The photo above is of the Model Y Juniper that has been published on Tesla’s website in China.

Strong Finish Led to EV Sales Growth for 2024, But What Does the Future Hold?

EV sales finished mostly on a high note with a strong fourth quarter leading to about an 8% year over year increase domestically to 1.3 million vehicles as estimated by Cox Automotive. These are BEV sales and are still estimates as final data will lag a few weeks.

Tesla is still the market leader but its sales total declined about 1% globally in 2024. According to the New York Times, the decline was steeper, at about 6%, in the USA, while GM, Ford, Honda, Hyundai, and Kia saw significant increases off a lower base.

Tesla does not break out individual models or regions in its reporting. Of the 1,789,226 vehicles that Tesla delivered globally, only 85,133 were the combined S/X/Cybertruck. It seems pretty clear that the Cybertruck is not driving enough volume to change the bigger picture for Tesla.

There were several reasons for strong EV sales that included lots of year-end deals from multiple OEMs, lower interest rates, and of course, the prospect of the federal incentive going away.

Other Thresholds Crossed

According to Inside EVs, the Ford Mustang Mach-E outsold its gasoline counterpart in 2024, by 51,745 to 44,003.

Tesla outsold Audi worldwide, as reported by Bloomberg.

Make and Model Details for CT Coming in a Few Weeks

As noted above, the EV sales data highlighted by the national press tend to focus on BEVs. They could be clearer about their labeling. However, EV policy at the federal and state levels includes plug-in hybrids and fuel-cell in their definition of “clean vehicles.” The IRA and state purchase incentives include these other drive trains. In fact, the structure of the IRA incentive gave a boost to PHEVs compared to the prior federal incentive which took into account battery pack size.

Fuel-cell vehicles are not a factor in CT but PHEVs account for roughly 37% of EVs registered in the state. As legacy manufacturers adopt a more hedged EV strategy, particularly in the face of the likely loss of the federal incentive, PHEVs, which have been losing share over the past few years, may make a resurgence.

Once other sources that ingest registration data become available, then we will start to see more granularity. In particular for Connecticut, the EV Club waits for data from DMV or DEEP and that typically lags a month or so. At that point, there will be a release that updates data through the second half of 2024. This is net registrations, not new vehicle sales.

Federal Incentive: 2025 Edition

Each year the requirements for approved sourcing of battery critical minerals and battery pack manufacturing become more stringent. When the legislation was passed in 2022, it was expected that many EVs would have difficulty qualifying and that it would get worse before it gets better due to the time needed to re-orient supply chains. In 2025 we are still in that no-man’s-land of a lot of vehicles not qualifying, although the ones that do include most of the big sellers. This is a list of all of the eligible BEVs (which can be found on the Department of Energy page here):

- Acura ZDX

- Cadillac Lyriq and Optiq

- Chevrolet Blazer, Equinox, Silverado

- Ford F-150 Lightning

- Genesis GV70

- Honda Prologue

- Hyundai Ioniq 5, Ioniq 9

- Kia EV6, EV9

- Tesla – All models

The only eligible PHEV is the Chrysler Pacifica minivan.

All of the models noted are eligible for the full $7500 incentive. Some of these vehicles start just barely below the MSRP cap and a higher trim level or an option package may cause them to exceed the cap.

All EVs are incentive-eligible if leased.

Note the eligibility of several of the Hyundai Group vehicles for the first time as the company is an early success story in establishing domestic manufacturing in Georgia for Hyundai and Kia, and Alabama for Genesis.

This is a living list. As supply chains evolve, vehicles can be added (or dropped).

Among the vehicles losing eligibility are the Nissan Leaf, Rivian R1S and R1T, Volkswagen ID.4, Ford Escape PHEV, and Jeep Wrangler PHEV. There are others.

Incentive Prognosis and Impact

The incoming Trump Administration has been very clear about wanting to get rid of the EV incentive. This could mean the manufacturing tax credit, consumer purchase incentive or both. Tesla CEO, Elon Musk, has publicly backed losing the incentive. That seems to be part of his new persona; he has been all over them in the past. This is an article from CNBC that describes how Tesla has used tax breaks and loans to build its businesses. A quote from the article from Mike Murphy, the Republican strategist who runs the EV Politics Project that promotes EVs, “Elon tends to say he’s hostile to subsidies while Tesla is gobbling them up like a hungry Godzilla.”

