Further $500 Reduction on Hold

As far back as last year, when DEEP reduced the standard purchase incentive for a BEV from $2250 to $1500 (which took effect on January 1 of this year), the agency teased a further reduction to $1000, possibly as soon as July. That did not come to pass in the recent board meeting of June 12th. This reduction would not affect the Plus incentives.

Standard and Plus Incentives

There are standard incentives and Plus incentives. The Plus incentive is restricted to those with an income level of no more than 3 times the federal poverty level, or participates in a state or federal income qualifying program (e.g. food stamps, a.k.a. SNAP), or live an a distressed or environmental justice community. Generous incentives for used EVs are also part of the Plus program.

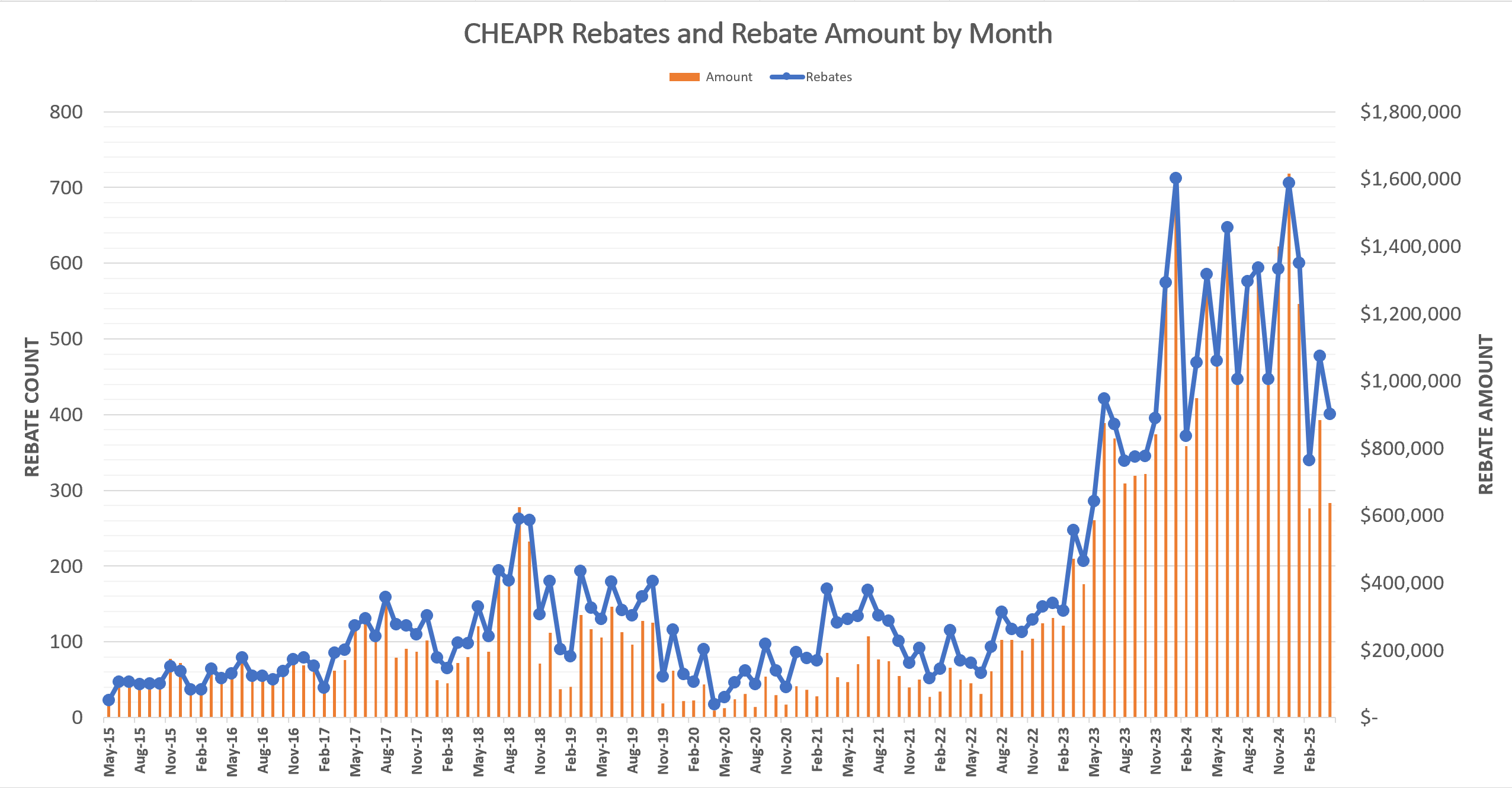

Burn Rate

The reason for the recent and prospective reduction is managing the burn rate. If the budget were to run dry, it would cause a temporary suspension of the program. As can be seen from the chart at the top, the expenditure rate, while still high, has eased a bit. In simpler terms, comparing the first 4 months of this year vs. 2024:

![]()

The next board meeting is in September, though they are not constrained from making an adjustment at any time.

