Policy

Charging Incentives for Condos and Apartments

Post by Barry Kresch MUD It stands for multi-unit dwellings. According to the Public Utilities Regulatory Authority (PURA) adjudication, about 10% of Connecticut residents call this type of dwelling home. These are mostly in the … Read more

Jennifer Granholm Visits CT to Promote EVs, Infrastructure and Jobs

Publicity Event Held at EVSE, LLC, a Manufacturer of Commercial Grade EV Charging Equipment Department of Energy Secretary Jennifer Granholm made two appearances in CT on December 2nd to promote the job-creation and clean energy … Read more

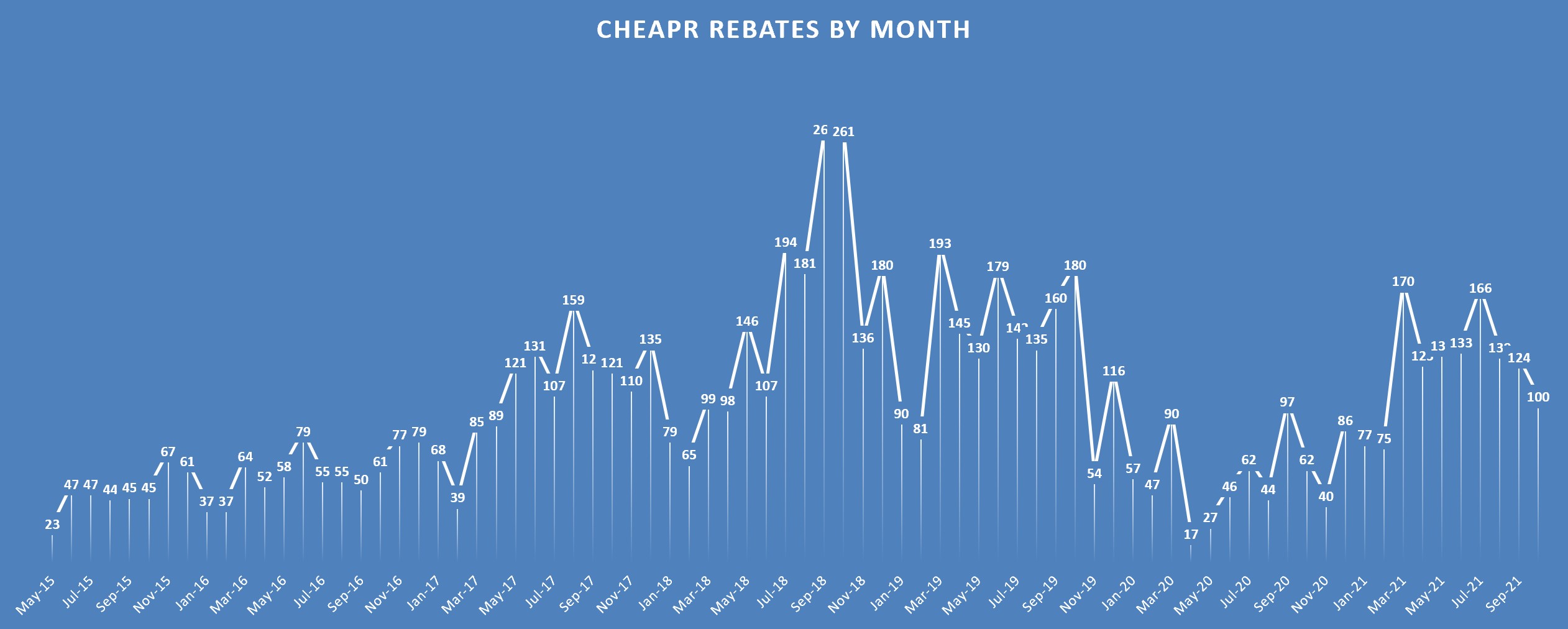

CHEAPR October Update

Rebates Slip in October 100 rebates were awarded in October, down from 124 in September. Of these rebates, 1 was a Rebate Plus for a used Leaf. (There have only been 3 Rebate Plus awards … Read more