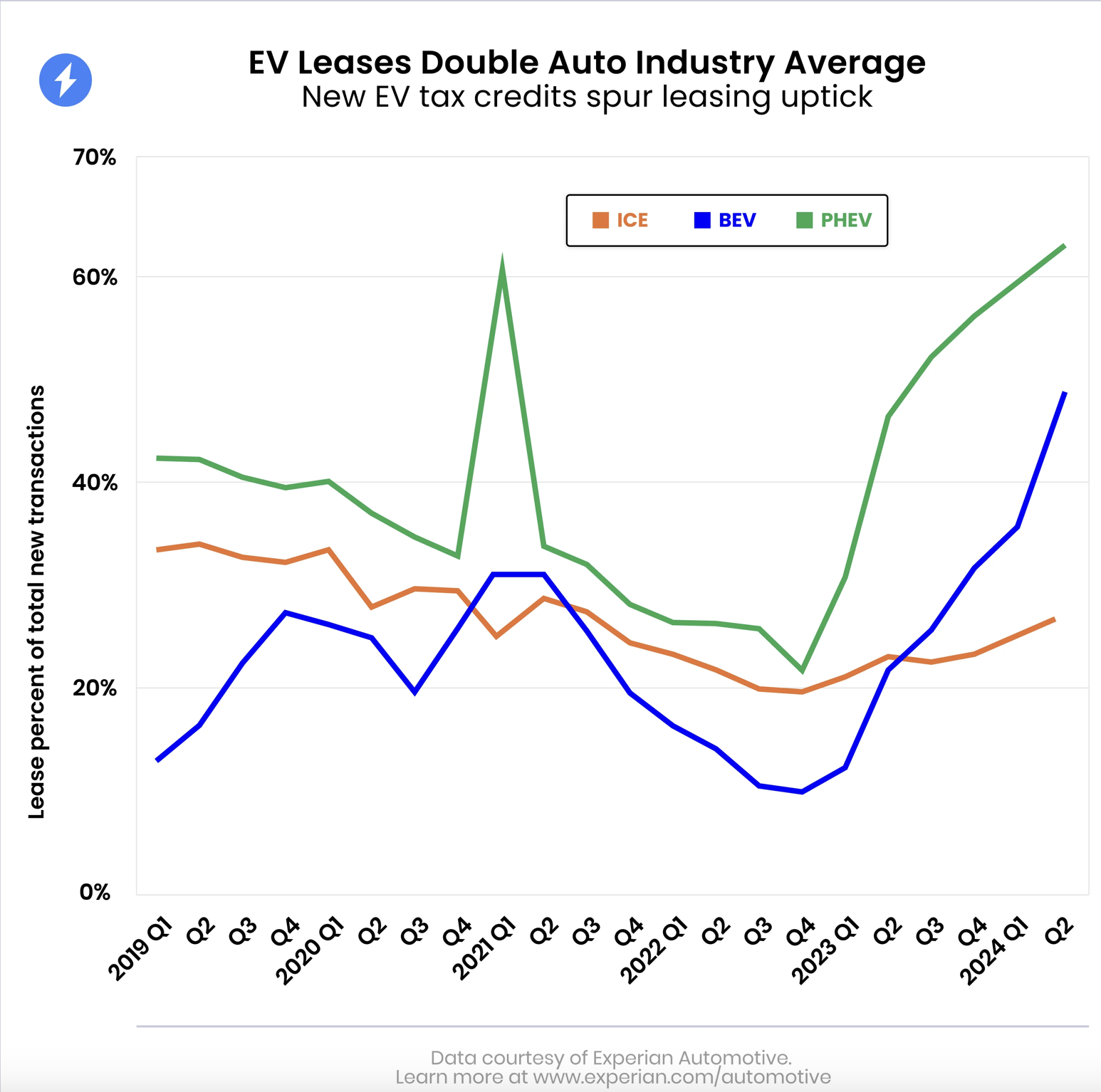

We have seen many examples of incentives affecting consumer behavior. Most recently, with the IRA and the fact that any leased vehicle is incentive-eligible, there has been a dramatic increase in the percentage of EVs that are leased as can be seen in the blue and green lines below beginning in Q4 2022. (The IRA was signed in August of 2022.)

In another dramatic example, Germany eliminated a federal incentive at the end of 2023 that caused the price of the average EV to increase by 14%, as reported by Barrons, leading to a drop in sales of 26% in 2024 compared to 2023. Could that be our fate?

Timing

“Day 1″ pronouncements notwithstanding, it is not likely the incentive will go away immediately upon Trump taking office.

There has been much reporting regarding how the Republican caucus and Donald Trump plan to logistically go about passing their immigration, tax, and energy proposals with said proposals having yet to be negotiated. A complex reconciliation bill could take as long 6 months to put together. With a very narrow majority in the House, the caucus has to stay united and there are some Republican legislators who are seeing the benefits of the IRA in their districts. According to e2.org, 68% of IRA job creation has taken place in Republican districts. Speaker Mike Johnson was quoted in E&E news as saying, “You’ve got to use a scalpel and not a sledgehammer…”

If we recall the early days of Trump 1.0 and the vow to immediately repeal Obamacare, the bill that the Republican caucus crafted to do that, and which ultimately failed with the dramatic, late night “no” vote of the late Senator John McCain, occurred on July 28, 2017. Hence, the 6-month estimate.

