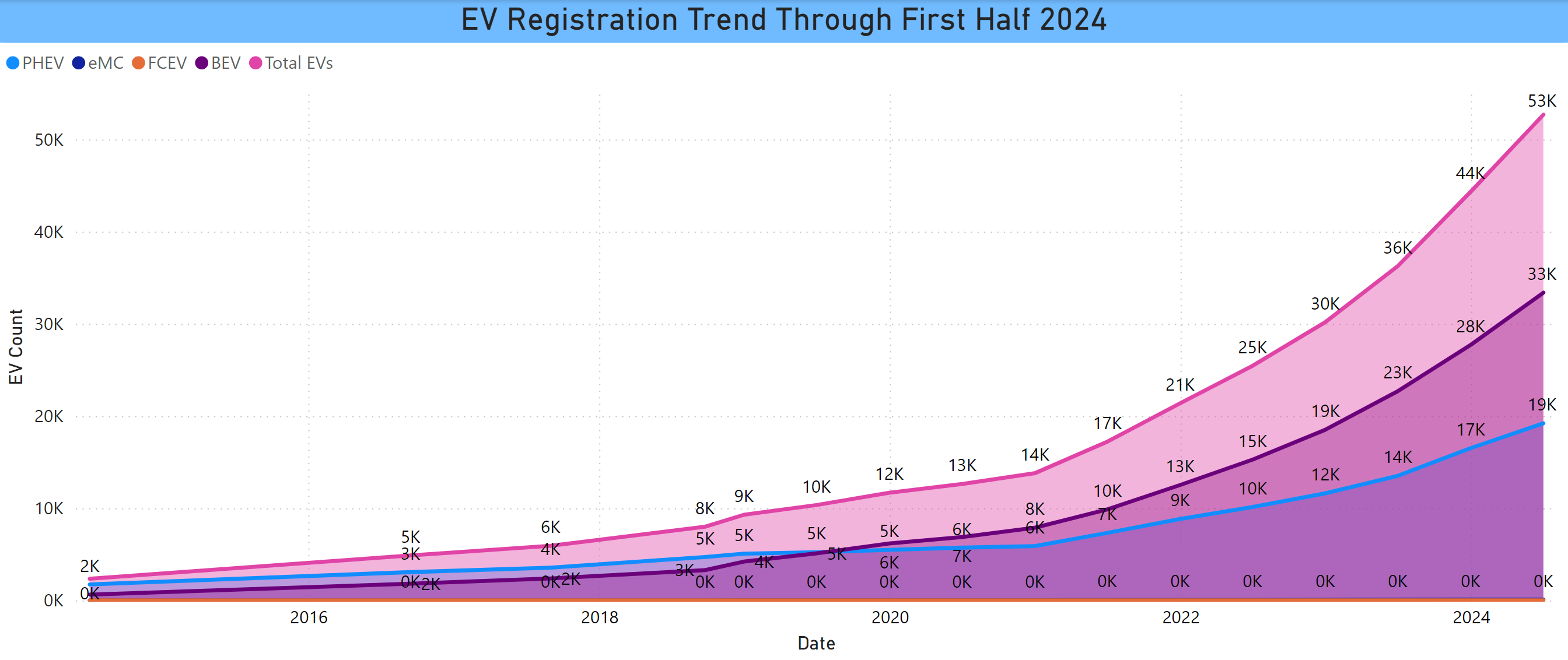

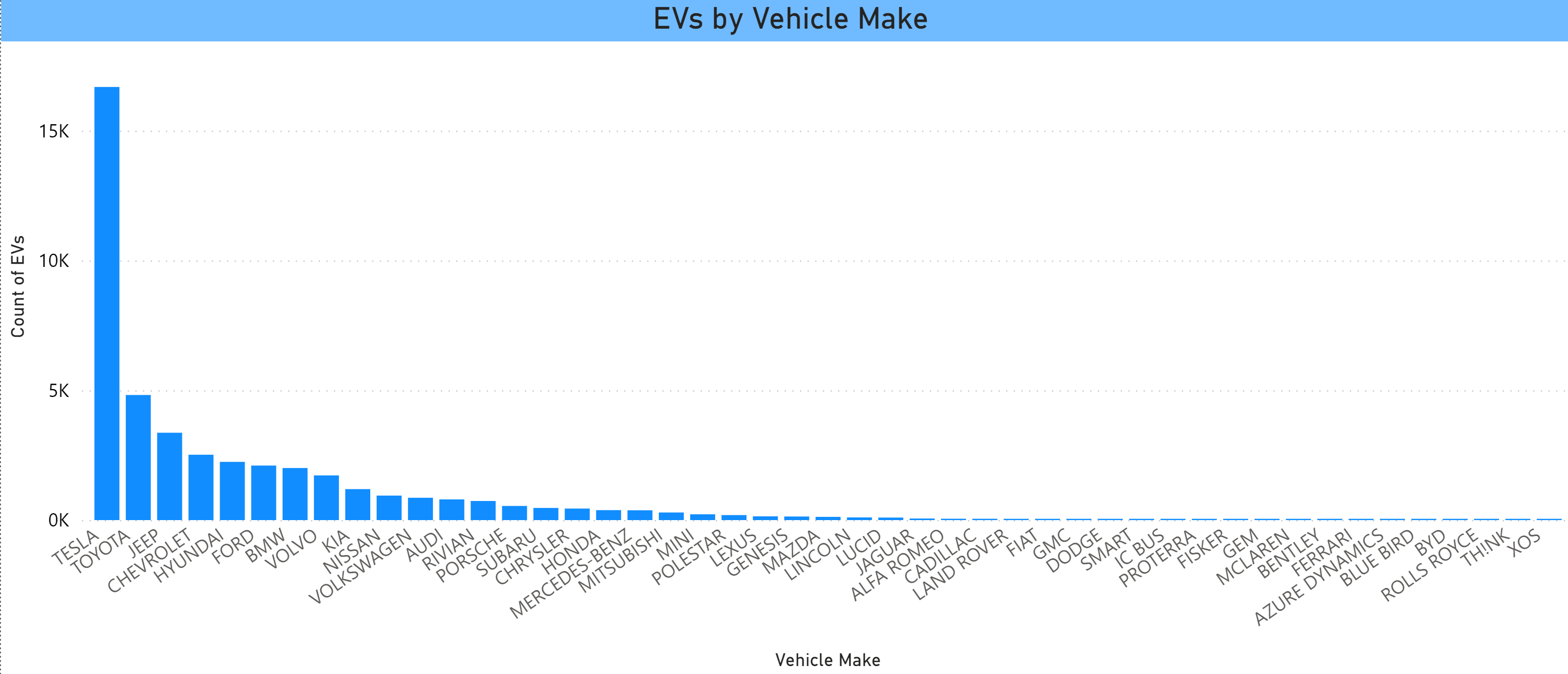

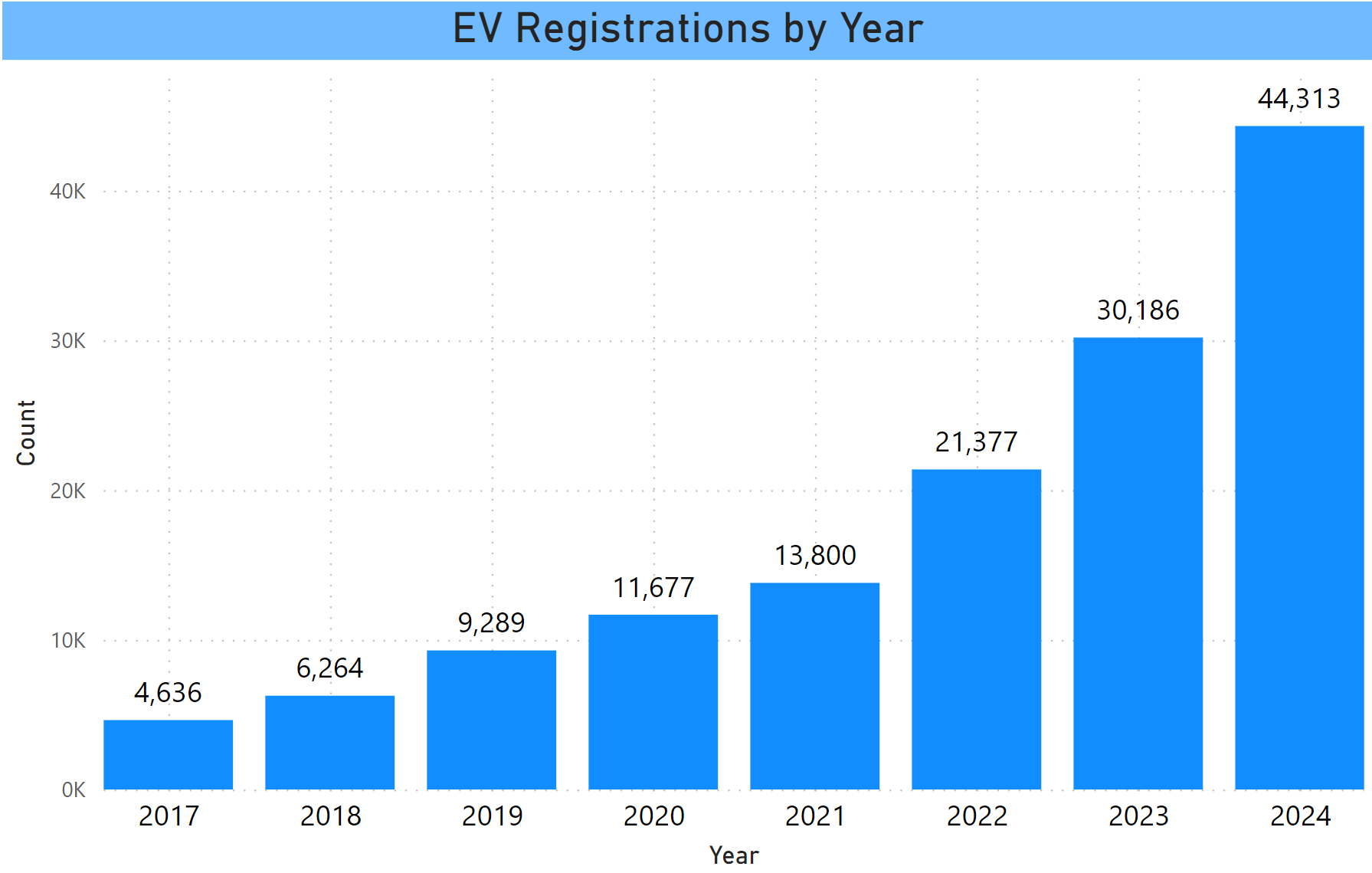

