Profile of Electric Vehicles in CT

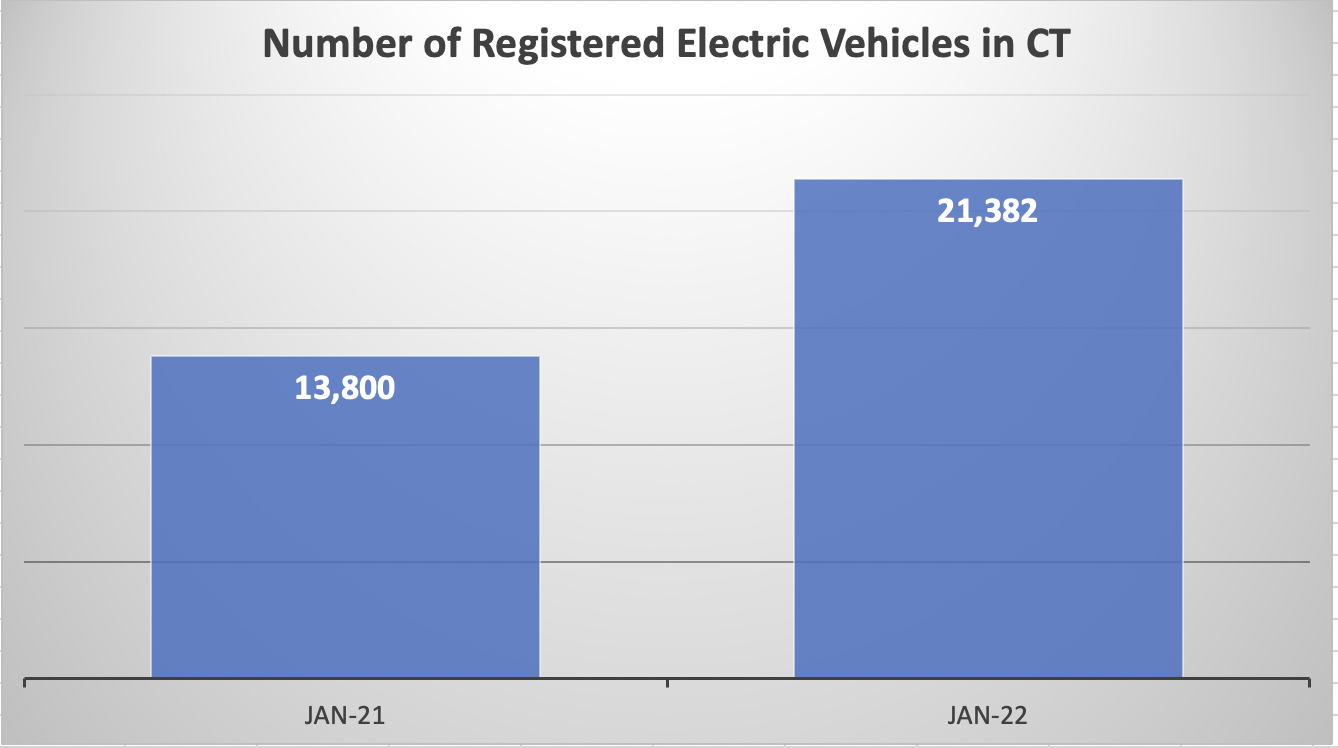

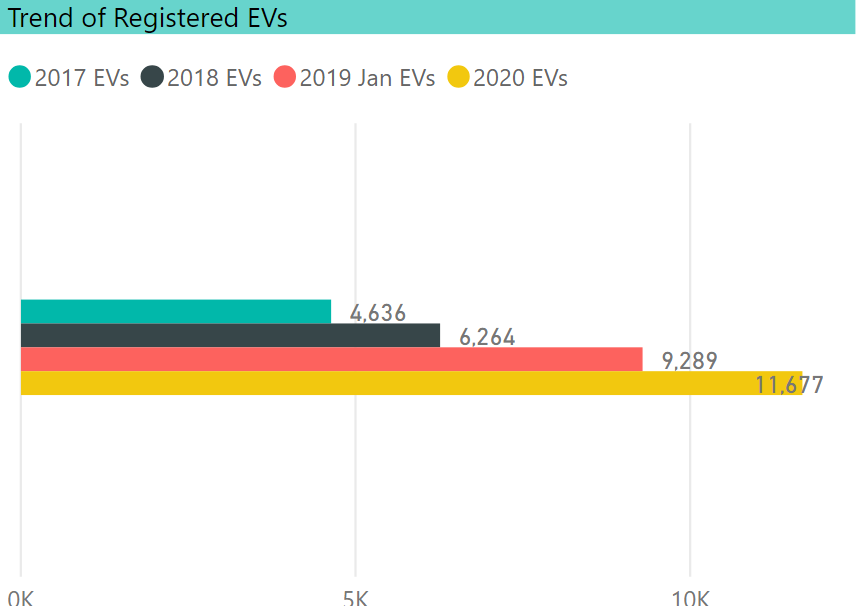

Barry Kresch Interactive EV Dashboard – EV Adoption in Connecticut Note: These data are obtained via a Freedom of Information Act Request from the Department of Motor Vehicles. The data are registrations, not sales, and … Read more