Following the ACA repeal fiasco, the administration adopted a more passive/aggressive approach – eliminating navigators, shortening the enrollment window, taking down helpful information posted on the federal website, etc. We may potentially be revisiting some of that approach.

Aside from a partial or complete repeal, the Treasury Department could redo the rules. For example, they could reclassify leasing such that it is no longer considered a commercial transaction, which is what exempts it from all the purchase restrictions. Or they could make the battery requirements more stringent. But that, too, has to go through a process and will take some time.

Is There Any Hope?

There is. Some. Not including the long shot hope that at least 2 Republican representatives who value jobs in their district prevail.

Incentives or no, the product is good. There are lots of good EVs out there with many more coming over the next two years. The Batteries Included YouTube channel/podcast just published an episode of “All the Electric Vehicles Coming in 2025.” It takes them about 2 hours to get through everything. Some highlights:

BMW Vision Neue Klasse – BMW has been in the EV game for longer than many realize, going back to the limited production ActiveE and i3. They make some good EVs, but the new platform with a structural battery and panoramic windshield display sounds promising.

Volvo EX30 – This is a well-regarded compact SUV that was initially delayed due to buggy software, but is now a success in Europe and imminently coming to North America. The car was originally built in China, but a newer plant in Belgium will most likely be the source for North America. It will avoid the heavy tariffs on Chinese goods, but will not be incentive-eligible. We need more EVs like this, along with the Chevy Equinox and forthcoming Bolt 2.0, at affordable price points.

Tesla – At last, the Model Y Juniper refresh should arrive. Early reports on range stats are good, but they are based on Chinese data which is less stringent than our EPA. There is also a lot of vague news about a lower price Tesla, first the Model 2 compact hatchback (not happening), and now what is referred to as the Model Q, which sounds like a Model 3 lite. We don’t count on anything until it is officially announced.

Honda – This company finally got in the BEV game using white-labeled GM vehicles for the Honda Prologue and Acura ZDX. But they have developed their own platform, unveiled at CES, called the Zero series, announcing an SUV and a sedan to be built in Ohio. 2025 is probably optimistic for these. They also have a partnership with Sony, launching an expensive, high-tech EV called the Afeela.

Stellantis – For a company that has seemed lost in the wilderness, and with the stock price down 56% over the past 9 months, they have an interesting pickup coming out in the RAM 1500 Ramcharger. With EV pickups struggling to gain traction and proving a bit under-powered, this vehicle pairs a 92kWh battery pack with a gas generator for an extended range electric vehicle yielding an electric range of 145 miles and total range of 690 miles with a max towing capacity of 14,000 pounds.

The First Legacy Manufacturers to Embrace Direct Sales

The new EV brand, Scout, backed by Volkswagen, is anticipated to deliver its initial SUV and truck offerings in 2027 with 2028 model year vehicles. What is interesting is how they plan to sell them, namely via direct sales. Scout’s VP of Growth, Cody Thacker, is reported in The Verge as saying, “We kept asking ourselves, if an OEM could start over again, what would they do differently? A big point of frustration for consumers is that they want transparency in pricing and they resent all the hidden fees and markups. Only through a direct-to-consumer model can we tackle these head on and resolve them.” Unsurprisingly, VW dealers are already threatening lawsuits.

Another new EV brand that is an extension of a legacy OEM also announced at CES that it will use a direct sales model. This is the Afeela brand that is a joint venture of Honda and Sony. As reported by Inside EVs, Shugo Yamaguchi, CEO of Sony Honda Mobility of America said, “We are taking a direct consumer approach to simplify the customer experience and enhance your satisfaction.” As with Scout, Honda dealers are mobilizing to file lawsuits.

These examples are different than the recently announced arrangement about Hyundai vehicles being sold on Amazon. In that case, the dealership is still involved; they’re integrated into the order flow. Nevertheless, 2 legacy manufacturers have finally admitted, albeit through a side-door, that the dealership model is not up to the task of selling EVs.

Parting Thoughts

We are the EV Club so, of course, we support the EV incentives. But we also support the IRA writ large. Industrial policy combined with tariffs is bringing clean energy jobs and a domestic supply chain to this country. Tariffs alone won’t work. Every legacy OEM is playing catch-up when it comes to EVs. Some are making more progress than others. If we lose the IRA, along with the EPA and CARB-state fuel-efficiency requirements, they will slow their transition, even though they all know that electric is the powertrain of the future. This is a quote from U.S. Secretary of Energy, Jennifer Granholm, from an opinion piece she published in Fortune, “The EV tax credit is one of many strategic investments in America and its future. If we start rolling it back, there’s a good chance we’re left eating China’s dust.”

Our hearts go out to the residents of greater Los Angeles coping with the latest but certainly not last, climate-induced, catastrophe.

1 thought on “Q4 Sales Burst Leads to 2025 Question Marks”

Comments are closed.