First Quarter Sales Results Were Terrible for the Industry, but a Sliver of a Silver Lining for EVs

The first-quarter economic data were just released and as bad as expected (GDP down 4.8%) with worse to come.

According to Automobilemag.com, nationally, automobile sales were down 12% for Q1 year over year because of a 41% decline in March.

Only two manufacturers reported a quarterly gain. Kia was up 1% and Tesla was up 40%. All others fell by as much as 30% (Nissan). Since Tesla basically carries EV sales, it is possible that EV market share is up for the quarter. General Motors was down 7%, but the Chevrolet Bolt was up 36%. That could be due to this being the final quarter of the phase-out of the federal tax incentive for GM, which is over the 200,00 unit sales threshold. It now joins Tesla as the only manufacturers that no longer have the benefit of this tax credit. We await final data for other EVs.

Despite a stronger than expected earnings call from Tesla, and after-hours momentum for the stock, there was some unfortunate hyperbole from Elon Musk over the temporary closure of its manufacturing plant in Fremont, CA. (Its plant in China is re-opening.) The company is ahead of schedule in its rollout of the Model Y, which is expected to be an even stronger performer than the Model 3. The economy may be cratering, but their problem seems to be more supply than demand.

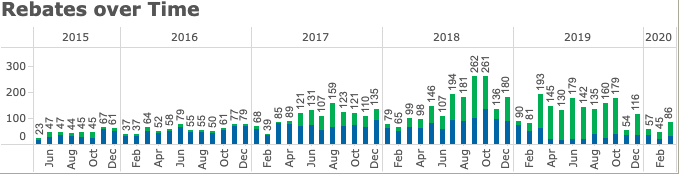

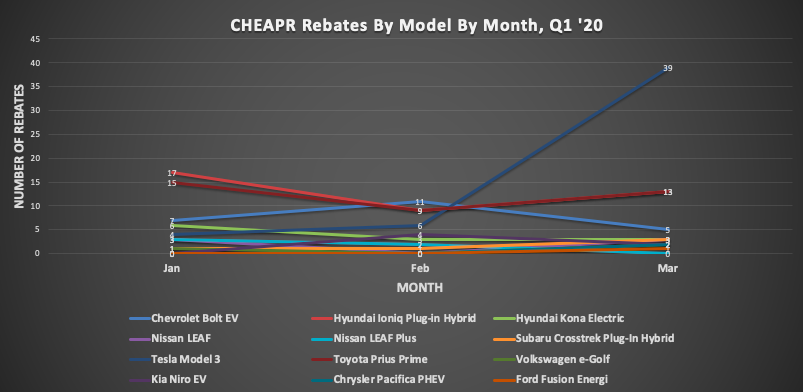

CHEAPR Rebates Run Countertrend and Rise in March

March was clearly the worst month of the quarter by far, but CHEAPR rebates actually rose relative to January and February. As shown in the graph at the top of the post, this is almost completely driven by the Model 3, despite the fact that only the most basic trim level falls under the revised MSRP cap of $42,000. 39 of the 86 rebates in March were for the Model 3, a lower percentage than it was before the change in October 2019, but still surprisingly high.

CHEAPR data are loaded through March 31. They typically update monthly and lag about a month.

Despite the March spike, the annual run rate based on a straight-line projection of the quarter is only $756,000, still well under the $3 million allocated. The messaging remains on the CHEAPR website that revisions to the program are coming this year, but, hey guys, it’s almost May!

This is a screengrab from the CHEAPR website showing rebate levels by month from inception through March 2020. The levels rose as EVs gained more traction and, in particular, Tesla launched the Model 3, but then fell after the changes in October. The green shading is for BEVs and the blue is for PHEVs. The amount of green shading has increased and is driven primarily by the success of the Model 3, the discontinuance of the Chevrolet Volt, and a softening in the number of rebates for the Toyota Prius Prime. The introduction of the Chevrolet Bolt and Nissan Leaf Plus have had a more modest impact.