Updates on CHEAPR Implementation

Almost one year ago, SB-4 was voted into law as Public Act 22-25, an environmental omnibus that made extensive changes to CHEAPR, the state EV purchase incentive program. The easiest change, raising the MSRP cap from $42,000 to $50,000 was implemented in July. The other changes required extensive platform revisions and we are just now getting to the point where these other items will go live. Below is the slide from the deck that DEEP presented that outlines the timetable.

Revised income-limited (LMI) program

The program remains on track to launch the revised income-limited program, including a pre-qualification voucher in second quarter. Our guess is that it will likely be toward the end of the quarter, especially since they have yet to make a final selection of a marketing vendor. These LMI rebates are known as Rebate+ New and Rebate+ Used.

To recap, the new LMI program expands eligibility to individuals or households earning up to 3 times the federal poverty rate. The current program requires enrollment in designated governmental assistance programs, which is more limiting. The other important addition is the ability to become qualified before the purchase and get a voucher. This way the incentive will be cash on the hood like the standard CHEAPR rebate. The current post-purchase process will be retained, as well, for the sake of continuity. We suspect it will fall away in time but that will be based on utilization data.

The LMI rebate for new vehicles is $2000 that gets added on to the standard $2250 rebate. There is also a $3000 rebate for used EVs. Used rebates can only be obtained if the vehicle is purchased through a dealer (either a new car dealer that sells used vehicles or a used car dealer), in other words, not through a private sale.

The LMI incentives have really struggled for traction since they were introduced, with only 8 being given out during calendar 2022 (5 new, 3 used). This change is sorely needed, along with effective marketing.

Expanded Options for Used EVs?

The eligible used vehicles for the Rebate+ Used have been restricted to vehicles that were eligible for the standard rebate when new. We never saw the point of that since these are income-limited rebates. We feel any used EV should be eligible. We have spoken to DEEP about this and we expect there will be a revision here, which would be effective when the new Rebate+ program goes online in a couple of months. Stay tuned.

Expansion to Non-Residential

At present, the incentive is available only to individuals. In the third quarter, referenced in the slide as “CHEAPR Fleets launch,” eligibility will be expanded to businesses, fleets, non-profits, municipalities, and tribal entities. This could potentially be a huge pool of purchasers. These entities are capped at 10 incentives in one year and 20 total.

E-Bikes

The state will incentivize e-bike purchases, something that was left out of the federal IRA legislation. This will be a gradual rollout over the remainder of the year, with possible tweaks continuing even after that. It is possible for an LMI individual to get as much as $1500 towards the purchase of an e-bike with an MSRP of no more than $3000.

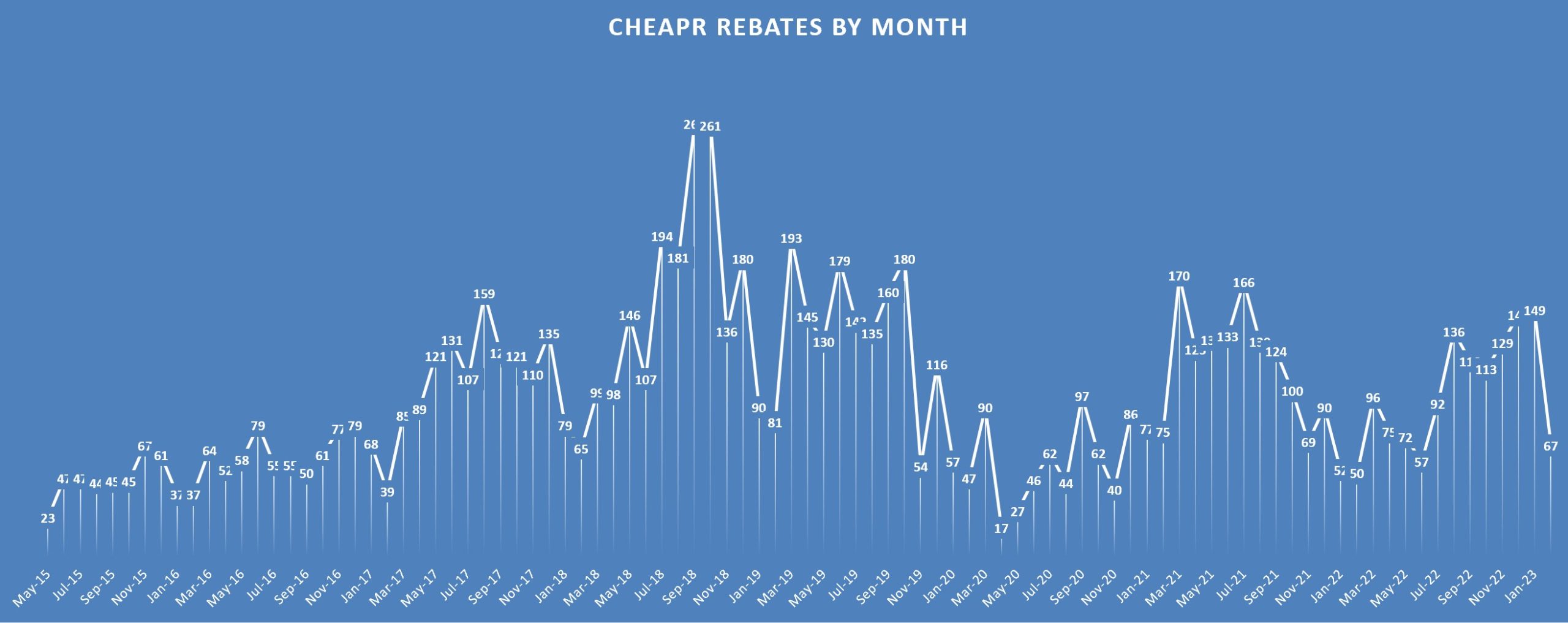

Program Performance

CHEAPR has been underperforming for years, defined as spending below its budget. It started to happen in a serious way in 2019 when the MSRP cap was lowered from $50K to $42K. The reversal of that as of July 2022 is helping, though we are in a more difficult environment at this time with higher prices and constrained supply chains.

The program rebated $1,894,000 for 1174 rebate instances in 2022. This remains less than the program’s old budget of $3MM annually, and way less than its new budget which is between 2-3 times that, depending on how much is collected in greenhouse gas fees. Not to mention that unused funds rollover. There is a substantial available war chest to fund the expanded program.

The 1174 rebate number is less than the 1408 in 2021. However, the pace picked up in the second half of 2022 after the MSRP cap increase, increasing 69% (737 vs 437) over the first half, and slightly higher than the 696 of the second half of 2021. The 216 rebates in Jan and Feb of 2023 are pacing well ahead of the corresponding period from 1 year ago when the number was 116.

34% Utilization Rate

The biggest area of concern is the utilization rate. which DEEP reported to be 34%. In other words, 34% of rebate-eligible vehicles actually got a rebate. This has been an ongoing pain point and has been the single biggest reason that it has been difficult to budget for this program. There could be several reasons for this: lack of promotion/consumer awareness, lack of dealership participation, and potentially important, we have heard that not all finance companies, which hold the title to leased vehicles, have set themselves up to deal with the rebate.

The changes to the program made in PA 22-25 are good ones and we will do our part to get the word out.