Post by Barry Kresch

An Opportunity for Large Cuts in Emissions Along With Major Budgetary Savings.

When the Westport Police were doing their diligence in advance of the purchase of a Tesla Model 3 for use as a patrol car, they worked with Sustainable Westport (SW) to run a set of estimates for the payback time period. After running the numbers, they were confident that within 3 years, the purchase premium would be recovered.

The vehicle entered service in February 2020. This spring, the EV Club approached the Westport Police about their interest in doing a deep dive on the financials: purchase, customization, operation, and maintenance. The police shared granular details of costs, including a maintenance schedule, which is the basis for the analysis. The completed analysis showed that full payback happens in year one and considerable savings are realized by year 4.

When I initially started the analysis, my expectation was that the SW numbers were reasonable and we would end up somewhere in that neighborhood. I hadn’t thought the financials would end up being such a slam-dunk with savings of $52,000 over 4 years, enough to buy a new Tesla.

Police fleet vehicles offer a bigger opportunity than initially expected.

This Tesla Pilot was only a test, but it begs the question: with such strong results, is there any reason not to go all-in for EVs, and forget gradualism?

To help understand what the financial ramifications look like, I used the information I had learned about the Tesla and the Ford Explorer comparison vehicle to model what a transition might look like. This is a general, somewhat macro exercise, and not specific to Westport or anywhere else. I would need more data for that. Nevertheless, I believe it is possible to generate directional numbers with the information at hand. The scenario, which is for a fleet of 12 vehicles, is obviously not New York City, but the basic findings wouldn’t change if it were larger.

Scenario

- A starting fleet of 12 patrol cars, 4 Ford Crown Victorias, and 8 Ford Explorers. The Crown Vic was a ubiquitous patrol car before Ford discontinued them. Many are still around, including in Westport.

- It is assumed the price for the Crown Vic and the Ford Explorer are the same. They probably aren’t but doubt the difference is that much.

- Service life is 4 years for the Ford patrol cars and 3 vehicles are turned over each year. The Tesla service life is 6 years. The service life is what is used in Westport.

- In the business as usual (BAU) scenario, each vehicle is replaced by a new Ford Explorer.

- In the ZEV scenario, each car is replaced by a Tesla Model 3.

- All cars are fully customized for law enforcement. When a new car replaces a like car, it is assumed that customization is reused and a zero cost is assigned in those instances. (This is most certainly understating the cost as the customization presumably does not install itself. If I had those costs, it would narrow the customization differential between Ford and Tesla due to less frequent turnover of the Teslas.) Also, in real life, if there is a model refresh, that can cause customization parts not to fit. Based on history, that is likely to happen more frequently with the Ford. But for the sake of keeping it simple for this exercise, all customization is treated as 100% re-usable.

- It is assumed that the first 6 Teslas will have to incur full customization costs and in the BAU case, the same goes for the Explorers that replace Crown Vics. But in general, the BAU scenario has a lesser degree of customization.

