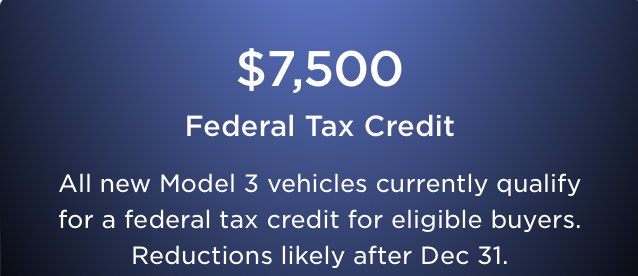

IRA EV Incentive Outlook For 2024

Post by Barry Kresch Beware the Disappearing Incentives There are 35 EVs (BEV and PHEV) listed as incentive-eligible by the Federal Department of Energy as of October 1, 2023. It is really fewer than that … Read more