Barry Kresch

Interactive EV Dashboard – EV Adoption in Connecticut

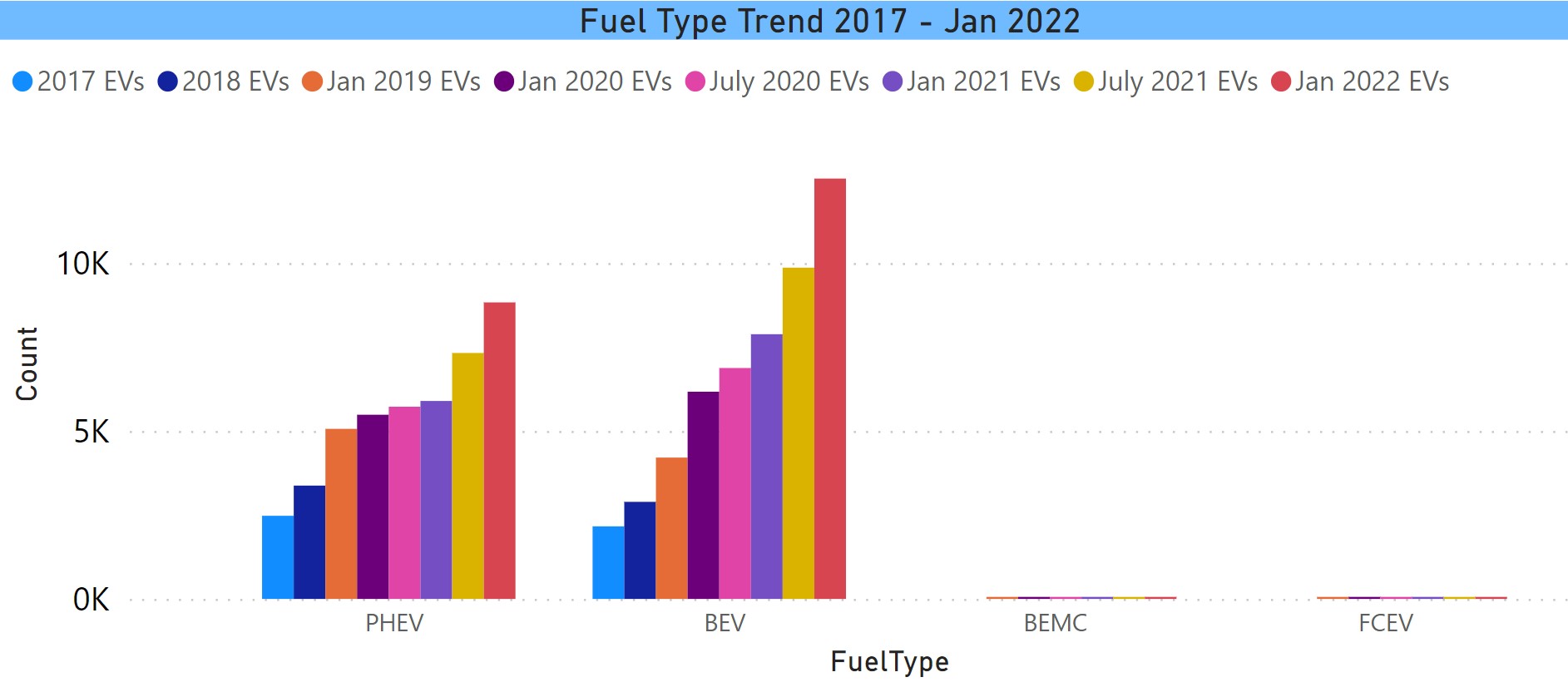

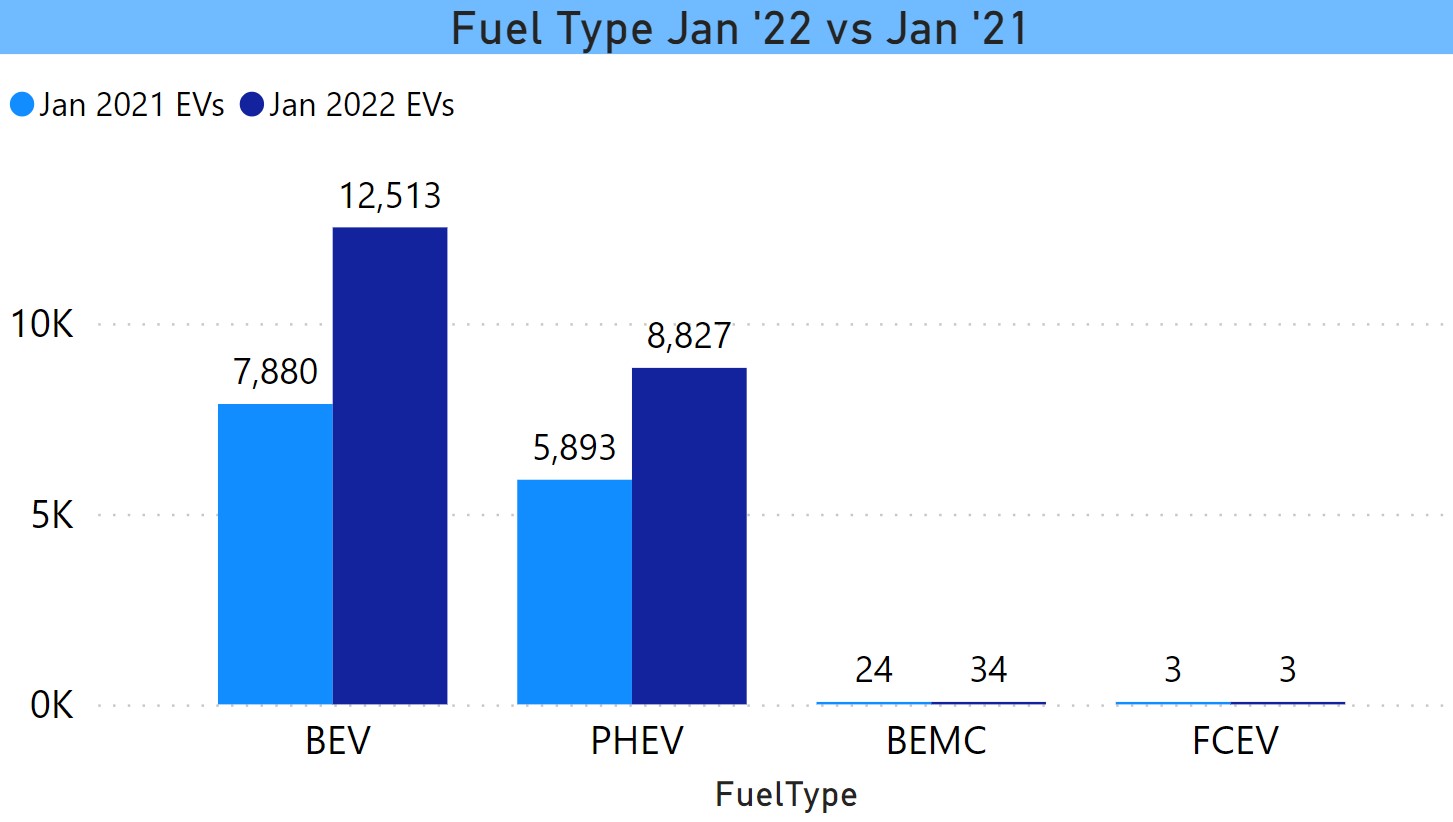

Note: These data are obtained via a Freedom of Information Act Request from the Department of Motor Vehicles. The data are registrations, not sales, and represent all light-duty electric vehicles registered in the state through the end of last year. The definition of “electric vehicle” or “EV” follows what is used in the MultiState Zero Emission Action Plan Memorandum of Understanding (MOU). This MOU has sets forth the EV adoption goals the state has set for itself, which are 150,000 registered EVs by 2025 and 500,000 by 2030. The definition of EV in the MOU includes Battery Electric Vehicles (BEV), Plug-in Hybrid Electric Vehicles (PHEV), Fuel Cell Electric Vehicles (FCEV), and Battery Electric Motorcycles (BEMC). These different “fuel types” are captured as a variable, enabling the report to be filtered, so for example, we can choose to only look at BEVs.

Why do this?

I don’t do this just to make pretty charts. In my past life in media, we used to have a saying: “If you can’t measure it, you can’t sell it.” The same holds true for public policy. The ZEV MOU already suffers from the fact that it is a resolution and has no teeth. The real work is all of the under-the-hood advocacy and policies that will get us to where we need to be. Those of us who work on behalf of the EV Club or in other organizations such as the Sierra Club, Save the Sound, or the League of Conservation Voters, know all too well that the devil is in the details. I put this out there for the purposes of policy planning, citizen advocacy, holding the state accountable regarding its progress toward achieving its ZEV Plan goals, and under the principle that transparency is best.

There are 21,382 EVs registered in CT as of Jan 1, representing 14.3% of the 2025 goal and 4.3% of the 2030 goal. It is obvious that we have a long way to go.

The DMV publishes top line data, but the details add texture and insight. Knowing where there are clusters (or deserts) of EVs can help with planning for charging expansion. We track the details of which fuel types are registered and which models are succeeding with consumers. The extreme example: there are only 3 fuel cell vehicles registered in the state. Is it a wise use of resources to promote this technology, which the state extensively does, and which inevitably comes at the expense of supporting electric vehicles and mass transit?

A new dataset is obtained every 6 months, based on current statutory reporting requirements. Changes in policy can be correlated with the differences we see over time in the trended data.

Finally, many people don’t know that it is possible to get these data using public records requests and that it breaks no laws. In this and a subsequent post, I summarize many, though not all, of the charts in the dashboard.

About the Charts

I have not displayed the values in some of the charts below due to lack of space. If you are interested in seeing all of the data that I have charted, it is in a BI dashboard and posted to the website here. The values are displayed either by default or by hovering over a chart element. There are slicers (checkboxes) on most of the pages that can be used to filter the data. To check multiple boxes, depress the command key on a Mac or the control key on a PC. There are 29 pages (subject to change). Pagination is below the fold. Scroll down and click on it, and it will display the other pages and page titles.

Fuel Type

Battery Electric Vehicles account for 59% of EVs and growing faster than PHEVs. This is largely due to the Tesla Models 3 and Y. BEVs are up 59% from one year ago, while PHEVs are up 50%. There are currently 12,513 BEVs, compared with 8,827 PHEVs.

