All graphics from CT Department of Transportation

The Next Shoe to Drop?

Once upon a time, there was free public charging. Well, there wasn’t that much charging infrastructure, but there were grants available for level 2 chargers that came with the proviso that the juice be dispensed gratis for a period of time. It made the business model about the grant, never a great idea. Many of these chargers fell into disrepair. Why spend money on maintenance if you don’t charge for the juice?

It did, however, give the impression that EV owners felt “entitled” to free charging, though that is stretching the point to say the least.

The other “free ride” that EV owners get, BEV owners anyway, is that they do not pay anything, namely gas taxes, that support the transportation fund that finances the upkeep of our roadways. That is changing as a number of states have begun imposing various fees. The landscape is mixed at this point, but one thing that seems clear is a lack of analytical thinking combined with thoughtful policy making.

Let’s look at the unexpected case of blue New Jersey, which arguably takes the prize for the most conflicted set of EV policies you can find.

How Not to Tax Electric Vehicles

Prior to a bill signed by Governor Murphy in March, NJ had an impressive array of incentives. EVs are exempted from the sales tax. There is a generous EV purchase incentive (for new vehicles only) of up to $4000, although it has been haphazardly administered. (The legislature appropriates an inadequate amount of funding to meet demand, resulting in the program getting suspended when funds are depleted before the year is out. It gets revived when the next tranche of funding gets allocated the following year and the same cycle ensues. It’s confusing for both consumers and sellers.)

Now, in a bill signed by Governor Murphy in March, NJ has initiated a 3-year phase-out of the sales tax exemption and imposed a registration fee for EVs. The new EV fee, which applies to battery electric vehicles (BEVs), begins on July 1st and adds a $250 annual fee to the existing registration fee. It then escalates $10 each year until it is capped at $290 in 2028.

When a consumer buys a new vehicle in NJ, they pay 4 years of registration fees in advance. Every EV will require payment of an additional $1000 to be registered, rising to $1160 in a few years.

And if you charge at a public charger in NJ, you also pay a 6.63% sales tax. (There is no sales tax on gas.) Sales taxes on public charging are not routine, though NJ is not the only state that has one.

Policy Environment

As background to this, New Jersey is one of the states that has adopted the second phase of the Advanced Clean Car rules. These are the rules that come from California having a waiver to create more stringent fuel economy standards than the EPA, and which other states can voluntarily adopt. The phase 2 rules mandate increasing percentages of electric vehicles be sold each year until 2035 when the sale of new internal combustion (ICE) vehicles becomes prohibited. 80% of new EV sales are required to be BEVs. (Connecticut followed the phase one rules which expire in 2025 but has not adopted the phase 2 rules.)

Policy matters. Incentives matter. In 2015, the state of Georgia repealed its $5000 EV purchase incentive while simultaneously imposing a $200 registration fee. In a matter of one month, EV sales declined by 93%.

In NJ, with all these policy oars pulling in different directions, the state will create problems for itself and its residents in fulfilling the mandate. It would not be a surprise if they try to back away from it.

NJ isn’t the only state to impose an EV registration fee, though it does have the distinction of being the first in the Northeast, as well as the highest.

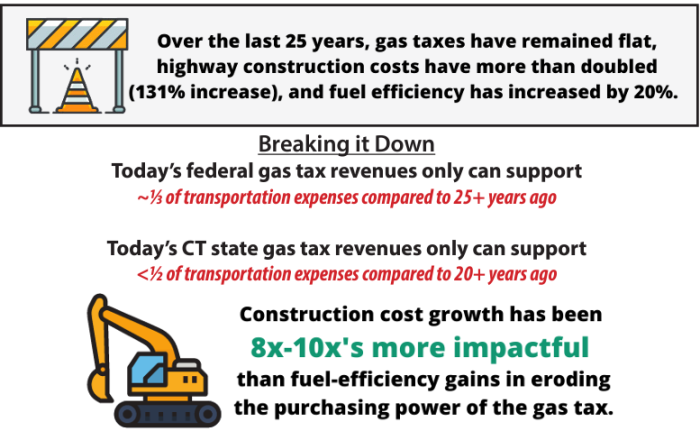

There are two reasons given to justify an EV registration fee. Both start with a kernel of truth that when scrutinized appear to be less than meets the eye. The first is that transportation infrastructure funds in the states are running out of money. These funds come from gas taxes. BEVs don’t use gas so they’re being singled out as the cause of this deficit.

