Some Stellar Performers; Many Also-Rans

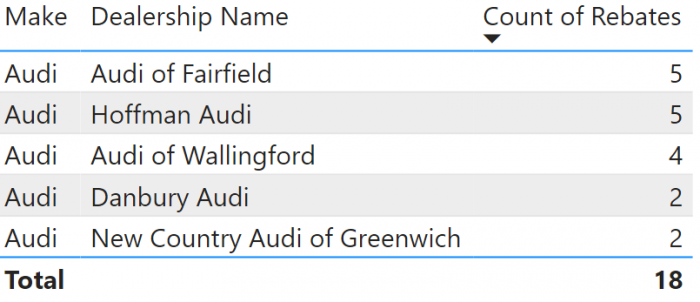

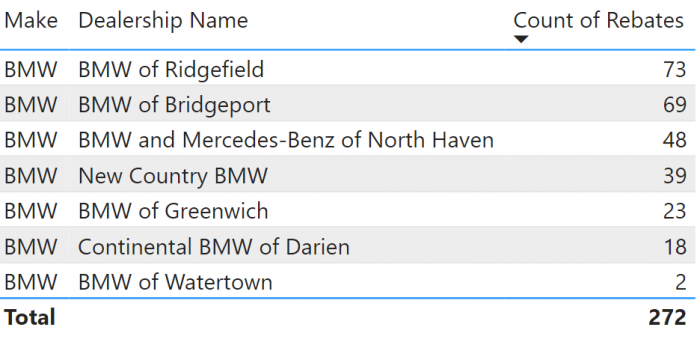

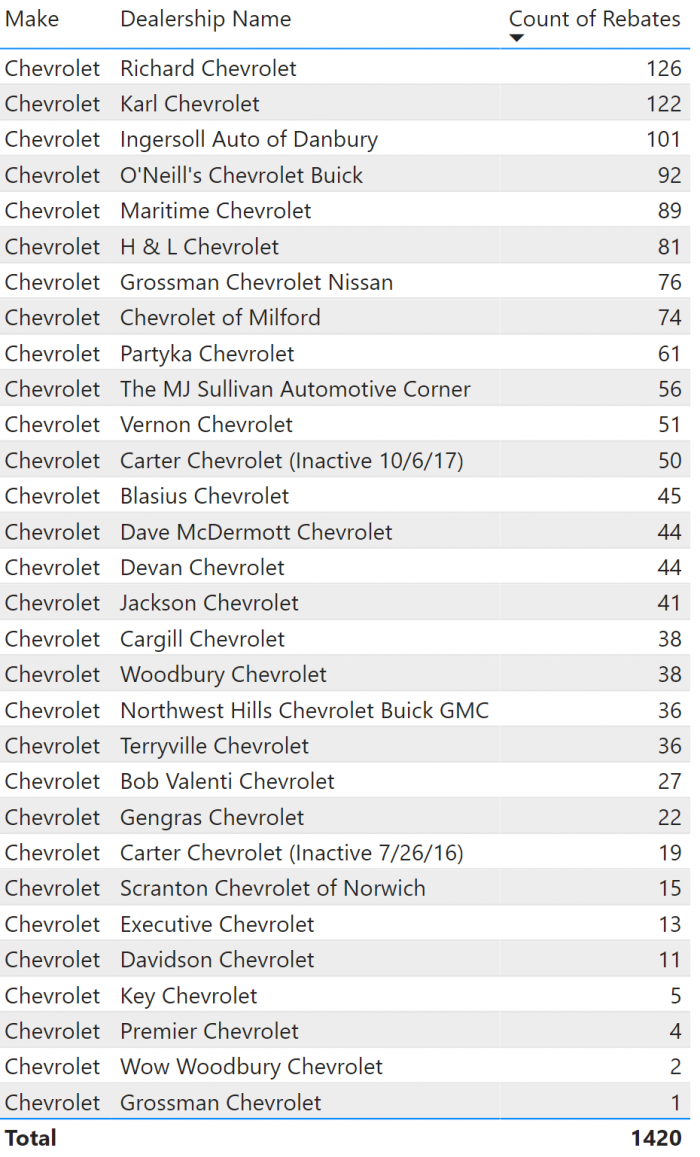

