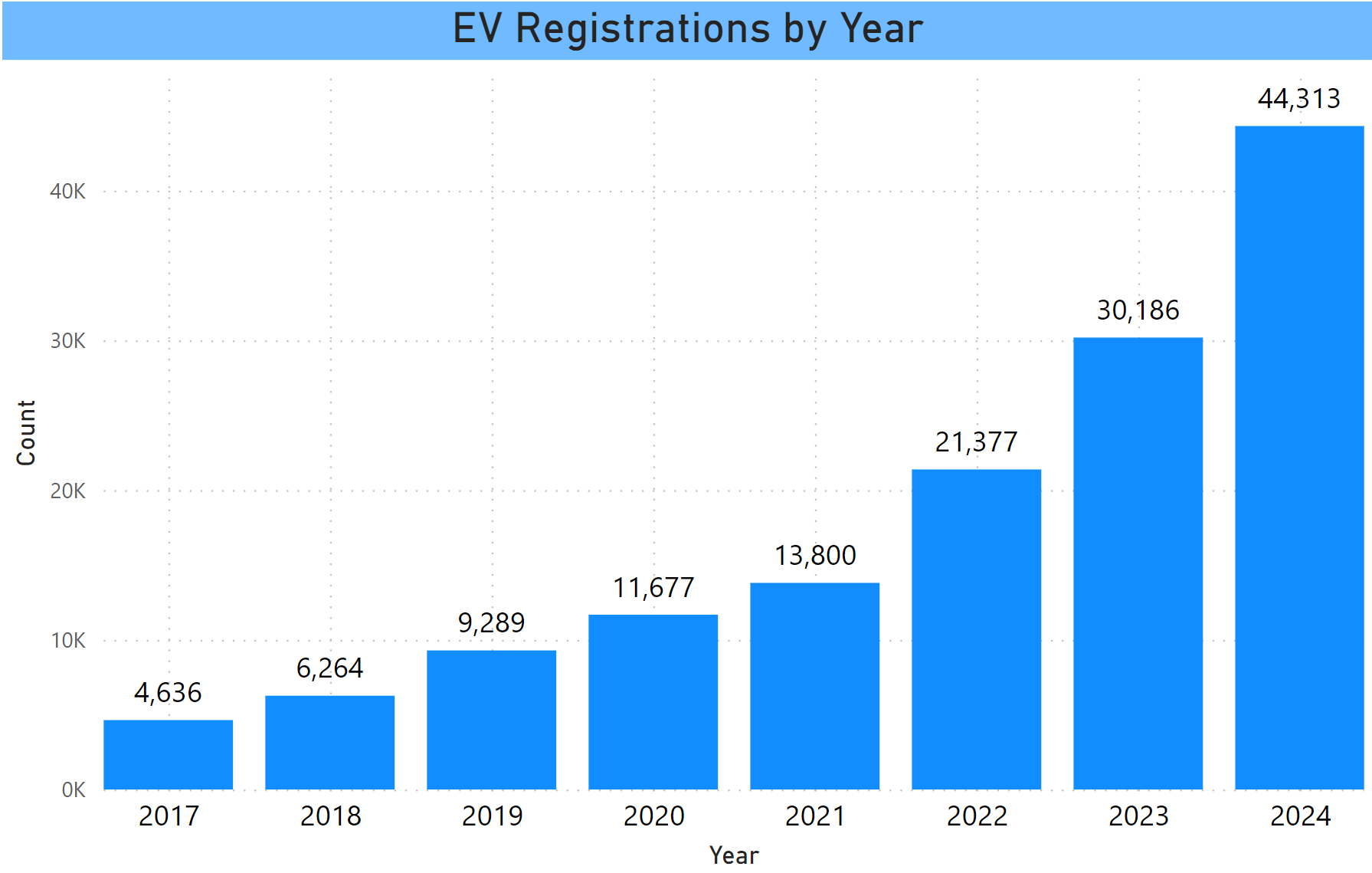

EV Registrations Up 47% Year on Year

There Are Now 44,313 Electric Vehicles Registered in CT The updated count includes registrations through the end of last year. It was released by the Department of Motor Vehicles, which is statutorily required to release … Read more