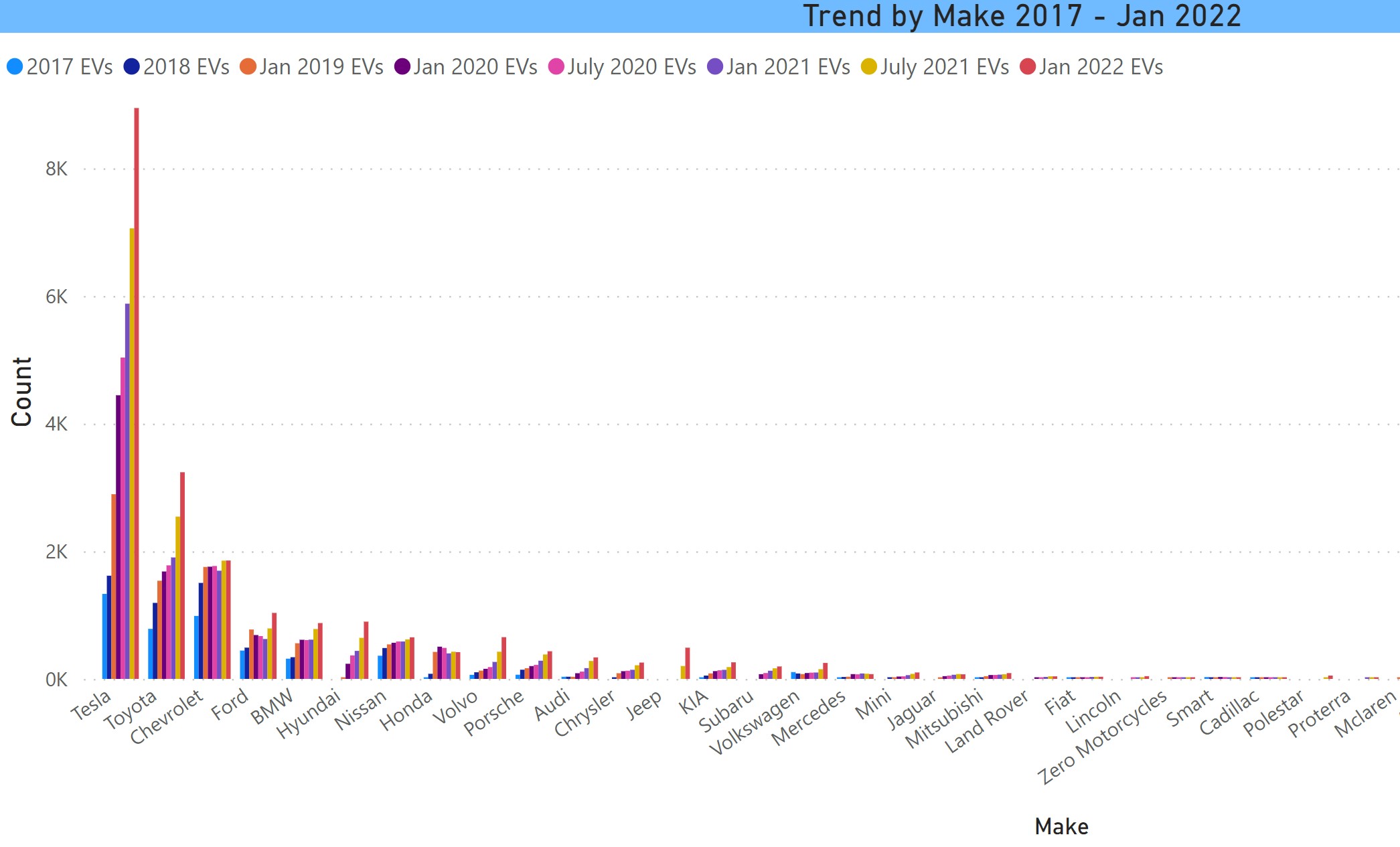

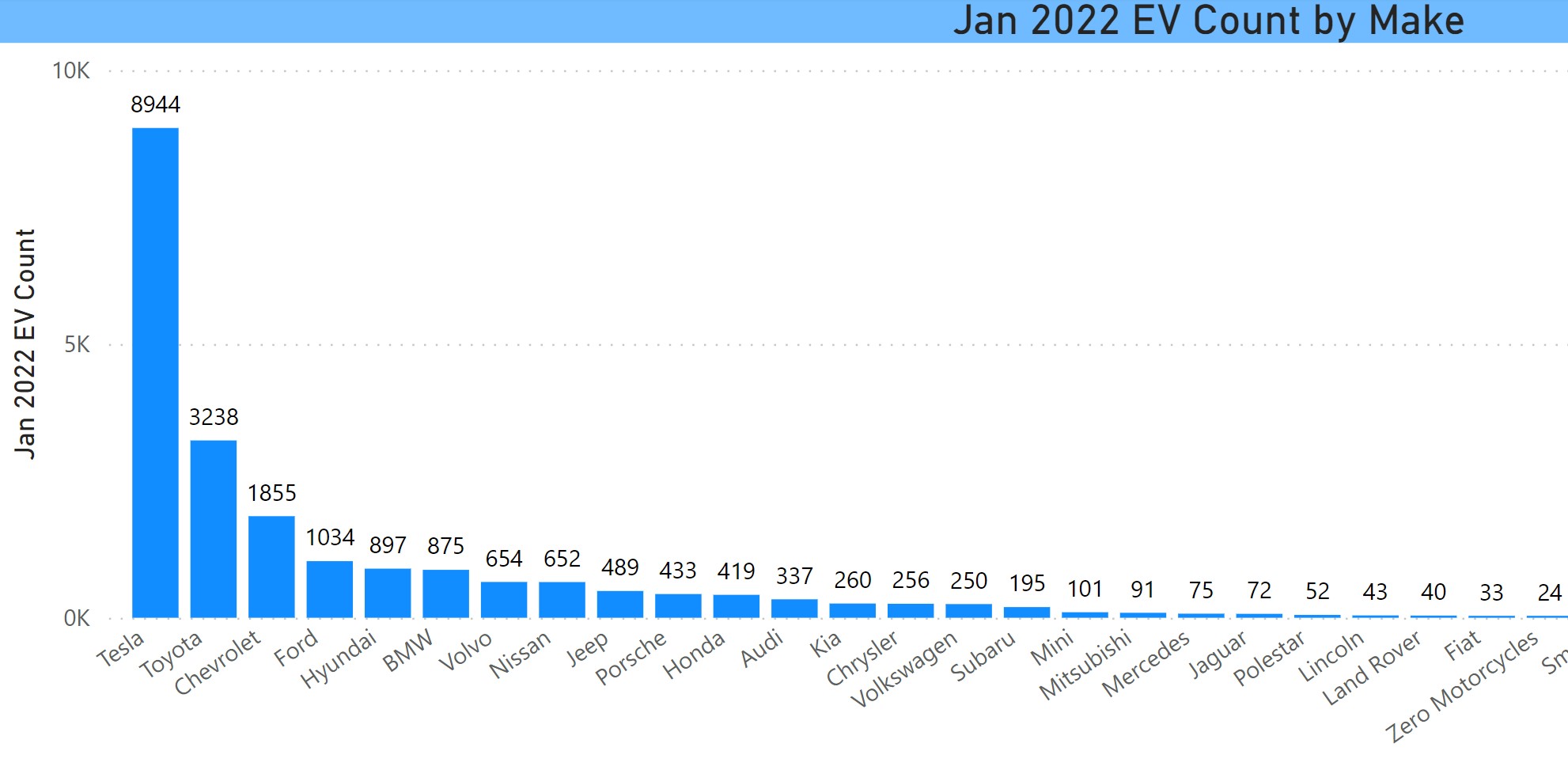

Tesla still has a commanding lead among EV makes

With 8944 registrations, Tesla is still way out in front of all other manufacturers. It is almost 3 times that of the number 2 make, Toyota, which has 3238, followed by Chevy with 1855. If the data are filtered for BEVs, the number 2 make is Chevy with 824.

Tesla accounts for 42% of all registered EVs and 71% of all battery electric vehicles (BEV). Despite numerous announcements from other manufacturers, this number has been holding steady with each successive wave of data.