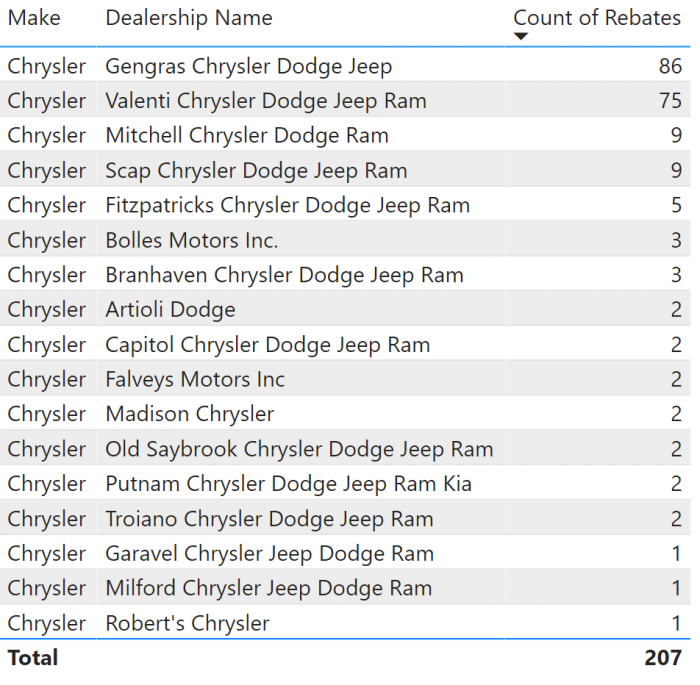

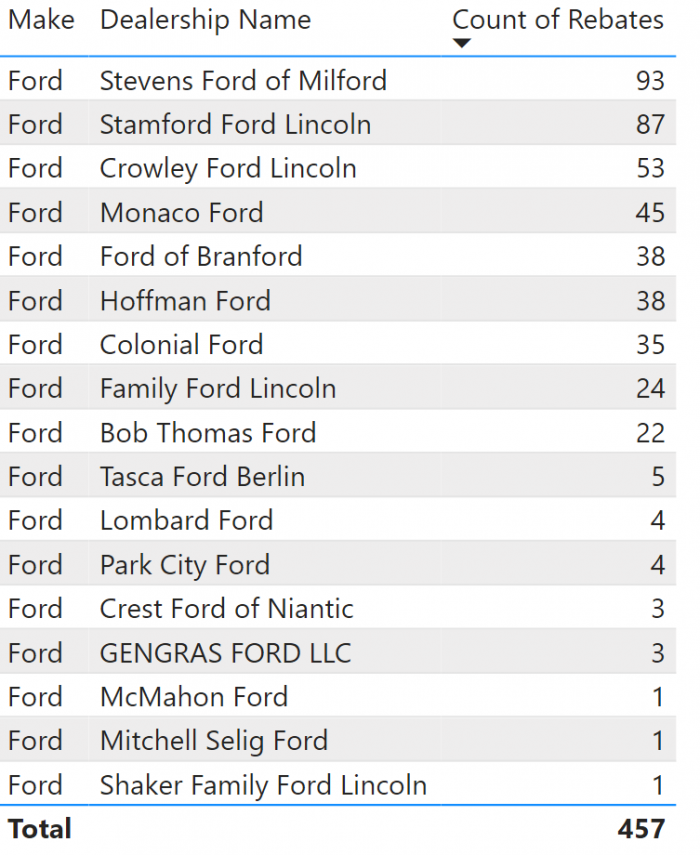

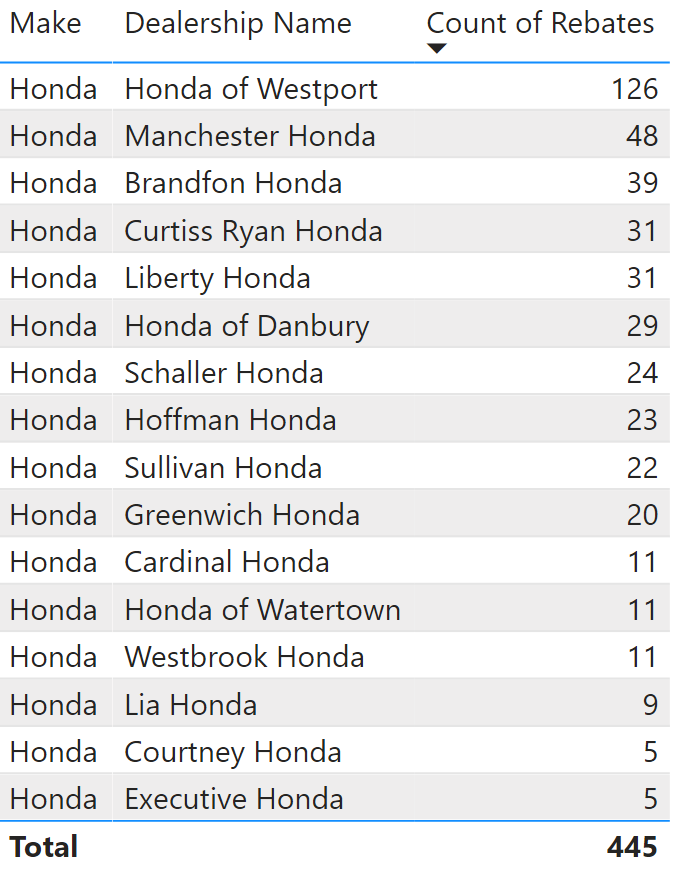

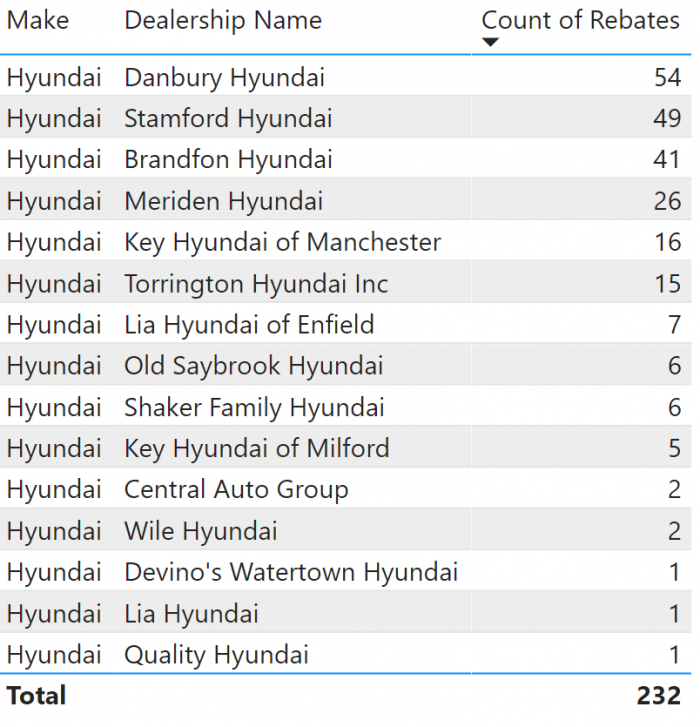

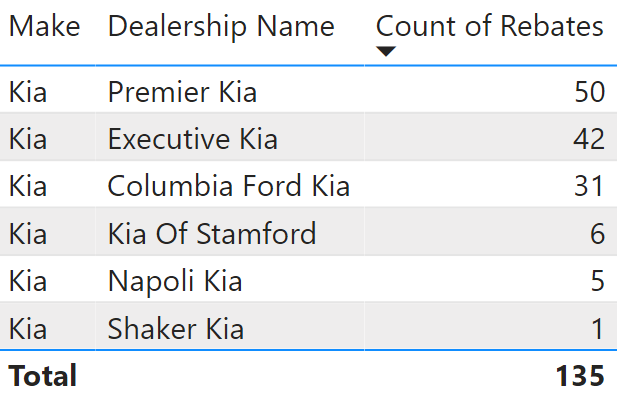

