Post by Barry Kresch

Beware the Disappearing Incentives

There are 35 EVs (BEV and PHEV) listed as incentive-eligible by the Federal Department of Energy as of October 1, 2023. It is really fewer than that as the website breaks out the different trim levels. For example, there are 8 variations of the Volkswagen ID.4. The DoE website is here. It includes the ability to filter vehicles.

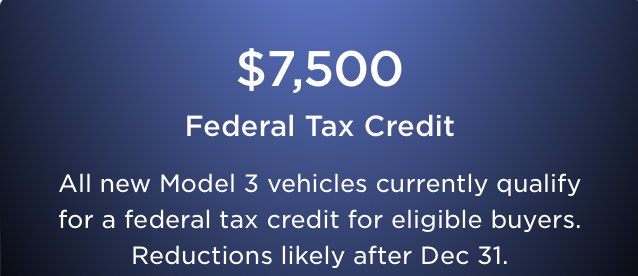

Tesla is publishing incentive alerts on its website, seen in the photo above, warning that some of its vehicles may lose full or partial incentive eligibility. Tesla is more public about it, but it is not alone in bumping up against the moving target of escalating in-sourcing requirements, the looming Foreign Entities of Concern rule, and ongoing IRS rule-making. From what we are hearing, most EV manufacturers could be affected, mostly because it is difficult to quit China as quickly as the legislation requires.

Battery Requirement Changes

These are the changes in the battery requirements that begin in January.

- Critical Mineral Sourcing/Refining increases from 40% to 50%. This minimum percentage must come from either a domestic supplier or free trade partner.

- Battery Assembly – the percentage of battery components that must be assembled in North America increases from 50% – 60%.

Foreign Entities of Concern

The rule that the manufacturers have voiced the most consternation about is the Foreign Entities of Concern (FEoC). This phases in beginning in 2024, followed by part two in 2025. The FEoC mirrors the battery regulations in that half of it applies to critical minerals and the other half to battery assembly. It is the latter half that starts in 2024 with the mineral portion following one year later.

Beginning in 2024, eligible vehicles cannot contain any battery components manufactured in a country so designated. The way to think about it is if you reference the 60% battery assembly requirement noted above, a manufacturer can source 40% of battery components from outside of North America in 2024. However, the FEoC rule specifies that none of that 40% can come from a FE0C. This is obviously about China, but other countries will fall into this designation.

We expect a number of vehicles to lose all or 50% incentive eligibility in 2024. Over time that will likely change, but the next two years are sure to be the most challenging as requirements tighten and new plants have not yet come online.

Ongoing IRS Rule-Making

A large rule-making task was quite literally dumped on the IRS in August of 2022. The wide-ranging IRA legislation, which encompasses much more than EVs, was passed in rather skeletal form, with the implementing agency, The Department of the Treasury, responsible for developing the specific rules. Sometimes this rule-making has run counter to the spirit of the legislation according to some of the legislators who voted for it. For example, the “leasing loophole,” which allows consumers to obtain incentives on vehicles that would otherwise not meet the requirements if purchased, came about because the IRS interpreted a lease as a commercial transaction. The vehicle is sold by the dealer or manufacturer to a captive finance company. This was defined as commercial. The fact that the finance company subsequently executes a lease with a consumer is beside the point from the perspective of the incentive. Commercial transactions fall under a different set of rules that do not include the restrictions that apply to consumer purchases.

Due to the short lead time, the ink has barely been dry on the rules at the time they are due to be implemented. Sometimes the IRS blows through the deadline. The first-year set of battery rules was postponed from January 1 to April 18th of this year for that reason.

The FEoC remains a moving target in this regard. The IRS has advised that the final list will be available before the end of the year, so potentially as little as 24 hours before it is due to go into effect. Maybe there will be an FEoC postponement, similar to what happened with the batteries.

How to Define FEoC

One of the big areas of contention involves not so much designating what countries fall under this rule, but how it is defined. For example, what if a Chinese company opens a plant in North America? What if it is a joint venture with a domestic manufacturer? What if a domestic company builds a factory but licenses technology from a Chinese company? The latter is the most minimalistic footprint and an example is the battery plant that Ford has begun building in Marshall, Michigan. The plant will be producing Lithium Iron Phosphate (LFP) batteries. Ford will own the factory. The workers will be Ford employees. The LFP battery chemistry IP is being licensed from CATL, the big Chinese battery company.

Last week, Ford announced it is pausing construction on this plant. Of course, the company is in the midst of contentious negotiations with the UAW, which is trying to include battery plants owned by the companies in which it has representation at parity wages. But Ford has also commented publicly that it is waiting for IRS determination regarding whether the IRA manufacturing and consumer tax credits are applicable to this plant. It has threatened to greatly downsize the plant if that is not the case.

VIN

While we hope that dealerships are able to offer consumers accurate information regarding whether an EV is incentive eligible, and in our experience Tesla has been pretty on top of incentives, the definitive way to know is to input a Vehicle Identification Number on this federal page. Of course, it would be better to know about eligibility further upstream, but that is what the government has provided.

Lobbying

There are lots of reports of furious lobbying behind the scenes, which occasionally spills into public view, such as the Ford battery plant. But there is more than that. Manufacturers would like to change the determination of vehicle eligibility from the “placed in service date” to the date of manufacture. They obviously have more control over the latter, and it buys them a bit of a grace period since it is earlier.

It has also been reported that manufacturers would like to get Vietnam designated as a free-trade partner for the purposes of battery critical minerals.

The Transfer Provision – Another Big Deal

Tax credits are not the most consumer-friendly form of incentive. You have to wait for it. And not everyone has enough tax liability to be able to use it. The transfer provision is the legislation’s way of turning the tax credit into a rebate. The buyer transfers the credit to the seller. The seller takes the credit and gets reimbursed by Treasury. Also, non-taxable entities can use the transfer provision.

My biggest concern is that the process won’t work smoothly when it is initially introduced. The IRS has been working on the process. It is yet another aspect of rule-making that will likely come down to the wire. Will the dealers and manufacturers be on top of it and not afraid to use it?