Whenever we have looked at CHEAPR, it has appeared to be a worthwhile program. (Our complaint is with how the parameters were changed in October 2019.)

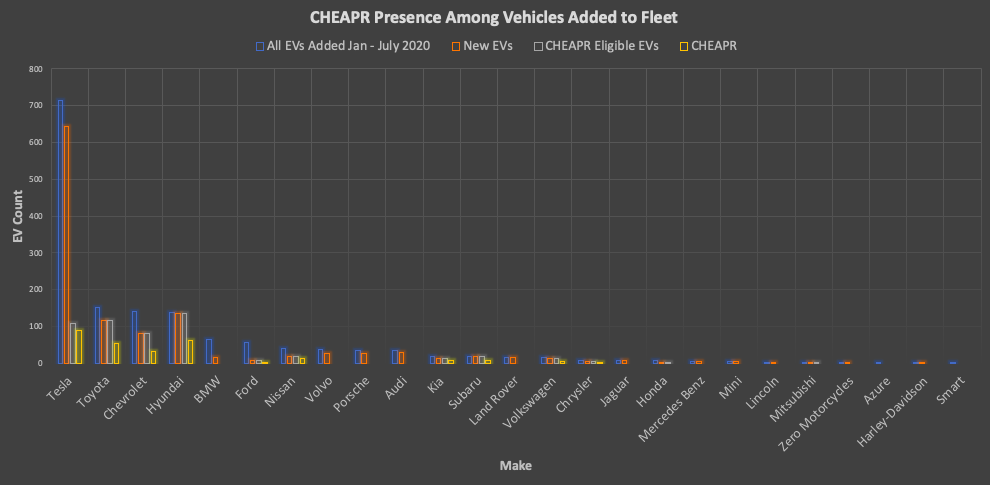

Creating a Comparison of Registered Vehicles with CHEAPR Rebates

For this analysis, which is seen in the chart at the top of the post, I began with all of the vehicles that were new to the file (comparing the January 2020 and July 2020 files). I then filtered that to the definition we have been using for new (as opposed to pre-owned) vehicles, which is the model year of 2019 or later. From that sub-set, I further winnowed it down to vehicles eligible for a rebate by make. Finally, I lined up the CHEAPR rebate data for the corresponding time period (first half of 2020), also by make.

There is some estimating here and not only for identifying new vehicles. Mostly, I used make as my proxy. For example, all new Chevrolets deemed new are considered eligible. This would only apply to one model, the Bolt, and it is possible to get a fully loaded Bolt that would exceed the MSRP cap and thus be ineligible. The same is true for the Mitsibushi Outlander. In the case of Tesla, I excluded all of the Model S, X, and Y vehicles, and took 25% of the Model 3. It is pretty easy to get above $42,000 with Model 3 options (e.g. long-range, all-wheel drive), so I made the assumption that relatively few are eligible.

If one takes these leaps of faith with me, then it works out that 53% of eligible vehicles are associated with a CHEAPR rebate. Of course, the CHEAPR restriction of only one rebate means that only first-time EV buyers can qualify. So it seems like the indicia are still pretty strong with respect to CHEAPR “driving” EV sales. If the rebate and MSRP cap were higher, CHEAPR could drive more EV sales.

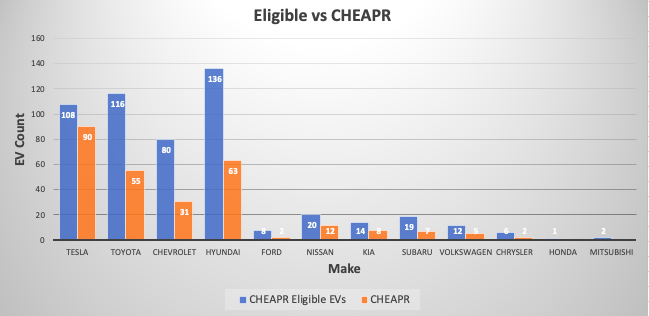

If the chart at the top of the post is too dense to easily read, below is a chart with only the eligible and CHEAPR data points, and only the eligible makes.

1 thought on “Presence of CHEAPR Among Eligible New Vehicles”

Comments are closed.