What Is the Progress Toward the Goal in the ZEV Plan

This has been quite a year for EVs – a major revamp of the federal incentive, an improved CT CHEAPR program, utility incentives for charging, a federal infrastructure bill providing over $50MM to CT to support a public EV charging station build out along major highway corridors, and most importantly, increased consumer interest. Unfortunately, there have also been supply chain disruptions and chip shortages leading to higher costs and a lack of inventory. Tesla and Rivian raised prices. Tesla blamed missing its Q3 delivery target on snaggled logistics. Many dealers have been charging a “market adjustment fee”, i.e. raising the price above sticker, sometimes way over sticker, or trying to force consumers to buy options they didn’t order. Dealers aren’t keeping demo vehicles on the lot because they are selling whatever they get their hands on. Consumers report waiting for long periods to get their vehicle. And finally, while we welcome the removal of the manufacturer cap in the revised federal incentive, it looks like it will create confusion for the first year or 2 with its complexity and uncertainty with respect to manufacturers aligning their manufacturing to meet the requirements.

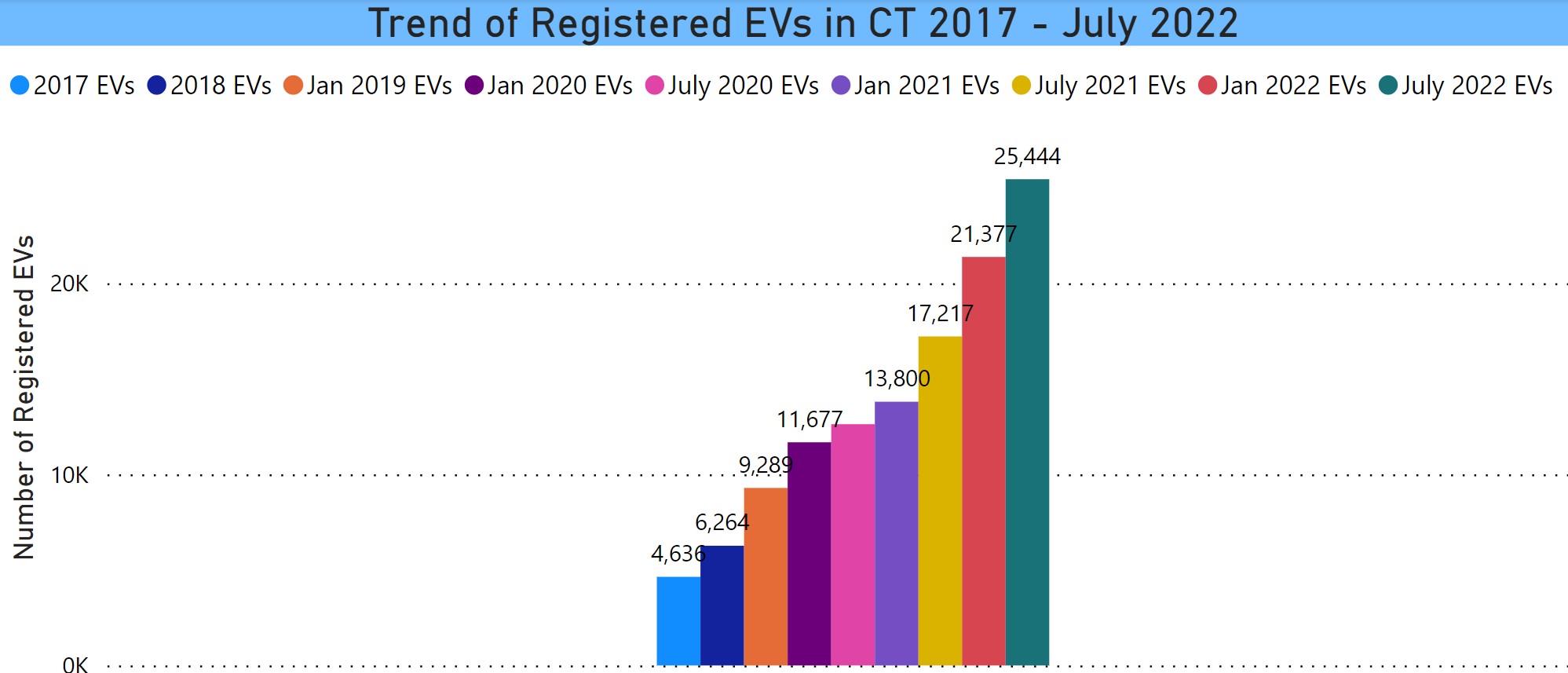

So where does that leave us? We are up to 25,444 EVs (defined as BEV, PHEV, along with electric motorcycles and fuel cell). That is how it is defined at DMV and what is published on its website. This is a July 1 number.