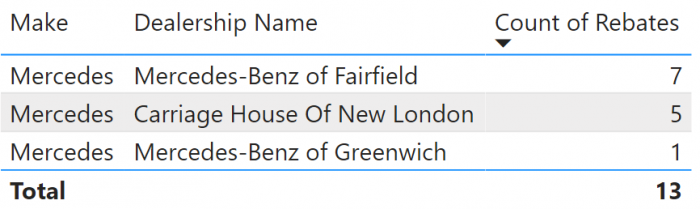

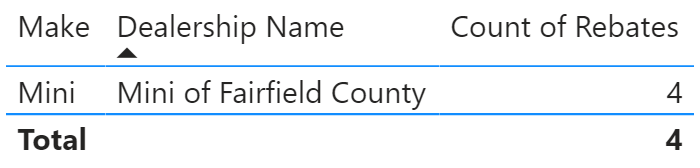

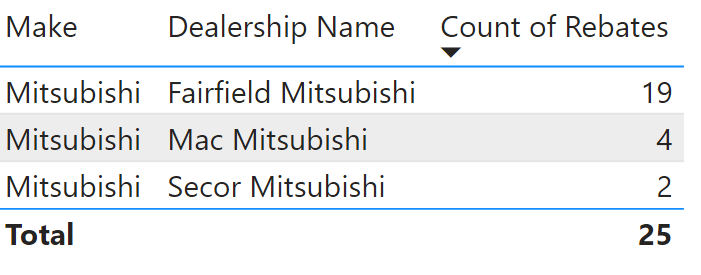

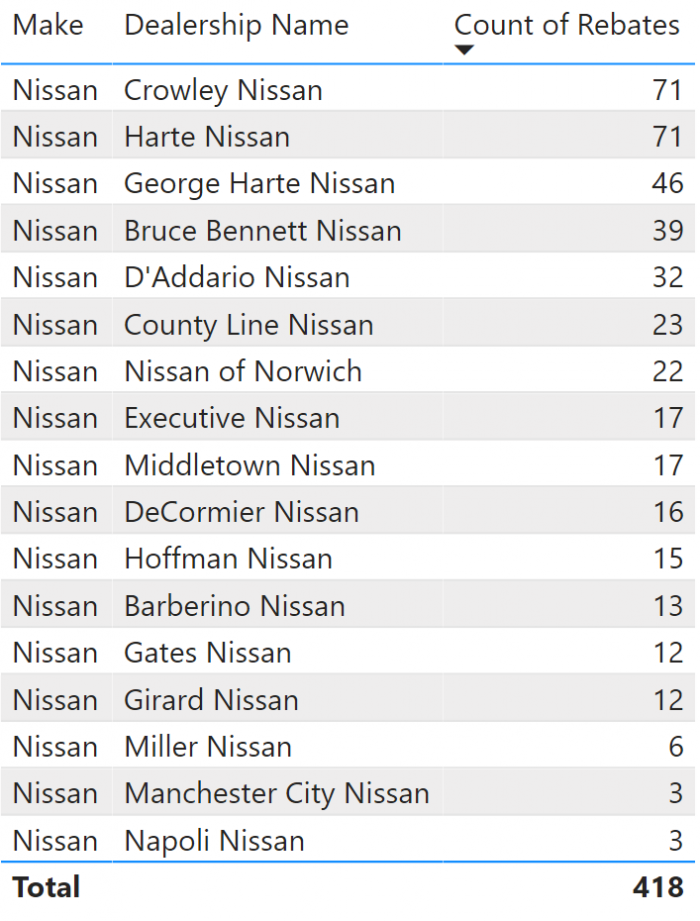

