Policy Environment for Used Electric Vehicle Incentives

When the Inflation Reduction Act was drafted, it had multiple goals, which can be loosely summarized as promoting clean energy, reviving the domestic industrial base, and making clean tech more affordable for consumers. Related to that is the Justice40 initiative, whereby the program design devotes substantial resources to direct these benefits to environmental justice communities.

EVs are very much a part of Justice40. Not only are the jobs important, but air quality is often poor in these communities. That is certainly the case in Connecticut with our bad and getting worse air pollution. (The new State of the Air report by the American Lung Association is due out next month. Keep an eye out if you want to get depressed.)

The early adopter profile for EVs, as with many products that represent a substantial purchase, is upscale. Though certainly helpful, new vehicle incentives alone may not be enough to reach a mass market. For EVs to displace internal combustion vehicles at scale, anyone who can afford to own a car needs to be able to afford an EV. The majority of vehicle sales in any given year are used vehicles. According to the Federal Bureau of Transportation Statistics, used vehicles accounted for 71% of all vehicle sales in 2019 (the most recent available data). And so, an incentive for used cars was incorporated into the IRA. The question is how easy is it for the consumer to access it.

Inflation Reduction Act Used EV Incentive Basics

These are the basic rules for the federal used EV incentive.

- Purchase price cap of $25,000.

- Only purchases through new or used car dealers are eligible.

- The incentive is 30% of the purchase price, capped at $4000.

- Purchaser income limit of $150,000 modified adjusted gross income for joint filers, $112,500 for head of household filer, and $75,000 for single filers.

- Income eligibility can be determined by the current or prior year.

- Vehicle model year must be 2 years older than the current model year.

- Transfer provision can be used. This provision is new for 2024 and allows the buyer to transfer the credit to the seller and receive it as a point of sale rebate.

- Minimum battery pack size of 7 kWh.

- No more than one incentive per VIN. As a practical matter, this is a non-issue at this point. The incentives just haven’t been around that long.

- Dealer registration with the Department of the Treasury is required in order for the consumer to receive the incentive. There are specific registrations for both the tax credit and for the transfer.

None of the new car rules regarding domestic assembly, battery mineral sourcing and manufacturing, and foreign entities of concern apply to used vehicles.

Dealer Registration

In order for a consumer to receive the incentive (new or used), the dealer that sells the vehicle must be registered with the Department of the Treasury (IRS). Not every dealership is registered. Unfortunately, there is no publicly available list of registrants, which we regard as a big oversight on the part of Treasury. It is necessary to contact the dealership you are thinking of visiting, though some have proactively advertised their participation. Based on what we have been hearing through our conversations with the Electric Vehicle Association, about half of new car dealerships have registered and a much lower percentage of used car dealerships.

We have heard various reasons why a given dealership may not have registered:

- Dislike of the IRA.

- Not interested in selling EVs.

- Registration declined by Treasury for whatever reason, for example an incomplete application.

- Registration still in process.

- Affiliated manufacturer doesn’t make incentive-eligible EVs so why bother, or why bother just for used EVs.

- Avoidance of non-mandatory involvement with the IRS.

This blog reached out to the two largest used car chains, CarMax, which is the largest by a mile, and Carvana. In both cases, these companies are set up to provide the Time of Sale report so the customer can claim the tax credit, but neither is registered for the transfer. CarMax is at least thinking about it. In their response to our inquiry, they wrote, “…We anticipate developments on the credit transfer in the future.” If we hear about a subsequent update, we will publish it!

Tesla

As with the new vehicle incentives, Tesla is also registered to process both the tax credit and the transfer for used EVs.

Used EVs are an Underdeveloped but Important Market

Our view is that the transfer is very important for the used EV market since there will be a higher incidence of consumers unable to make use of a conventional tax credit. (These tax credits are non-refundable, meaning if you are not able to use it, you lose it, and there is no carry-forward provision.)

We do not have access to a subscription service that tracks vehicle sales. Our very back of the envelope calculation, filtering for vehicles registered in 2023 with a model year of 2021 or older indicates that roughly 5725 used EVs were sold in CT last year. So, not nothing, considering there were about 18,000 overall EV registrations occurring last year.

Private Sale Workaround?

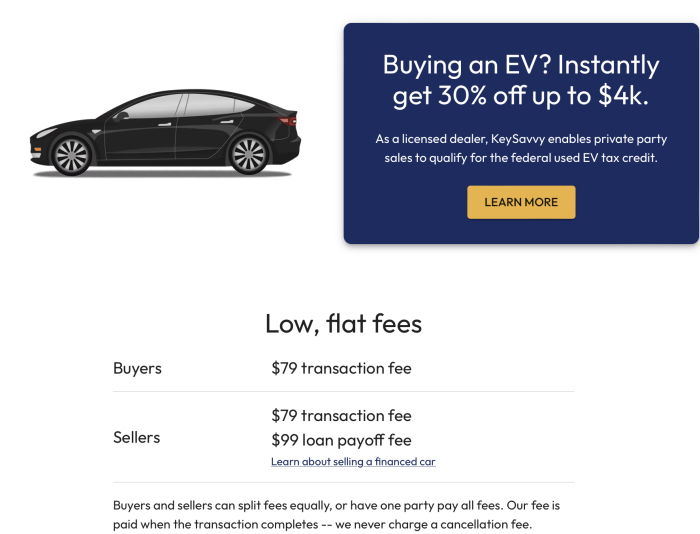

This incentive structure with the registration was designed to work through dealers and does not apply to private sales. However, a company called KeySavvy, which has a dealership license, is offering to facilitate private transactions via its dealership status and does offer the transfer. (We do not have personal experience with them.) This is a sceengrab from their website. If any readers use them, please let us know how it goes.

State Incentive

This article mainly focuses on the IRA, but there is also a CT CHEAPR incentive for used EVs. It is part of the Rebate+ incentives that are available for households with income of no more than 3 times the federal poverty level or that are located in an Environmental Justice or Distressed Community. This is a true point of sale rebate, not a tax credit, and it gets deducted from the invoice price. It is $3,000 for a battery electric vehicle and $1125 for a plug-in hybrid. Rebate+ also offers an added incentive for new EVs and the total of the base and + incentives are $4250 (BEV) and $2250 (PHEV). To avoid a suspenseful purchase experience, consumers can register in advance and obtain a pre-qualification voucher from DEEP. Vehicle eligibility for this rebate is limited to vehicles that were eligible when new. Eligible vehicles can be found on this page of the CHEAPR website. The website also has a link to which communities are EJ/distressed.

Usual Disclaimer: As always, we seek to provide the most up to date information but things change and it is always advisable to check when shopping for a car and to check with your CPA.