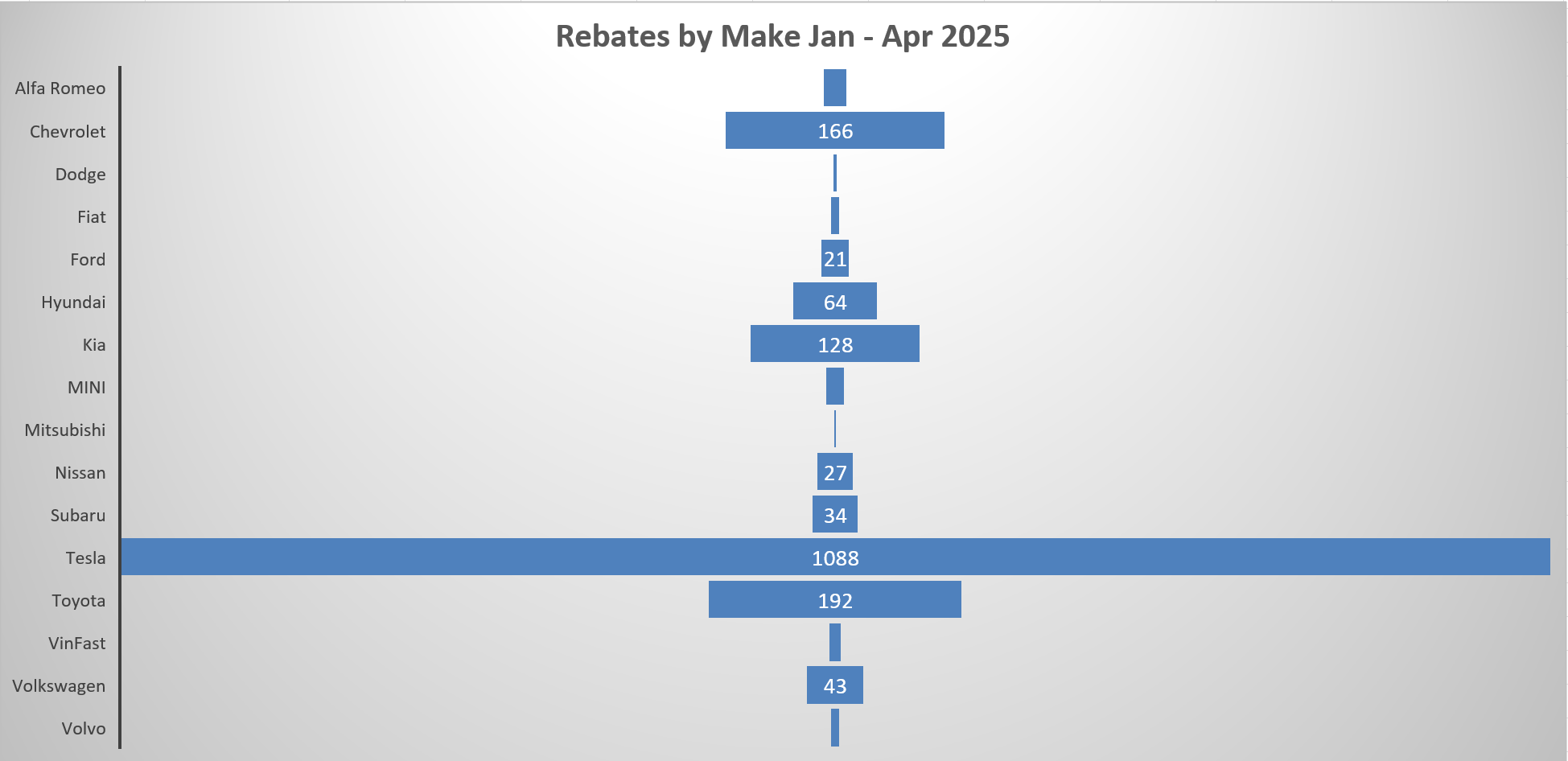

We think it was wise to hold off on reducing the incentive. There are several factors that could influence why the pace has slowed. These include which vehicles are eligible, as many exceed the MSRP cap. Overall EV sales trends could be an influence, though that is not likely the cause as EV sales are up while rebate numbers are down. Teslas have been responsible for the bulk of the rebates and overall rebate volume.

