participate. New enrollees who do not qualify for the hardware/installation incentive will continue to be accepted if they have telematics-eligible vehicles or if they happen to own an approved charger. (The list of telematics-eligible vehicles is not the same for Eversource and UI.)

The bigger picture benefit of the program has been to encourage off-peak charging, i.e. load-shifting. The big going-forward challenge will be that the major recruiting lever, namely giving an incentive to acquire a charger in return for participation in the managed charging program, will be gone. It’s too bad, as with respect to EVs, strategies like load-shifting and vehicle to grid distributed storage can make a major difference in the path to an efficient, modernized the grid.

Recent Changes

There were recently some other changes approved, the big one being in increase in the incentive from $1000 to $1500 for the purchase and installation of a charger. This was a recommendation from the utilities in light of the forthcoming lower-income applicant profile and the greatly restricted potential user base. It more accurately reflects the typical cost of buying and installing a charger. They are, however, reducing the number of permitted hardware/installation rebates per account from two to one.

V2G Pilot

There is still room in this limited vehicle to grid test, where participants can receive up to 75% of the cost for bidirectional charging equipment and installation, capped at $10,000, as well as up to $1350 per year for participating in all demand response event. The catches are a) that the only eligible EV is the Kia EV9, though some others are expected to be added, and b) the fate of the program after the pilot is unknown at this time. We think it’s a great idea and could add significant flexibility for the grid.