CHEAPR Rebates Up as Car Sales Plummet

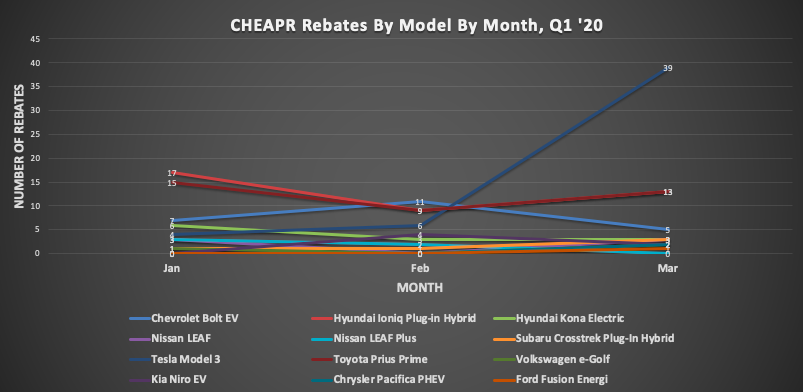

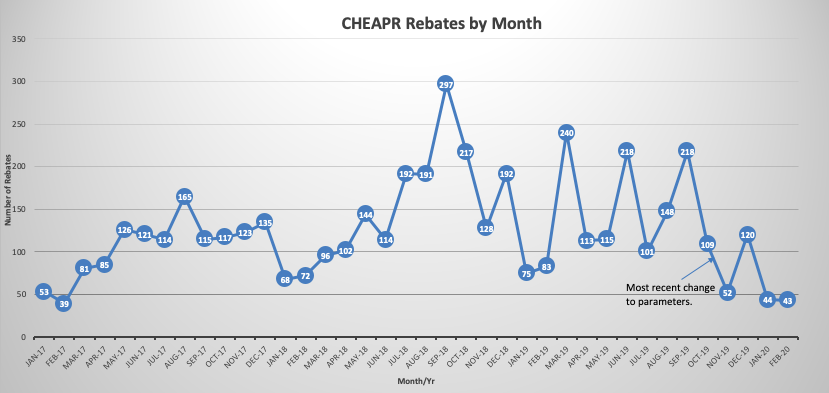

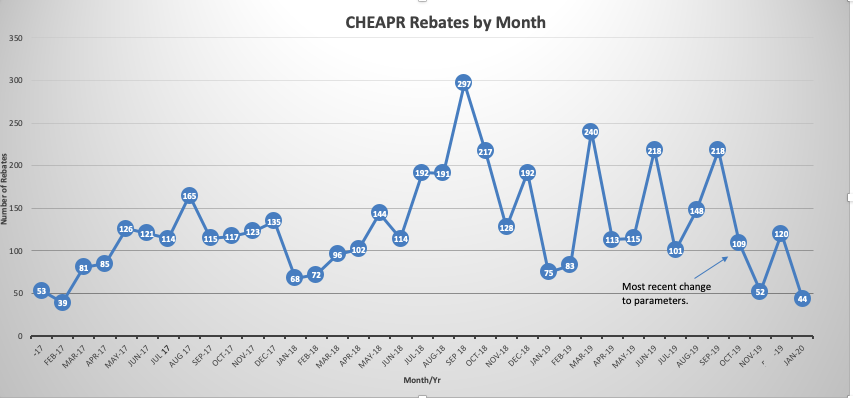

First Quarter Sales Results Were Terrible for the Industry, but a Sliver of a Silver Lining for EVs The first-quarter economic data were just released and as bad as expected (GDP down 4.8%) with worse … Read more