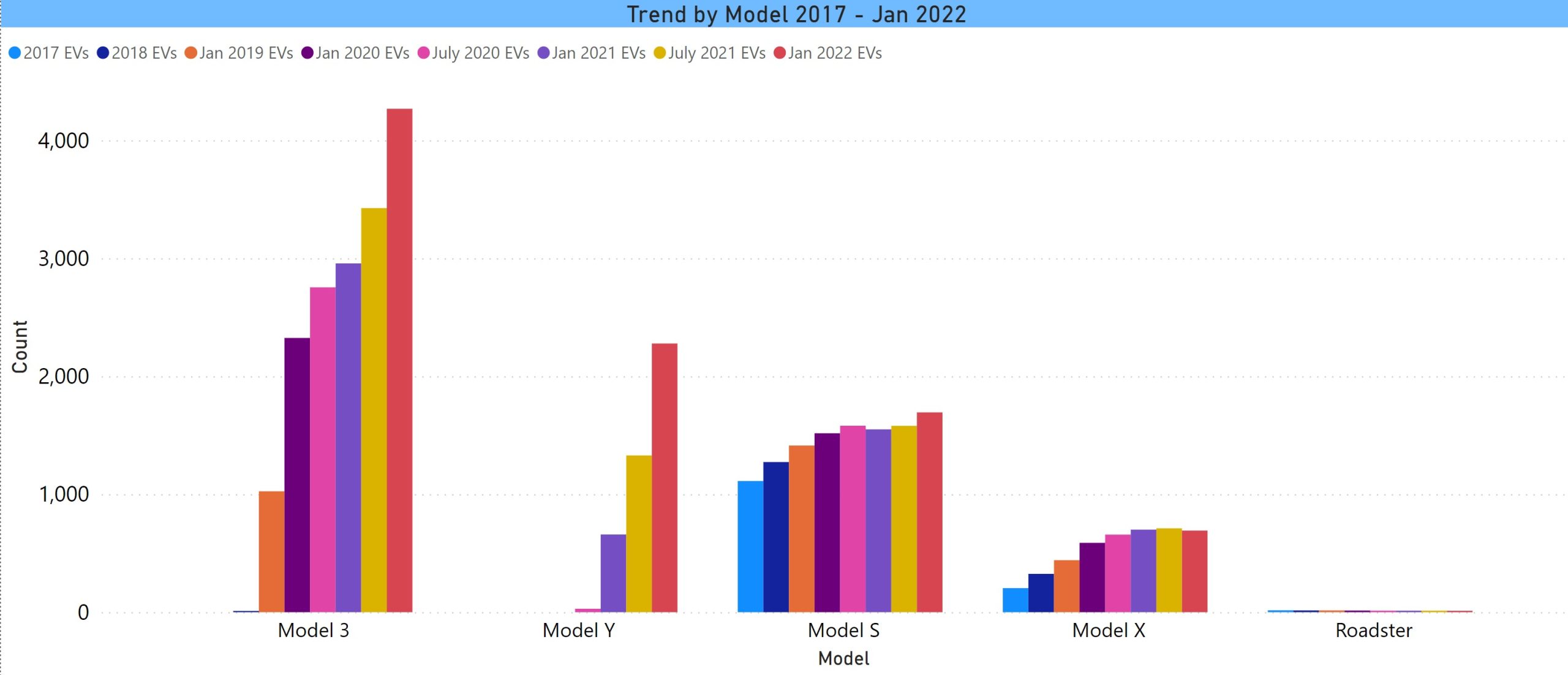

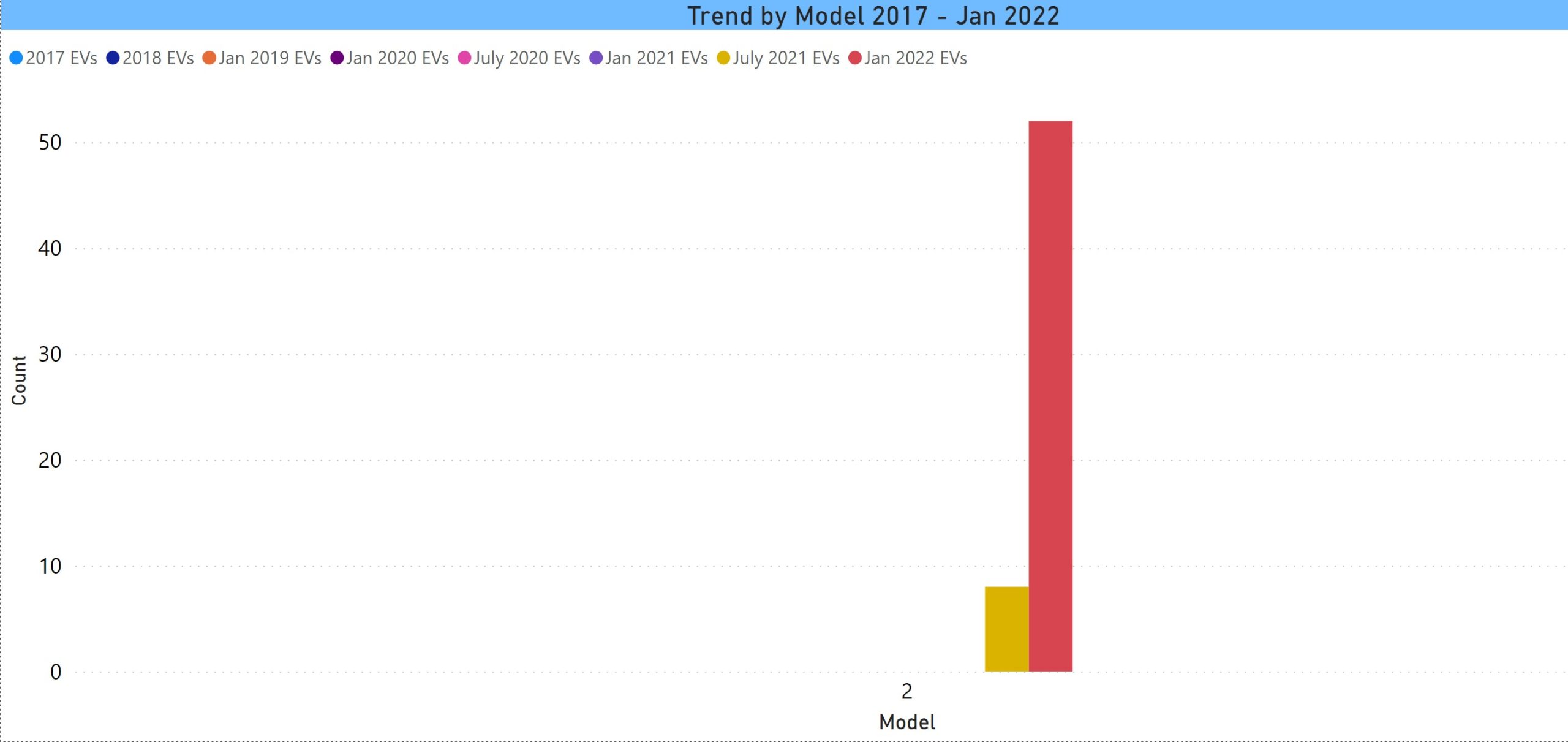

Tesla – 8944 Registrations

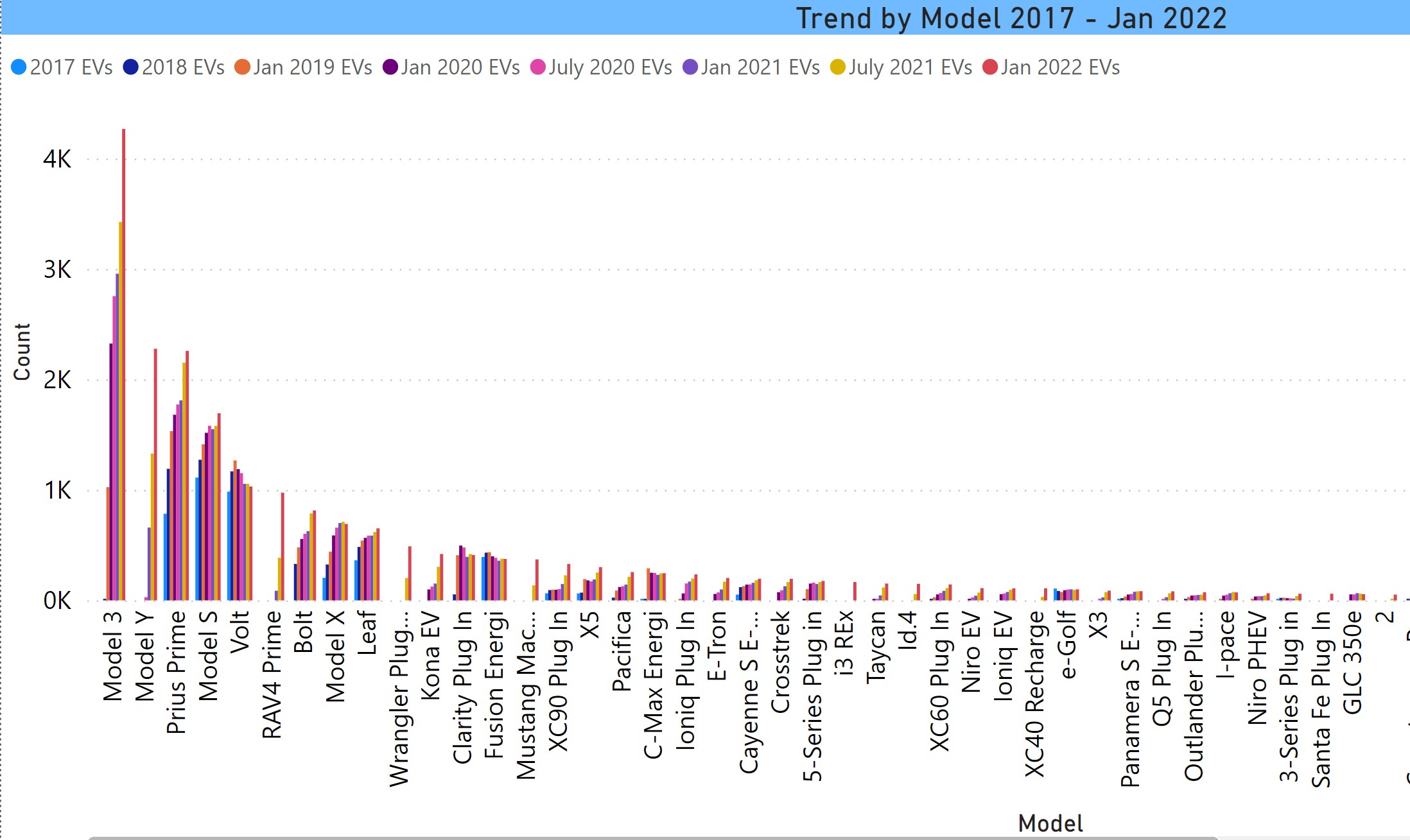

There were more Model 3’s entering the file than the Y even though the reporting is that the Y is Tesla’s top-seller. This pattern is likely due to supply constraints. We know that customers are waiting a long time for their Model Y. The new plant in Austin, TX is expected to go online soon which will help alleviate the supply crunch. In the chart below, which is the trend in net registrations, the Y is growing faster than the 3, which speaks to the 3 having higher turnover, not unexpected for a vehicle that has now been around long enough for lease expirations or turnover for other reasons.

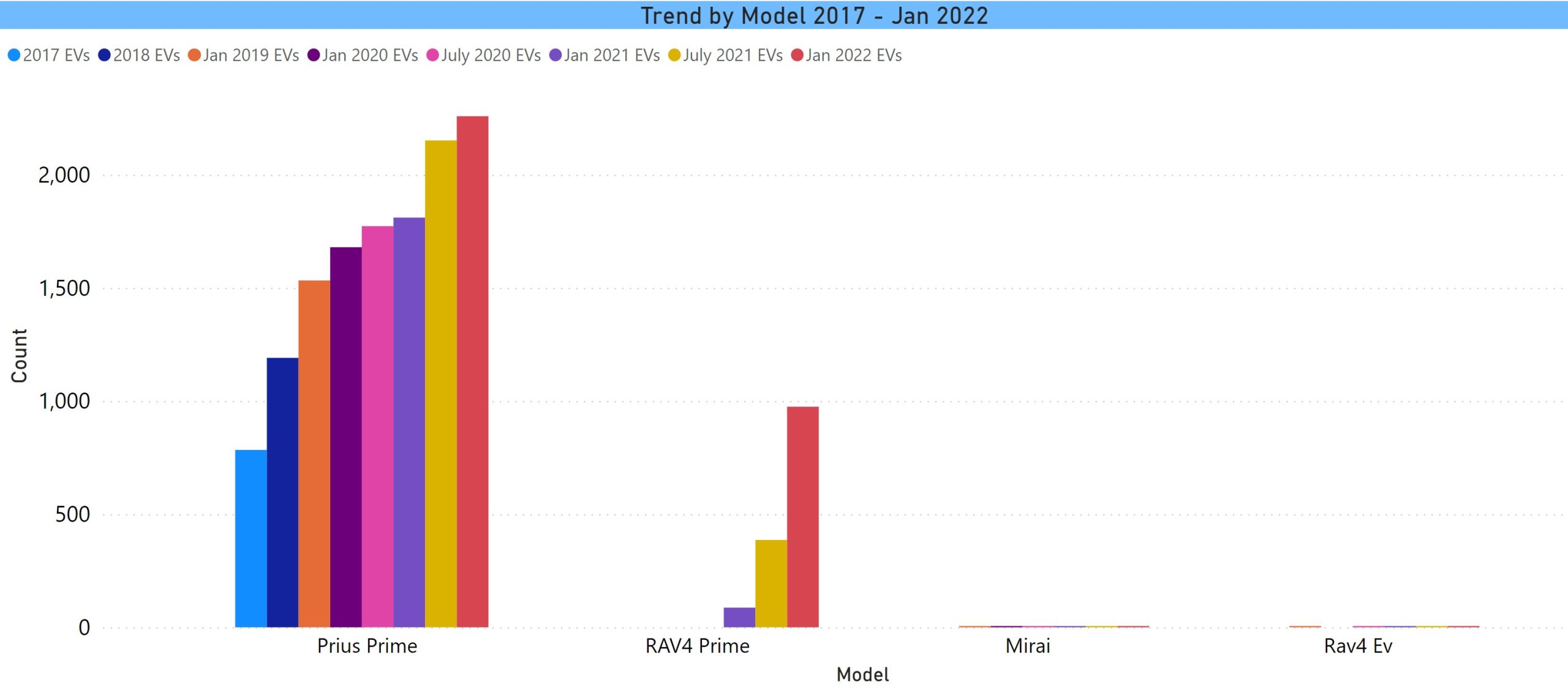

Toyota – 3238 Registrations

The Prius Prime and RAV4 Prime models, which account for almost all of the Toyota registrations, are plug-in hybrids. The RAV EV is a battery electric vehicle that was built in small numbers as a compliance car. The Mirai is a fuel-cell vehicle. There are 3 of them in the state and none currently for sale in CT as far as we know. Toyota did a refresh of the Mirai that became available in November 2021. They have been the manufacturer pushing hardest for fuel cell. Toyota is introducing its first battery electric vehicle, the bZ4X, an electric SUV (or EUV) later this year, according to its website.

It looks like Toyota has a hit on its hands with its RAV4 Prime. It came out of the gate strongly, but its success seems to be coming at the expense of the Prius Prime, where growth has greatly slowed. Note: The version of the Prius that pre-dated the Prime, simply known as the Plug-in Prius (one of those, “Why did they bother building this?” head-scratchers with a pitifully short electric range of only 11 miles), is folded into the Prius Prime numbers. (There are 1838 Primes and 421 of the older model.)

