Blog

Final Conference Agenda for NEEVS

NorthEast Electric Vehicle Symposium Set for September 15th and 16th We thank our Gold Sponsor: BMW Sunday – EV Test Drives Sunday will feature test drives with 10 EV models: BMW i4, i5, iX Tesla … Read more

Test Drives of Tesla Cybertruck

Above photo is a wrapped Cybertruck which ships with the stainless steel body panels. We have seen lots of folks having fun with wrapping it. First Public Test Drives of a Cybertruck to Be Offered … Read more

BMW, Tesla, Rivian Test Drive Vehicles Confirmed for EV Club Conference

BMW Signs on as Gold Sponsor They will offer test drives of the i4, i5, and iX battery electric vehicles. There will be an i7 on display in the showcase. In addition to BMW, we … Read more

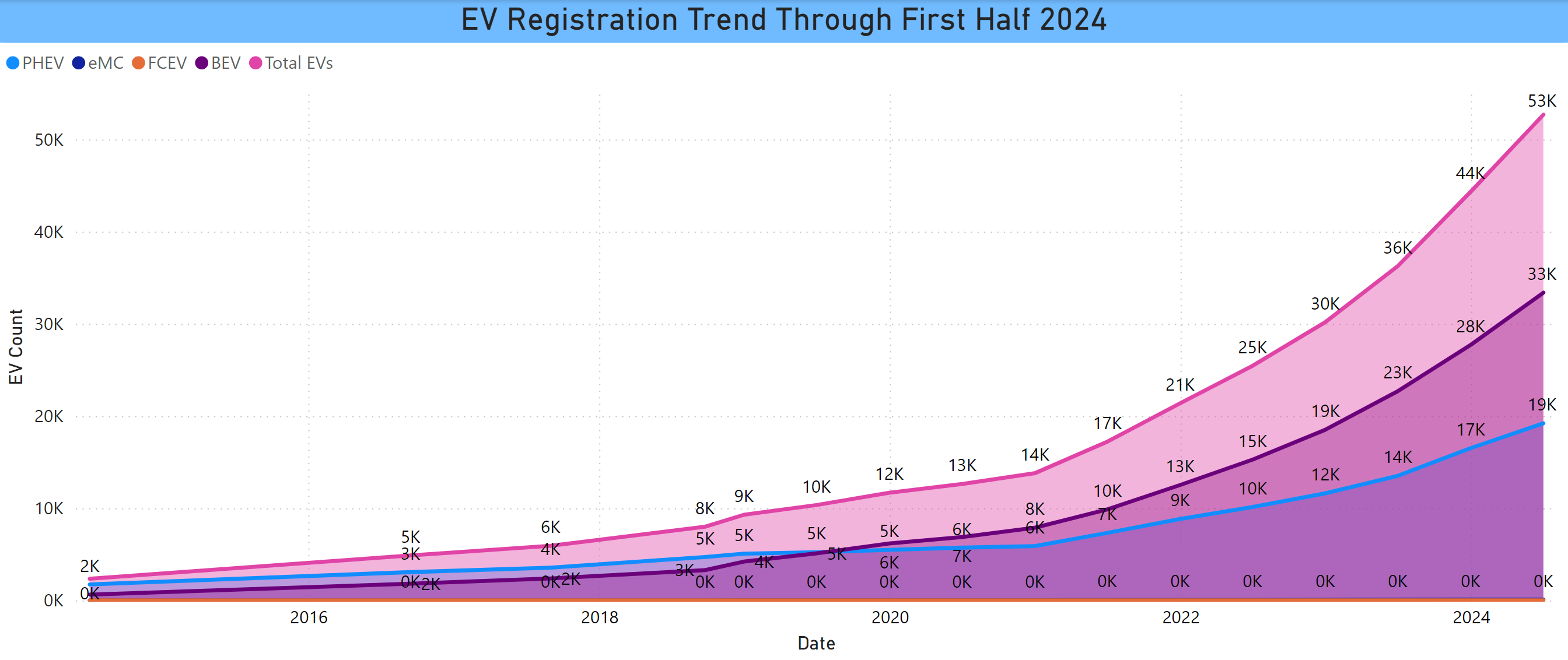

Registered EVs in CT Thru First Half 2024

Photo above – EV registration trends. Post and chart by Barry Kresch Updated EV Registration Counts as of July 1, 2024 52,691 Registered Electric Vehicles in CT 33,386 Battery Electric Vehicles 19,211 Plug-in Hybrids 91 … Read more

New Tesla Service Center Opening

Under Construction – Photo above is a selfie from YouTuber Out of Spec Dave, taken when he visited the new service facility last month before it was completed. Used with permission. Opening Set for August … Read more

EV Adoption in Environmental Justice Communities

post by Barry Kresch CT Roundtable for Climate and Jobs Panel The CT Roundtable for Climate and Jobs recently hosted a virtual event entitled “Transportation Infrastructure and Electric Vehicles in Connecticut.” I was one of … Read more

EV Charging Incentives from Eversource and UI Back Online

Post by Barry Kresch The Utilities and PURA Have Worked Out Their Differences I spoke today to United Illuminating and they advise that they and the Public Utilities Regulatory Commission have come to a meeting … Read more

Shelton Rivian Service Center Opens

Rivian Service Center in Shelton is Finally Open After a lengthy legal battle, followed by the time necessary to build out the facility, the Rivian Service Center in Shelton, CT has finally opened. Rivian R1S … Read more