Breaking Down the 60,489 Registered EVs

The updated registration data are now published. This takes us through the end of last year. We call it as of January 1, 2025.

Of course, the question that everyone is asking is whether Tesla is tanking. There are reports of large sales declines in Europe and China but the data in this country are less transparent and slower to be reported.

With this timing and this dataset, we will only be able to see flickers of this. These are stats of registered vehicles, not sales, so it is something of a lagging indicator. This period covers the period of when Elon Musk declared for Donald Trump and funded a PAC, but ends before inauguration and the DOGE “chainsaw,” and before the protests.

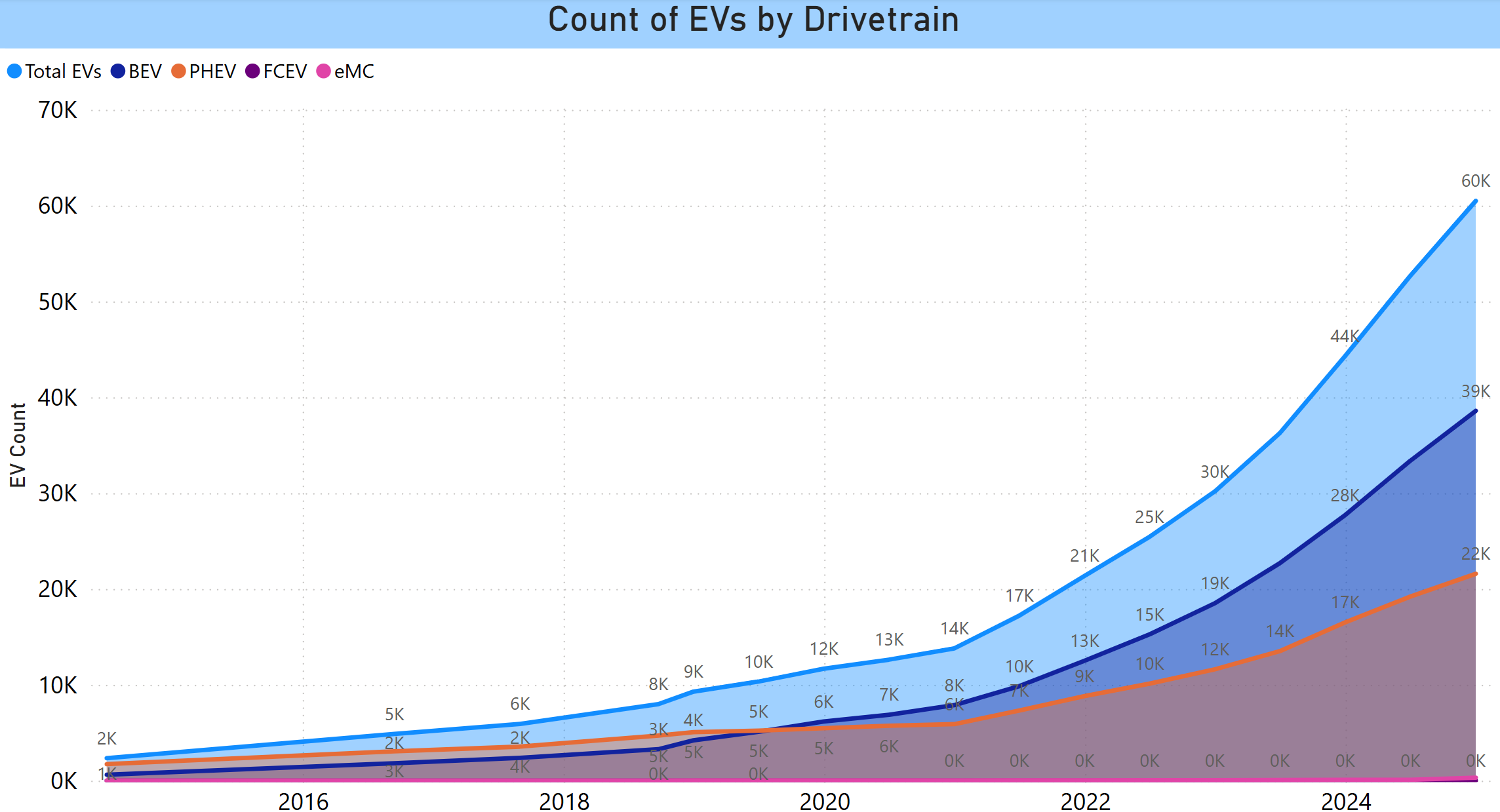

Drivetrain

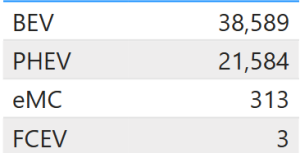

Fully electric BEV drivetrains continue to be the choice of the majority of EV consumers. Below is the trend and below that, the actual numbers.

eMC is not Ensteinian; it is electric motorcycles. FCEV is fuel cell, which aren’t really a thing around here.

