Cut in Standard Incentive Likely to Stay, Absent a Huge Drop Off Or Restructuring After Federal Incentive Expires

Post by Barry Kresch

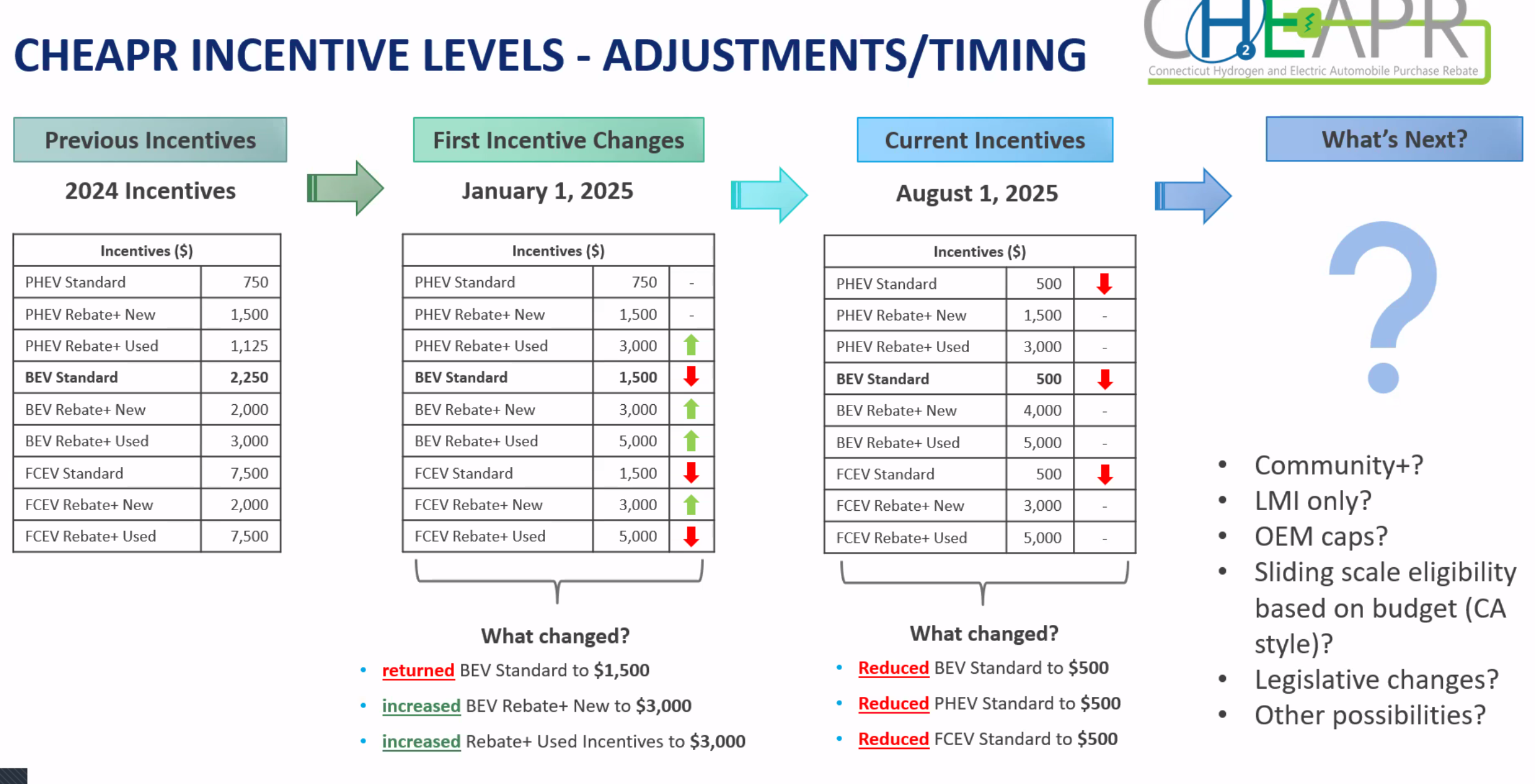

With the CHEAPR rebate program running hot, the agency tasked with running it, DEEP, lowered the primary incentive for BEVs and PHEVs to $500 from $1500 and $750 respectively as of August 1. This was anticipatory as there was not yet a visible impact due to the federal legislation at the time the change was made. And in the press release from DEEP, the agency left the door open to raising the incentive if the spend dropped sufficiently. It is certainly expected to drop after the 9/30 sunset date, but will it be enough? A restorative increase would be welcome, but having attended the board meeting on September 11, I doubt it is in the cards.

