Higher Incentive Levels, Low MSRP Cap, New Income-Limited Incentives

Note: This page is updated to note that the new incentive levels have been implemented as of June 7, 2021. The CHEAPR home page has been updated but we think the explanation below is clearer. If you do look at the CHEAPR page, please ignore the $9500 incentive headline. Nobody will get that level of incentive. It would only apply to an income-limited individual buying a fuel-cell vehicle this year, which is ridiculous since there aren’t any fuel-cell vehicles for sale in the state, and how would an income-limited individual afford an expensive fuel-cell vehicle.

An updated set of rules was adopted by a 6-3 vote of the CHEAPR board that supersedes the last rule change made in October 2019. Here are the most relevant changes:

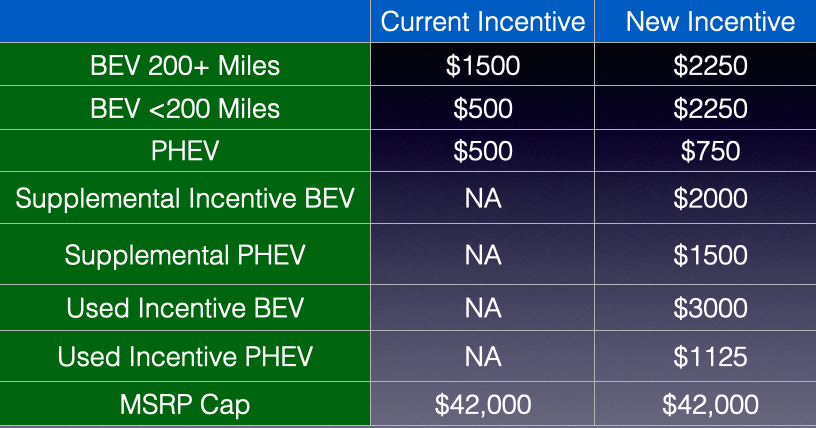

BEV = Battery Electric Vehicle, PHEV = Plug-in Hybrid Electric Vehicle, MSRP = retail price

Major Changes

- No difference in incentive levels based upon EV range.

- Higher incentive levels for the remainder of 2021.

- New income-limited incentive for used EVs

- New income limited supplemental incentive for new EVs

- Likely effective date is on or about April 1.

There is no longer a difference in the size of the incentive as it relates to the range of any given BEV. Incentives are higher across the board. The MSRP cap was left unchanged at $42,000. There are new income-limited incentives for used EVs and a supplemental incentive for new EVs. The supplemental gets added to the base incentive for qualifying income-limited individuals buying a new BEV or PHEV. There is no MSRP cap for a used EV.

The CHEAPR incentive limit has been increased to twice per driver per lifetime. And the clock resets as of June. If you already received a CHEAPR rebate before then, you are entitled to two more. (It is different than the federal tax credit which can be used each time someone buys or leases a new EV.)

Other CHEAPR Program Details

There is still a fuel cell incentive and the MSRP cap for an FCEV is still $60,000, though there is none of that type of vehicle being brought into the state presently.

Dealers receive an incentive of up to $125. This, once upon a time, was higher. DEEP, in its analysis for its EV Roadmap, questioned whether the dealer incentive accomplished its objective because most of the time it was not being passed along to the salesperson, which was the basic idea. However, it remains in this reduced form.

Income-Limited Incentives and Eligibility

The incentive for a used EV applies to purchases from a licensed dealer. This applies to any dealer of used cars, not just new car dealers that also sell used vehicles. It does not apply to private sales.

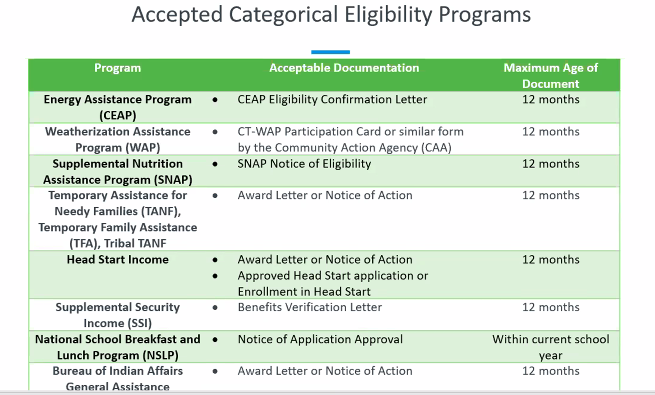

An individual’s eligibility for the income-limited incentive is determined by whether that person is already participating in certain assistance programs. Administratively, this is simpler than performing an income verification, but it still takes a few steps and involves a lag in receiving the money. These are the programs that are determinative:

