Post by Barry Kresch

Way back in 2015, The New York Times published a story entitled, “A Car Dealers Won’t Sell: It’s Electric.” 2015 is a long time ago in EV years, but are we there yet?

This is a running series, updated more or less annually since 2020. It is something we hope loses relevancy over time as dealerships become uniformly good at selling EVs. Some do a nice job, but many others, not so much. This is buttressed by the Sierra Club release of the third wave of its triennial EV shopper study. In the most recent release in 2023, 66% of dealers nationally did not have an EV available for sale. The study timing was at the tail-end of the pandemic supply-chain disruptions, but 45% of the 66% said they would not sell EVs regardless of supply constraints or other factors.

Consumer Complaints About EV Purchase Experience

Consumers reach out to us to complain about poor dealership experiences. This has been happening for years. The most common complaint is that a salesperson tried to push them to buy an ICE vehicle. But it’s not the only one: the salesperson didn’t know anything about EVs, there was no vehicle available and charged for test drives, they don’t know or don’t give a straight answer about the incentives being among other examples.

However, after that venting, the person might say despite that, they are still interested in the vehicle and they ask where they could go to have a better purchase experience. Since we don’t know every dealer, we began analyzing CHEAPR rebates by dealership in 2020 as a proxy for EV-friendliness. We saw large differences across dealerships, which still persist.

This analysis is based on the 2024 year-to-date reporting of CHEAPR rebates through early December. During this time, there were 5870 rebates awarded.

Limitation of This Approach

There are limitations to this approach, mostly that the incentive has a $50,000 MSRP cap. (The CHEAPR MSRP cap works differently than the federal Inflation Reduction Act MSRP cap in that it is determined by the base price of the trim level. In other words, adding options does not affect it, even if it brings the cost above $50,000.) But dealerships selling more expensive vehicles will not be represented in our data set.

The incentive applies to both battery electric vehicles and plug-in hybrids, and leased as well as purchased vehicles. The data are sorted by dealership within make. While CHEAPR has a used EV incentive that is accessible for lower-income individuals, this analysis is looking at new vehicles only. Used incentives only accounted for slightly more than 1% of all incentives.

