Should There Be An Incentive for E-bikes

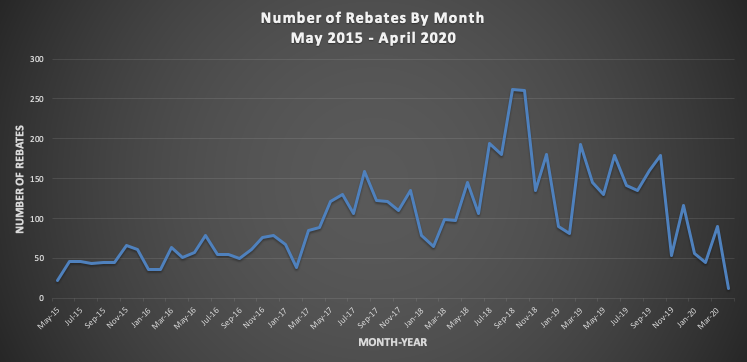

An E-bike Pilot Among the suggestions offered by members of the new CHEAPR board has been a pilot project for e-bike rebates.[1] This is most strongly advocated by those who are focused on lower-income households, … Read more