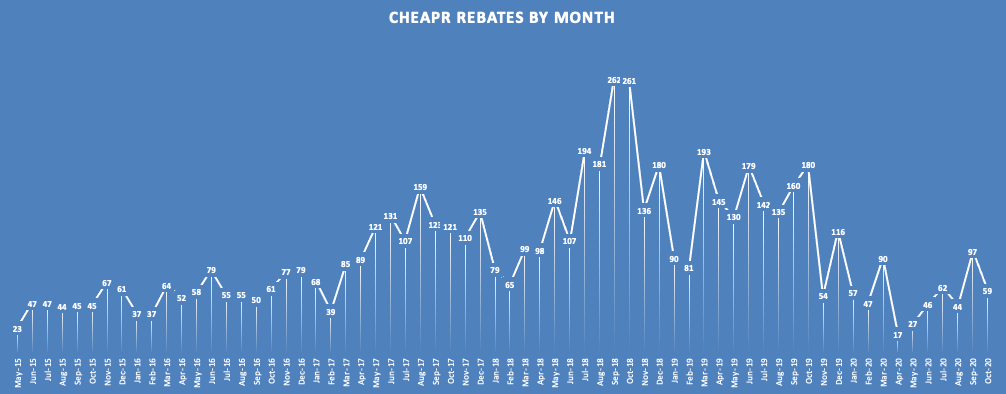

48% Month Over Month Drop in October Rebates

Newly released data, updated with transactions through October 31, show a decline from September to October from 97 to 59 rebates. (The September number was restated and is slightly higher than the initial reporting.) The expenditure for consumer rebates for the 10 months of the year to date is $587,000. The annual budget (including admin and dealer incentives) is $3 million. (The consolation is that the unspent funds will be rolled over into 2021.) There have been 62% fewer rebates issued year over year, Jan. through Oct. (546 vs 1435).

The Tesla Model 3 (15 rebates) and the Toyota Prius Prime (13) were the only vehicles in double digits for the month.

2020 has been a lost year in many ways that are more important than CHEAPR. But in our EV world, this incentive program has been in need of revamping and it hasn’t happened. We will discuss our take on why in a moment.

In another 6 -8 weeks or, we expect we’ll have the data to see if this was a lost year for EVs in general in CT.

We have blogged in the past about how we feel that CHEAPR has been a meaningful program, having given out over 6,000 rebates since inception. But rebate numbers, which had been steadily building, have reversed course since the changes in October 2019 that lowered the incentive levels and the MSRP cap, which was then further exacerbated by the recession.

Revisions to the program that were promised for 2020 are still pending. The most recent board meeting was on October 9th. There is no meeting posted on its website as of this writing. The CHEAPR board apparently remains divided as we await a vote on revised parameters. (This is our reading of the situation. The EV Club is not represented on the board, something we have requested.)

The legislation passed in May 2019 authorized a used EV incentive. A revised program plan was submitted to the board in July that included an income-limited used EV incentive and an income-limited supplemental incentive for new EVs. There has also been discussion of a time-limited “stimulus” incentive adder.

From our perspective, the impasse stems from whether to restore the base incentive and MSRP cap to the levels of before Oct 2019. (The used and supplemental incentives haven’t been areas of controversy.) DEEP is concerned that doing that and adding the new incentives risks depleting funds that could result in a temporary interruption in the program. They rely on modeling from their program consultant to assess this. (Though there was another round of modeling requested in October that has not been publicly disclosed to this point).

There was a second reason articulated by DEEP, which is that for the more expensive vehicles, consumers will buy them anyway, rebate or no. We don’t see it that way but won’t get further into that here.

Time to Restore the Prior Incentive Levels

The EV Club, along with the broader CT EV Coalition, believes there is a strong case for restoring the pre-October 2019 incentive levels and MSRP cap, along with introducing the used and supplemental incentives.

- The program is clearly failing this year.

- As of the most recently published EV registration data by the DMV in July, the state is losing ground relative to the commitments made in the Multi-state Zero Emission Vehicle Action Plan.

- There will be $4.9 million in available funds in 2021 due to this year’s underspending and some unused bridge funds from 2019, a 63% increase relative to budget.

- The recessionary economy is likely to persist for another 6 months. Let’s hope it is only that long. (It also makes for a difficult environment in which to model.)

- Due to the income-limitation aspect of the used and supplemental incentives, software development is required for implementation. They are thus unlikely to be ready for launch on January 1.

- The take rate for the used EV incentive is likely to be low in the short-term.

- The incentive is income-limited.

- The dealership representation on the board stated that the current market for used EVs is small. Our analysis of DMV registration files is consistent with this perspective.

- As noted, the start date is unknown at this time.

- There is still a shortage of charging infrastructure in the urban communities that this is intended to most benefit. This applies to the supplemental incentive as well. Over time, this will improve, but it will still be an issue in 2021.

- For BEVs, which, as noted in DEEP’s EV Roadmap, have a greater impact in lowering greenhouse gas emissions, there just aren’t a lot of them available under the current $42,000 cap. As EV introductions move more toward larger battery packs, EUVs, crossovers, and other popular (and larger) form-factors, this is likely to be even more the case.

- Even at the old (higher) levels, the CT plan is less generous than what is offered in other, nearby states.

- Finally, the EV Coalition intends to lobby for a larger share of the clean-air fee to be devoted to CHEAPR. If successful, the budget issue will be ameliorated. If not, there will be plenty of runway to make adjustments, not to mention empirical data as a basis on which to do so.

1 thought on “2020 – A Lost Year for CHEAPR”

Comments are closed.