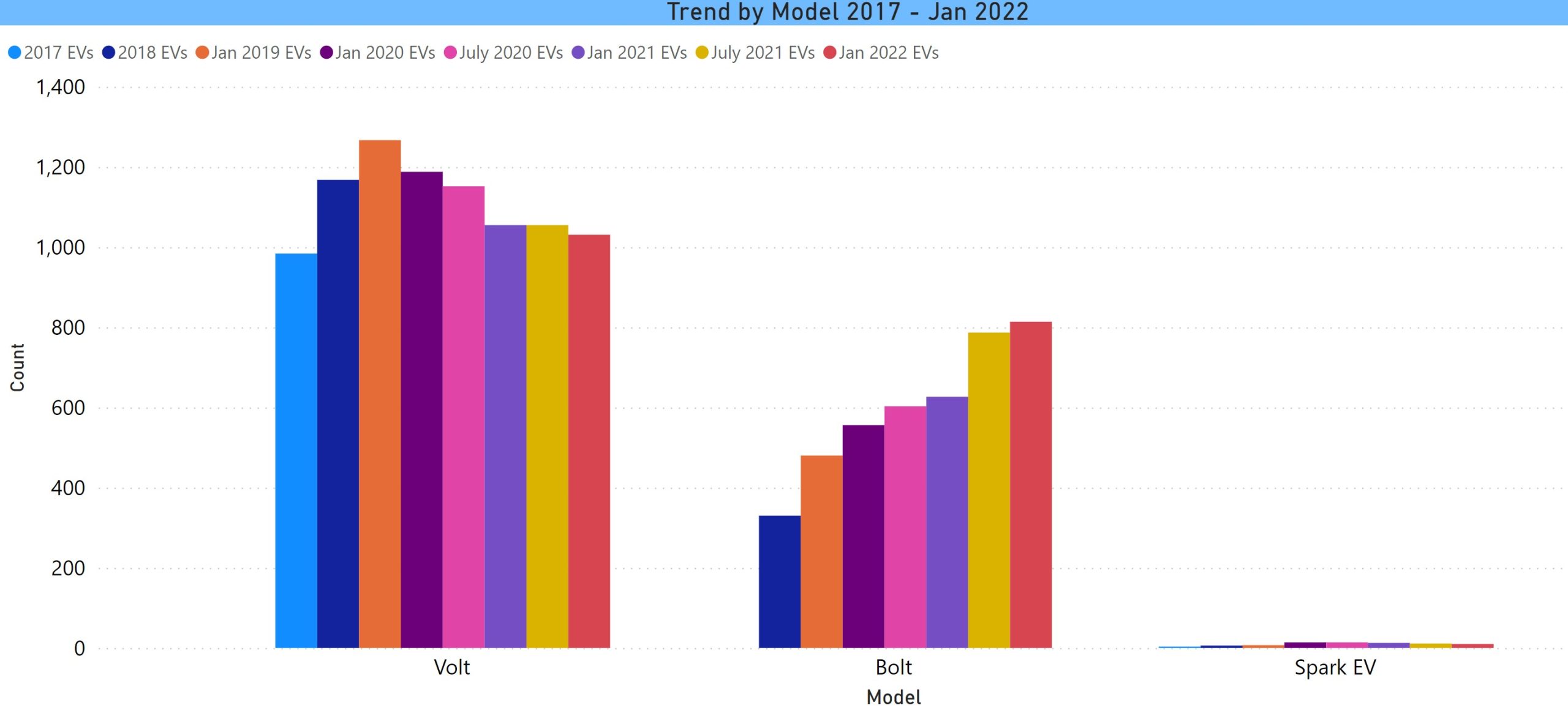

Chevrolet – 1855 Registrations

Chevy was at one time the leader in number of EVs registered, mainly driven by the now defunct Volt PHEV. Of course, Chevy is the tragic story of last year with the extensive recall of the Bolt due to a small, but unpredictable, incidence of battery fires. After the Bolt’s refresh with a lower price point, sales picked up, but the recall slammed on the parking brake. The Bolt has yet to overtake the declining Volt.

Chevy has made a number of high-profile announcements, including an electric Silverado pickup and an electric Equinox, both anticipated as 2024 model year vehicles.

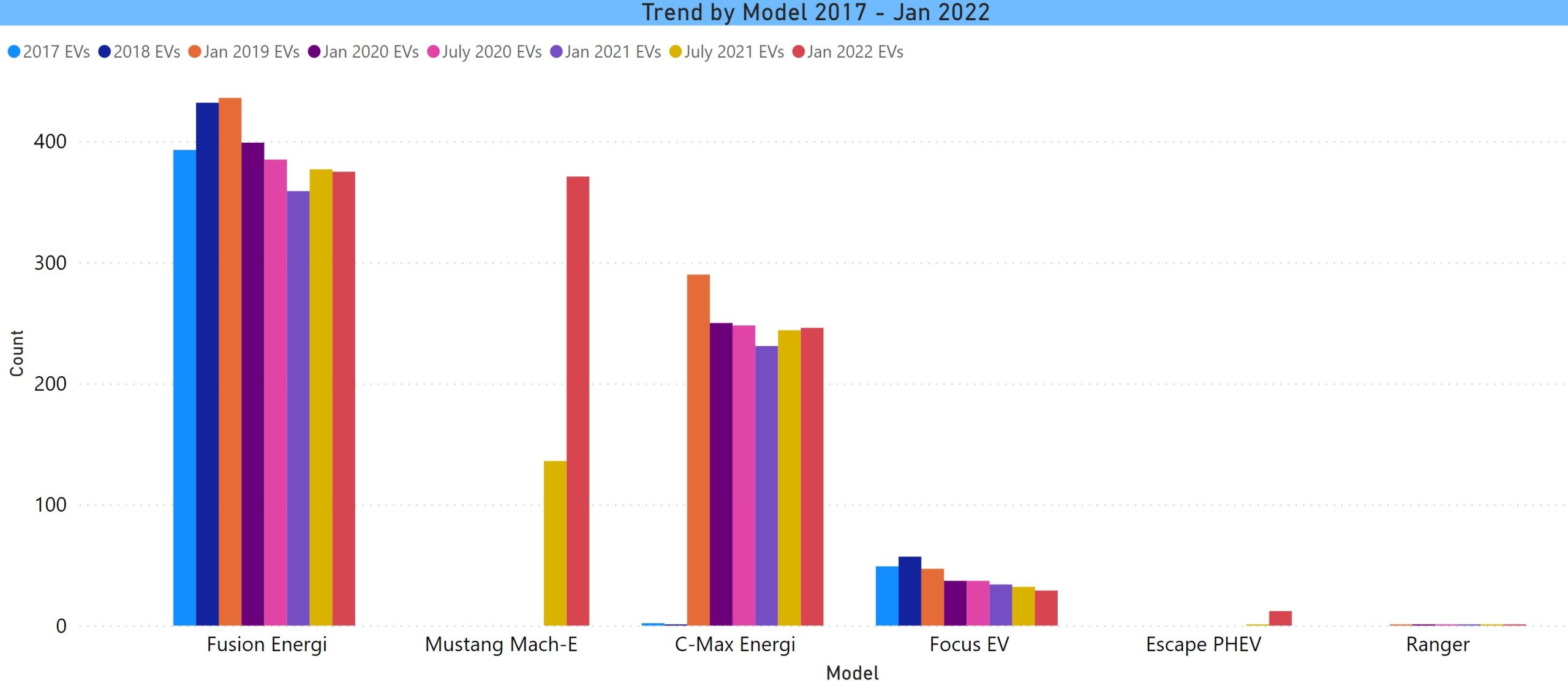

Ford – 1034 Registrations

The big news from Ford was the introduction of the BEV Mustang Mach-E and the F150 Lightning. There was a limited production run of the Mustang this year, but enough to make a noticeable difference. There is a much smaller bump for the Escape PHEV. Deliveries of the F150 Lightning will begin later this year. Ford reports a strong order book and this will be the first EV pickup for sale, reaching the market faster than the Chevy Silverado and Tesla Cybertruck.

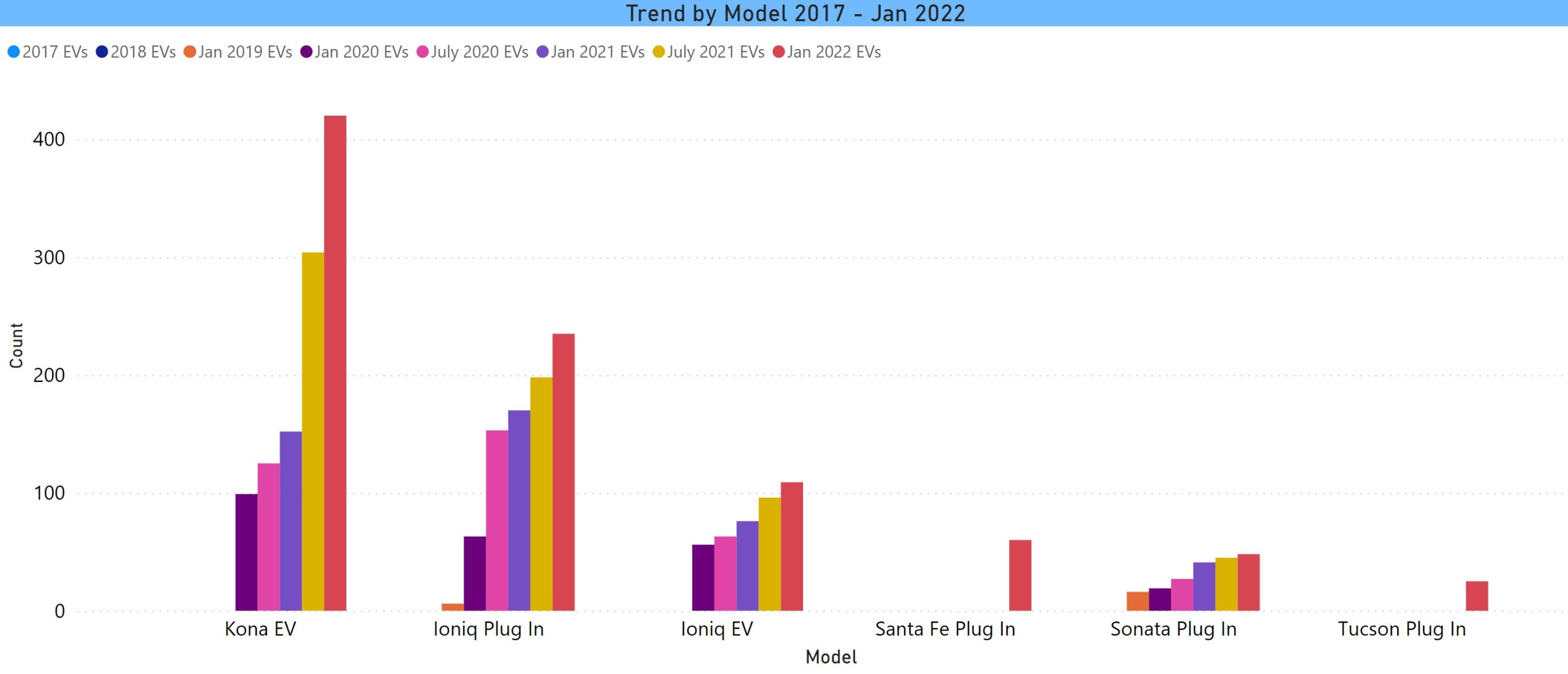

Hyundai – 897 Registrations

There was some progress with the Kona BEV. The big introduction of the year was the Ioniq 5. The file from the DMV includes the “Ioniq EV” with no “5” designation, so we may not yet be seeing it.

