Post by Barry Kresch

Summary of Comments Submitted to the IRS for IRA EV Incentive

The EV Club has partnered with the Electric Vehicle Association to author comments for the in-process IRS rule-making regarding the implementation of the EV incentive in the Inflation Reduction Act.

There is a scrum of lobbyists from manufacturers and interests groups weighing in with their cadres of lawyers and tax accountants. The focus of the EV Club and the EVA is the consumer and that informs our perspective and where we choose to focus our efforts.

Comments inform the details of enactment that are within the purview of the IRS, not the legislation itself, which cannot be changed without further legislation. The outlook for the legislation to be amended in the near-term is cloudy at best.

The usual disclaimer – This is based on the latest information available and is not a legal opinion.

Sourcing/Manufacturing Requirements

The IRA is a landmark piece of legislation with a lot to recommend in it, but the EV incentive leaves much to be desired.

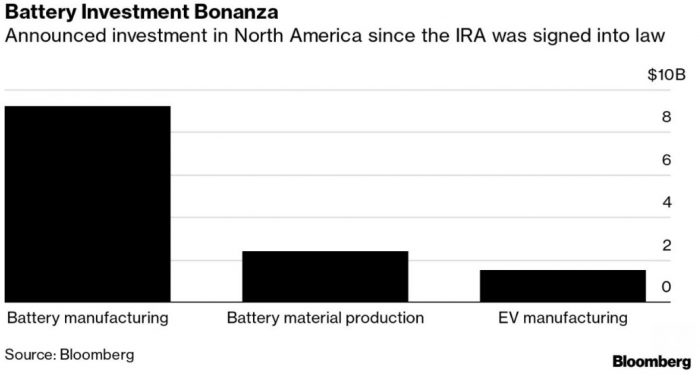

The focus of the IRA writ large is to “inshore,” or re-orient manufacturing to North America. It already seems to be having a material effect. This is a chart from Bloomberg showing significant announced investment levels that seemingly flow directly from the legislation.

The concern is timing. As of the date of this writing, we are not aware of any EV that would qualify for the full incentive when the requirements begin to phase in as of January, and we are aware of many that won’t qualify for any incentive. We are advised that the IRS does have within its power to grant a temporary waiver, and facing a potentially significant disruption in the ability of the consumer to access EV purchase incentives, we support a modest delay in the requirements so that supply chains have a little more time to adjust.

Certification – A Real Buzzard’s Nest

Our view is that the least well thought out part of the legislation is how the eligibility of a given vehicle is communicated to the consumer. There are requirements for final assembly, battery mineral sourcing, and battery manufacture. (Price, too, but we’ll get to that later.) The latter two change every year, so a car that is compliant in 2024 might lose compliance in 2025. The fact that the requirements change on a calendar year basis puts it out of sync with the model year focus of building cars, not to mention EPA certification and other regulatory things that happen with a new vehicle.

Websites that have a list of vehicles, such as Plugstar or the AFDC.energy.gov website, are no longer able to provide definitive information regarding incentive eligibility. The best they can do is list cars that may be eligible, leaving it for the consumer to do their own research. The AFDC website directs consumers to contact the manufacturer or check on the IRS website. When I look up “fun” in the dictionary, the definition doesn’t include reading the IRS website. I wouldn’t be surprised if the confusion filters down to dealerships. It would be possible for a Volkswagen dealership, for example, to have a German made ID.4 parked next to the identical vehicle manufactured in Tennessee. The former is immediately disqualified due to the final assembly rule, while the latter might be eligible if the battery requirements are met.

The AFDC site also links to a VIN decoder. The VIN has the information needed to know if a vehicle qualifies. The problem is that a VIN isn’t available in anywhere near a timely way relative to the consumer shopping journey. By the time the VIN is known, a binding contract is almost certainly in place and the vehicle is almost at the point of delivery.

Proposed Solution

- Have the certification be on a model year basis and have it be available at the time the model year is initially offered for sale (which may precede deliveries).

- The manufacturer takes responsibility for the certification. If due to a certification running change, the model (or some units of the model) is subsequently found to not meet the requirements, any incentive claw-back would become the responsibility of the manufacturer.

