CHEAPR Continues to Limp Along

At one point during the CHEAPR board meeting held on December 16, one of the board members observed (I’m saying this without sarcasm) that it is harder than it looks to give away money. By that measure, the program is performing with flying colors (that is sarcasm) as it looks to close another year without coming close to spending the budget, a year that was strong for vehicle sales generally. (Unspent funds get rolled over.) There seems to be a lack of urgency by most, though not all, of the board to get the program on track.

Higher Incentive Retained for the Present

As of June 2021, the base incentive levels were raised by 50%. A BEV now gets an incentive of $2250, up from the prior level of $1500. PHEVs were raised from $500 to $750. The higher incentive was positioned as a temporary adder, dependent on funds availability and set to sunset at the end of 2021. It comes as absolutely no surprise that depletion of funds was a non-issue. When we first wrote about the new incentives in June, it was an easy call back then. These incentive levels are now designated to remain in force until March (by a 5 to 2 vote) when an analysis and forecast that the board has requested from its consultant will be presented at the next board meeting. My prognostication is that the higher incentive will remain in force at through 2022.

Rebate Plus

The Rebate Plus incentives remain in force. These are so-called “LMI” incentives, targeted to lower and middle income people. They were not intended to be temporary. The problem has been that very few have been distributed – 3 through the end of October.

No Raise in MSRP Cap

There was a second motion to raise the MSRP cap to $45,000 from its current $42,000. This small raise wouldn’t have made much difference, but it failed 4-2, with the majority saying they wanted to wait to review the analysis in March.

Forecast and Budget

It is no secret that the EV Club and the larger EV Coalition want to see this program positioned more aggressively and break out of the multi-year doldrums. The consultant analysis, as it did last year, will involve forecasting. That is fine as far as it goes, but we should keep in mind that the forecast for 2021 missed by a mile. It can be an input but should not be sacrosanct.

With respect to the budget, while the program is budgeted for $3 million per year, it had over $5 million in the bank due to the rollover of past unspent funds. Continuing the program as is pretty much guarantees at least an underspent first half of the year. Even if at the March meeting, the board adopts a more proactive stance, there will still need to be an implementation period. The only thing that represents any change is a new wave of outreach for the Rebate Plus incentives targeting lower income individuals. More outreach is welcome, but we are not expecting more than a modest increase in these incentives.

The proposed changes that would make the most difference are a higher MRSP cap, looser LMI criteria, along with some kind of LMI pre-qualification so that it is cash on the hood. (There was pushback from DEEP on the pre-qualification based on experience in other states where many went through the pre-qualification process but did not then use the incentive, and whether that makes the idea an inefficient use of resources.) Even if these changes are implemented, given the backlog of unspent funds and likelihood of being in force for half the year at most, the chance of funds depletion in 2022 is vanishingly small.