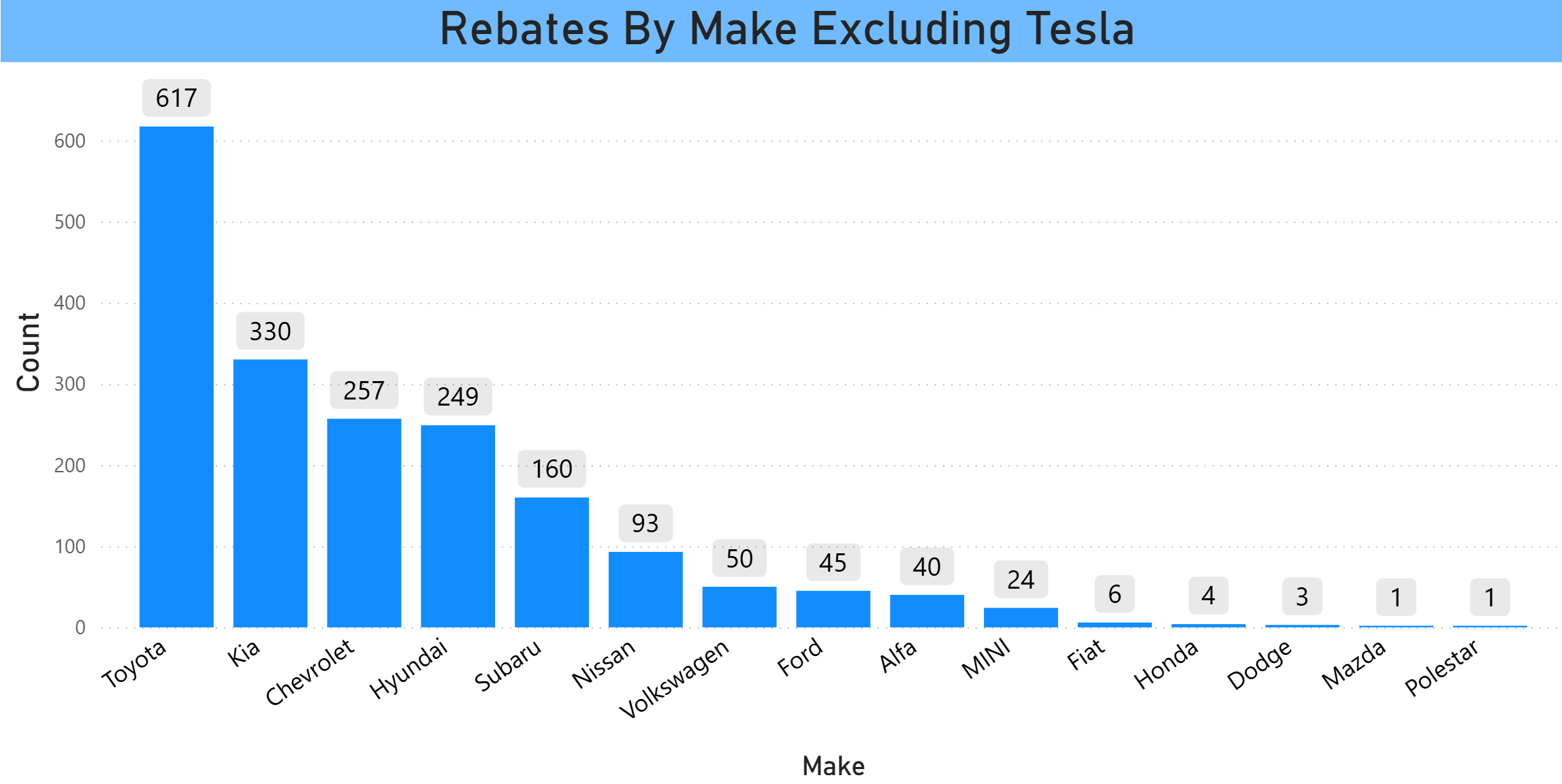

The manufacturers that sell directly to consumers are incentive-eligible, though only some trim levels of the Tesla Model 3 and Model Y are within the MSRP cap. Tesla, being the largest selling EV marque, had the largest number of incentives, 68% of all new vehicle rebates, but they are not included in the charts below since they don’t have a dealer network (and they are obviously invested in selling EVs). That leaves us with 1880 rebates that came through dealerships.

The charts below cover each make individually, as long as it had a minimum of 10 rebates. If you notice that a dealership is missing from the charts, it means that there were zero rebates associated with it (and thus it did not appear in the file). There are some of those. The makes are presented in alphabetical order.

If you have any feedback, positive or negative, about a dealership (or Tesla, Rivian, or Lucid) experience, we are always interested in hearing from you.

Alfa Romeo

Alfa Romeo cracks our 10 rebate threshold for the first time with the Tonale PHEV.

Chevrolet

Chevy saw rebates for the Bolt, Blazer, and Equinox. General Motors, both Chevy and Cadillac, had a pretty good year. Cadillac is not in these charts due to the price.

Ford

Incentives were mostly for the Mustang Mach-E with some for the Escape PHEV and the F-150 Lightning. Many trim levels, especially of the Lightning, exceed the MSRP cap.

Hyundai

Hyundai had a good sales year and rebates were given for the Ioniq 5, Kona, Ioniq 6, Santa Fe PHEV, Tucson PHEV.

Kia

Kia rebates were for the Niro EV, Niro PHEV, EV6, Sorrento PHEV, Sportage PHEV.

Mini

Rebates were for the Mini Cooper Hardtop and the Countryman SE.

Nissan

Rebates were given for the Leaf and Ariya. Nissan was an EV pioneer with the introduction of its Leaf in 2009. It has since lagged in updating its offerings and in recent years has seen sales slide across the board. Prospective merger talks with Honda seem to be going nowhere. Nissan is reportedly interested in partnering with a tech company and Foxconn is reportedly waiting on the sidelines.

Subaru

Subaru has one EV, the Solterra, which is based on the same platform as the Toyota bZ4X. The Crosstrek PHEV is no longer being produced but there is reportedly a BEV version of it in the pipeline. It is also reported that the company will continue to utilize the Toyota EV platform for upcoming EVs.

Toyota

Most of the Toyota rebates are for the RAV4 Prime PHEV. They also have the Prius Prime PHEV and the bZ4X EV.

Volkswagen

The VW rebates were for the ID.4.

Purchase vs Lease

The CHEAPR rebate profile of purchases vs leases runs counter to the national trend of most EVs being acquired via lease, which has clearly been driven by the IRA incentive. There were 2706 leases and 3083 purchases. Nationally, about two-thirds of EV acquisition is with a lease. There is a CHEAPR rule that could be influencing this, which is that a person is capped at 2 incentives lifetime. If someone is churning leases every 2 or 3 years, that is a good way to use them up. But the rule began in 2022, so it feels early for it to have a major impact.

Final Thoughts

This post began with the hope that it won’t be necessary to continue to update it at some point due to dealerships upping their EV game. Unfortunately, in light of the current turbulent EV environment, we don’t see that happening anytime soon. Dealers are slow to change, but they are even slower if their affiliated manufacturers don’t give them enough to work with. This paragraph about Stellantis and Volkswagen was published by Bloomberg today:

“Stellantis postponed its first all-electric Ram pickup, pulled back from plans to lay off workers at a Jeep sport utility vehicle plant in Ohio and recommitted to building a new midsize truck at a factory in Illinois. Volkswagen told Automotive News this week that it no longer plans to bring its ID.7 electric sedan to the US market. The publication also has reported that Stellantis paused work on an electric Chrysler crossover and abandoned plans for its Alfa Romeo brand to only sell EVs by 2027.”

Bloomberg New Energy Finance also released this revised EV forecast.

Our opinion about Stellantis, and to varying degrees about all of the legacy OEMs, is that the future of transportation is electric, and if they allow themselves to manage only for the short term and fail to invest and develop a viable EV strategy, they will consign themselves to oblivion and the USA will cede a critical industry to China.

The Bloomberg forecast does not take into account the possible revocation of the California EPA Waiver, which the administration is trying to do.

For now, we continue to showcase the dealerships that are effective in selling EVs, and help guide consumers toward the best possible purchase experience.