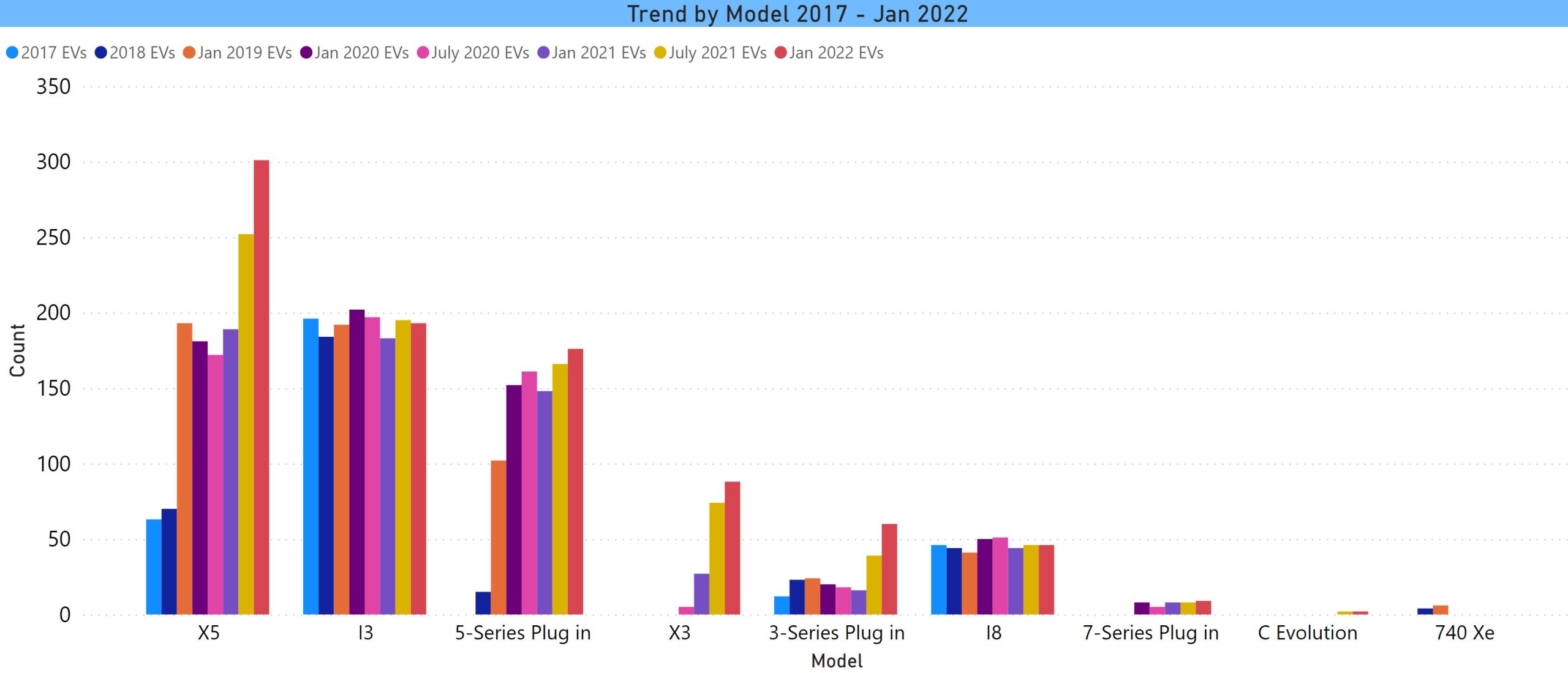

BMW – 875 Registrations

BMW was a relatively early EV player, with the BEV i3 and high-end, sporty PHEV i8 models. It has a relatively large number of models, mostly PHEV, mostly uninspiring performers. Recently, they have gotten some traction with the X5 PHEV. The imminent launches of the iX and i4 may build on this.

Note: for these charts, I combined the i3 and i3 REx. DMV classifies the i3 as a BEV and the REx as a PHEV, even though the range extender is an under-powered engine that enables you to get to a place to plug in, a preferable option to being dead-sticked, but not intended to function like a regular car as with other PHEVs. Most of the i3s are of the REx variety.

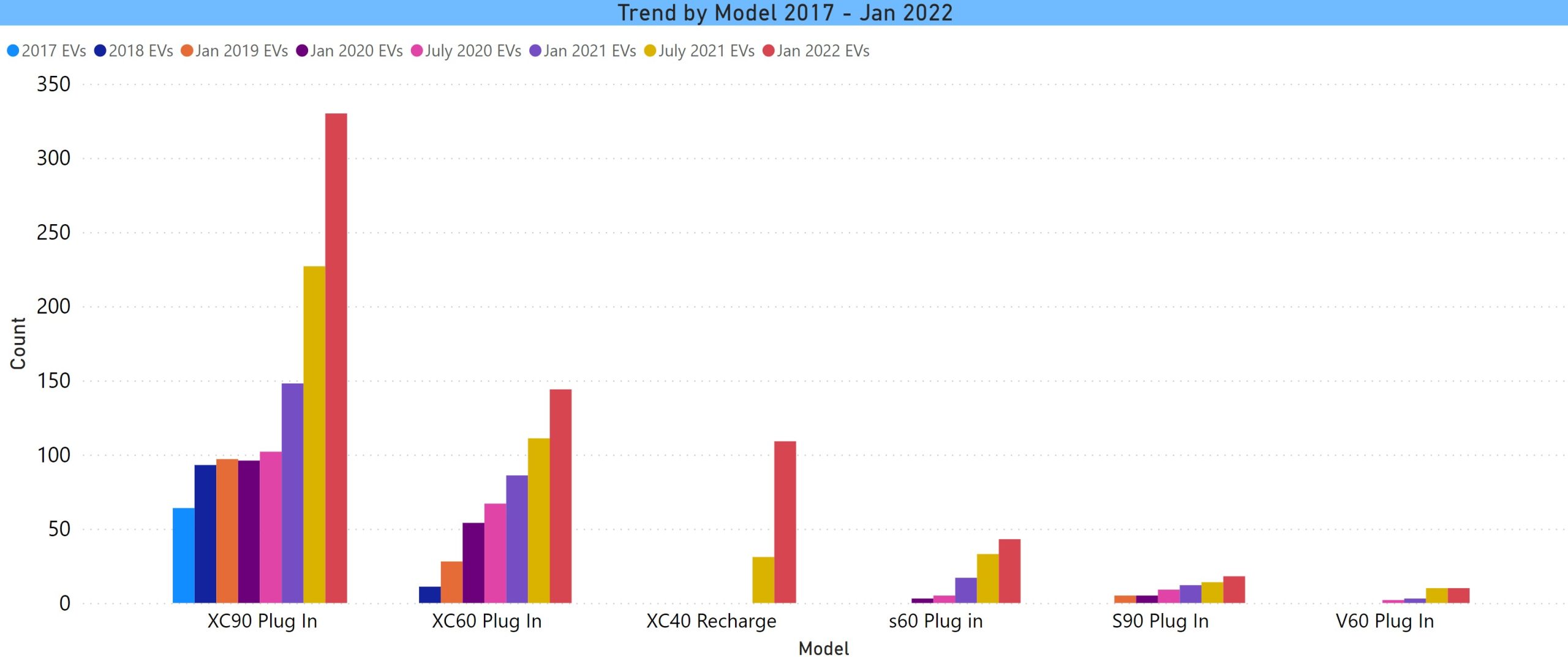

Volvo – 654 Registrations

Volvo had exclusively been selling PHEVs with modest success with its XC90. More recently it introduced the BEV XC40 Recharge.

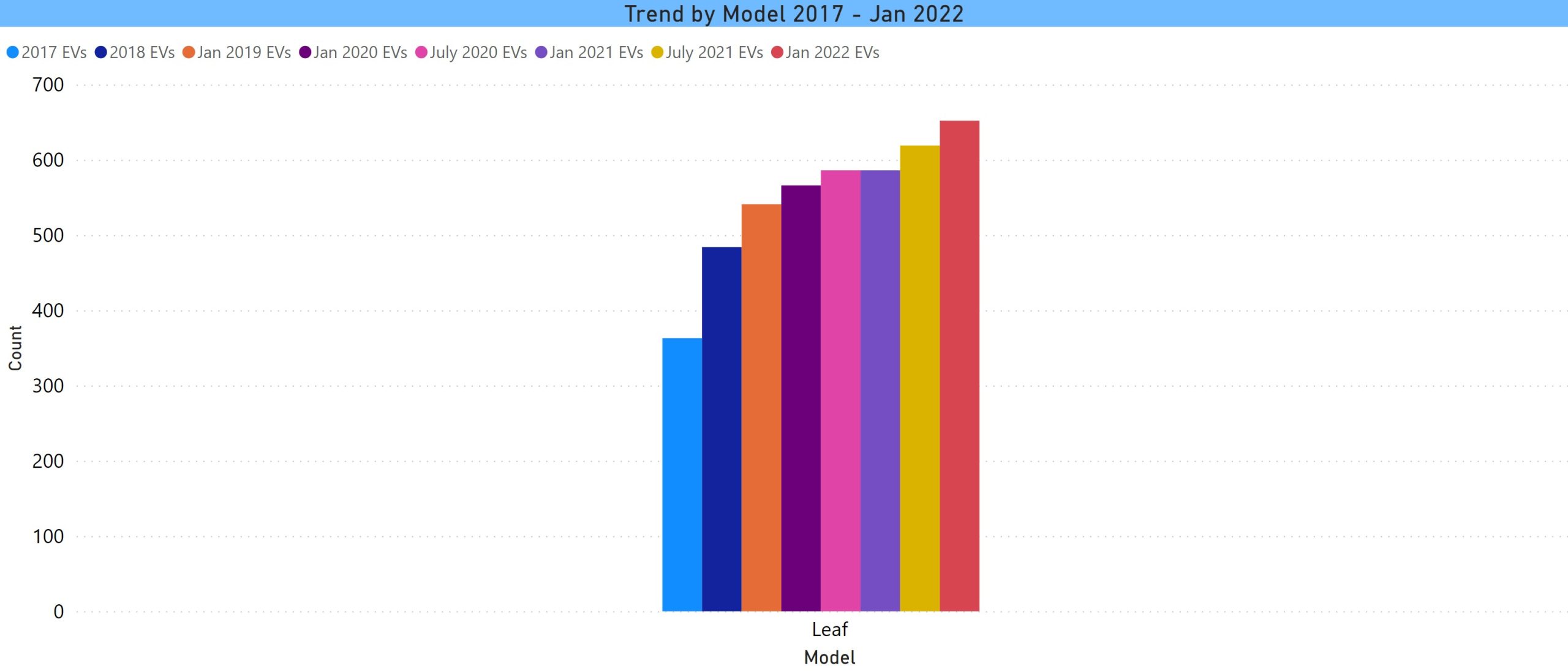

Nissan – 652 Registrations

Nissan sold the first mass market EV to go on sale in this country, the BEV Leaf. It is still with us, though never a particularly strong seller. Nissan has announced an electric SUV called the Ariya, scheduled to be on sale by the fall of this year as a 2023 model.

