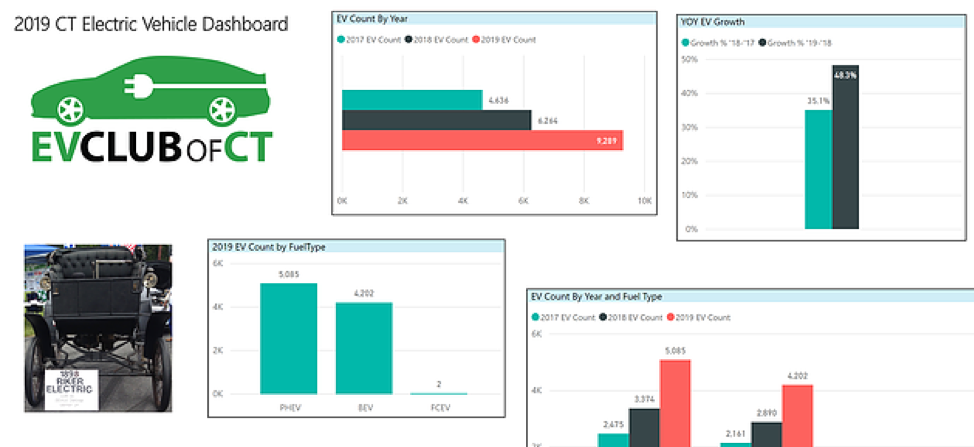

EVs in CT – Where Are We, How Far To Go

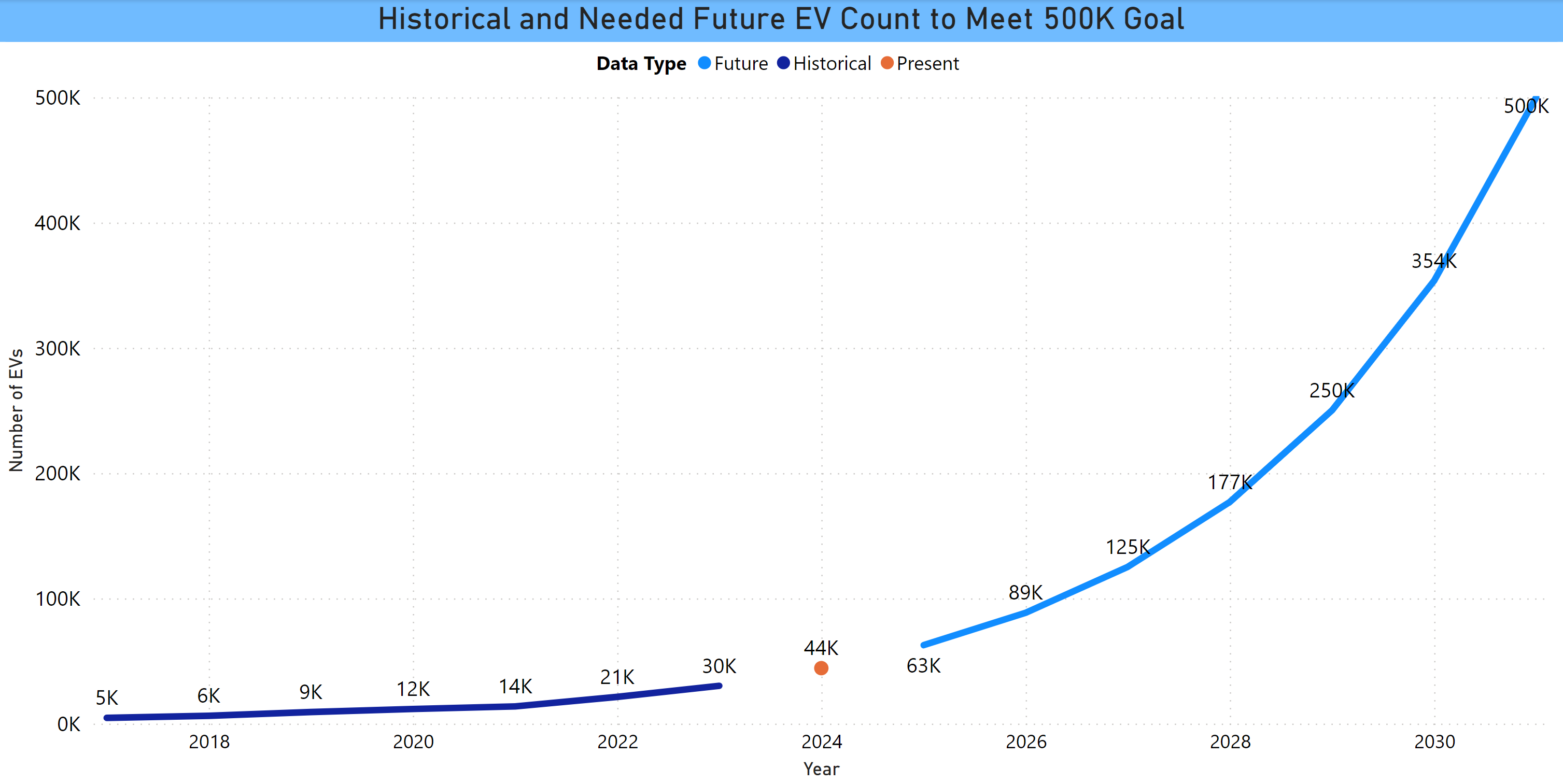

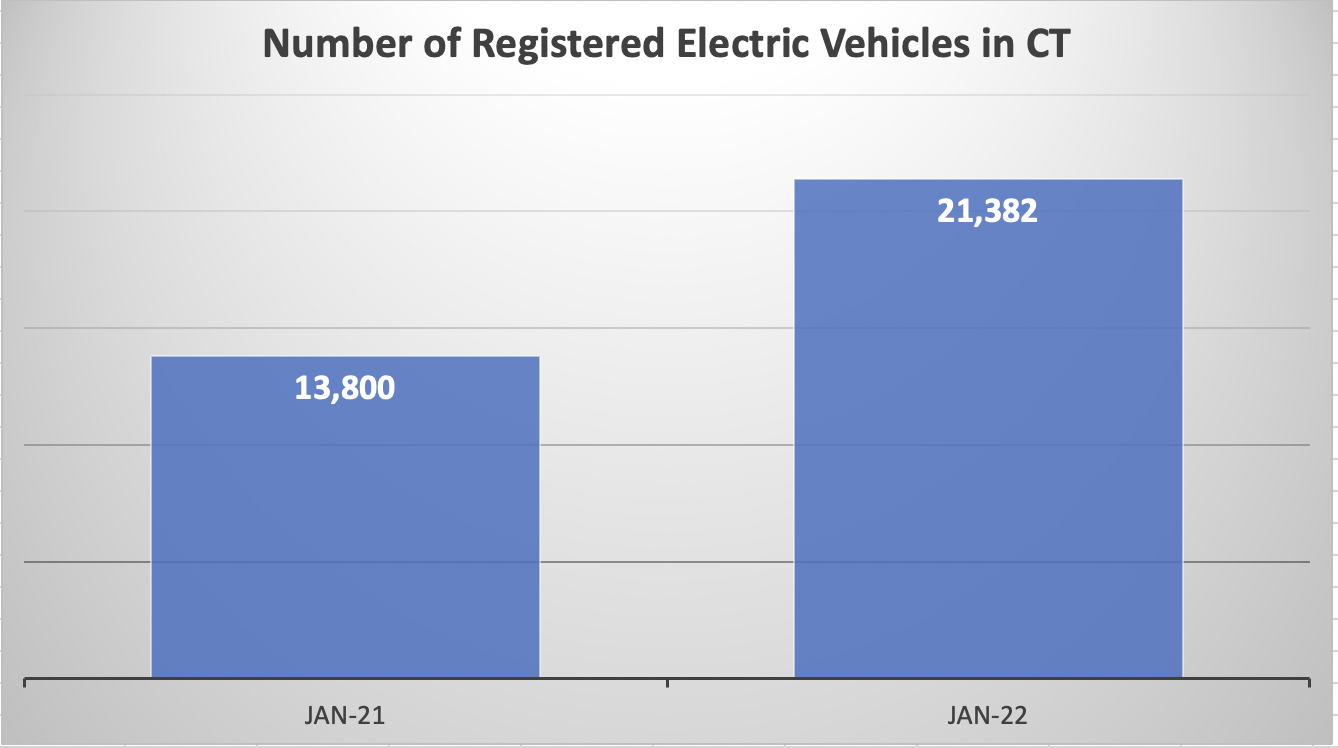

A 47% year on year increase in Registrations Still Leaves Us Playing Catch Up As we recently published, there are 44,313 registered EVs in CT. This includes BEVs, PHEVs, eMotorcycles (eMC), and Fuel Cell (FCEV). … Read more