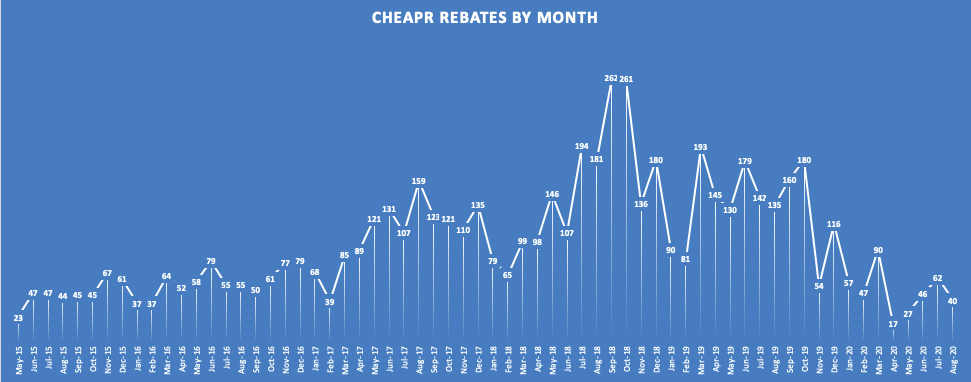

Few CHEAPR Rebates Given in August

Another tepid, desultory, underwhelming (I’m running out of adjectives – feel free to help in the comments) month for the CHEAPR program with only 40 rebates given out and a total dollar amount of $28,000. This is the second-lowest month of the year and continues the dispiriting (another adjective!) trend we have seen since November 2019. One interesting item: there were 9 rebates for the new Toyota RAV4 Prime plug-in hybrid. Between the RAV4 Prime and the Prius Prime, Toyota vehicles dominated the rebate activity. The reporting has been that the plug-in RAV4 Prime is a severely supply-constrained vehicle at present and there was some doubt that any would make it out of California, but apparently, they have.

Note: CHEAPR often restates the prior month when issuing new data. In this case, July has increased from 57 to 62 rebates and it is incorporated into the title graph.

Decision Time

The next CHEAPR meeting is scheduled for October 9 at 11:00 AM.

The Center for Sustainable Energy (CSE) presented a set of proposals for program revisions in July. The agenda includes a vote on the new program. The meeting is scheduled for only one hour, so we don’t expect much discussion. We do not know if this will be an up or down vote on the package or if the items will be considered individually. We know that despite 3 meetings and public comments, there isn’t a consensus on all the items.

This is what we know to the best of our information.

The package that will likely be presented to the board in October will have no differences relative to what was proposed in July.

- No e-bike incentive or even a pilot test. Ix-nay on this from the DEEP attorneys.

- A used-EV income-limited (lower/middle income, or LMI) incentive (non-controversial).

- A supplemental LMI EV incentive (non-controversial).

- No changes to base incentive levels or to the MSRP cap.

- No changes to the much higher fuel-cell vehicle incentive, which stands at $5000 with an MSRP cap of $60,000.

UPDATES as of 10/25/20

Modeling scenarios include:

- Maintaining the current (since 10/19) MSRP cap of $42K or raising it to $50K.

- Base BEV incentives of $2500 or $1500.

- A possible temporary “stimulus” additional sample of $1750 for BEVs and FCEVs, and $500 for PHEVs.

- $500 increase to $2500 for the LMI incentive.

- Possible inclusion of scenarios with base-level incentives less than $1500.

Incentive Levels and MSRP Cap

Much commentary, from board members, public attendees, and public comments, was in favor of raising the base incentives and the MSRP cap to at least where they were before DEEP lowered them in October 2019. These currently stand well below comparable incentive programs in nearby states. The CSE was tasked with modeling scenarios and they forecasted that there was a possibility that demand would exceed available funds, thus risking disruption. This blog doesn’t buy that line of argument for several reasons.