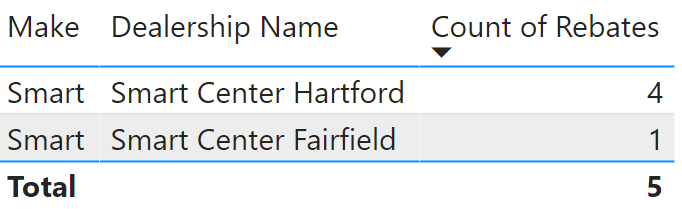

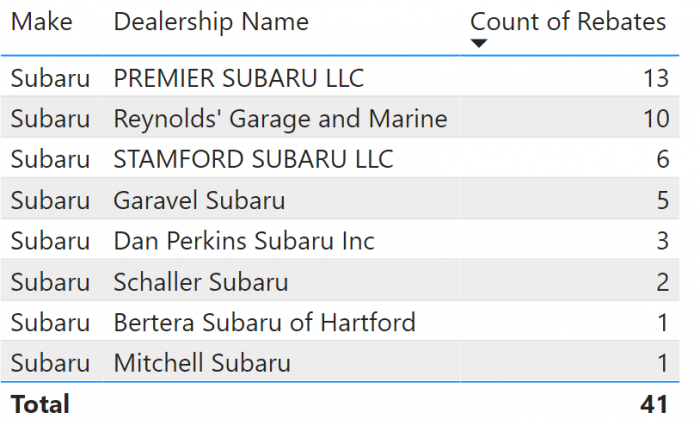

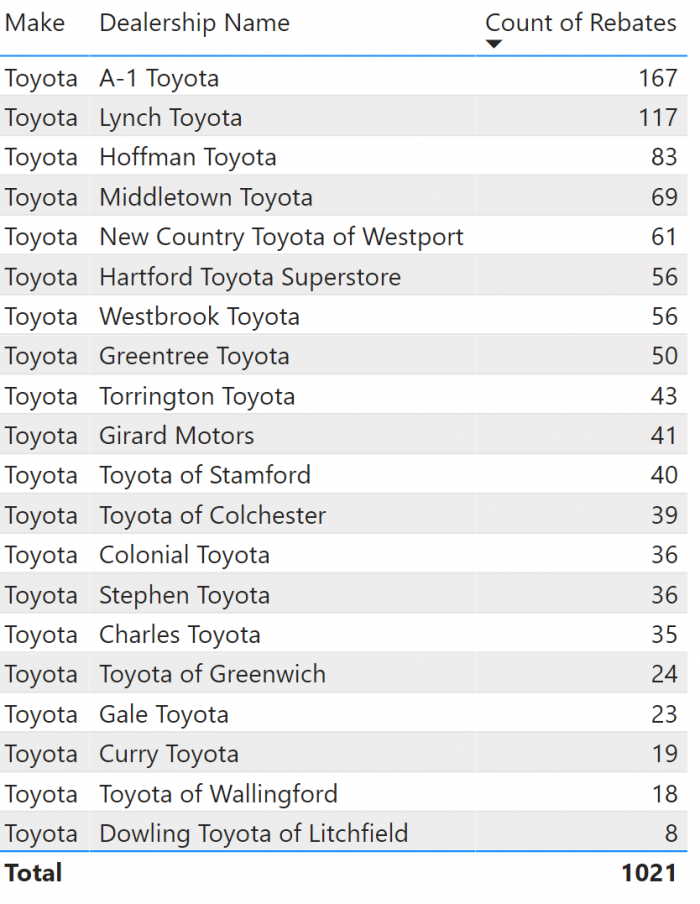

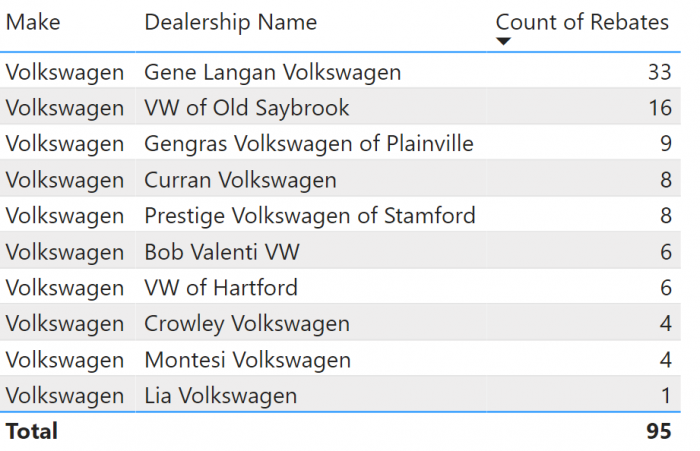

We obtained an updated dataset of CHEAPR rebates by individual dealerships from the program’s inception through the end of 2020. It is all pasted below, but a couple of observations first.