Trends

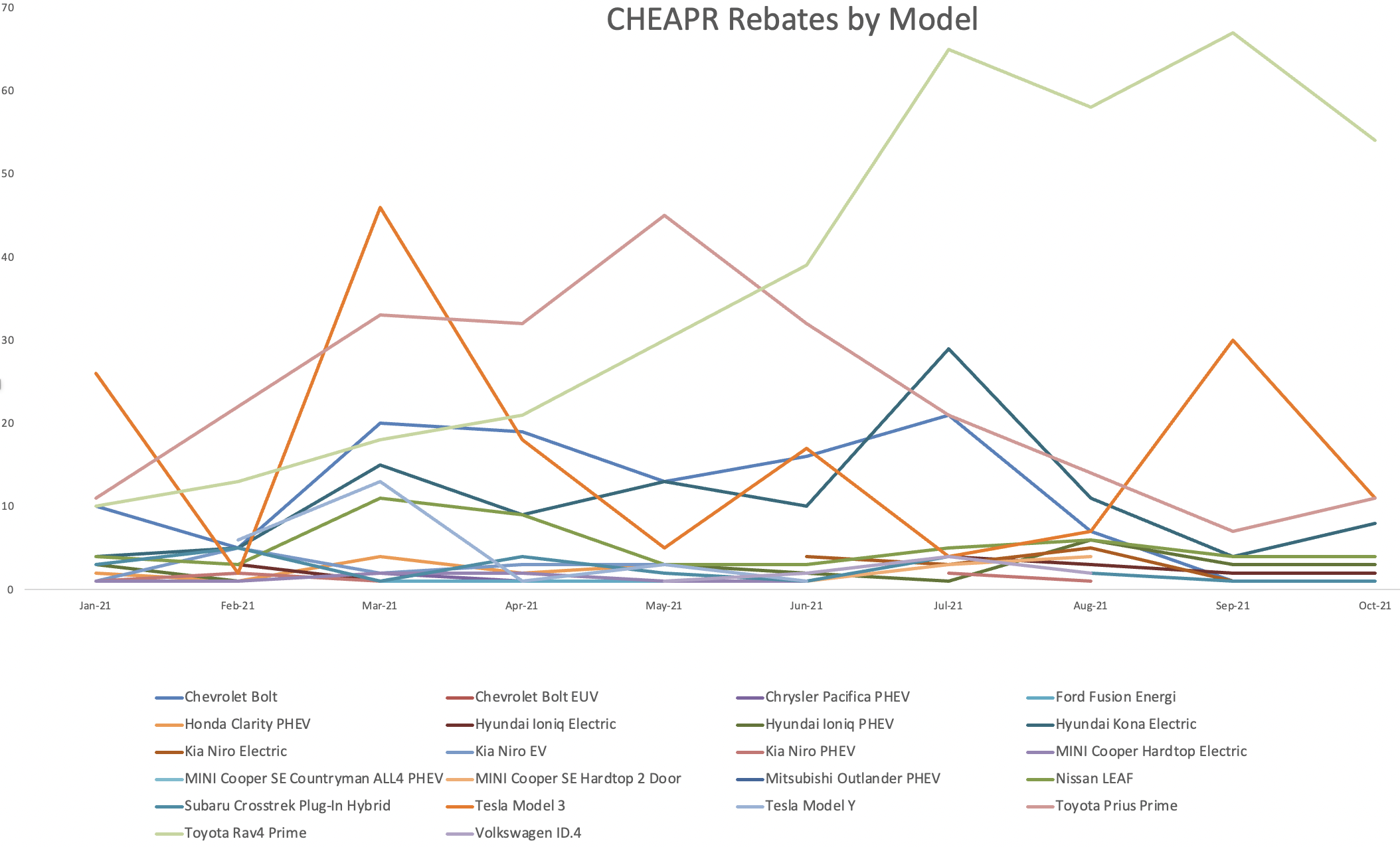

Rebates follow vehicles, based on eligibility and popularity. The program has shifted toward a plug-in hybrid dominant pattern. PHEVs accounted for the majority of rebates in 8 of 10 months this year, and every month since April. Below is a chart if rebates by vehicle model by month for 2021 that is a bit difficult to read, but it shows the trends driving the changes:

- The RAV4 Prime PHEV looks to be a big hit for Toyota and is the line that shoots above all others on the graph. That has been the single biggest factor, though it has been somewhat offset by a concomitant decline in the Prius Prime. The RAV4 does seem to be cannibalizing Prius sales.

- There were several significant BEV declines in the Tesla Model Y, Model 3, and Chevy Bolt.

- The Model Y had some rebates early in the year, but Tesla has discontinued the base trim level of the vehicle and the other trim levels do not qualify for the rebate.

- The Model 3, where only the base trim level has qualified for the incentive, has been more of a factor. Since Tesla has been experiencing high demand for the Models Y and 3, the company has prioritized delivering the more expensive versions. There are spikes in Model 3 rebates when they deliver a batch. There was a big spike in March and a lesser spark in September. More recently, there has been a price increase in the Standard Range Plus Model 3 and it no longer qualifies for rebates.

- The Chevrolet Bolt had seen improving sales with its recent refresh and lower price point. The recall stopped that dead in its tracks. The new Bolt EUV barely got out of the gate. Bolt rebates have been falling since July and have been zero for the most recent two months. New deliveries are not expected for at least another couple of months or so as GM works through its repair backlog.

- Finally, there are popular new BEVs that exceed the MSRP cap. As it currently stands, the rebate program excludes the first, second, and fourth most popular BEVs currently for sale in the U.S. that together comprise 75% of overall BEV sales (Tesla Models Y and 3, and Ford Mustang Mach-E).

EV Coalition Letter to DEEP

The EV Coalition sent a letter to DEEP to present our concerns and suggestions to the board. These are:

- Raise the MSRP cap to at least $50,000.

- Extend the temporary higher incentives levels through 2022. (This has been done through March and, as noted, could be extended further.)

- Loosen the income criteria for Rebate Plus. It is supposed to target lower middle income individuals but is in practice limited to low income.

- Add a pre-qualification for Rebate Plus so the rebate can be given at the point of sale and the consumer won’t have to float the cash.

- Make all EVs eligible for the Rebate Plus Used. Eligible used vehicles are limited to vehicles that were rebate eligible when new and exclude vehicles manufactured before the program inception in 2015. The point of an MSRP cap in the main program is to control costs by not subsidizing individuals who can afford an expensive car. Where to draw that line is a matter of judgment. In the case of the Rebate Plus Used, there already is an income screen. We don’t see the point of restricting vehicle choice and it really feels like an “own goal.”

- Do a better job of calling out the main program components on the program home page. We have inquiries come to the EV Club with folks not fully understanding the program because they haven’t taken the time to go through the denser material such as the FAQs.

- Delete the misleading headline that a consumer can get a rebate of as high as $9500. This would require a low-income individual to buy a new fuel-cell vehicle (the most expensive type of zero-emission vehicle). There have been no fuel cell incentives awarded in the program’s history and none are currently for sale in the state.