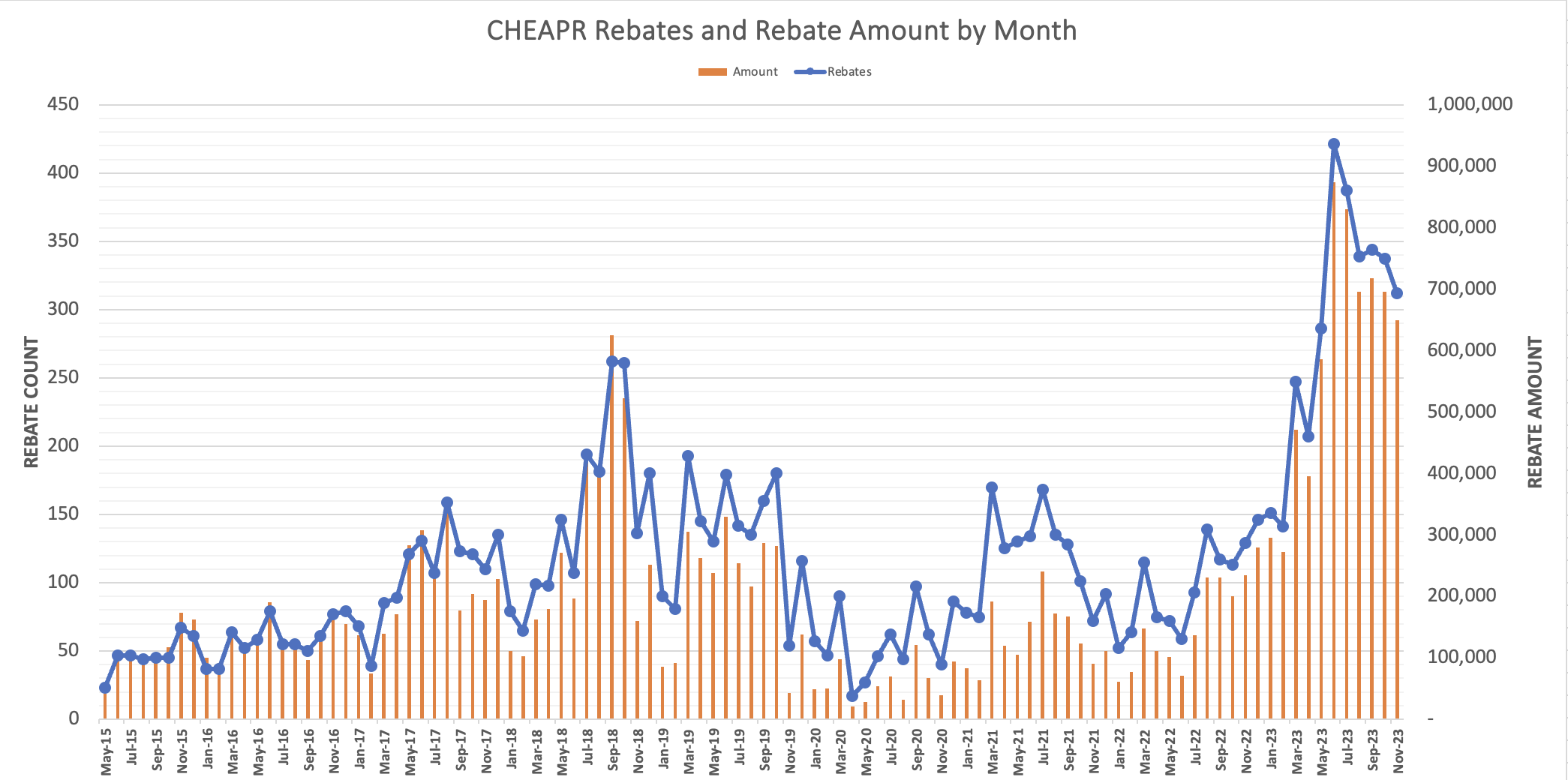

Registered EVs in CT Thru First Half 2024