While it’s true that BEVs don’t pay gas taxes, EVs are such a small percentage of the fleet that the impact today on transportation infrastructure funding is de minimis. The fees being levied on EVs in a number of states are punitive, meaning they are significantly greater than what would be collected in gas taxes from a similarly sized vehicle, and just high enough – like Georgia and likely NJ – to discourage EV adoption. Arguably, in some states, discouraging EV adoption is the point.

Inside EVs Senior Editor and YouTuber, Tom Moloughney, a NJ resident, reported on the NJ fee and quoted Pam Frank, CEO of ChargeEVC, who noted that the most widely registered vehicle in NJ is the Honda CRV which would typically pay $127 in gas taxes, or half the EV tax. The equivalent in CT with its lower gas tax is $87.

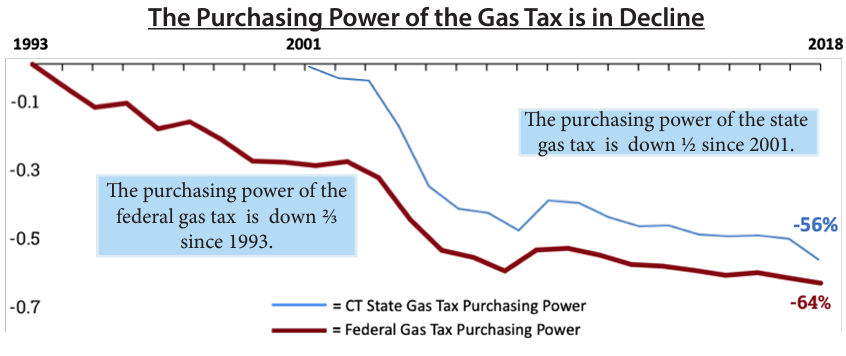

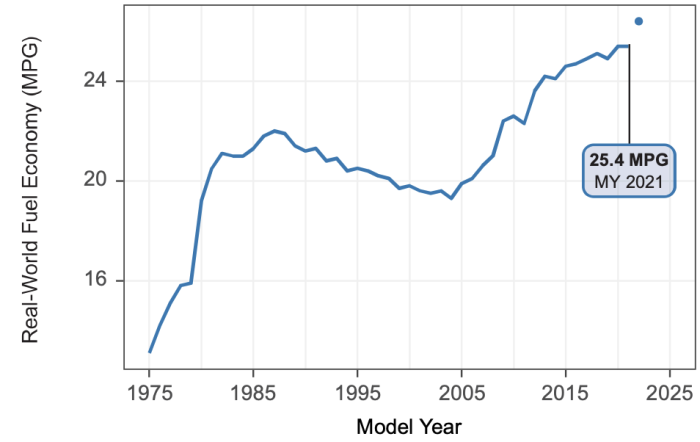

The main reason for the transportation funding shortfall is that ICE fuel economy has improved and gas taxes are not indexed to inflation, while road and bridge maintenance costs inexorably increase. Gas taxes are the third rail, or a third rail, of politics. Politics has way more third rails than Metro North. (The transportation fund in CT is flush at the moment, but this issue isn’t going away.)

The second justification offered is that EVs should pay a higher registration fee than ICE vehicles because they are heavier and do more damage to the roads. The facts don’t support this. If you compare like to like, an EV is somewhat heavier. The ICE Ford F150 weighs up to 5,697 pounds while the Ford F150 Lightning weighs up 6,897 pounds. But if we make a comparison with what vehicles are on the road, it’s a different picture. The F150, as noted, at 5,697 pounds is the most popular ICE vehicle in the country. The most popular EV is the Tesla Model Y (though due to its head start, there are more Model 3s registered). The Model Y weighs up to 4,398 pounds and the Model 3 weighs up to 4,034 pounds. There are plenty of ICE vehicles on the road that weigh more than just about any EV.

