Dealers Hit The Brakes On EVs

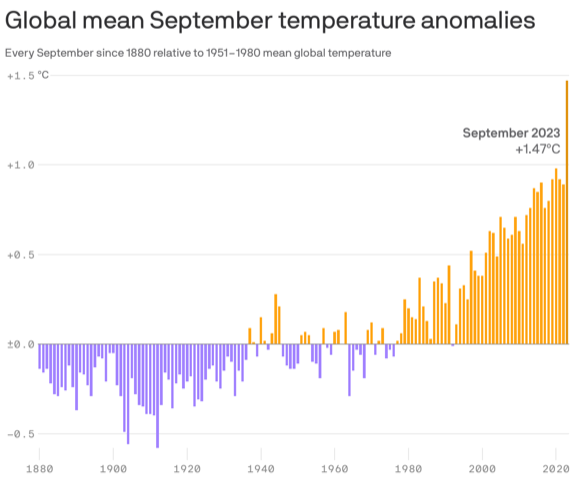

Proposed EPA Rules Amidst the current contretemps over Connecticut’s stalled efforts to adopt phase 2 of the California emissions standards, known as ACC II/ACT, which stand for Advanced Clean Cars II and Advanced Clean Truck, … Read more