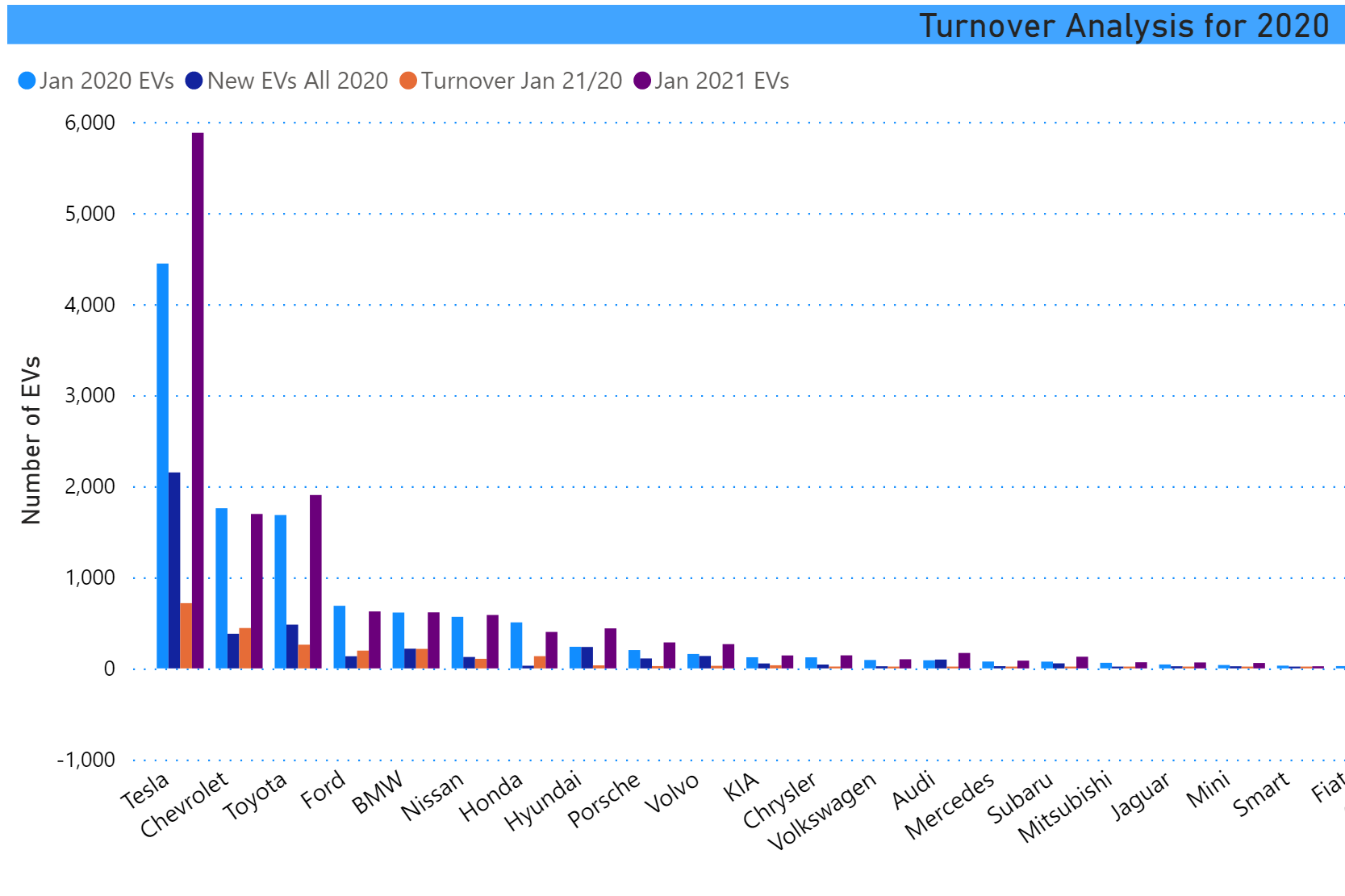

2020 – Turnover And Internal Dynamics of EVs in CT

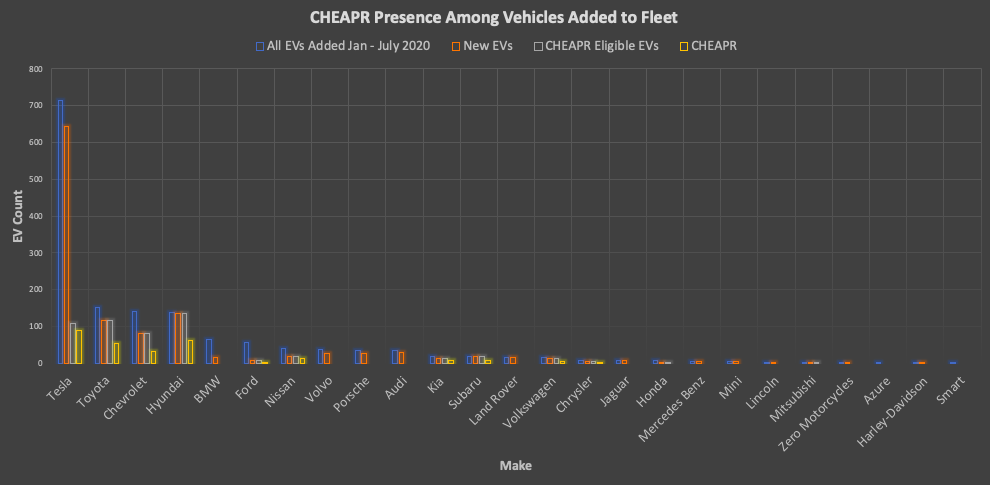

The Equivalent Of 52% of EVs Added To The File in 2020 Turned Over EV registrations in Connecticut increase 18.2% in 2020, a not great number in a very difficult year. However, as difficult as … Read more