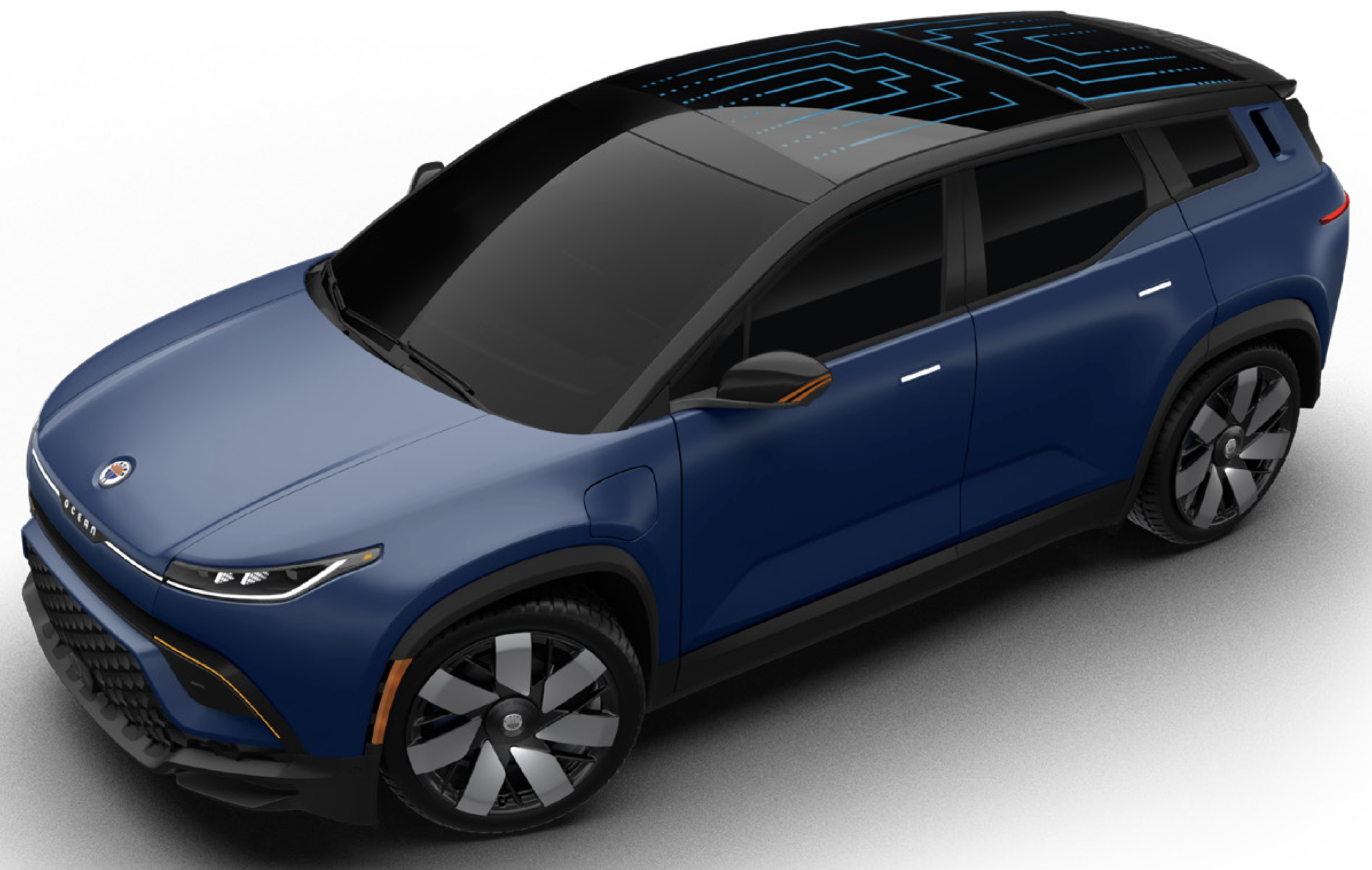

Proposed Republican Budget Bill Kills IRA EV Purchase Incentive

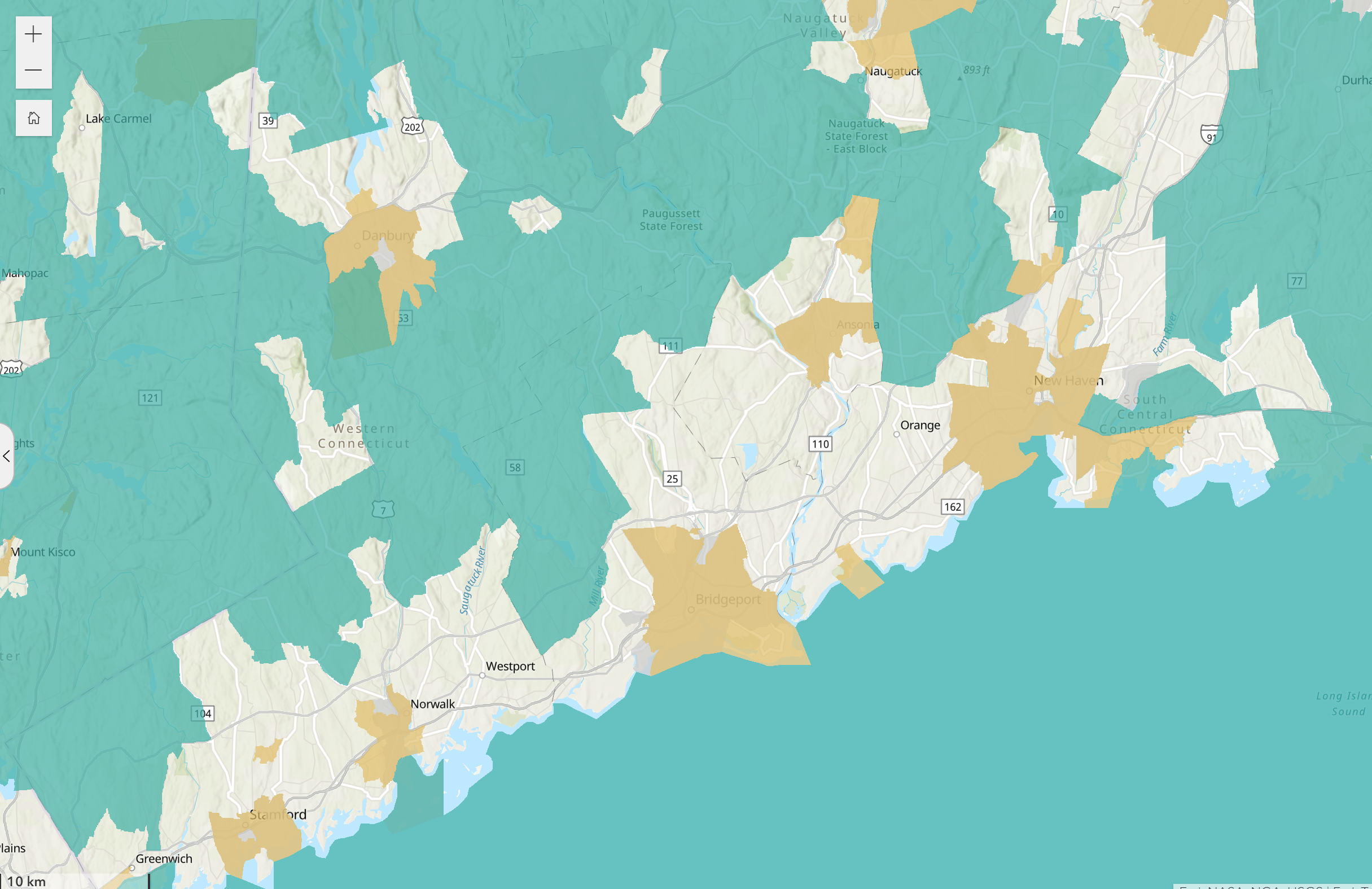

Federal Government Doing All It Can to Give EVs the Electric Chair Highlights (really lowlights) of what came out of the Ways and Means Committee EV purchase incentives will mostly end after this year. This … Read more