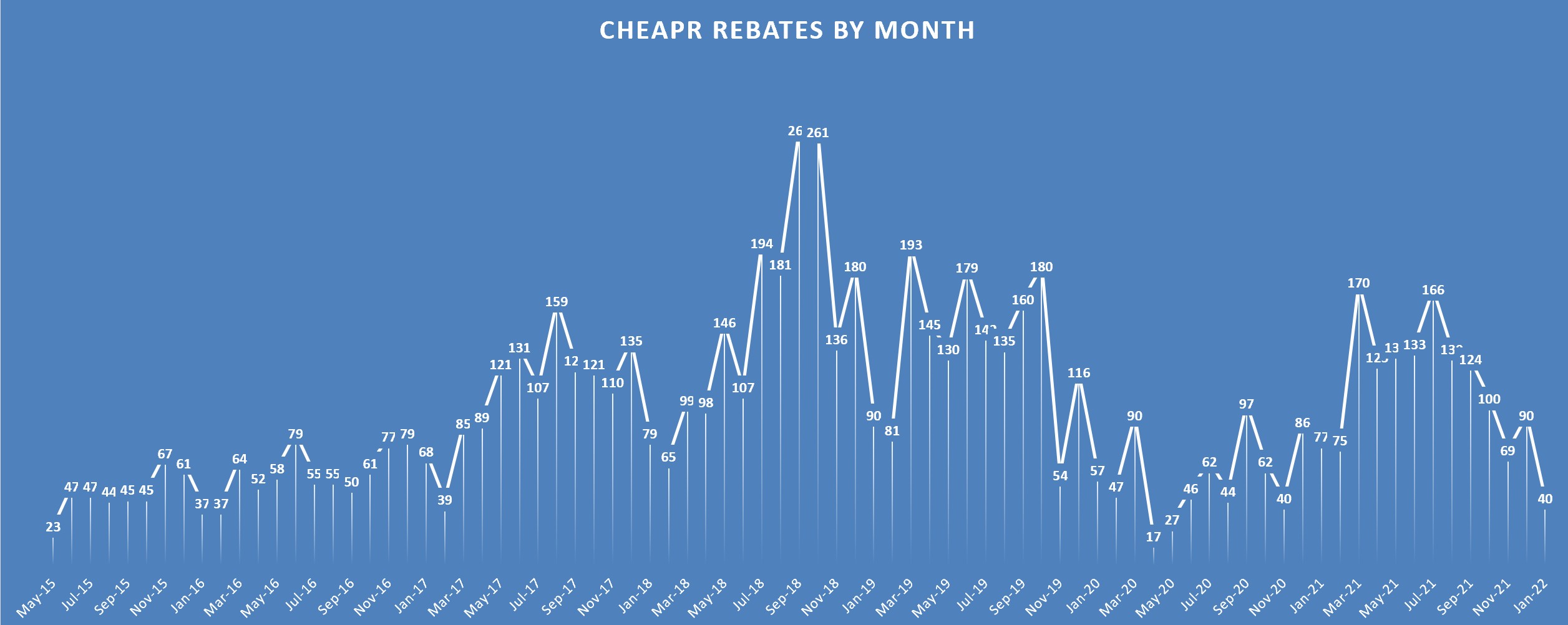

CT EV Charging Incentives Restricted

SB-4 Passed by Legislature Restricts Incentive The part of the EV charging incentive that applies to single family residences was restricted in the just concluded legislative session. It is now only available to income-limited households … Read more