EVs are still on the technology curve. The new electric motors from Ford are lighter than their predecessors. Tesla’s structural battery pack saves several hundred pounds. As EVs gradually move to 800 volt architecture, they will shed weight due to less wiring.

More importantly, these weight differences are too small to matter. Again, from Ms. Frank, whose organization has reviewed multiple studies, road damage is predominantly caused by heavy-duty vehicles, those in excess of 26,000 pounds.

How Should EVs Be Taxed?

EVs will have to bear a share of the burden to fund infrastructure going forward, but how should we think about it? We don’t have the definitive answer, and the following is intended as a way to frame the question and look at the strengths and weaknesses of some of the options.

The first question is when such taxation should begin. EVs are an essential emissions reduction tool which is why policies have been enacted to encourage adoption. Moloughney suggests that when EVs reach 5% of the fleet is a good place to begin. In CT, EVs are currently about 1.5%.

With respect to taxation, there are different ways to go for both ICE and EV. Below are some of the of the options and the pros and cons of each.

Gas Tax

Pro

-

- Tracks utilization.

- Rewards fuel efficiency up to a point.

- Picks up out of state drivers (and we have a lot of those transiting CT).

Cons

-

- Gas taxes at current levels are not only insufficient to maintain necessary funding levels, but also don’t nearly compensate for the environmental and public health destruction from fossil fuels.

- Regressive and politically difficult to raise.

- No revenue from EVs.

Mileage tax

Pro

-

- Tracks utilization.

- Picks up EVs.

Cons

-

- Does not capture out of state drivers.

- Intrusive and potentially administratively burdensome.

- Does not consider emissions or fuel efficiency.

- Penalizes rural residents.

Tolls

Pro

-

- Tracks utilization of the most heavily traveled roads without the intrusiveness of a mileage tax.

- Collects revenue from out of state drivers.

- Smart technology enables the ability to have discounts for lower income individuals, low emission vehicles (e.g. EZ Pass Green Pass), or time of use rates.

- Picks up EVs.

- Can more heavily toll the heavy-duty vehicles that damage the roads.

Cons

-

- Requires investment to build the infrastructure.

- Politically difficult. (When proposed in CT a few years ago, they ran into a political buzz saw, but they have some advantages relative to other options.)

- Potential to direct more traffic onto local roads.

EV Registration Fees

Pros

-

- Generates revenue from EVs.

Cons

-

- Can potentially discourage EV adoption.

- At current registration levels, an EV fee will not have a meaningful financial impact.

There is no single or right answer. There are judgment calls and trade-offs to make. The best answer may be a hybrid approach. This is something that can be analyzed, a step that should be taken before final taxation levels are set. There is also the question of whether the objective is to generate some revenue from EVs or whether it is to raise enough revenue to adequately keep pace with the needs of the transportation fund.

Ms. Frank feels that EVs should be taxed at a lower rate than ICE vehicles to maintain momentum on adoption and reward the lower emissions profile of electric vehicles, and suggests a fee of $75 in the context of NJ.

This is one possible approach.

- Raise the gas tax. It lags inflation. We don’t have a carbon tax or cap and trade. (Along with the EV tax, NJ is raising the gas tax.)

- When EVs reach 5% penetration, add an EV registration surcharge of $75.

- Implement tolling with the considerations noted earlier to minimize the burden on lower income individuals, encourage off-peak transit, and have trucks pay for the damage they inflict.

This is done without running the numbers. It is possible that not all 3 are needed.

The elephant in the room is the damage done by fossil fuels and the economic favoritism that has accrued to these incumbent businesses over the years.

According to the US Senate Budget Committee, cash fossil fuel subsidies cost the taxpayer about $20 billion per year. According to conservative economist Gib Metcalf: these subsidies offer “little if any benefit in the form of oil patch jobs, lower prices at the pump, or increased energy security for the country.” But that is a major understatement in that the biggest subsidy is the ability to pollute for free. If we were to take that into account, the true cost would be $646 billion. And that is just the US. Worldwide, that number is closer to $5.4 trillion. For that reason, our suggested approach includes raising the gas tax in this context of no carbon tax or cap and trade.