The CHEAPR board virtually convened for their first meeting since late January to consider what the program should look like going forward.

To briefly recap recent history, changes were made to the rebate parameters on Oct. 15, 2019, which lowered the MSRP cap and the rebate amounts. The number of rebates immediately dropped precipitously. As CHEAPR morphed into its new administrative structure as of January 2020, these rebate levels were held over on an interim basis, which continues to this day. The board received a proposal for a revised rebate structure from the Center for Sustainable Energy (CSE), as well as a proposal for a used EV rebate, along with requests for an e-bike rebate. These are described below, but no final decision was taken. DEEP is setting up a mechanism to receive public comments for a 3-week period. The board will meet again in 4 weeks for the next steps, which presumably could mean a vote.

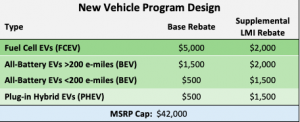

New EV purchase rebate proposal:

As you can see, the proposal leaves the lower rebate for new vehicles in place and adds a supplemental LMI (lower-middle income) incentive. We do not endorse leaving the existing rebates and MSRP cap at these low levels that were established in October. There were a number of attendees from the public who also spoke in support of this position.

For the 4 months prior to the October change, there were 616 rebates awarded. The corresponding post-change period, November through February, saw 272 rebates. And this was before COVID. As a result of the changes, plus the recession, CHEAPR is 81% underspent through May (the latest available data at the time of this writing).

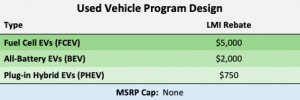

This is the proposal for used EVs:

The supplemental LMI and used EV LMI proposed rebates are generous, and we accept the analysis that this is what is needed to make the program work. The definition of LMI is an AGI of $50,000 for a single person and $75,000 for a family. There is a proposed mechanism to verify this through federal income tax returns.

The supplemental LMI and used EV LMI proposed rebates are generous, and we accept the analysis that this is what is needed to make the program work. The definition of LMI is an AGI of $50,000 for a single person and $75,000 for a family. There is a proposed mechanism to verify this through federal income tax returns.

For either LMI incentive, the consumer, upon income verification, would be given a voucher that they would then bring to the dealer. This would apply to both franchised dealerships and independent pre-owned car dealers. (The rebate for FCEVs in this context is ludicrous, but more on that later.) The two dealer representatives (Jim Fleming of the CT Automotive Retailers Association – CARA, and Brad Hoffman of Hoffman Automotive Group – both organizations are represented on the CHEAPR Board) who were on the Zoom both said that there are few used EVs available and that it will be a couple of years until there is a critical mass of inventory. They said the rebate would induce dealers to bid on used EVs that become available via an auction, which would speed the accumulation of inventory in the state. They also cautioned that the incentive has to be structured in a way that prevents “flipping.”

The supplemental LMI and used EV rebates will not come online until the first quarter of 2021. The backend architecture still has to be developed.

The request for e-bike rebates met with a mixed response.

E-bikes were not part of the CSE proposal. Many on the Zoom felt that e-bikes have the potential to be a valuable component of an emission-free transportation mix, especially in the larger urban centers. A petition was submitted to DEEP to formally make this request. Here is a link to the letters. DEEP raised the question of whether it is statutorily permissible to incorporate e-bikes into CHEAPR (they will research that further). Some others felt that an e-bike rebate is a good idea, but that it shouldn’t be part of CHEAPR.

Dealer Incentive

The proposal modifies the dealer incentives to be either $125 or $75, depending on the level of rebate. When CHEAPR was first begun, they were as high as $300.

Fuel Cell Vehicles

Several participants voiced skepticism about the inclusion of a fuel cell rebate, especially considering that no vehicles of this type are currently sold in the state. DEEP briefly explained (there really wasn’t time to get into it) that it had to do with the multistate ZEV and CARB arrangements that CT participates in.

The CHEAPR board

While CHEAPR had a quorum to hold this meeting, over a year after the enabling legislation was passed, and 7 months into its first year, there are still unfilled positions. As far as we know, that number is 2. The board does not include any representation from an EV Advocacy organization (ahem, the EV Club), nor are there any persons of color. (The CHEAPR board itself doesn’t appoint members, though they may have influence.)

Where are the Funds?

CHEAPR is funded to a level of $3MM for 2020. Through May, the program paid $242,000 in rebates. We estimate that payments to dealers amounted to approximately $29,000 (adjusting for Teslas). The presentation from the CSE listed an amount of $1.9MM remaining. So how was the other $829,000 spent?

These are the club’s positions:

- Raise the incentives back to the pre-October, 2019 levels. Given that CHEAPR is so underspent and the supplemental LMI and used incentives will not happen this year, there is virtually no financial risk. The data can be re-evaluated later in the year, along with updated modeling for the LMI and used incentives, to determine the plan for 2021. And even in 2021, based on the dealer POV, there won’t be that many used EV rebates.

- We support the LMI and used EV incentives.

- We support e-bike incentives. There is enough money in 2020 to support a pilot. We are concerned that the wrangling will indefinitely delay action on this.

- Dispense with dealer incentives. They aren’t having a noticeable impact. In the DEEP EV Roadmap, it was reported that incentives were often not being passed along by the dealerships to the salespeople, which is who they were intended for. And the landscape has changed. This is the concluding sentence on the subject: “The auto dealer incentive may have been necessary during CHEAPR’s earliest years, but the availability of greater numbers, models, and types of EVs and the need to maximize available funding for EV deployment may necessitate the discontinuation of the auto dealer incentive.”

- We have nothing against fuel cell vehicles but see no point in keeping this incentive. At least, we would like to hear a more convincing rationale. We don’t see how credits earned from an out of state sale have anything to do with a local incentive.

This is what we think. Whatever your point of view, make it known to DEEP/CHEAPR. The information about how to do that will be provided when it becomes available.

It would be great to execute an e-bicycle EV rebate. Our E bike riders have found that they are healthier and happier by riding their bikes. It also keeps everyone from mingling with others in car pools which at this time could be an unhealthy way of commuting.

Please support and pass this initiative for an e-bicycle rebate.

Hey Folks,

Great to see the support on the topic. We’re all for it as you could probably guess. There is one area we are not seeing alot of discussion on: emoped/emotorcycles. Has anyone seen info on these two? For those interested, we just launched our design in Branford: https://www.youtube.com/watch?v=zWX4iIgIE7o&feature=emb_title

Spark Cycleworks Team

Hi Cheapr Board meeting,

I am a bicycle commuter in a one car family in New Haven. I have been a year round bicycle work commuter since January 2009.

I firmly support an e-bicycle EV rebate. I think this can help a lot of people eliminate a 2nd car in their household and save thousands of dollars. E-bikes are an inexpensive, safe, and effective way to commute for the 1-10 mile one way ride. They are very inexpensive to purchase and use compared to even a decent used car.

Please support and pass this initiative for an e-bicycle rebate.

Thank you for promoting electrical vehicles over ICE vehicles.

Paolo Desiato

Please be sure and send your thoughts to deep.mobilesources@ct.gov before 5 PM tomorrow (Aug 12th).