- Improve dealer compliance. Though our evidence is anecdotal (i.e. people who reach out to the club), there are two concerns here. The first is from dealers who don’t seem to want anything to do with the program and tell consumers that it is their responsibility to file for the incentive after the purchase, which, well, no. The second is where a dealer does know how the incentive works but does not want to float the cash for the time period from when the vehicle is delivered and when they get reimbursed by the state. One club-member told us the dealership literally gave him an IOU.

- As you can see from the low vote counts, the board has unfilled positions. 7 of the 8 serving board members were present at the meeting and there are 4 vacancies. The vacancies have existed for months. There is statutory language around who can fill board seats. For example, 3 seats are reserved for “Selection for Industrial Fleet or Transportation Companies,” despite the fact that fleet or transportation company vehicles are not eligible for these rebates. One of these slots is filled by one of the Deputy Commissioners of the Department of Transportation. There are no representatives of EV consumers/advocates. There is a dealership representative, a dealership trade association (vacant) representative, but no representatives from the companies seeking to sell direct in this state. The question remains whether this is a board that will ever lean forward to get more EVs on the road.

The club, of course, desires a successful purchase incentive program and would like nothing better than for DEEP to take a deserved bow for accomplishing this. We would like to think we’re both working toward the same goals. It doesn’t always feel that way. Strategically, we would like a successful program to act as a basis for asking for more support, especially if there are available green-focused funds as there would be if TCI were to pass. The way things are now, color us skeptical. Your comments are welcome.

From the December 16 2021 CHEAPR call that was open for public comment, a summary of the meeting notes are posted her:

https://portal.ct.gov/-/media/DEEP/air/mobile/CHEAPR/Board/2021-12-16-CHEAPR-Board-Meeting-Minutes.pdf

Here’s an exact copy and paste of my notes that I pasted into the Zoom chat during the call, which I used as my speaker notes when my turn to speak.

—–

From Me to Everyone 04:06 PM

Ford Mustang Mach-E, Standard Range (230 miles), MSRP $43,895

Ford Mustang Mach-E, Long Range (305 miles), MSRP $52,775

Tesla Model 3, Standard Range (267 miles), MSRP $46,490

Tesla Model 3, Long Range (334 miles), MSRP $52,490

Tesla Model Y, Long Range (330 miles), MSRP $58,990

As it currently stands, the rebate program excludes the first, second, and fourth most popular EVs currently for sale in the U.S. that together comprise 75% of overall EV sales.

(thanks to Larry for pulling these numbers together)

sources

https://www.caranddriver.com/features/g36278968/best-selling-evs-of-2021

https://insideevs.com/news/553972/us-bev-sales-october-2021

sources:

https://www.ford.com/buy/mach-e/build-and-price.html#/model

https://www.tesla.com/model3

https://www.tesla.com/modely

From the September 22 2021 CHEAPR call that was open for public comment, a summary of the meeting notes are posted her:

https://portal.ct.gov/-/media/DEEP/air/mobile/CHEAPR/Board/2021-09-22-CHEAPR-Board-Meeting-Minutes—Draft.pdf

Here’s an exact copy and paste of my notes that I pasted into the Zoom chat during the call, which I used as my speaker notes when my turn to speak.

—–

From Me to Everyone: 04:21 PM

If we are to significantly increase the adoption of EVs in CT, a great start would be making the most popular EV in the US (by far) eligible for CHEAPR rebate, it’s the Model Y SUV/Crossover, see:

https://evclubct.com/make-and-model-movers

Best selling Model Y starting price is $54K, loaded is roughly $63K.

Second best selling Model 3 all-wheel drive starts at $50K.

The average vehicle cost in the US is $42,258, and the average Mid-size SUV/Crossover is $43,623, and the average Luxury Mid-size SUV/Crossover is $65,874:

https://mediaroom.kbb.com/2021-07-19-Average-New-Vehicle-Prices-Hit-All-Time-High,-According-to-Kelley-Blue-Book

The current CHEAPR cap of $42K is too restrictive, and is lower than the average cost of a vehicle in the US. It’s not just Tesla, is also eliminates many Bolts, all Mach-E models, and all VW ID.4 all-wheel drive models. Prices nicely outlined in the best selling EVs of 2021 overview article:

https://www.caranddriver.com/features/g36278968/best-selling-evs-of-2021

In constrast, New Jersey has 26,000 EVs on their roads, the seventh-highest number nationally. They have higher caps on their rebate program, $2000 rebate for MSRP of $52K Model Y all-wheel drive for example, and $5000 rebate for MSRP of $40K Model 3 all-wheel drive:

https://chargeup.njcleanenergy.com/sites/default/files/docs/Charge_Up_NJ_Eligible_Vehicle_List.pdf

Maybe allow CT residents to use the rebate on purchases from dealerships outside of CT? It can be much easier to locate EVs in MA and NY for example but buyers from CT can’t get the credit there.