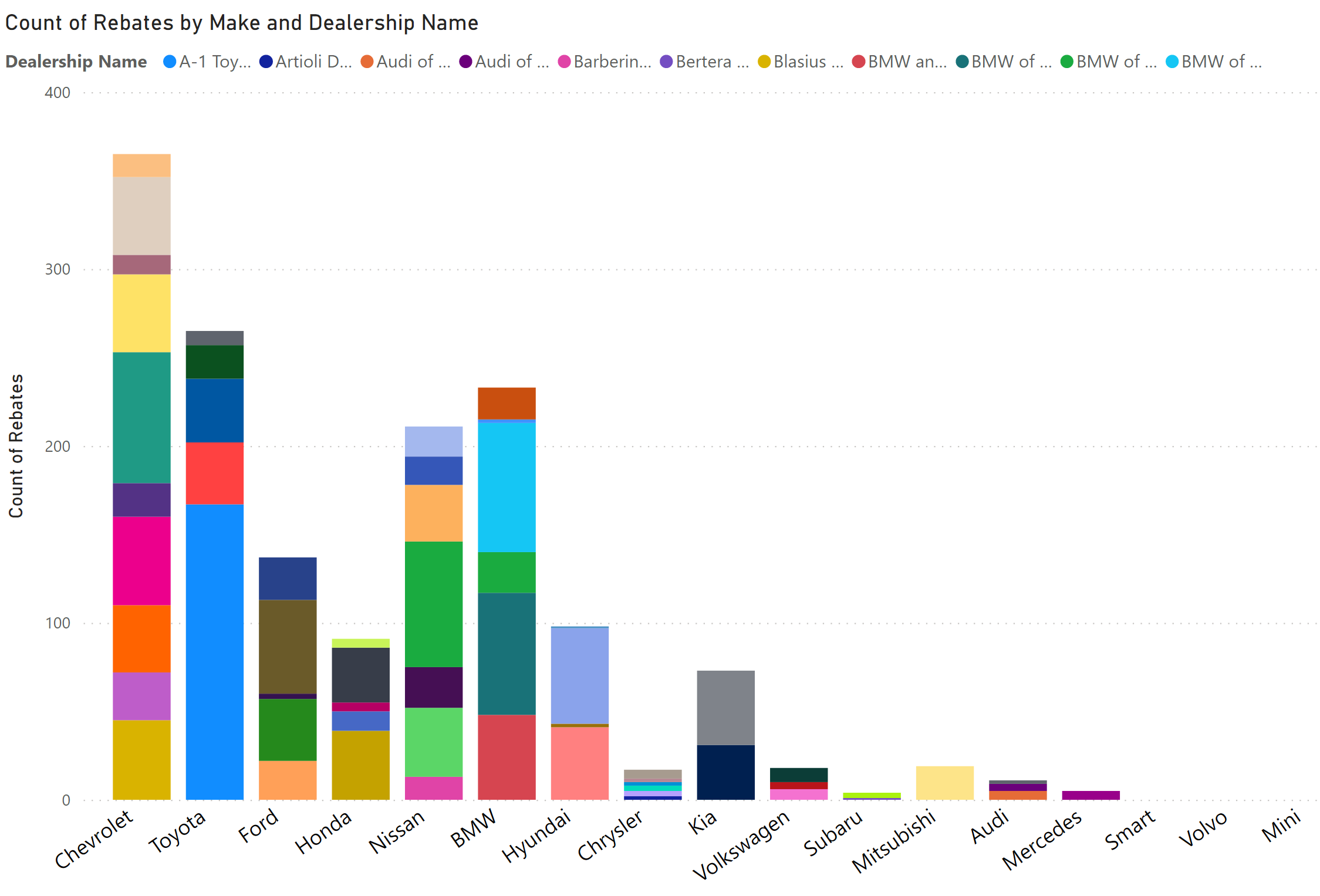

There are a small number of dealers that really do great work. Unfortunately, they are not representative. If great work is defined as 100 or more rebates over this duration, these are the 6 companies that have achieved that level.

- A-1 Toyota – 167

- Richard Chevrolet – 126

- Honda of Westport – 126

- Karl Chevrolet – 122

- Lynch Toyota – 117

- Ingersoll Auto of Danbury – 101

This project originally began due to member complaints about poor dealership experiences, followed by a request: Please make a recommendation. I had anecdotal reports of dealerships that do a good job, but nothing systematic or statewide. This approach uses CHEAPR data as a proxy for EV-friendliness.

There are a few considerations to bear in mind. Not all dealers sell CHEAPR-eligible cars. The parameters of the CHEAPR program have changed over the course of the program’s life. In particular, the lowering of the MSRP cap in October 2019 causes the exclusion of some vehicles, for example, from BMW and Volvo, that were formerly eligible. The offerings of manufacturers have changed over time. The cancellation of the Chevy Volt caused a slowdown in the number of Chevrolet rebates. Hyundai has become more aggressive recently about introducing EVs. The Honda Clarity got off to a good start when it was introduced, but Honda then stopped sending it to the state (which may be changing). The new Toyota RAV4 Prime is showing some early promise.

It is for that reason that I have displayed the rebates sorted highest to lowest within make. That way, for example, it can be seen that Danbury Hyundai has a strong record with a make that was barely selling EVs before 2019.

