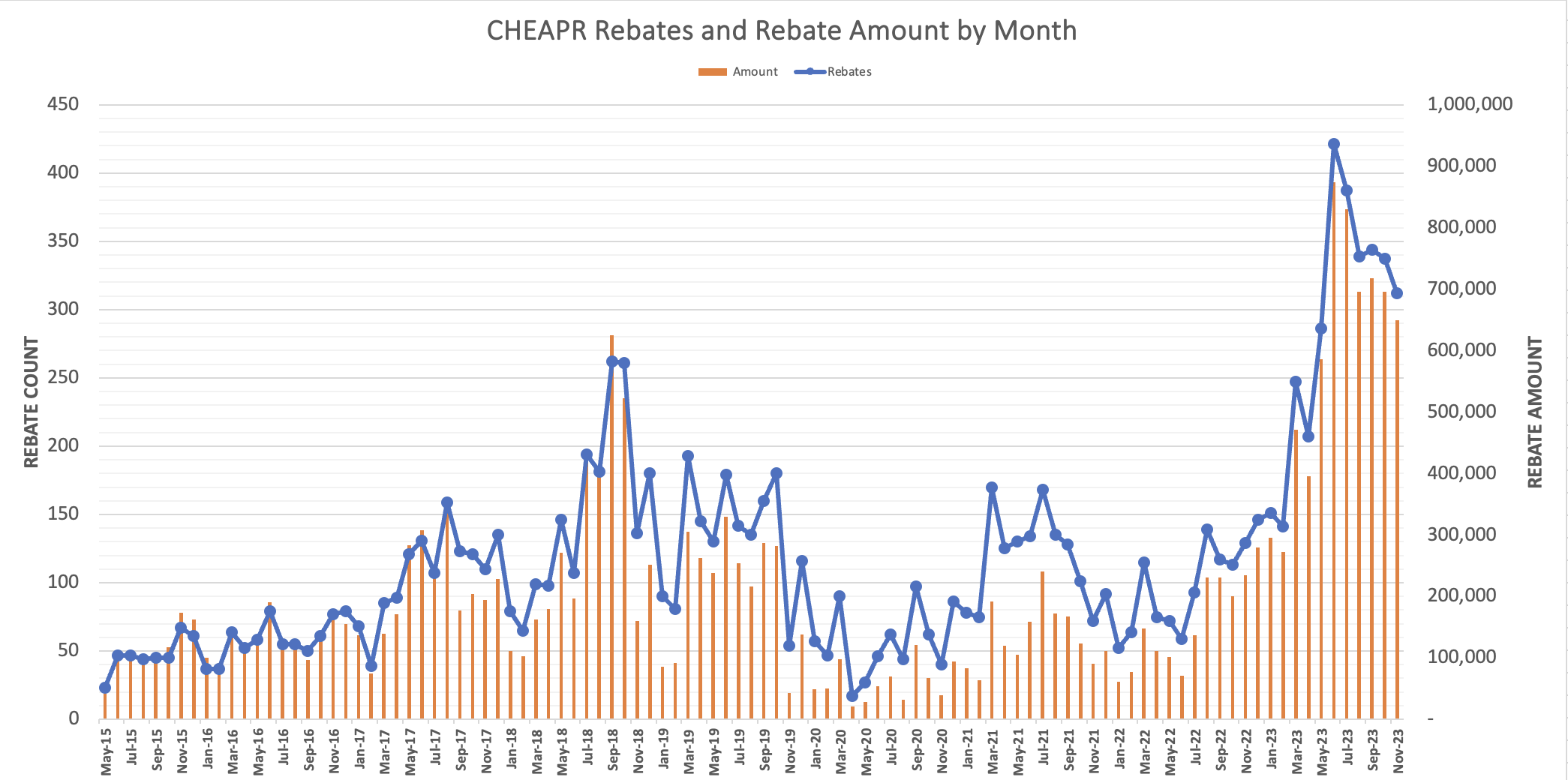

Above chart is the monthly rebate trend through November 29, 2023. Recent months tend to get restated higher in subsequent updates.

LMI Program Focus

The CHEAPR program has always had a focus on making an EV more affordable for those who otherwise might find the purchase price too high a barrier. There is an MSRP cap to avoid subsidizing the most expensive vehicles. (Until the recent Tesla price-cutting, Teslas were mostly not eligible.) The program also offers consumers with limited income an extra subsidy, as well as a used EV incentive. The standard for doing so was loosened somewhat in 2023 and now applies to households with an income of no more than 3 times the federal poverty level. This translates to $43,740 for a single person or $90,000 for a family of 4. (These numbers get adjusted every year.)

This revised incentive, often referred to as “LMI” for lower-middle income, also offers a “pre-qualification” voucher. Qualified purchasers obtain the voucher ahead of time, and the amount of the voucher can then be deducted from the price of the vehicle at the time of the sale. Even though it’s more complicated to administer, it represents an improvement for the consumer. Buyers now know ahead of time that they are approved for the rebate and no longer have to front the cash as they did with the earlier program design.

This revised program soft-launched in March of this year. Due to the one-year shelf-life of the voucher, it was expected that there would be a lagging effect. DEEP has reported high interest in the voucher, though specific data are not reported. We can only see the reporting based on redemption. There has definitely been an increase in recent months. We hope they will be higher as more vouchers are in circulation. The chart below tracks the monthly redemptions for 2023 through November. It is likely that November will be restated higher with the next release.

Overall Rebate Volume Slackens But Is Likely to Recover

This is shown in the chart at the top of the post. We believe that this had to do with the base trim level Model Y having been temporarily withdrawn from sale by Tesla as it redesigned the vehicle, and perhaps augmented by the Chevy Bolt’s increasing scarcity as the model sunsets for the time being. The standard range Model Y is back now with an LFP battery, rear-wheel drive configuration for $43,990 (at least today), well under the CHEAPR MSRP cap. The Model Y AWD long range is also under the cap at $48,990. We expect rebate volume to pick up again. CHEAPR has dispensed about $6.8 million year-to-date and is on pace to reach $8 million. This is quadruple what it was in 2022 and is due to greater model availability and the increase in the MSRP cap to $50,000.

Models

The most rebated vehicle this year is the Tesla Model 3 with 927 rebates, followed by the Model Y with 681. These are followed by the Toyota RAV4 Prime (380), Chevy Bolt (274), Volkswagen ID.4 (204), and Hyundai Ioniq 5 (116). All other models were <100.

Fleet Rebates Coming

The final program component included in the 2022 legislation is the rebate program for fleets. It is expected to launch sometime this spring. These apply to commercial, municipal, tribal, and non-profit entities – in other words just about all fleets. Fleets are eligible for up to 10 rebates in a calendar year and 20 total.

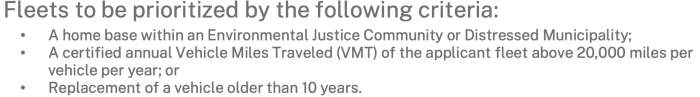

There is potentially significant demand for these rebates. Given that potential, and the program having a pretty high burn rate generally, not every applicant will necessarily be granted a rebate. Below is a slide from DEEP indicating how they are prioritizing rebate requests. Please note, the final contours of the program are still being developed.

The reason for these gating criteria is to avoid a lapse in available funds that would cause the program to be paused, like what happened in New Jersey. The rebate size and MSRP cap are the same as with the consumer rebates.

Rebates will be pre-certified (and the funds reserved) with post-purchase repayment.