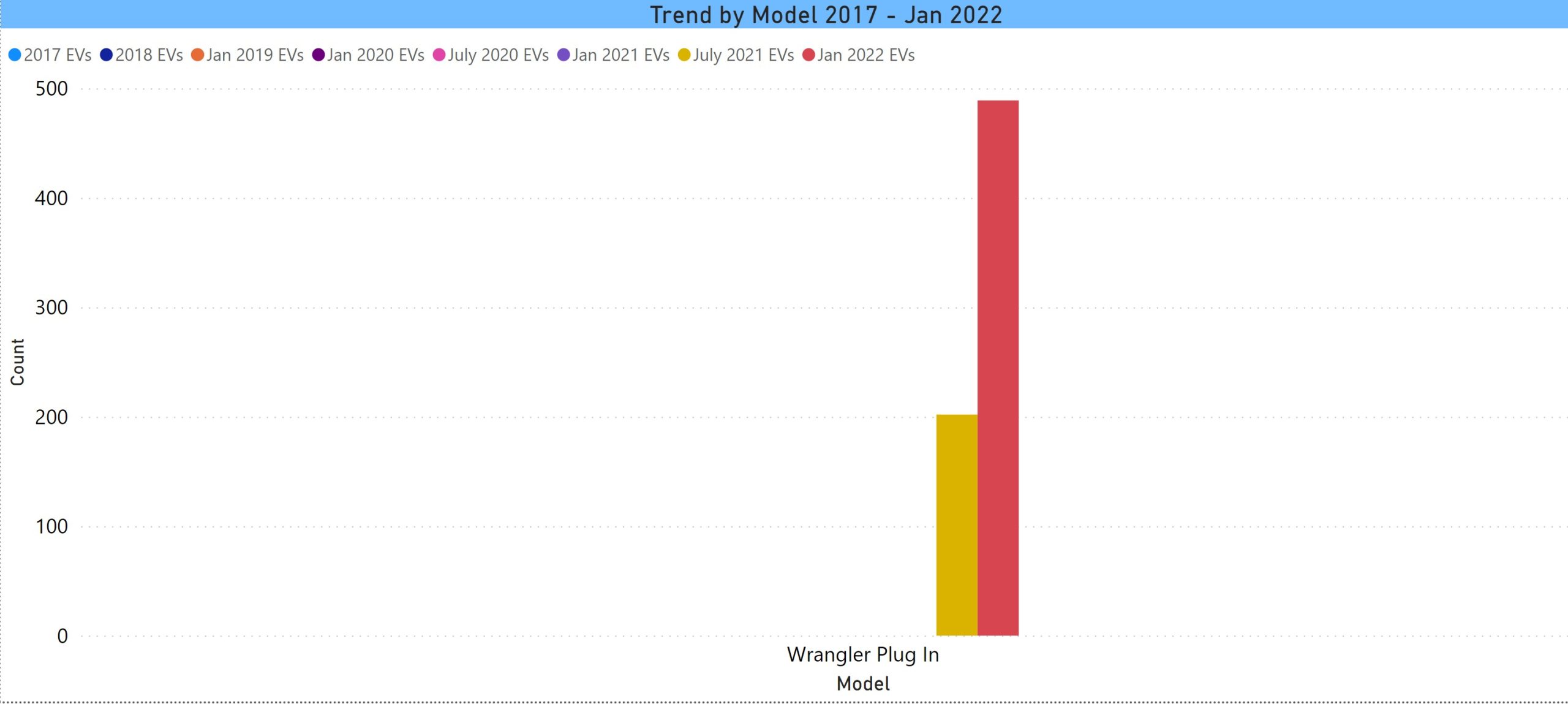

Jeep – 489 Registrations

The first plug-in from Jeep became available in the state this year, a PHEV Wrangler, and it has gotten off to a decent start.

A few more charts:

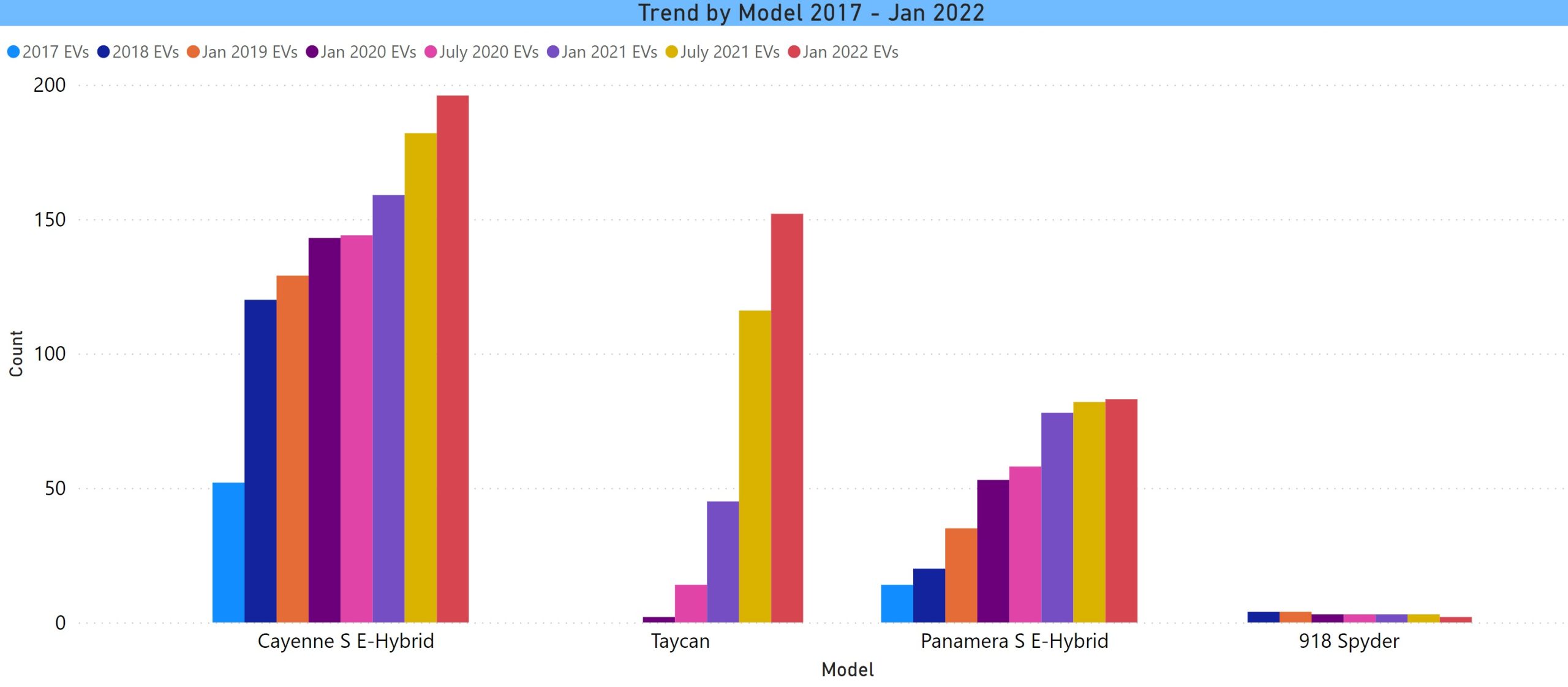

Porsche – 433 registrations

Its most recent model, the expensive BEV Taycan has had a faster growth curve than earlier PHEV entries.

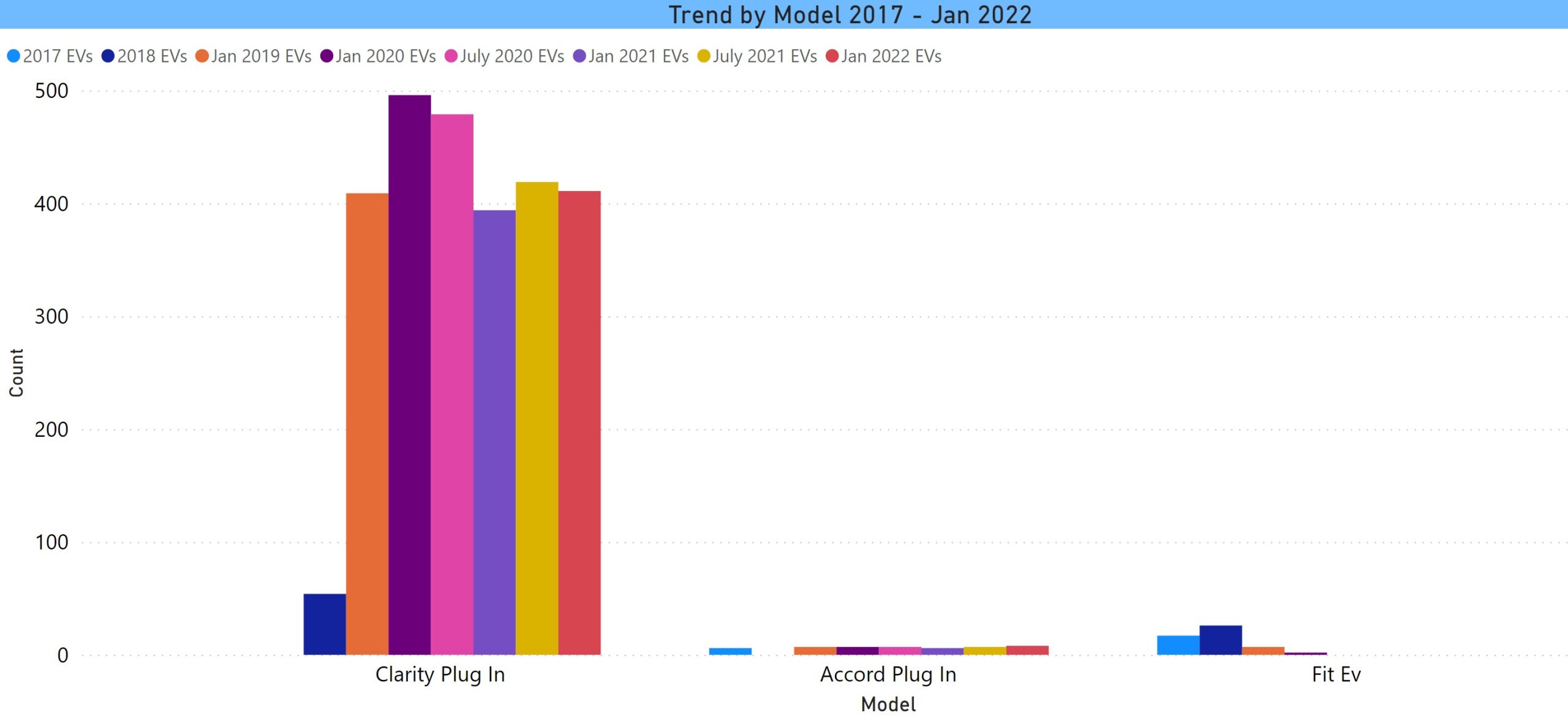

Honda – 419 registrations

Despite its having gotten off to a strong start, Honda stopped supporting the PHEV Clarity in this state a couple of years ago. It has now been discontinued. Honda also made a short-range BEV Clarity that was never sold in CT. The registration count for this model will gradually erode. Honda has announced a BEV SUV called the Prologue, schedule for a late 2023 introduction as a 2024 model.