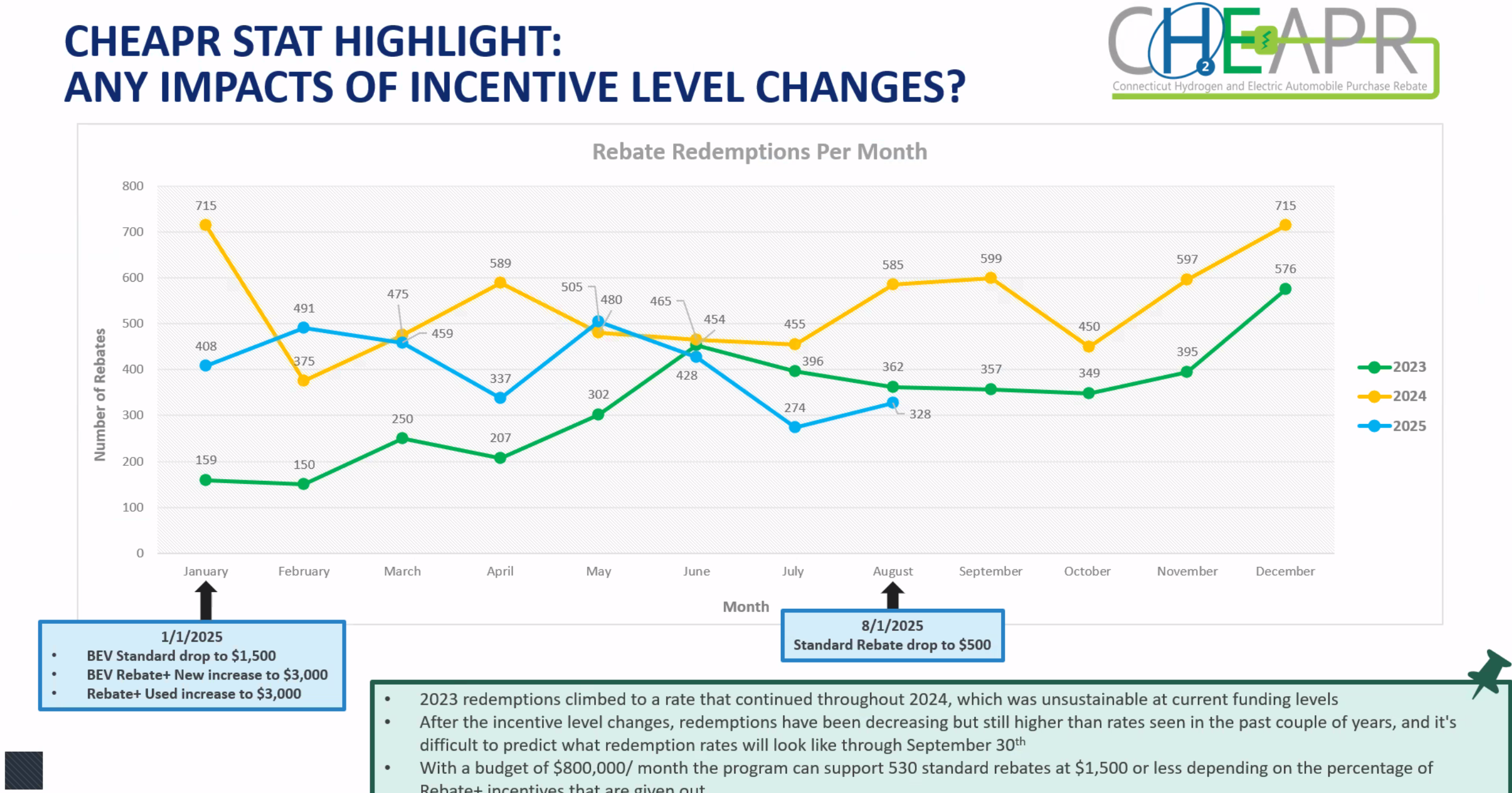

Rebates hit a record level in 2024. However, the numbers in 2025 have been below the corresponding month in 2024 for 6 of the 8 months in the year to date, including July and August, subsequent to bill passage. Even at this lower level, the program faces financial challenges.

A big reason for the fiscal caution is that CHEAPR had been spending down surpluses. It had underspent for several years. Those funds were carried forward. The record year in 2024 used up the last of that surplus. So, even with the lower run rate of 2025, the program is on the fiscal edge.

Another reason is a higher utilization of Rebate+, which carries larger incentive awards. During the first half of the year, the number of these rebates was pacing about 20% higher than the corresponding period last year.