The first time we published registration data, when there were only about 10,000 EVs in the state, reporters inquired about it. The first question they asked was how many fuel cell vehicles were registered. That number hasn’t budged in the almost 10 years we have been reporting. Toyota in particular invested heavily in fuel-cell with nothing to show for it. We are not against the technology if the hydrogen is clean (which is a long way from happening), but it has sometimes been a stalking horse for anti-EV legislation.

Registrations increased 38% year over year, a smaller increase than we saw in the prior 2 years, which came in at 46% and 41% going in reverse order. The state has an interim goal of 150,000 registered EVs by 2025. That is obviously not happening. The goal of 500,000 by 2030 is potentially doable, but the actions and potential actions of the Trump administration will make it a heavier lift.

As of this writing in late March, there is still a $7500 federal incentive. There is, as yet, no reconciliation bill on the table, so it may be that our best bet is a closely divided congress that is having difficulty contorting itself enough to pass another tax cut.

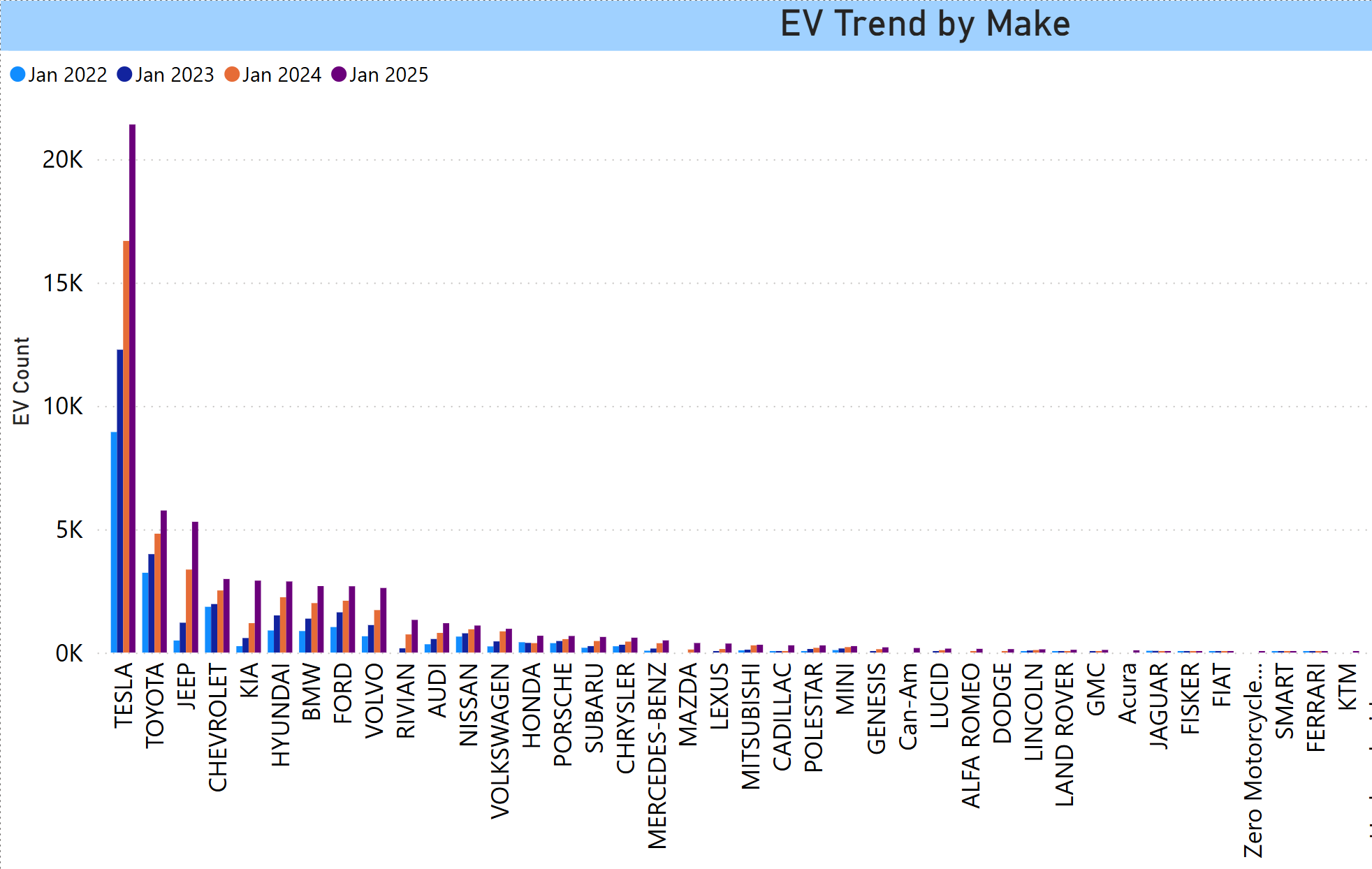

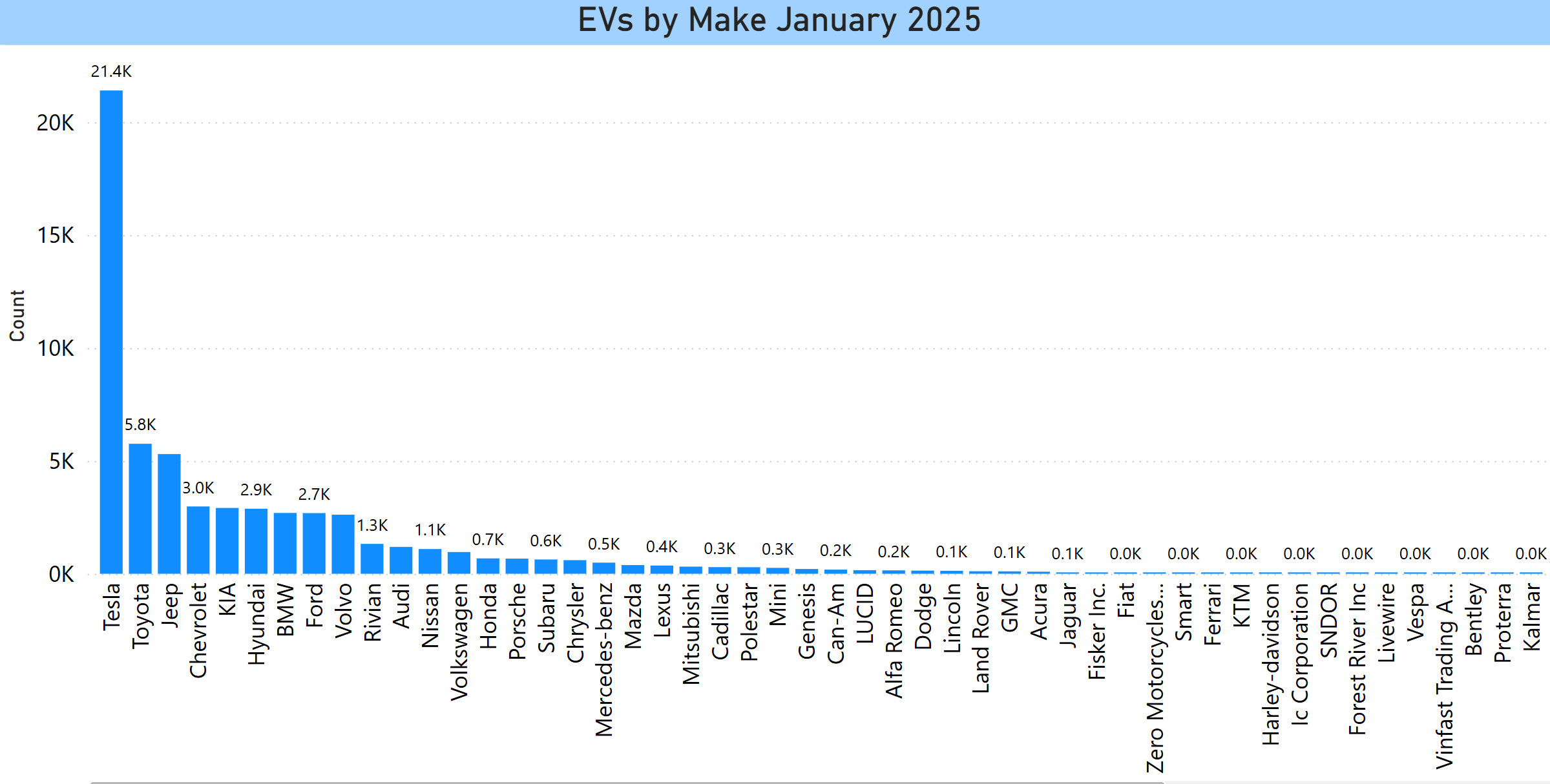

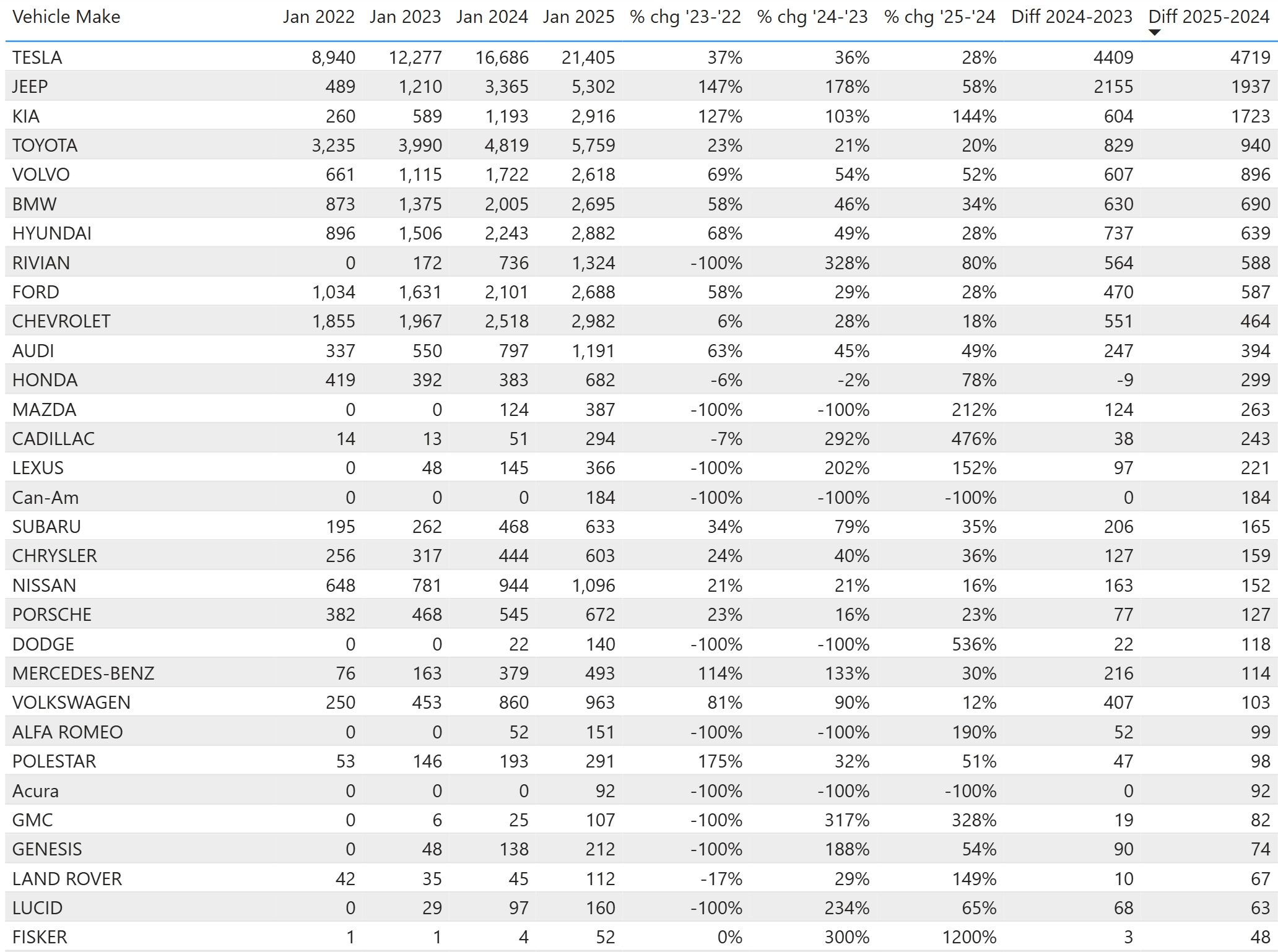

Top Makes

Tesla still leads the way but its rate of growth was slower. Jeep jumped into third place, paced by its PHEV Wrangler. These are most of the makes. There are 12 makes with at least 1000 registrations.