- This timing would enable the certification to potentially be included on the Monroney sticker (the label affixed to the window of a new vehicle that displays the EPA mileage rating and other officially required information).

- Online tools like those referenced above would be able to definitively report the incentive status for a particular vehicle.

- This model year basis is consistent with how many state programs are run.

The first year of this will be extra complicated as the rules themselves will not be clear until the rule making is complete. Manufacturers shooting for IRA compliance have a moving target.

Our guiding principle is that an incentive must be simple, dependable, and easy to access. The intent of this proposed solution is make the inherent complexity of the legislation invisible to the consumer.

MSRP Cap

The bill specifies that a vehicle must have a maximum MSRP of $55,000 for a sedan or $80,000 for an SUV or light truck. It does not define how the MSRP is determined. Early reports about the legislation indicated that the MSRP would be defined as the final price of the vehicle, including options (but not taxes, title, or destination charges). There are MSRP caps in state incentive programs but they typically don’t work this way.

Most vehicles have multiple trim levels and then offer options within each trim level. The Connecticut program, CHEAPR, uses the base trim level MSRP. If a trim level is below the maximum allowed MSRP, ordering additional options does not affect eligibility, even if the final price exceeds the cap. The California law is more generous. If the base price of the lowest priced trim level is below the cap, then all trim levels qualify. The EV Club and EVA are advocating for the CA definition. This would obviously allow more EVs to qualify. We can deal with that!

Transfers

Eager to get a purchase incentive but not happy about waiting many months until you file your taxes to realize it? The transfer option is designed as the answer. Becoming effective in 2024, the consumer has the option to transfer the incentive to the dealer (new or used) and receive the tax credit as a “cash on the hood” rebate. As we have been diving into the bill details, an important point about the tax treatment of the rebate is not clear. If someone elects the transfer, they receive the full amount. However, if they do not have the tax liability to absorb it, they are on the hook for paying the difference between their liability and the $7500 (for a new vehicle) come tax time. At least that is how several folks who know more about tax accounting than I have interpreted it.

Doing this kind of claw-back makes no sense on any level. The consumer is exposed to an unquantified risk. The dealer is receiving the credit, and either using it or getting reimbursed by Treasury, so it would be a weird form of double taxation. Finally, it is self-defeating. The intended design of the incentive is to increase EV adoption among non-affluent consumers. This would act as a red flag for exactly the target consumer. The EV Club and EVA are advocating that anyone taking the transfer get the full incentive, full stop.

Transfers vs Leasing

A transfer works differently than a lease. If a customer leases, the incentive goes to the finance company or whomever holds the title. That entity can package the incentive into lower lease payments. It has always been a way for someone who does not have $7500 of offsetting tax liability to be able to take full advantage of the incentive. However, the title holder is not legally obligated to do this. They can just keep all or part the incentive for themselves. It is why we have always advised consumers to discuss this specifically with the seller.

One of the good things about the transfer is that the rules require full disclosure on the part of the seller and that the seller pass the entire incentive through to the customer. The EV Club/EVA recommend that these requirements be expanded to include leasing customers.

Transfers and Income Eligibility

There are income caps in this program as we explain on our incentives page. If someone takes the tax credit the old-fashioned way, meaning when they file their taxes, income eligibility can be determined by either the current year or prior year modified adjusted gross income. In the case of a transfer, where the dealer is tasked with verifying eligibility, as an operational matter, the only option is to look at the prior year. It is the recommendation of the EV Club/EVA that the consumer, if determined to be ineligible for the prior year, be given the option of using the current year. In that scenario, the incentive would be given at the time of purchase. The consumer would take responsibility for current year eligibility (to be verified upon tax filing). If the consumer remains ineligible, it is their responsibility to repay the incentive. There are situations where someone has a pretty good idea whether they will have a change in taxable income and this expands their opportunity to receive an incentive.

The IRA EV consumer purchase incentives suffer from being too complicated for consumers to easily negotiate. Our comments seek to address this. The IRS is working to have its rule-making done by the end of the year.

3 thoughts on “How Not to Implement Policy”

Comments are closed.