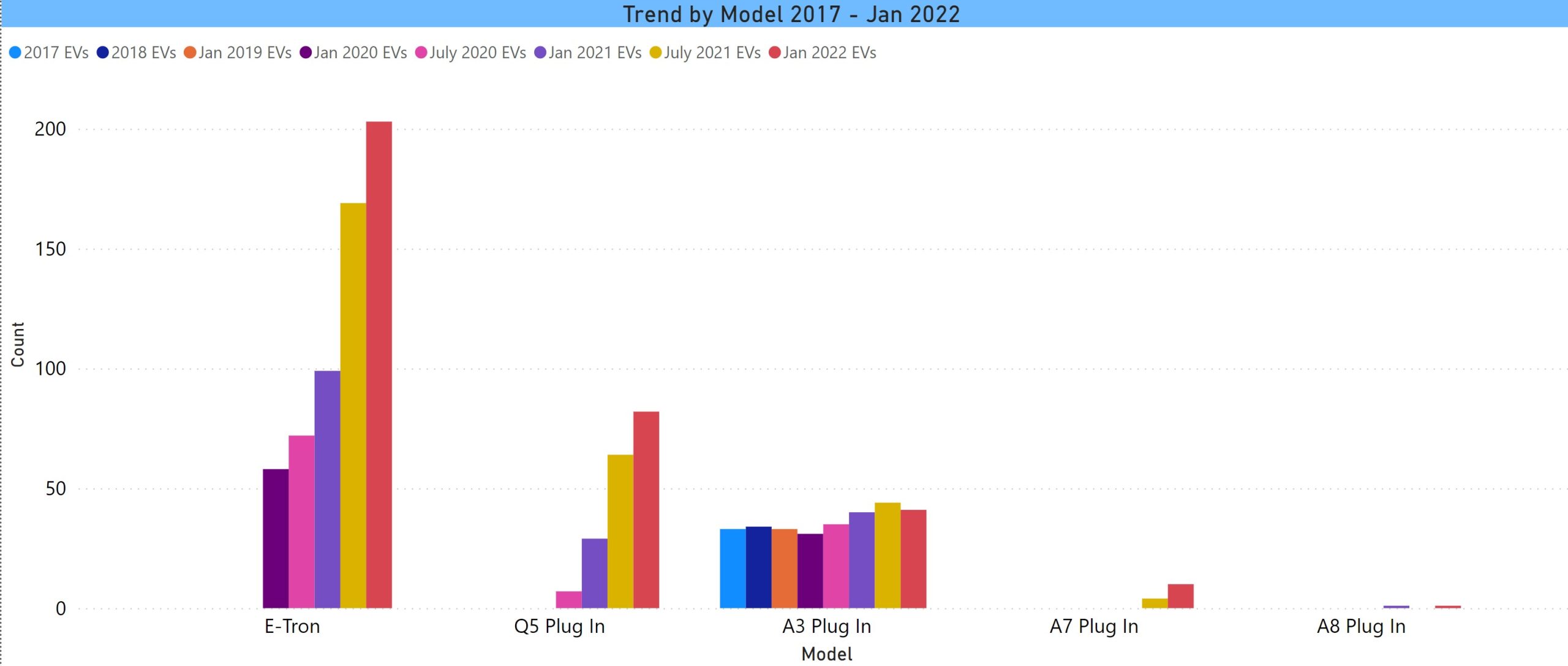

Audi – 337 registrations

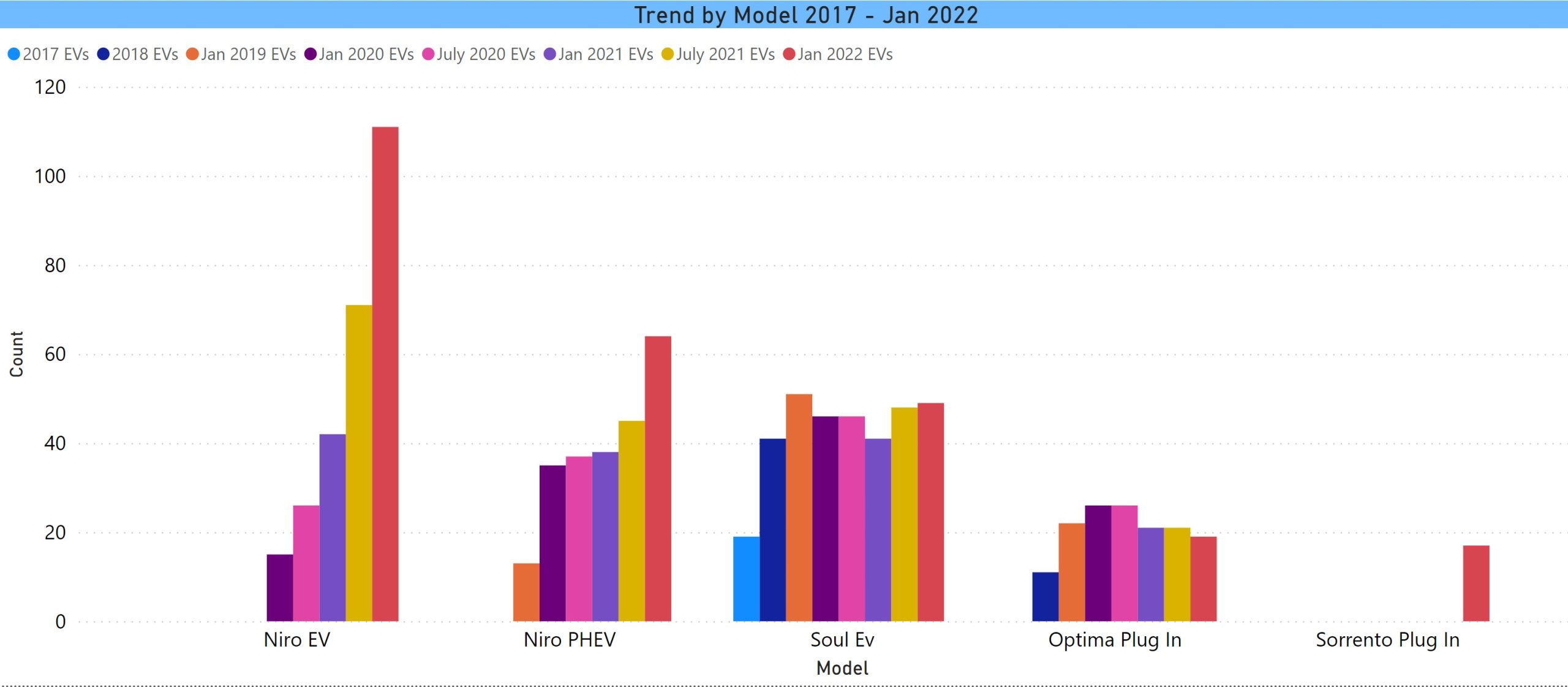

Kia – 260 Registrations

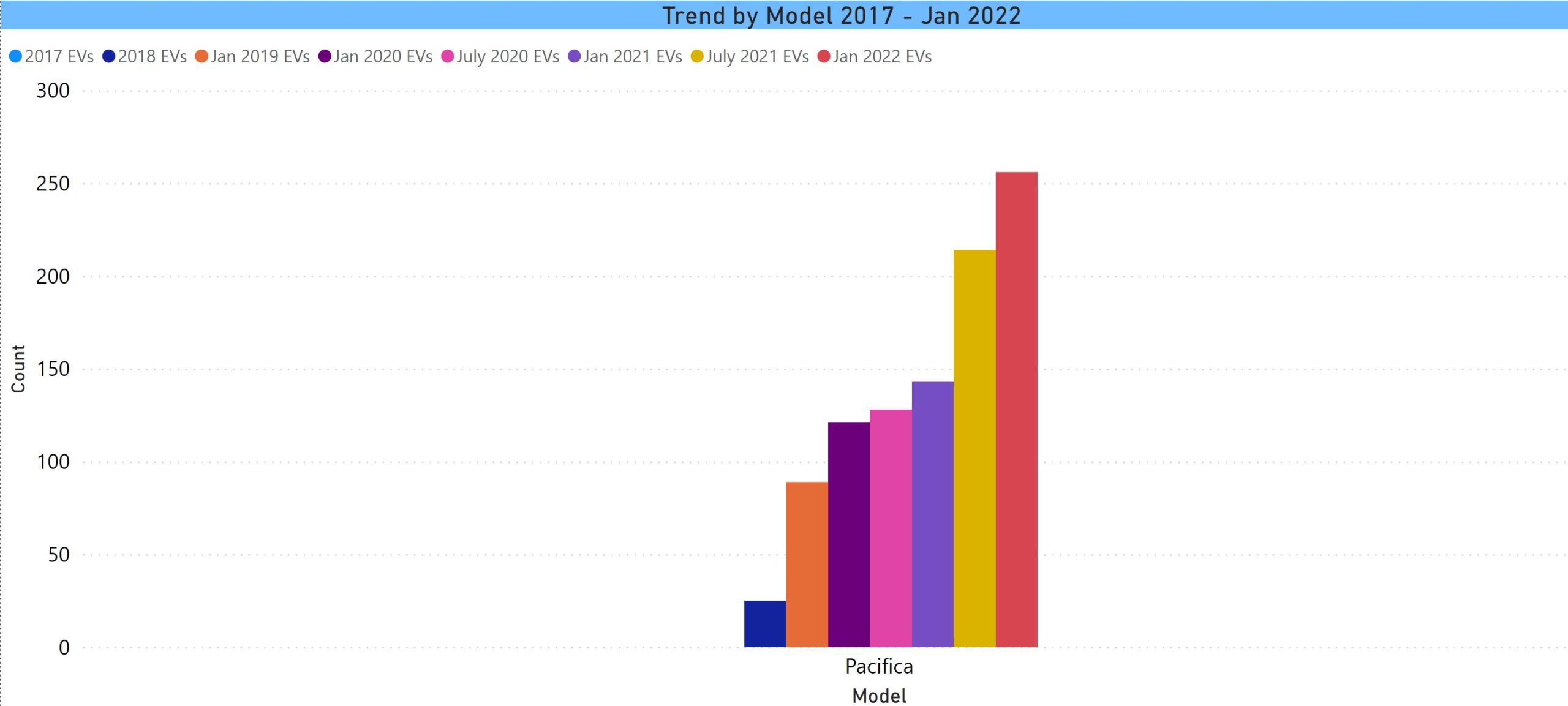

Chrysler – 256 Registrations

Chrysler introduced the Pacifica, the first PHEV Minivan, but never sold very many. They arguably still have the category to themselves.