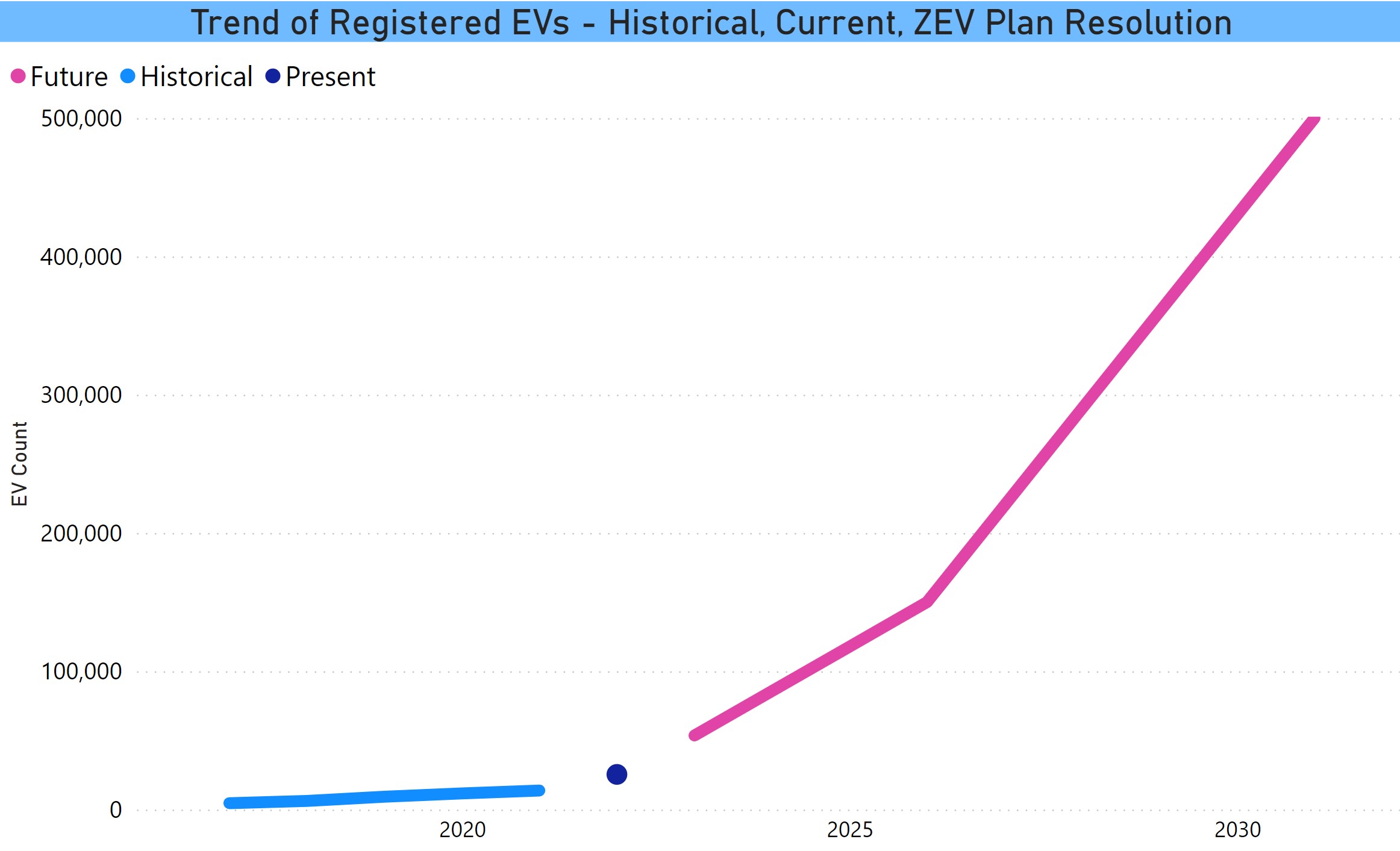

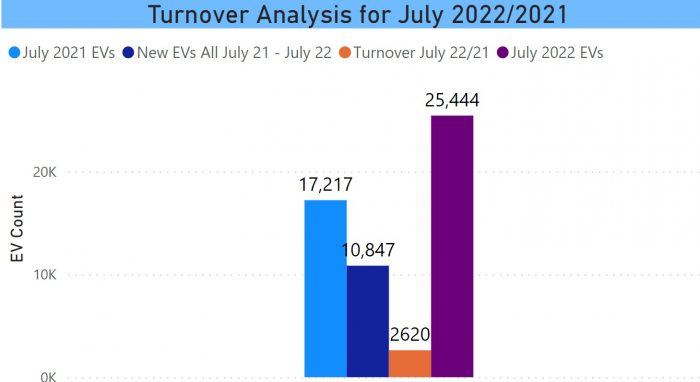

The state has established a goal of 500,000 EVs registered by 2030 with an interim goal of 125-150,000 by 2025. This comes to us via the Multistate Zero Emission Vehicle Action Plan Memorandum of Understanding. A lot of words for a non-binding document, but a useful yardstick for expectations, nonetheless. The chart at the top of the post represents where we’ve been (blue), where we are as of July 1 (dark blue dot), and where we need to be with the goals graphed on a straight line basis (magenta line). We need substantial increases every year, order of magnitude of 50% in net registrations. This is the turnover over the past year, the equivalent of roughly a quarter of acquisitions. That means sales (new + used) need to increase about 75% annually to get to that net figure.

For whatever reason, one of the questions we always get is how many fuel cell vehicles are registered. 6.

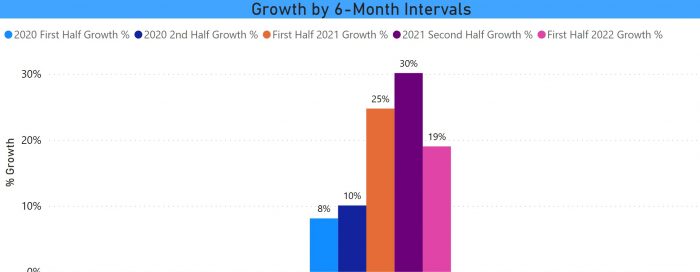

We have recently been close to that but it becomes a taller order as the baseline gets higher. Growth over the past year is about 48% (25,444/17,217), but the pace fell in the past 6 months to a level below the same period one year ago. We should ideally be overachieving at this stage.

There is momentum, but it has yet to be manifest in the numbers. It is important to keep in mind that the steep percentage increases required to meet the goals will be a greater challenge as the baseline increases. And it may take another year to assess true demand levels.