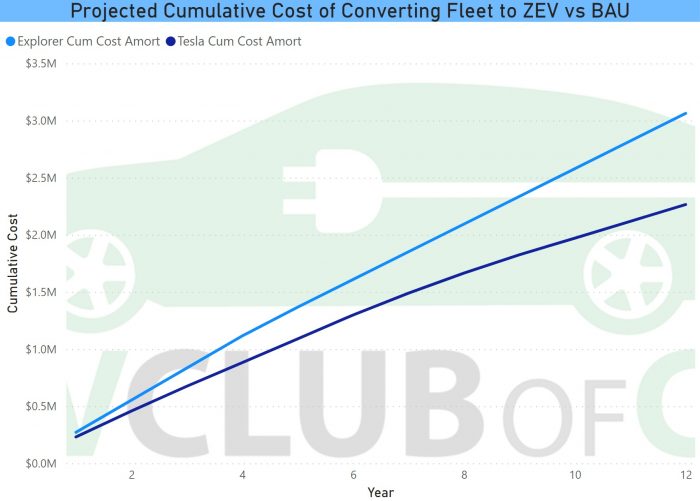

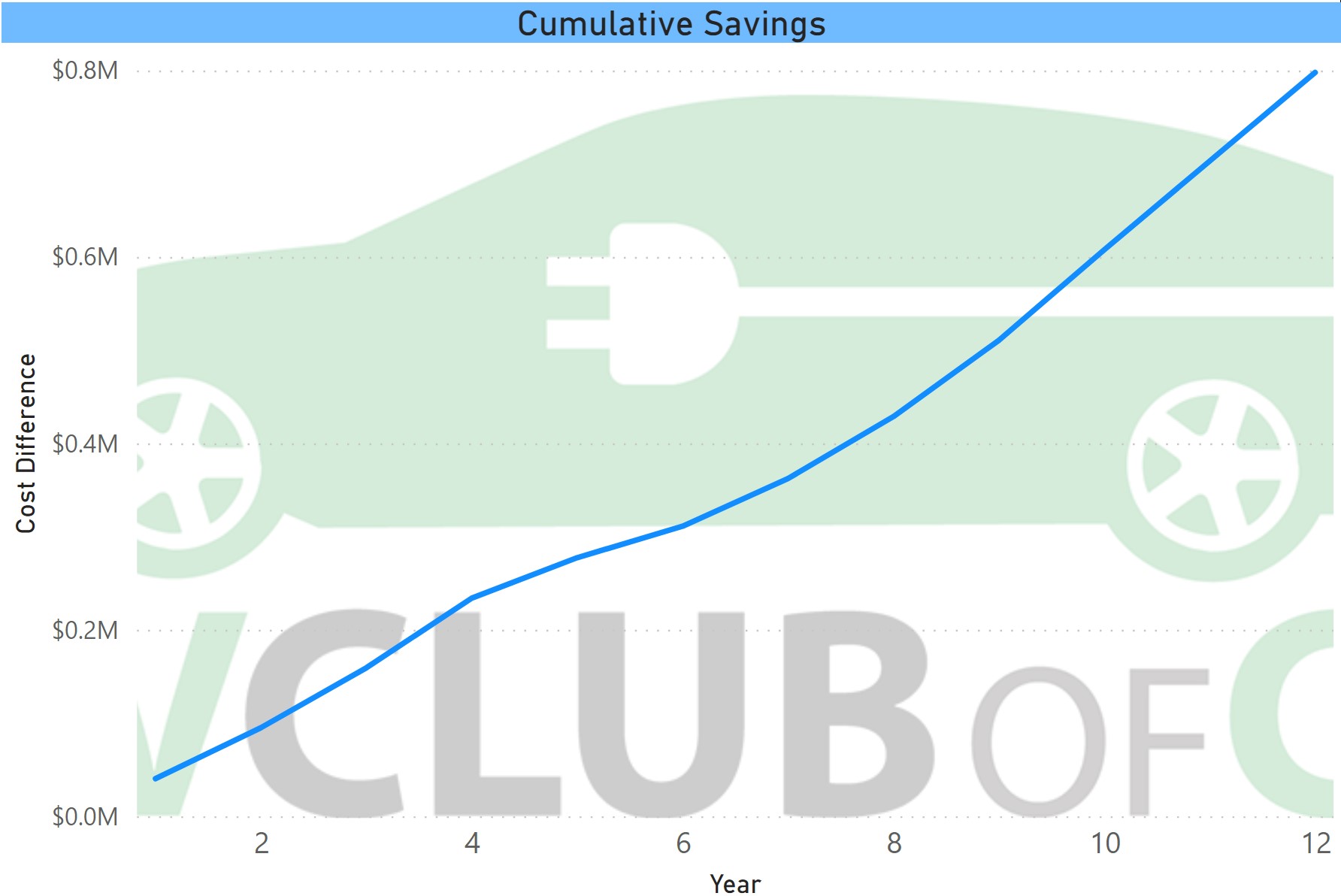

The chart at the top of the post depicts the cumulative savings in this hypothetical example of 12 patrol cars over 12 years with staggered turnover. It comes in just a whisker short of $800,000. The charts below show the cumulative cost lines by year for each scenario. The charts for the fixed costs are calculated on an amortized basis with fixed costs divided by the respective service life of each vehicle.

