Transfer Provision is Now Live

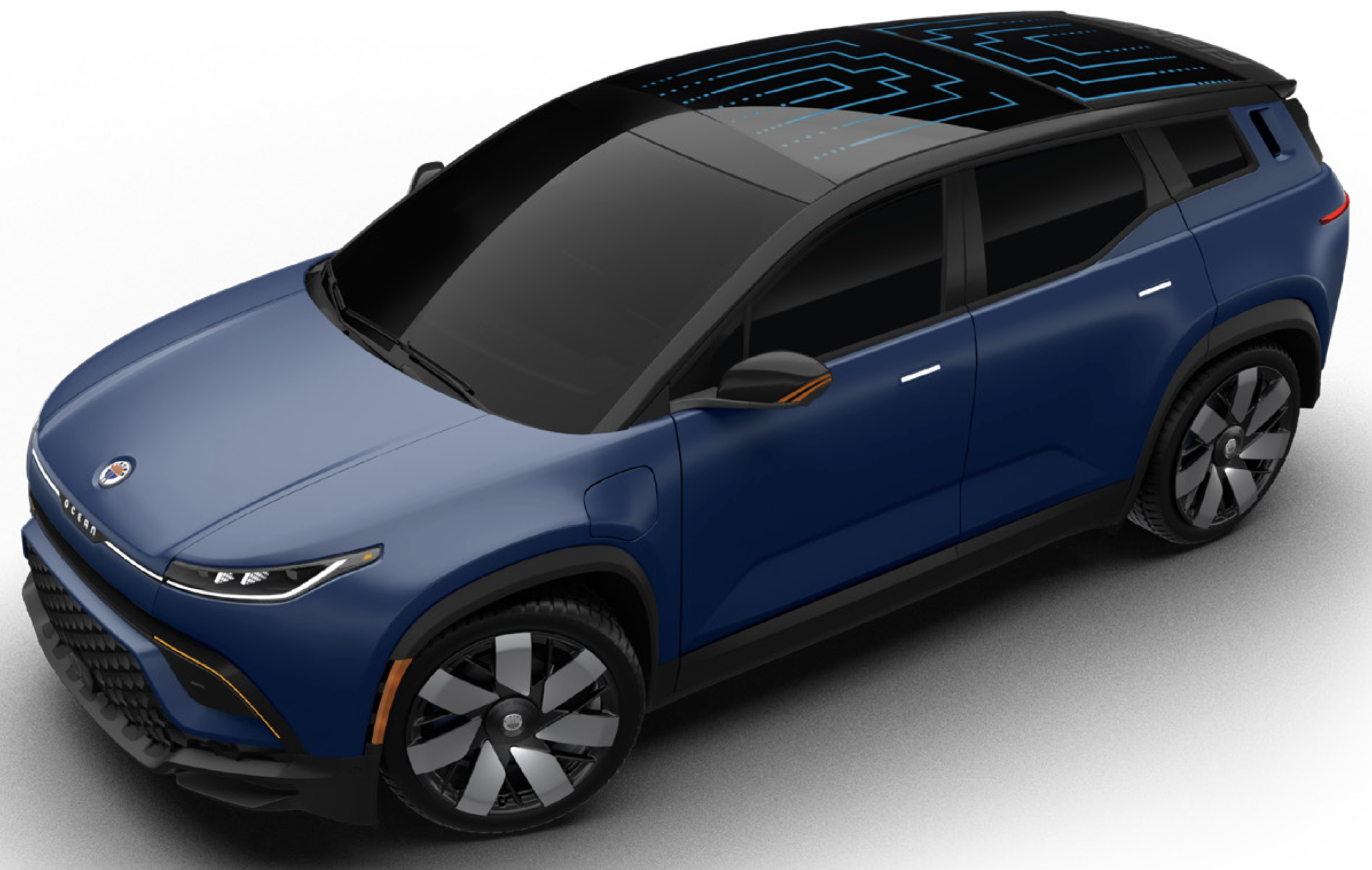

Fisker Ocean pictured above Transfer Provision Details The transfer provision is now in place for the federal incentive. This allows the buyer to transfer the tax credit to the seller and take the incentive as, … Read more