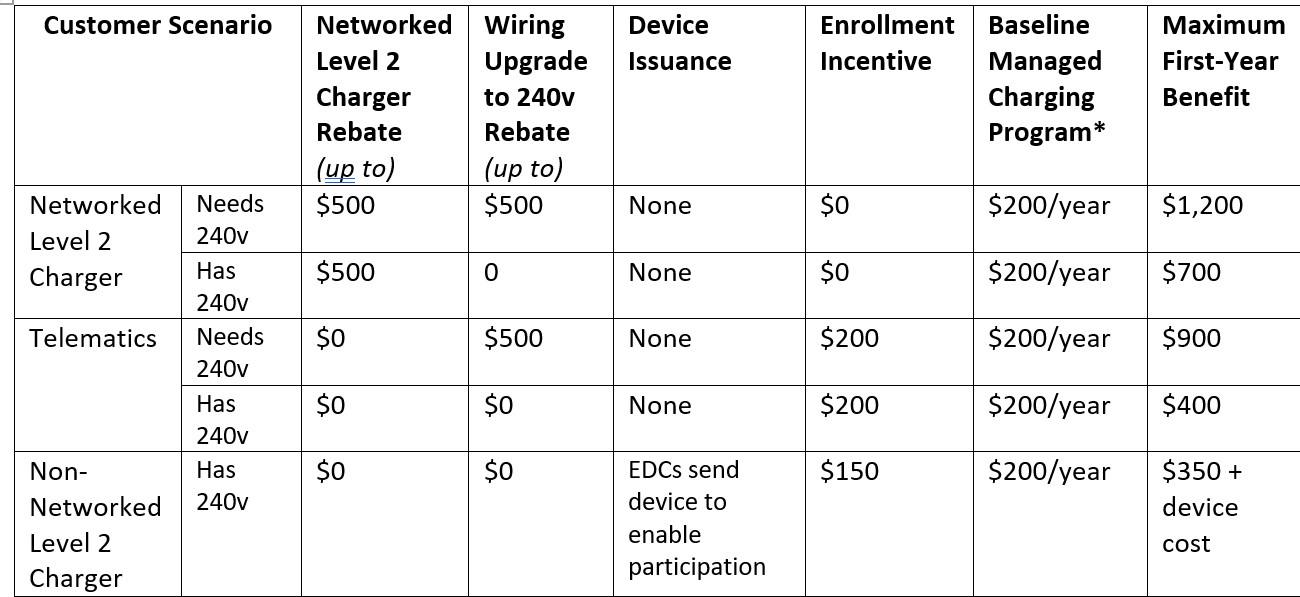

First Look at Managed Charging Incentives

Utility EV Rate Design – Proposed Details for Single Family Residences The grid at the top of this post comes from a filing by Eversource for its proposed EV charging incentive structure for single family … Read more

Governor Lamont Meets with EV Club

The photo above shows the governor meeting with Bruce Becker, Analiese Paik, and Barry Kresch of the EV Club of CT. This was a meeting about how the environmental community can more effectively mobilize to … Read more

Webinar – EV Purchase incentives and Free Charging

EV Purchase Incentives, EVSE (charging equipment) Subsidies, Free Charging This past Tuesday, July 27th, the EV Club presented a webinar jointly sponsored with Sustainne, LLC, Sustainable Westport, and the Town of Westport on how to … Read more

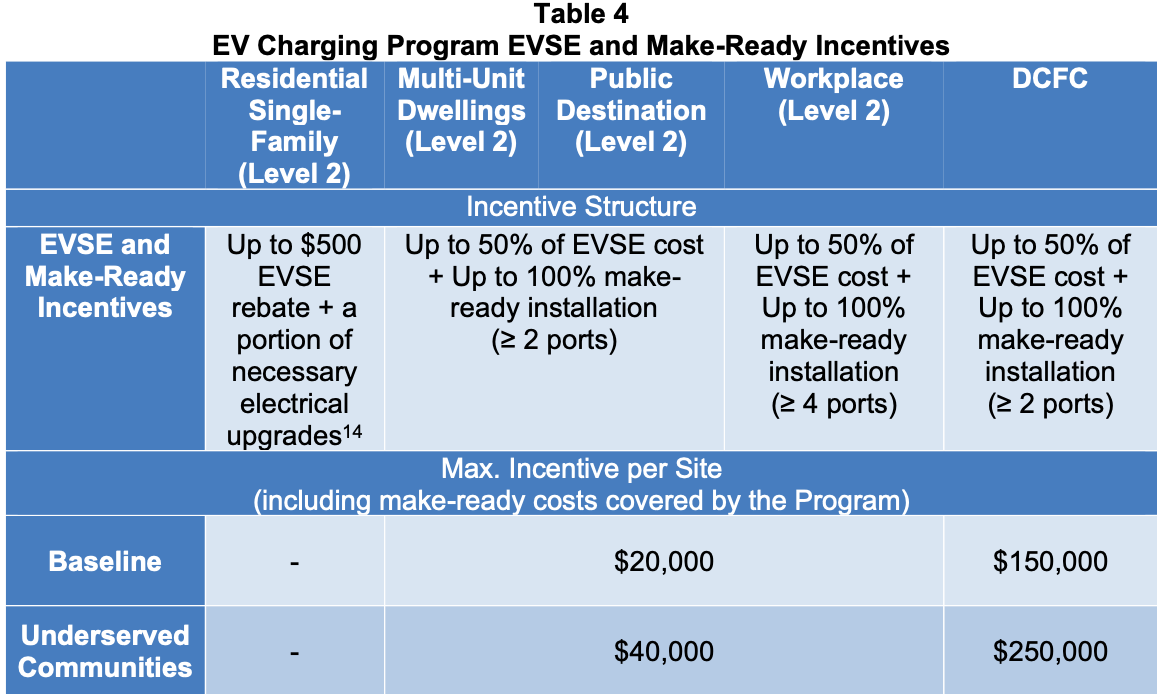

New EV Rate Design Released by PURA

Public Utilities Regulatory Authority (PURA) Directs Utilities to Offer EV Charging Incentives The final rate design adjudication was released on July 14th. Even though it is the final version, it actually isn’t quite final yet. … Read more

New EV Rate Design – Final Adjudication from PURA

The Public Utilities Regulatory Authority has released the final version of the EV Rate Design This program provides incentives for off-peak and managed charging, subsidies for EV chargers, and make-ready (bringing the electricity to where … Read more