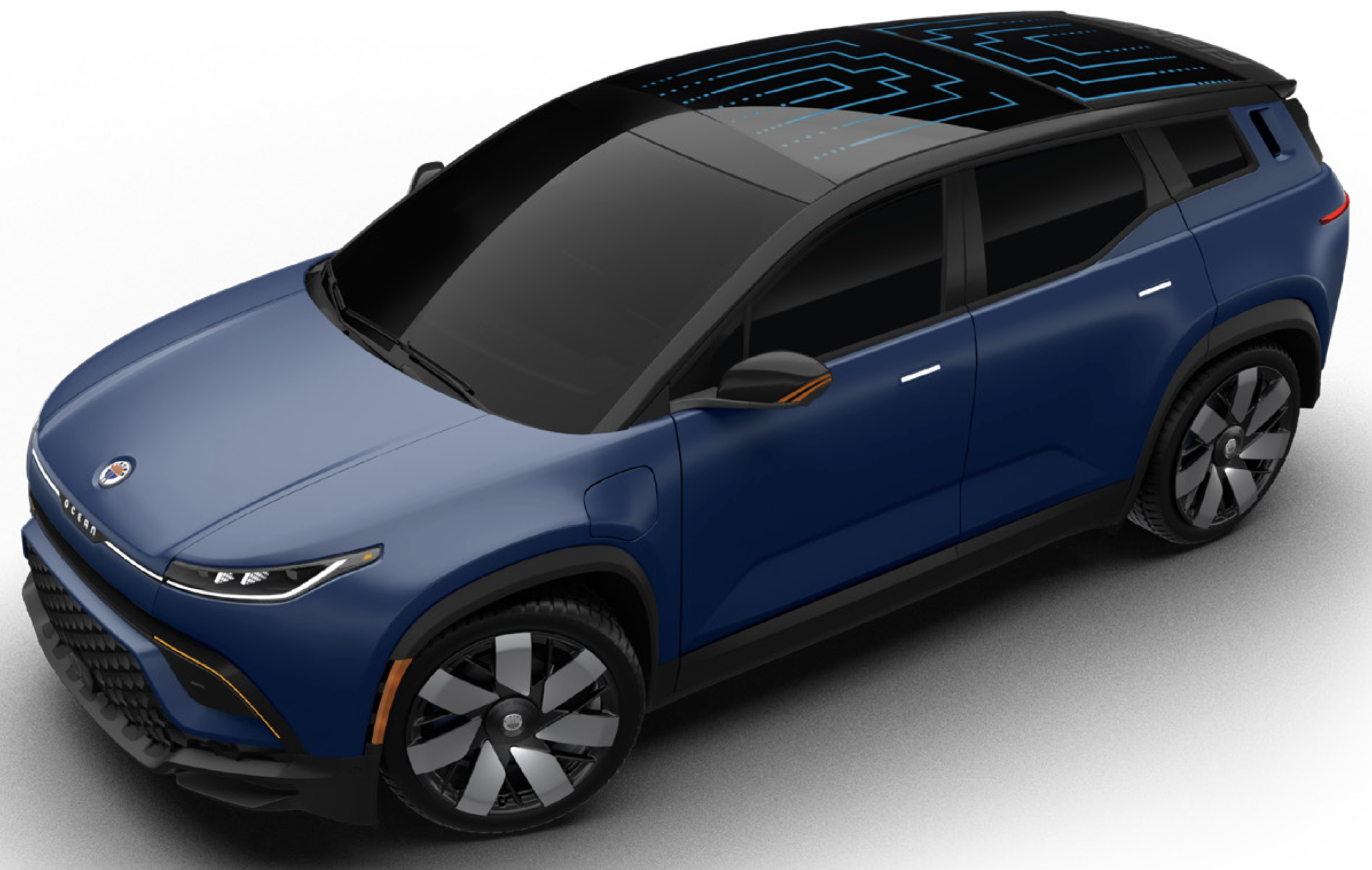

Fisker Ocean pictured above

Transfer Provision Details

The transfer provision is now in place for the federal incentive. This allows the buyer to transfer the tax credit to the seller and take the incentive as, in effect, a point of sale rebate, even if it technically still is a tax credit. Consumers still have the option to take the tax credit the old-fashioned way if they so choose.

