Rebates Way Up, Mostly Due to Tesla

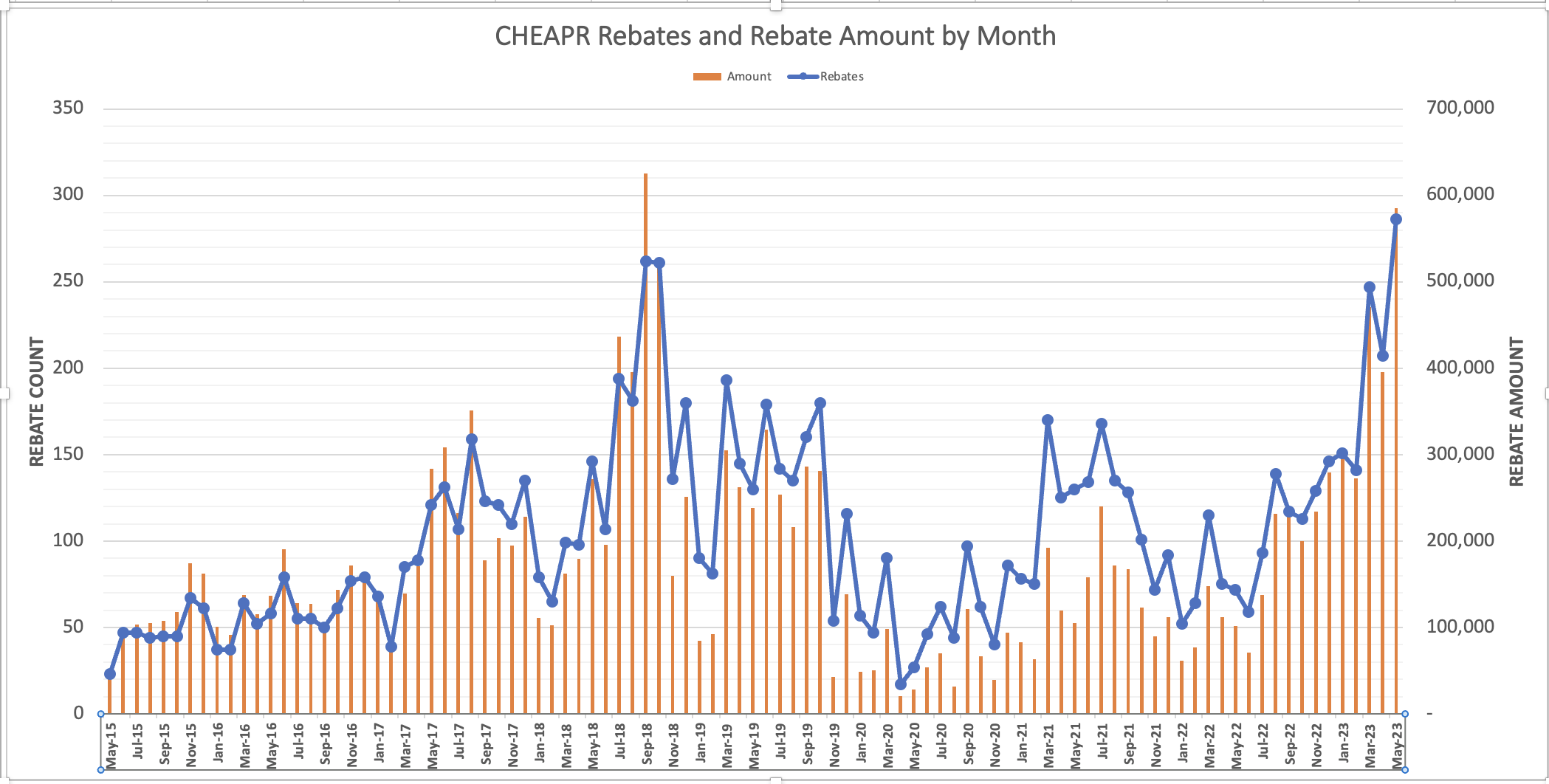

DEEP has published stats through June 14th, but for the purposes of this post, we are looking at complete months, thus through May 31st.

As can be seen in the chart at the top of the post, rebates have really spiked. In fact, the 286 rebates in May is the most the program has ever had in a calendar month. This is mostly driven by Tesla.