This is a table of most of the makes showing data for the past 4 years, % change over the past 3, and the change in the raw count over the past two years. It is ranked by the latter – the number of registrations added in the most recent year.

- Tesla still had the highest number, but it was barely above the prior year and the percent change was lower.

- Jeep and Kia had big jumps.

- Toyota maintained a growth rate similar to recent years.

- Volvo had a pretty good increase.

- Any make with 0 vehicles in the baseline will appear as -100% for the following year.

Below is the model-level detail for the leading makes, based on total number of registered vehicles..

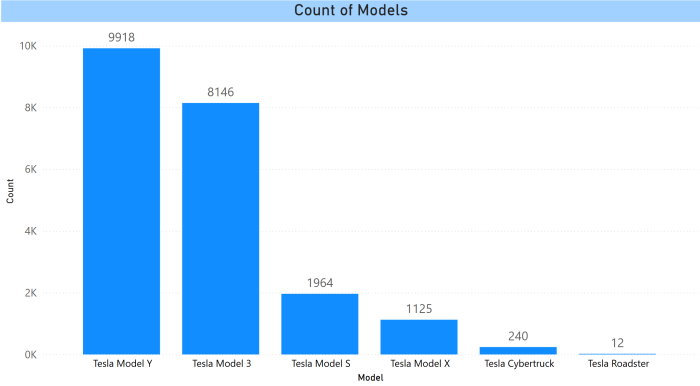

Tesla

For Tesla, the Model Y is its largest seller and it has overtaken the head start of the 3 to become the most widely registered model. There are a small number of Cybertrucks. With 21,405 registered vehicles, the company is still the leader by far. It has a 55% share of BEVs and a 35% share of all plug-ins. That is down by 5 points for BEVs and 3 points overall from one year ago.

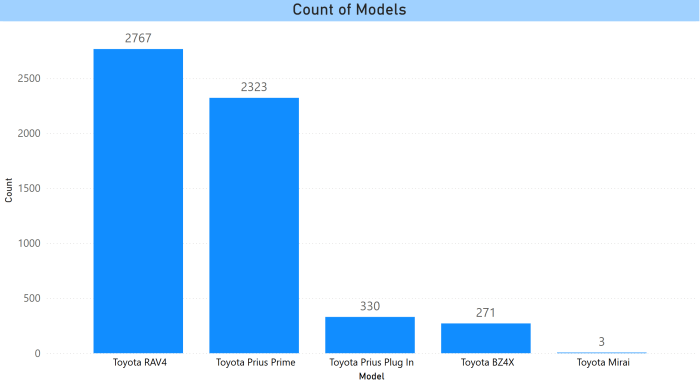

Toyota

Toyota registrations are driven by its PHEVs. The BEV bZ4X has not made a big splash. The Prius Plug In is the precursor to the Prius Prime and the company’s first plug in vehicle. The Mirai is a fuel-cell vehicle.

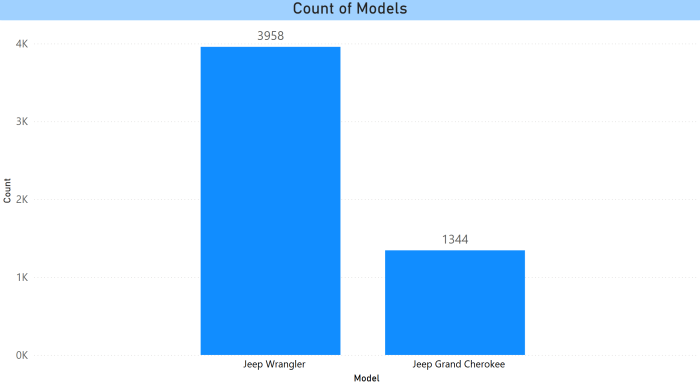

Jeep

Shooting up to third is Jeep with its PHEV entries.