The benefit of the transfer provision is the point of sale immediacy, but also the fact that a consumer does not need to have tax liability in order to utilize the credit. (The tax credit is non-refundable and has no carry-forward provision.) Another benefit of the transfer provision is that if you are financing the vehicle, it lowers the amount of interest paid because you are financing a smaller amount. The incentive does not lower the sales tax.

Dealer Registration

A dealership has to register at a portal created by the Treasury Department. This portal captures the transactions, the associated VINs, and enables the process whereby the Treasury issues reimbursement for the incentive to the seller and verifies the transaction at tax filing time. This applies to both new and used EVs. It also applies regardless of whether you are taking the transfer or the standard tax credit. In other words, if you are counting on the incentive, don’t waste your time speaking with an unregistered dealer.

According to Treasury press releases, about 50% of new car dealers have registered. This could still increase over time. Sellers of vehicles that are not eligible may not have a reason to register at present, though they would still need to if they sell used EVs. Not every dealer who registers gets approved, though we don’t have detail as to why that would be. Buyers of a vehicle from an unregistered dealer only get the standard tax credit.

Only a very small percentage of the 150,000 used car dealers have registered. Big sellers like Carmax and Carvana have not registered. Nor has Hertz which has been selling a large number of used Teslas.

There is no master list from Treasury delineating which dealerships have registered. This is very disappointing. The only option for consumers is to directly ask the dealership. (Some dealerships are advertising their registration.) We recommend making sure a dealer is registered before going there to shop if you are thinking about using the transfer.

The dealer issues a seller’s report for the transfer. You must get this before the car leaves the lot. If you do not, the only option available to you is the standard tax credit.

VIN Verification

Final determination of vehicle eligibility cannot be made until a VIN is available. Hopefully, dealers will be supported by their affiliated manufacturers and be able to accurately represent the status of a vehicle, including build to order.

Used EVs

A reminder, incentive-eligible used EVs must be at least two years older than the current model year and have not previously had an incentive associated with the VIN. Almost no used EVs have received an incentive, so for the time being the prior incentive consideration is largely beside the point. The income limits (see below) are half what they are for new EVs and the negotiated price must not exceed $25,000. Used EVs are eligible for the transfer provision. Hopefully, more used car dealers will register. In the near term, the transfer is more likely to be available from a new car dealer that also sells used EVs.

Battery Rules Lead to a Reduction in Eligible Vehicles

The new rules for 2024 are in effect, specifically higher thresholds for battery critical minerals, battery assembly, and the implementation of the first half of the foreign entity of concern (FEoC) rule. For the FEoC, no battery component assembly can take place in China as of this year.

A car must certified by the manufacturer that it meets the requirements and must appear on the EPA list at FuelEconomy.gov to be incentive-eligible.

It is not a surprise that the number of incentive-eligible vehicles has decreased. We expect a gradual recovery going forward as more North American assembly and battery plants come online, and more critical minerals come from eligible sources.

Income/MSRP Cap

The non-battery-related provisions of the incentive rules remain in place.

The income limit is $300K/$225K/$150K for joint/head of household/individual filers respectively. This refers to modified adjusted gross income. You can fulfill this requirement with either your current or prior year income. There is one exception to this, which is if you get married during the year you bought the vehicle and the income of your new spouse put you over the limit, you would not be disqualified.

The federal incentive has an MSRP cap of $55K for sedans and $80K for an SUV. The definition of MSRP includes factory-installed options but not software.

Discounting

We have been seeing reports that several manufacturers, and we have specifically seen reports of GM, Ford, and Hyundai, discounting vehicles to partially or fully compensate for the lack of an incentive. This is an example from GM Authority. Discounting is even better than an incentive because it lowers the sales tax.

Leasing

None of this changes the fact that these rules don’t affect leases. The finance company that holds the lease receives the incentive and it is not subject to battery, assembly or any other rules. The lessor is not required to pass the incentive to the consumer. And leasing costs tend to be opaque due to the different factors that determine them. That places a greater burden on the consumer to obtain the specifics of if/how the incentive is incorporated into the monthly rate. All of that said, however, EV leasing has shot up rapidly, as can be seen in this chart from The Peterson Institute for International Economics, using data from Edmonds. The biggest increases are from non-North American brands, so apparently, the incentive is getting passed along.