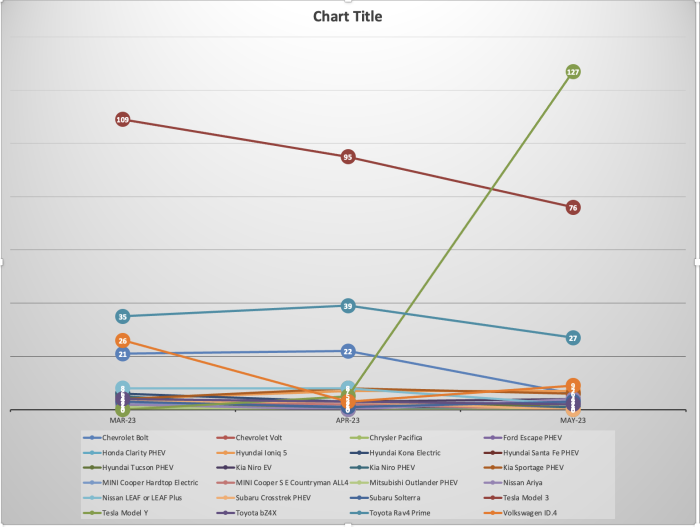

Below is the trend of rebates by model. That green hockey stick is the Model Y. Price cutting by manufacturers has brought some popular models below the $50K CHEAPR MSRP cap. The Model Y is the best-selling electric vehicle and the best-selling non-pickup vehicle in the USA, and as soon as the base trim level became eligible, it zoomed right to the top in terms of rebate count. The brown line that is currently second is the Model 3. The base trim level Model 3, as well as the reintroduced long-range non-performance version are CHEAPR eligible.

Aside from the Tesla vehicles being the most popular EVs, Tesla has been the best organized in terms of helping eligible consumers claim the rebate. With dealerships, it is bit of roulette as not all of them are up to date on the program or have knowledgeable salespeople. We have also heard that some of the finance companies that dealerships use for leased vehicles don’t accommodate the incentive.

Ford recently announced a price cut for the F-150 Lightning and the base trim level will now qualify for CHEAPR.

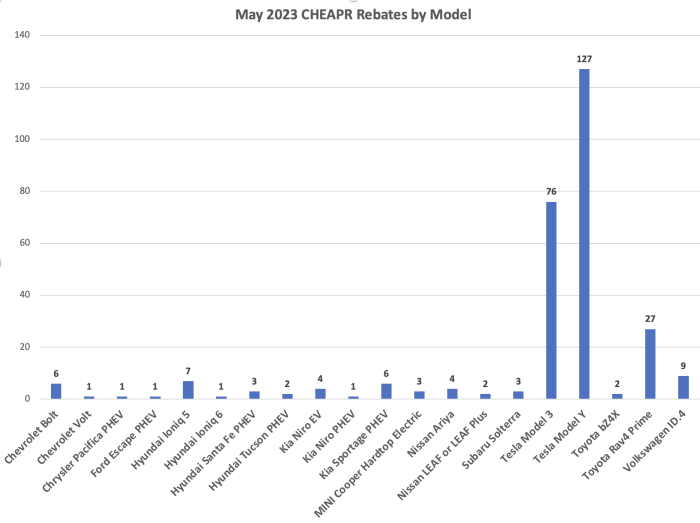

Outside of the Tesla models, only the Toyota RAV4 Prime PHEV was rebated in double digits. The RAV4 had been a leader in the number of rebates but has been tracking at a lower level more recently. The Chevy Bolt, particularly the newer EUV variant, had been building as the company began to see daylight in its recall efforts, but that momentum is stalling with the cancellation announcement. The Bolt had come to dominate the value segment. It was small but not that small, with a roughly 238 mile range for about $30K. GM doesn’t comment on future plans before they become firm, but they have dropped hints that they value the Bolt nameplate and, who knows, we may see a variant of it on the new Ultium platform.

This is what May looks like.

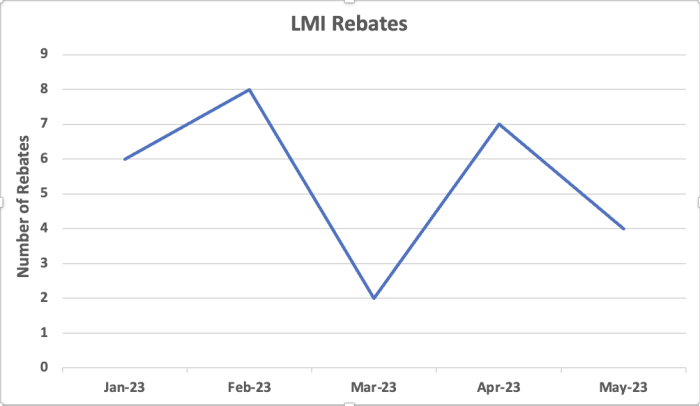

New Rebate Plus – Rebates for Income-Limited Individuals

The latest piece of the CHEAPR program to go live was the loosened income standard and pre-qualification voucher for the supplemental income-limited rebates. The pre-qualification voucher enables the buyer to get a “cash on the hood” incentive, rather than be forced to float the cash until a reimbursement arrives. Also, the highly restrictive previous eligibility criteria was expanded to include anyone with an income level up to 3 times the Federal Poverty Level. More detail on this program can be found on this blog post here.

DEEP reported an encouraging early response in terms of voucher requests. To this point, very few rebates are appearing in the data. This shows rebates by month for Rebate +. The program soft-launched, meaning absent a marketing push, on March 29. It feels to us that given the multi-step process, it is too soon to know how well this new program is working.

There are several things that have to happen before a voucher request turns into an incentive.

- How long does it take to get the voucher approved?

- How long will the consumer take to place an order?

- How long will it take for the vehicle to be delivered?

- Is there any dealer friction over the new voucher process that holds up orders?

- How many people get a voucher that they then do not use?

Hopefully, we’ll be in a position to get a better read on this by the fall.