Components

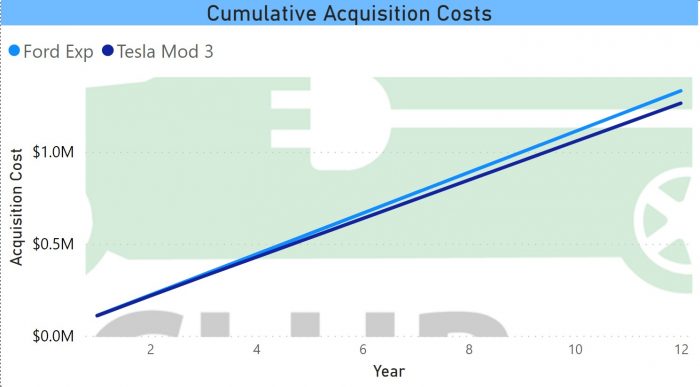

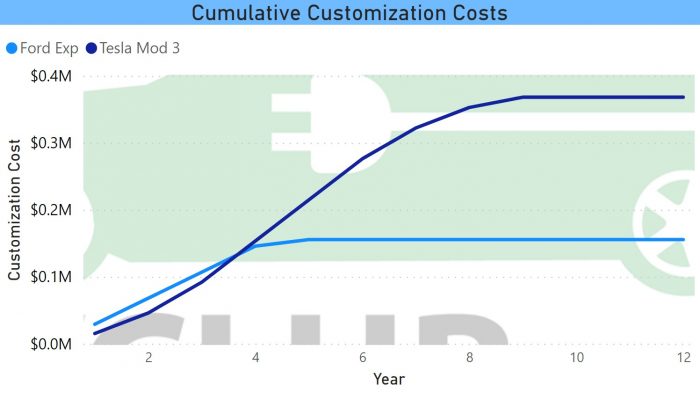

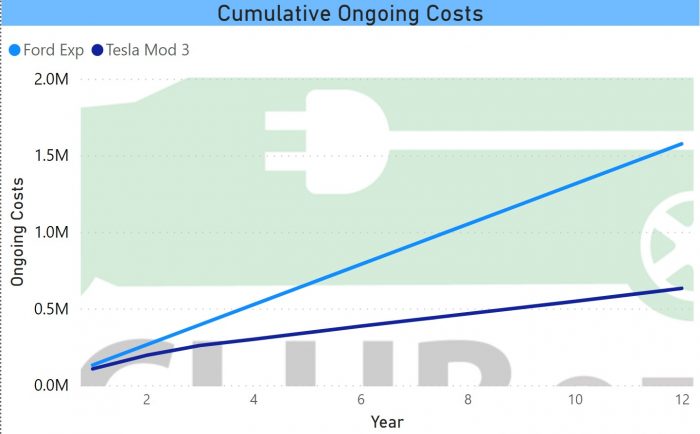

The three charts below break this up into the 3 categories of expense: acquisition, customization, and ongoing costs (fuel and maintenance).

Acquisition – This chart illustrates cumulative acquisition costs. Keep in mind that acquisition is staggered as neither scenario does envisions retiring vehicles before their normal service life ends. The cost curve slightly favors Tesla because, on an amortized basis, the annual cost of a Tesla is slightly lower. The longer this comparison is extended, the greater the differential would be.

Customization – The customization costs are somewhat lower in the BAU scenario. This is due to the fact that replacing the 8 incumbent Ford Explorers does not incur customization costs in this model. Customization costs are a bit lower for a Tesla, so in the early years as Teslas are customized and Explorers replace Crown Vics and require customization, the Tesla cost curve is lower. It catches up once the Crown Vics are fully replaced. Once the fleet is fully Tesla, that part of the curve flattens out. As noted earlier, if there are any costs incurred in the re-use of customization, it would narrow the differential as the service life is shorter for the Explorers.

Ongoing Costs – As we saw in the earlier Model 3 patrol car analysis, there are large savings in fuel and maintenance for an EV. Electricity is more efficient than gasoline and these vehicles need much less maintenance. This category saves around $940,000.

This makes manifest the ramifications inherent in the Westport Analysis. There are major savings to be had. This is not to underestimate the complexities of the budget process and the need to deal with upfront acquisition costs. However, as noted in the earlier analysis, the upfront purchase premium is recovered within one year, so it isn’t that big a burden.

We have data on the police patrol vehicles, but the same logic applies to other vehicles on the force and for a municipality in general. With savings this substantial, to borrow a Tesla term, it pays to up the pace of acquisition to Ludicrous Mode.

Fantastic article and assessment!! Thank you!