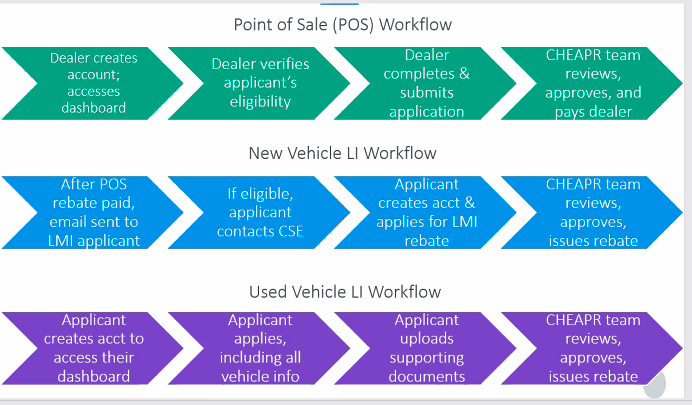

Unlike the way the primary part of the program works, where it can be cash on the hood, the buyer completes an application to confirm eligibility based on one of these programs. DEEP estimates that it will take about a month to process the paperwork at which point a rebate check will be issued. This process can be done online (desktop or mobile) or via postal mail. This is the workflow:

Since nobody wants an applicant to get a surprise denial, DEEP promises outreach and education so that buyers understand what is involved and whether they qualify before filling out the application.

Incentive Structure

As noted in the table at the top of the page, someone buying a new BEV will receive a $2250 incentive. However, the way it is actually structured is that the base incentive of $1500 from the current program is actually retained and a “stimulus increase” of 50% is added to it. This additional stimulus is earmarked for calendar 2021, funds permitting. It will be tracked and reviewed regularly. This is why you get that odd $1125 number for a used PHEV. The base is a more neatly rounded $750. Each incentive size will then revert to its base level in 2022. We will update our information as it gets confirmed closer to the end of the year.

Start Date

The changes take effect as of June 7th, 2021. The income limited used and supplemental incentives are now ongoing, but the higher incentive levels may revert to the old levels at the end of 2021.

Our Take

The Connecticut EV Coalition made a proposal to the board that would have raised the stimulus to $2500 for BEVs and the MSRP cap to $50,000. The incentive including the stimulus adder is close to our proposal but the MSRP cap remains at a level that excludes too many vehicles. According to Cox Automotive, the average cost of an EV is $55,600. MSRP caps exist in other states but at much higher levels: MA – $50,000, NJ – $55,000, NY – $60,000. Given that the program was about 70% underspent in 2020, we expect it will underperform in 2021, though to a lesser degree.

We like the introduction of the equity aspect of the program, particularly the used EV incentive, as this market is not well-developed.

This structure of an incentive plus a stimulus adder is not the most consumer-friendly formulation. This allows the incentive to revert to a lower level after this year without making a formal change to the program. It is administratively convenient, but it has the potential to be confusing. To the consumer, it will still be a change. We think the incentive should be the incentive and if it needs to be changed, it needs to be changed.

The fuel cell incentive is there because the state is trying to be supportive of this industry. We are not sure if there will be a compelling and cost-effective case for hydrogen in light-duty vehicles, especially green hydrogen. Be that as it may, our main issue with this is the way it has consistently been used as a misleading headline. It has now been made even more misleading.

Rivian, most Teslas, Hummer EV etc will not be eligible for this incentive. It will apply to the Tesla Model 3 and few other EV. The fuel cell incentive and the MSRP cap for an FCEV for $60,000 is a gift to the hydrogen fuel cell lobby. No one buys FCEV cars in CT. The income-limited incentive was obviously designed by persons who are out of touch with lower income persons. Low income persons DO NOT buy electic vehicles. EV are typically bought by upper income and wealthy persons. Low income persons buy much older cars, with significant mileage. Does not make any sense.

I’m confused – what is the supplemental incentive of $2500 for a BEV? Who receives that? Is that just for anyone who’s on the income limited list?

Also can anyone qualify for the used BEV incentive regardless of income? Thanks

There is a supplemental incentive for a BEV of $2000 that is restricted to income-limited persons. The definition of income-limited is determined by participation in at least one of the public assistance programs mentioned in the post. The used incentive is similarly only for income-limited individuals.

The club is trying to convey information about the program to the public since there is precious little of it on the CHEAPR website. We are not on the CHEAPR board. If you want to say something to them directly, this is the contact email for the program: cheapr@energycenter.org. This email goes to the consultant that has been engaged by DEEP to run the program.

I understand you are not the board and dearly appreciate both your advocacy and willingness to answer our questions since the CHEAPR board seems rather incompetent and unwilling to release information in a timely manner. But hey, it’s not like that’s their job or anything ;-).

So if I were to consider a used Hyundai Kona EV later this year, what would the rebate for this be based upon the new rebates? Thanks!

It would be $3,000 IF you qualify as an income-limited individual based on the chart that is reproduced in the post, which includes receiving supplemental social security or food stamps, for example.

Do the premium paint and tires count toward the 42,000 limit?

The incentive is based on the base trim level price. Premium paint, etc is not going to affect it.

Final price? Or MSRP from manufacturer?

So if the dealer sold a 46k car for 41k, then charged a 5k doc fee, would that be a legal loophole?

The determination is made by MSRP and there is a list of pre-approved makes/models on the CHEAPR website. On the other hand, you can add options to the car that brings it above the $42K and that is ok. Anyway, the safest best is to check the website for the EV you are considering.

The MSRP cap should be raised. It makes no sense at $42,000. I’d love to buy a Model Y long range this year. The state should be making EV adoption easier, this move doesn’t do that.

That’s a bummer. I was looking to buy a new VW I.D.4 but the incentives would rule out all but an absolute base model with cloth seats.

We feel your pain. The cap is too low!