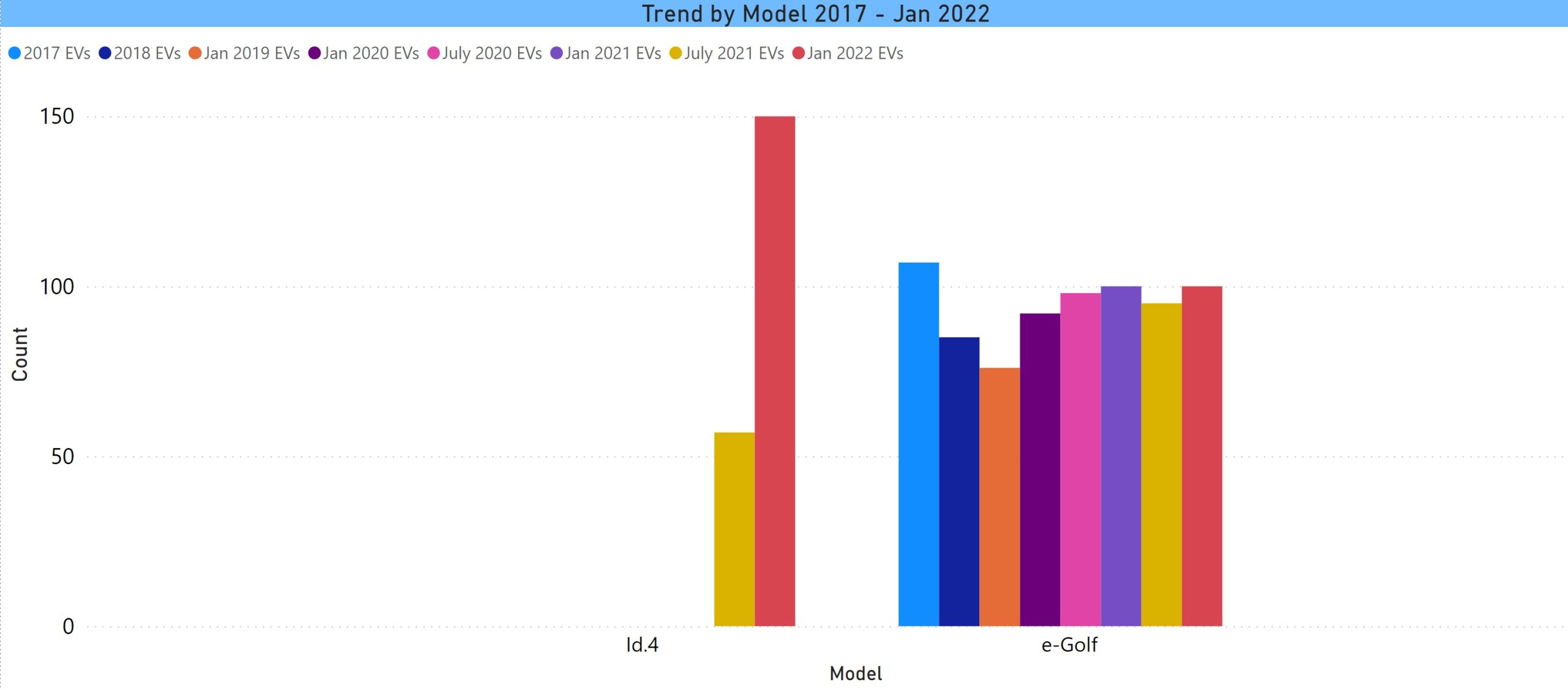

Volkswagen – 250 Registrations

VW has moved on from the BEV e-Golf to its new platform and its introductory vehicle, the BEV ID.4 (there is a smaller ID.3 that has been a success in Europe). The ID.4 looks to be an improvement over past sales performance, but this was a supply constrained vehicle in 2021.

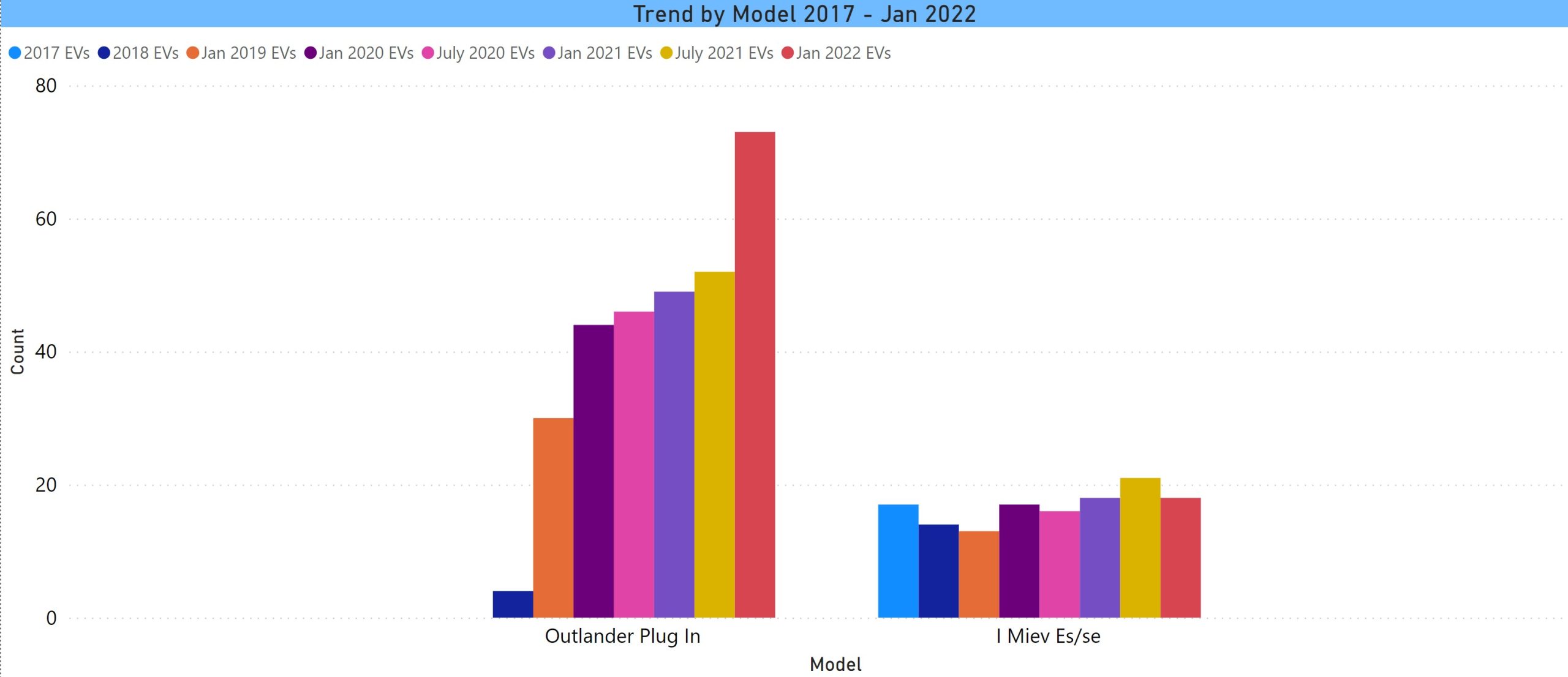

Mitsubishi – 91 Registrations

Mitsubishi is another manufacturer that was one of the earlier movers in terms of introducing EVs. There is the micro-compact BEV iMieve and the PHEV Outlander. The former never seemed like a serious entry. The latter was the first plug-in SUV available in the country but has never done more than minimal volume.

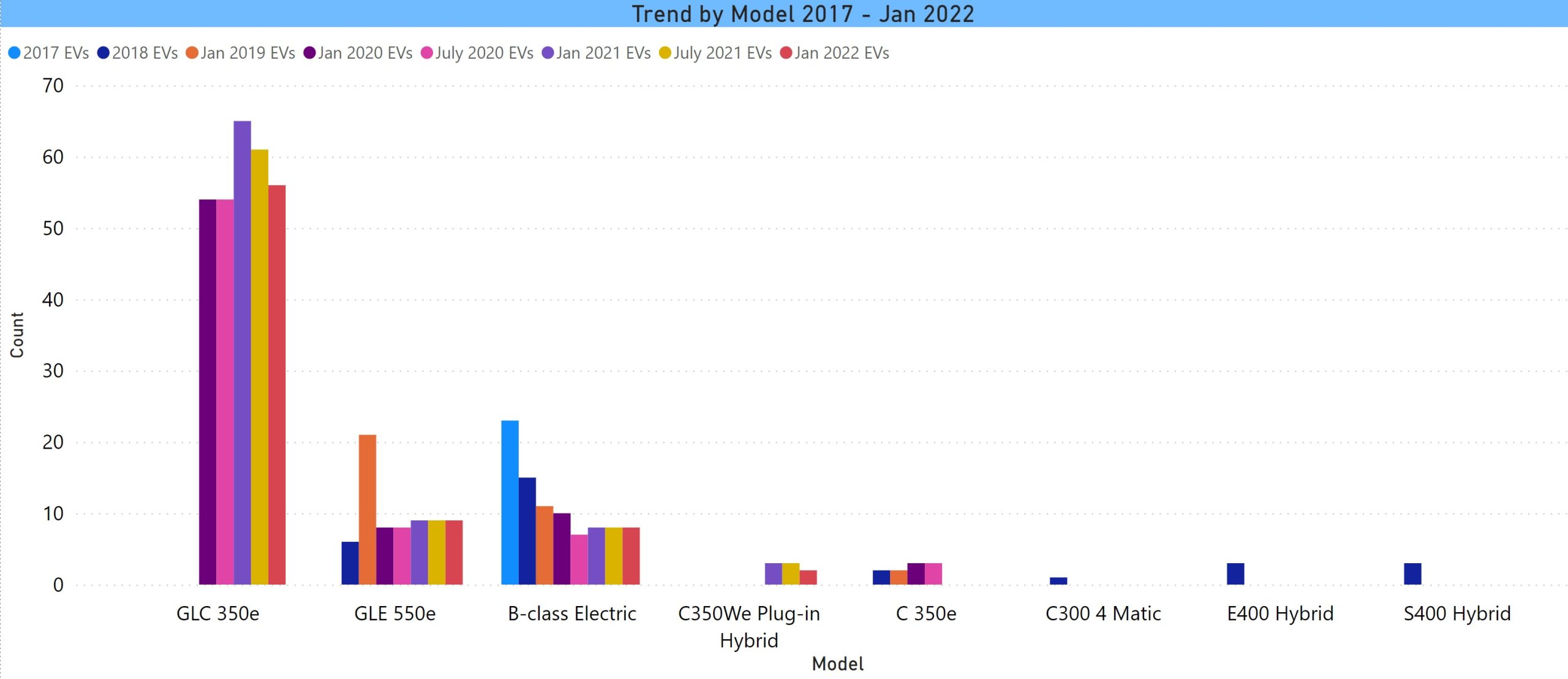

Mercedes-Benz – 75 Registrations

Mercedes is an example of a major manufacturer that prides itself on cutting-edge technology that has thus far failed to have even a minimal impact with electric vehicles. The company now has a new EVA2 platform and EQ branded vehicles with the EQS sedan to be available this year.

Polestar – 52 Registrations

Polestar manufactures 2 EVs, the Polestar 2, a BEV and the Polestar 1, a high-performance, expensive plug-in hybrid. The chart below may not appear to have a vehicle label, but if you look closely, you will see a “2” at the bottom. Only the Polestar 2 has any ownership in CT.

Polestar, owned by Geely, which also owns Volvo, initially opened only 3 dealerships, 2 in CA and one in NYC. It was their way of avoiding this state’s retrograde laws against direct sales. One of our Polestar-owning members advises that the car is appearing in at least some local Volvo dealerships. Volvo dealerships can be certified to repair them, as well.

These charts are not an exhaustive review of every make. There is quite a large long tail with 22 makes having fewer than 100 registered EVs.

Electric vehicles may have finally reached a tipping point in consumer interest. 7 of the 9 auto ads in the Super Bowl featured EVs. Gas prices are high, which in years past caused hybrid sales to spike. The main headwind seems to be the chip shortage. Bloomberg just released a report that in Europe, overall car sales in January declined year over year for the 7th straight month due to this reason.

Does CT provide this data with zipcode info, otherwise anonymous?

They have not been providing zip code. They did at one time, but then stopped. The data-set has no PII and it really shouldn’t be a problem, but they have taken a very conservative position.