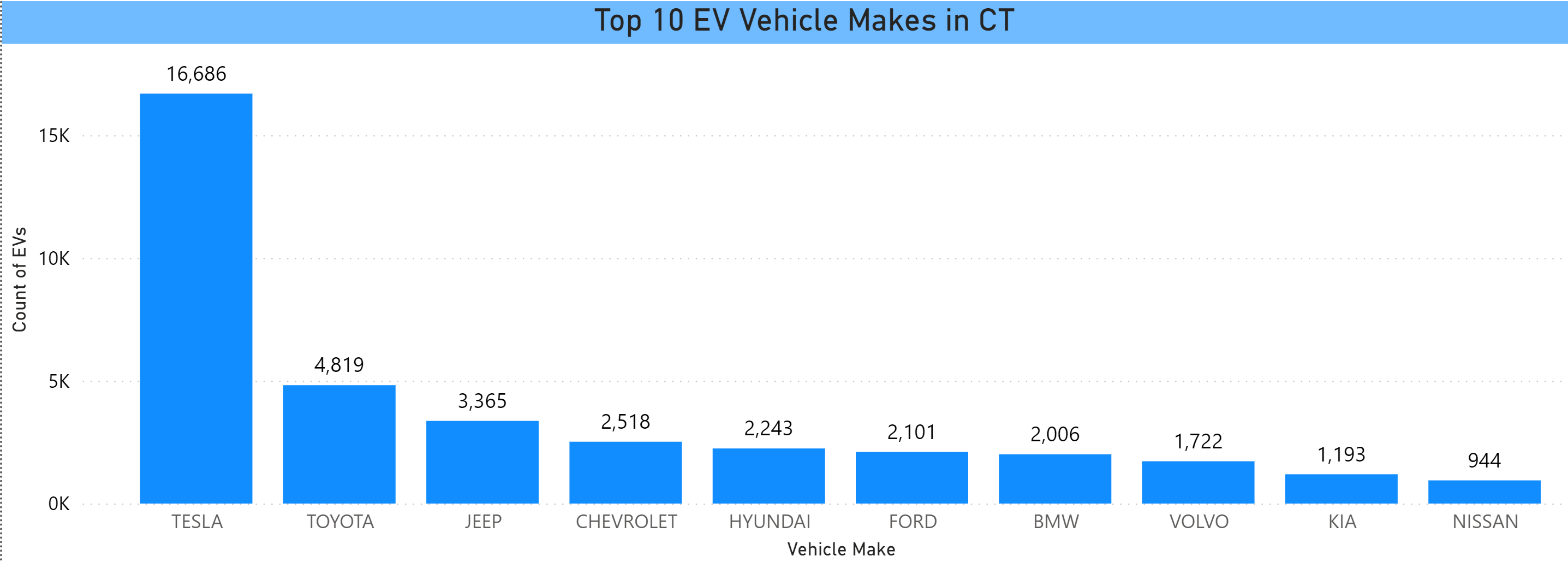

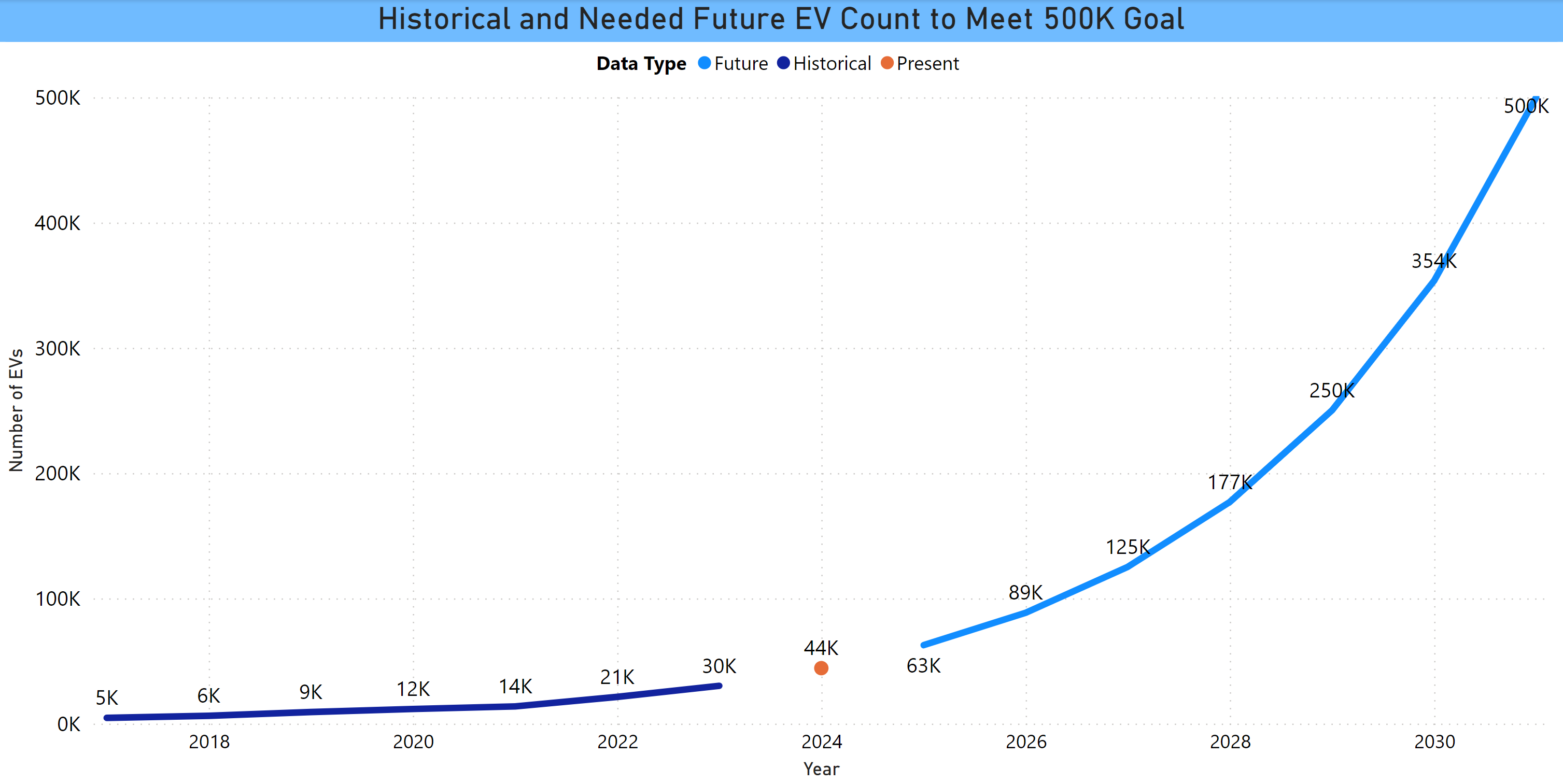

Photo above – EV registration trends. Post and chart by Barry Kresch Updated EV Registration Counts as of July 1, 2024 52,691 Registered Electric Vehicles in CT 33,386 Battery Electric Vehicles 19,211 Plug-in Hybrids 91 … Read more