- A pandemic and recession of unknown duration make for a difficult environment in which to model. There is a lot of guesswork here, exacerbated by the fact that there are no empirical data on the take-rates for the new LMI incentives. A disruption would likely only occur if the economy roars back and the participation rates are at the high end of estimates.

- The dealership contingent spoke out for a higher MSRP cap. They argued that leases have grown in popularity to about half of all new car sales, and people can manage a lease payment on a vehicle they can’t afford to buy. Also, we are soon to see a wave of crossover and SUV EV launches, and these popular form factors are more expensive than sedans.

- Based on our analysis, and comments from the dealers, there isn’t much of a used EV market at this time. The incentive will help, but it will take some time for auction bids to be influenced such that inventory can build. Also, used Teslas are probably too expensive for an LMI limited buyer (and we don’t know how the rules will work for them – they may not qualify – something we will seek to find out).

- At the July meeting, when CSE proposed this incentive regime, they advised that the LMI system development would cause it not to be available until Q1 2021. We don’t know if they have been able to work on it during this period when the program isn’t finalized, but there could potentially be a delay.

- There is more money available – DEEP has indicated that the unspent funds from 2020 (they have only given out $398,000 in consumer rebates), as well as unspent bridge financing from 2019, will be rolled over into 2021. This will yield approximately $4.9 million in available funds (compared to the $3 million budget).

- The CHEAPR mission seems to be increasingly skewed towards the equity part of the mission. This blog supports the LMI incentives (and e-bikes, for that matter), but also sees the mission as just getting more EVs on the road. The program has fallen seriously short of that in the past year.

For these reasons, we think the best course is to raise the incentives and collect data. There will be plenty of time to course-correct if necessary. CHEAPR has an important role to play in moving people to drive electric. This is attested to by consumers, dealers, and our data. Let’s allow it to fulfill its potential.

Closing Pet Peeve

The $5000 fuel-cell rebate has never been given out in the 5+ years of the program’s existence, and there is no sign it will be anytime soon. You can’t buy one of these vehicles at present, and there is only 1 public hydrogen refueling station in the state. And yet, DEEP continues to use this as its headline incentive. It is misleading. It can be seen in the first sentence of the first paragraph on the CHEAPR home page. It was spoken out loud by Tracy Babbidge during the Sustainable Fairfield Webinar on September 28th. It was said by Victoria Hackett when she spoke at the Tesla leasing kickoff in February. Those are the occasions we are aware of but this is clearly not inadvertent. They are not helping themselves.

Editors Note: The October 9th meeting did not yield a resolution. A letter from the EV Coalition was debated that proposed a different structure. No vote was taken.

Meeting Details

We encourage members of the public to listen in! This is the Zoom info:

Webinar Information:

Join Zoom Meeting

https://ctdeep.zoom.us/j/99938032925

Meeting ID: 999 3803 2925

One tap mobile

+16468769923,,99938032925# US (New York)

Meeting ID: 999 3803 2925

Find your local number: https://ctdeep.zoom.us/u/adlDH6PJuC

Incentivizing an EV purchase this year (in lieu of next year or later years) is actually more valuable in terms of climate mitigation, since additional years of carbon and pollution reduction result from earlier sales. So from that perspective the CHEAPR board should be happy spending 100% of their funds this year, since it means getting more EVs on the road earlier. There is nothing gained from delaying conversions to EVs.

(Disclaimer – I’m a CT CHEAPR board member.) CT DEEP talking about and advertising the $5,000 per vehicle incentive that only applies to non-existent hydrogen fuel cell vehicles is absurd and needs to stop. Sure, keep the rebate as a “just in case”, but don’t pretend that it is functional. Geez.

Not mentioned in the article. There is hopefully going to be a proposal for a 2021 “stimulus” EV rebate that would raise the rebate levels for a limited time due to the economic downturn. I’d like that, and it makes sense with 2020 budget under spent.

Thank you, Tony.