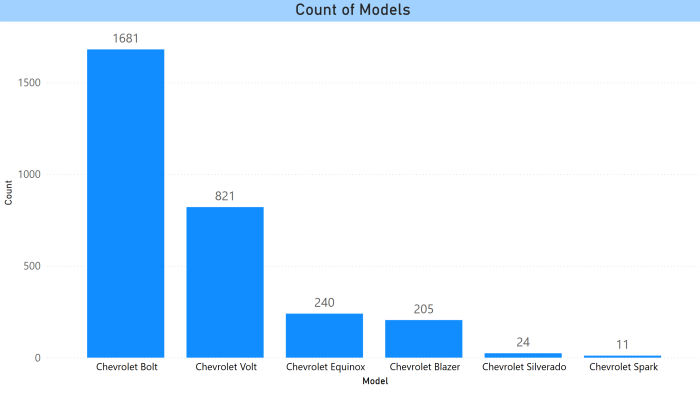

Chevrolet

Chevy’s no longer in production Bolt and Volt (which ceased production in 2019) are still its most widely registered models. The Equinox and Blazer were introduced late last year and will likely make up ground quickly. Bolt 2.0 is expected later this year.

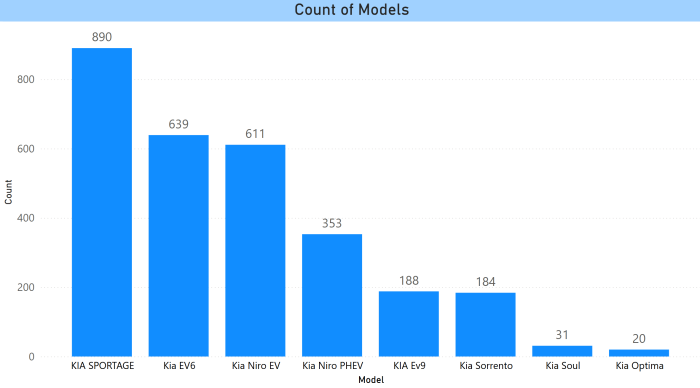

Kia

Kia sells a mix of BEVs and PHEVs. It had the third biggest jump after Tesla and Jeep with its new models selling well.

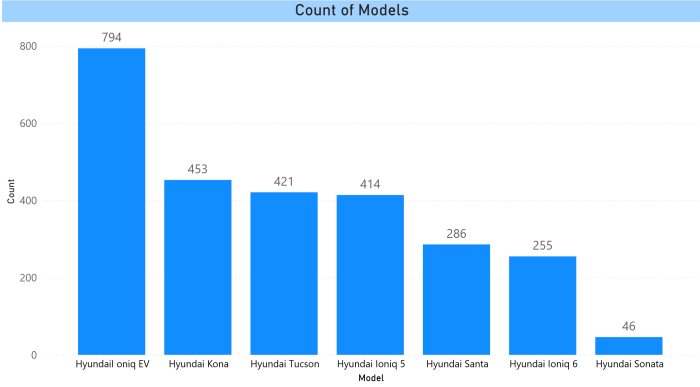

Hyundai

Hyundai, the sister company of Kia, makes a number of models that are counterparts to Kia models. The exception is the Ioniq 6 sedan.

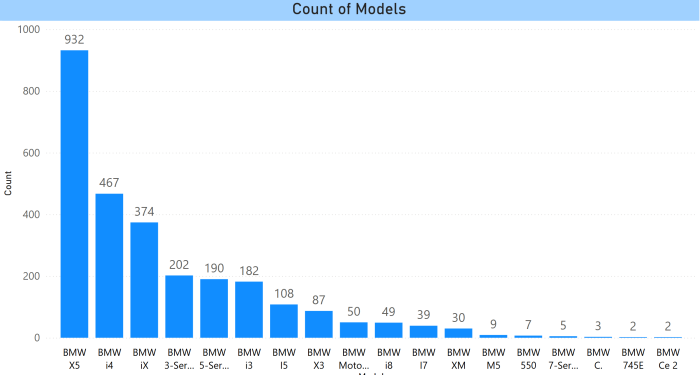

BMW

BMW was relatively early to EVs and has a number of BEV and PHEV entries. The X5 is a PHEV version of the popular mid-size crossover, followed by BEVs i4 and iX. BMW is planning a major launch of its Neue Klasse platform later this year, which can be used for any powertrain.

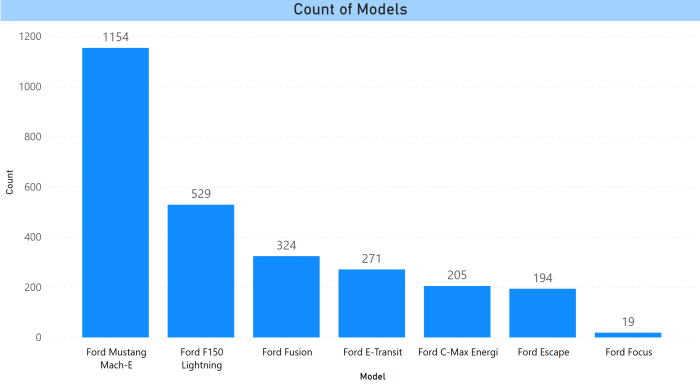

Ford

Ford’s electric Mustang is faring pretty well, but sales of its electric pickup, the F150 Lightning, have disappointed. A new Lightning, code-named “T3” is reportedly due in 2027.

