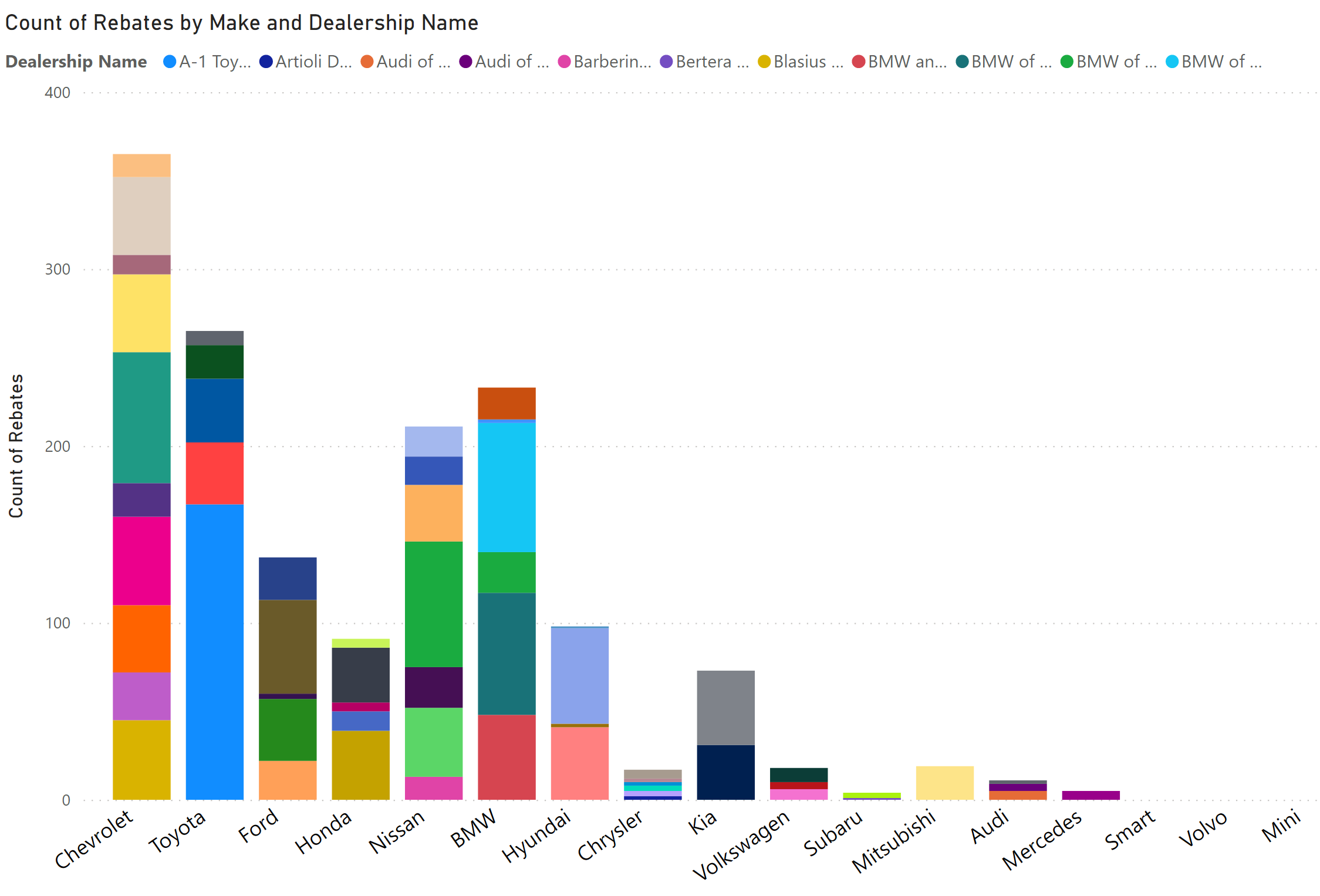

Update to CHEAPR Stats By Dealer

Some Stellar Performers; Many Also-Rans We obtained an updated dataset of CHEAPR rebates by individual dealerships from the program’s inception through the end of 2020. It is all pasted below, but a couple of observations … Read more