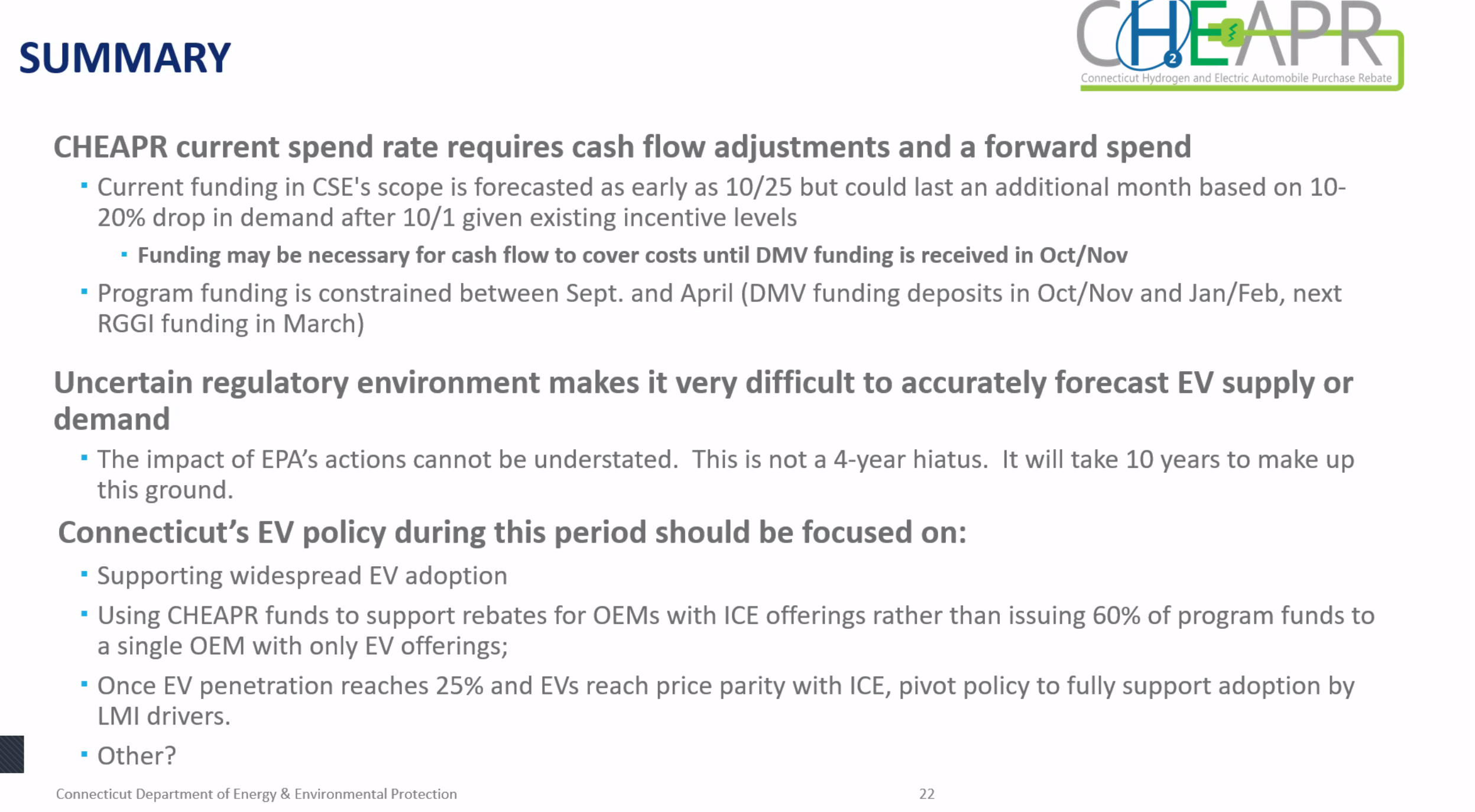

To cap it off, a portion of the discussion was about ways to further curtail the burn rate, not a discussion one would be having in anticipation of raising incentives.

While it feels premature to get into the weeds of what steps might be taken outside of changing the incentive levels, most would require legislative action. There was a set of incentive reductions announced prior to the most recent changes, that was, in fact, pre-empted by the Aug. 1 changes. In this earlier plan, there was the creation of a new tier of incentive called Community+. Currently, anyone living in a distressed community is eligible for the Rebate+ level of incentives, even if they, themselves, would not qualify based on income. Community+ would have lowered the incentive for those folks to a level between the standard incentive and the + incentive. If they go with this, it is likely to yield modest savings.

One of the other ideas, which we hope they don’t do, though they seem inclined to, is an OEM cap. This is reminiscent of the structure of the federal incentive that existed prior to the Inflation Reduction Act. A manufacturer was allowed 200,000 incentives before a phase-out period would occur. We don’t like this idea because it penalizes success, rewards laggards, creates an (for want of a better term) asymmetrical competitive environment, and deprives the consumer of agency. We prefer offering the incentive and letting the market take it from there. This is the final recap slide that indicates this and some other thoughts.

Another option is, of course, to persuade the legislature to add more funding. Given that its most recent action was to cut the charging incentive, we won’t bet on it.

Incentives matter. It is highly likely EV sales will stall for a period of time following the end of the federal incentive. Manufacturer discounts may ameliorate it to an extent, but the fact is that there is a lot of uncertainty about what will happen. DEEP and their contractor, the Center for Sustainable Energy, will be monitoring the numbers closely. To the extent that people are looking to the states to step up to partially fill the void left by the feds, and some are trying, there are obvious limitations if this is any example.