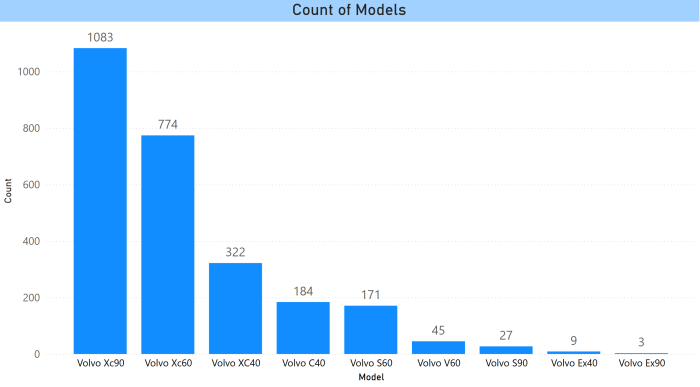

Volvo

Volvo offers both BEV and PHEV models. It’s most recent is the EX30, a compact SUV that began deliveries this year.

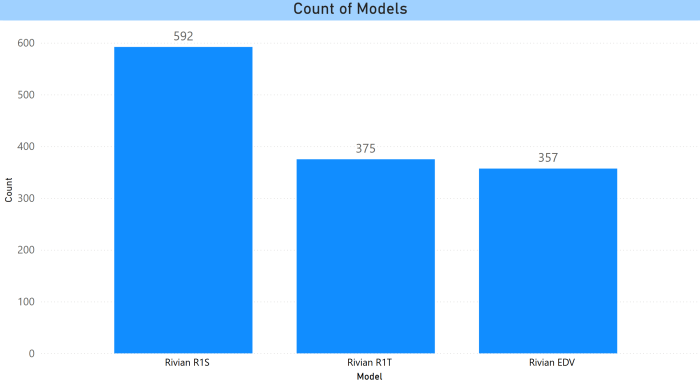

Rivian

Rivian’s full-size SUV is its big seller. The EDV is the delivery van it has been manufacturing for Amazon, which has now been made available to other companies. Rivian has several highly anticipated, smaller vehicles, the R2, due out in 2026, and R3 and R3X, due in late 2026 or early 2027.

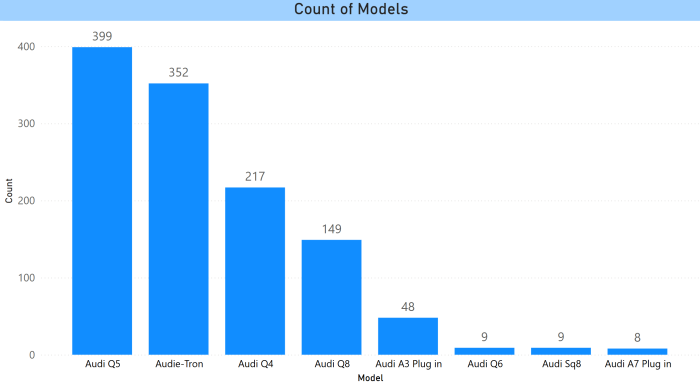

Audi

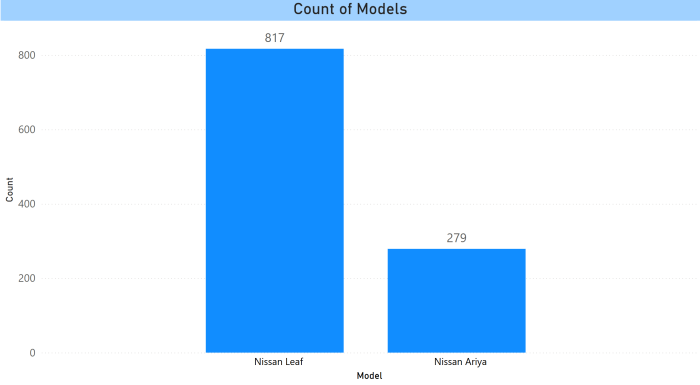

Nissan

Nissan was an early EV pioneer with the Leaf which was introduced in 2010, but the company has stalled somewhat for EVs and generally speaking. It had been in merger talks with Honda but those have been terminated.