Tesla

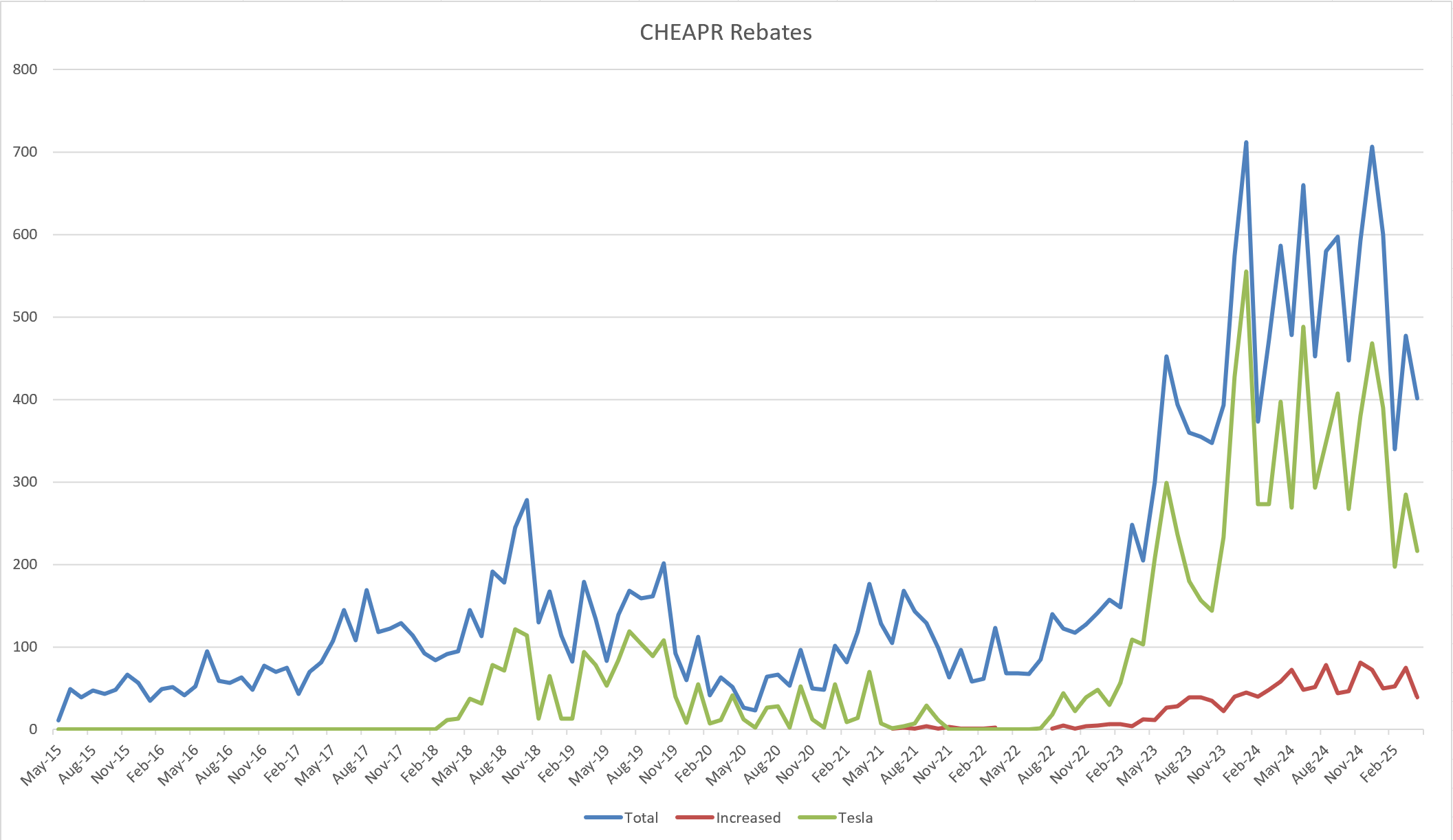

Tesla rebate volume has fluctuated and the overall program volume generally tracks it. Earlier in the program, Tesla rebates were low because the vehicles, including most trims of the Model 3 were too expensive. This was exacerbated in late 2019 when the MSRP cap was lowered from $50K to $42K. It caused a discernible dip in both Tesla and overall program rebates. When the cap was raised back to $50K in 2021, rebates increased. Subsequent Tesla cost-cutting and the introduction of the Model Y, enabling more trim levels to qualify, caused a further spike. The consultant that runs the program for DEEP, and which runs similar programs in a number of states, advised that setting program parameters that enable Teslas to qualify causes programs to run hotter. Aside from the cap and the vehicle price, Tesla has been the most efficient in terms of incorporating the incentive (and the federal incentive) into its order flow.

Lately, Tesla has been having its problems and has posted 2 consecutive quarterly sales declines globally. Judging by the rebates, that may carry over into Connecticut. When the registration data are available for the first half of the year, we’ll see if this correlation mirrors its presence in the fleet.

The other element in the chart is the performance of the Plus rebates (the red “Increased” line). It is gradually improving. No doubt the pre-qualification voucher has helped, but the Plus portion of the program is still fairly small at 11.9% of the rebate count from January – April.

Looking Forward

Of course, the elephant in the room is the impact of the Republican reconciliation bill that was passed as this was being written on July 3rd. The House approved the bill sent over from the Senate which eliminates the purchase incentive as of September 30. We may see a short-term sales surge in response to it, but the forecasts indicate sales declines of 25-40%, depending on the time frame analyzed.

We think the technology trend still favors EVs, but the ability for domestic manufacturers to scale will be significantly hampered without the purchase and manufacturing incentives in the Inflation Reduction Act that supported building new factories and localization of supply chains. China already has scale, plus dominance in critical minerals and battery production. Although this blog has been critical at times of domestic manufacturers being slow to invest in EVs, they are now playing catch-up and this will greatly increase the challenges before them.

Given the federal bill, it is some small comfort that the BEV incentive from CHEAPR has not been reduced. We hope DEEP will adopt a watchful waiting posture for CHEAPR as the post-IRA landscape evolves. In a post published on January 10, we forecasted that if a reconciliation bill were passed to do away with EV incentives, that it would most likely be in a July timeframe. We would have preferred to have been wrong about that.