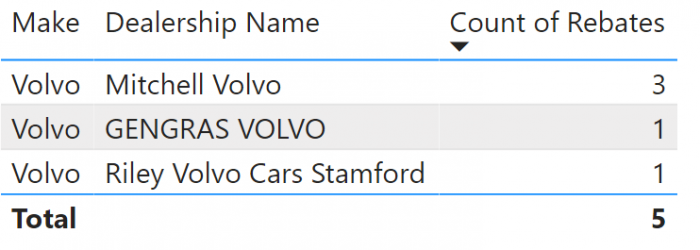

The file that was provided did not have the specific vehicle model for which a given rebate applied. There are some dealerships that sell multiple makes that have CHEAPR-eligible vehicles. I made a judgment and assigned the dealer to the brand with the most rebates. Note to self – work on getting that next time around. Also, in a couple of cases, there may be more than one line for a dealership because the file did not have a consistent naming convention. I cleaned it but may have missed a couple.

This is all of it (except Tesla). If a dealership had zero rebates, it will not appear in the tables below.

It would be best, of course, if DEEP were to publish this information as part of its regular CHEAPR reporting. It is done in other states and would remove the burden for both of us of going through the Freedom of Information Act process.

Finally, this has relevance for the EV Freedom Bill. One of the arguments for the bill is that the conventional dealership model is antithetical to selling EVs, that EVs come into tension with the legacy ICE business. There is more nuance to it than that, but the data largely illustrate this point. It seems like it is a lot harder for a dealership to embrace EVs or more of them would have effectively done so and there wouldn’t be such large differences between the top performers and the laggards.

For those dealerships that are making an effort to sell EVs, if SB 127 passes, they’ll be fine. For the others, it will be a shot across the bow to wake up or risk being left behind.

4 thoughts on “Update to CHEAPR Stats By Dealer”

Comments are closed.