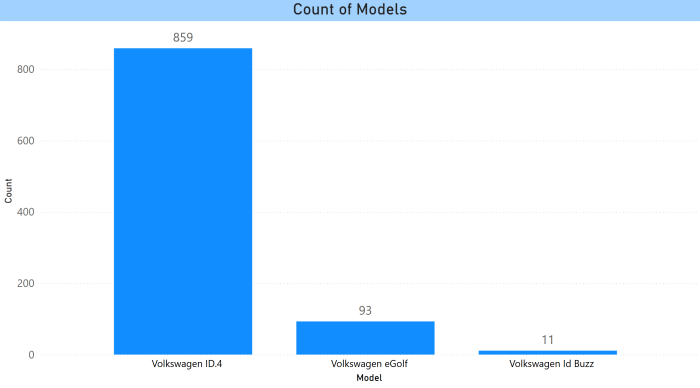

Volkswagen

Volkswagen has had its share of production issues with the ID.4, though reportedly they are now sorted. The newest VW, the ID Buzz, a BEV version of its iconic minibus, only began deliveries at the tail-end of the year.

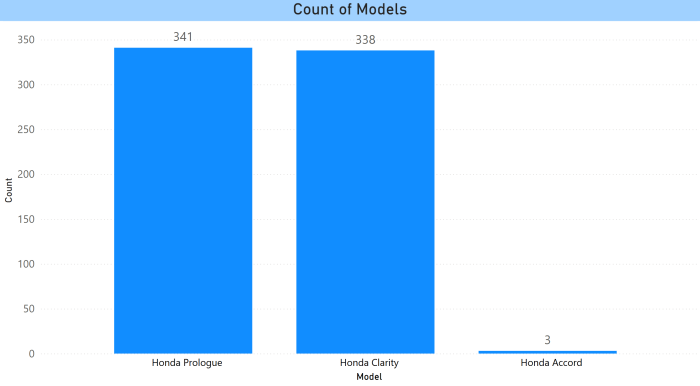

Honda

The Prologue is built by GM and is basically a Chevy Blazer, though Honda has done pretty well with it. The company has developed its own platform called the Zero. The 0 series vehicles, a sedan and an SUV, are expected in 2026.

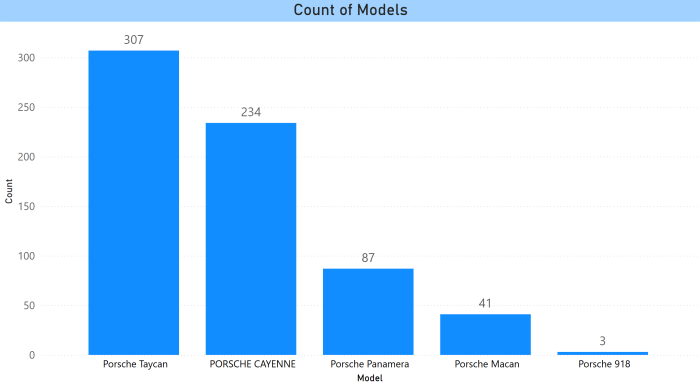

Porsche

Porsche has been expanding its lineup with the Macan being its newest entry.

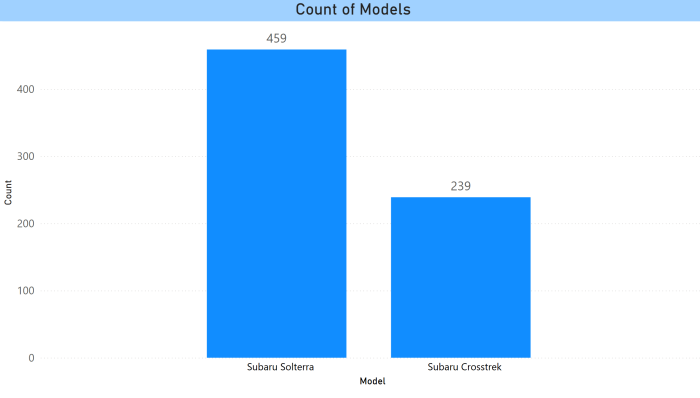

Subaru

The Soterra is built on the Toyota platform that is also used for the bZ4X. Future Subarus will share the Toyota tech. The Crosstrek is a no longer in production PHEV, though there are reports it is coming back as a BEV.