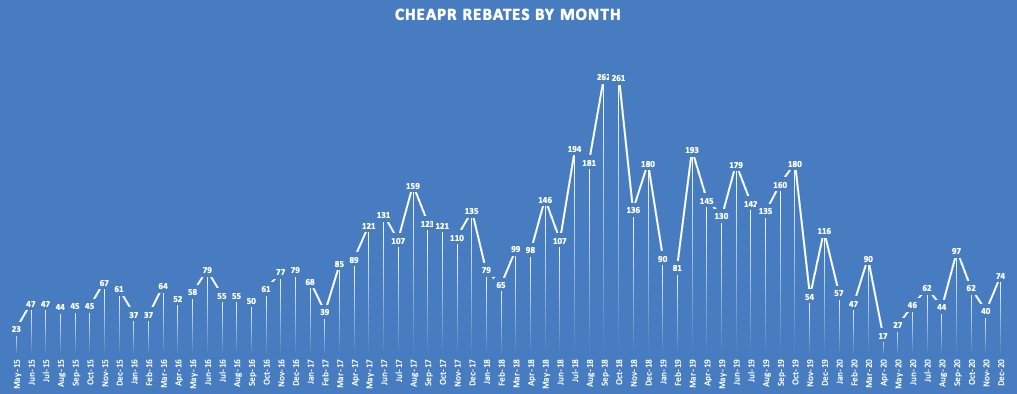

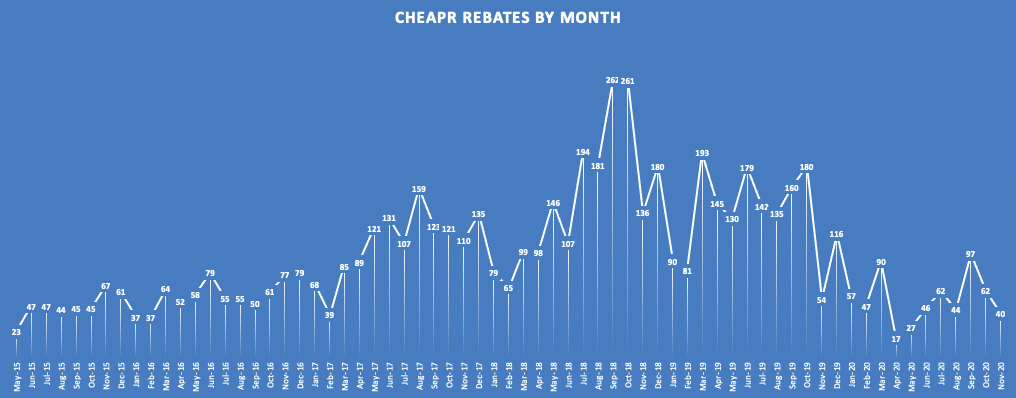

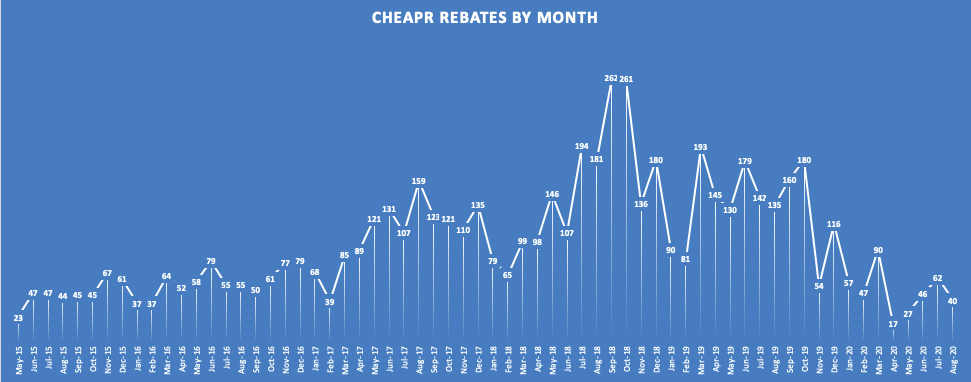

CHEAPR Closes 2020 With an Uncertain Outlook

CHEAPR Rebate Data Released for December 2020 The EV purchase incentive program awarded 74 rebates in December. This is slightly higher than the 40 from November, but of a piece with what we have been … Read more