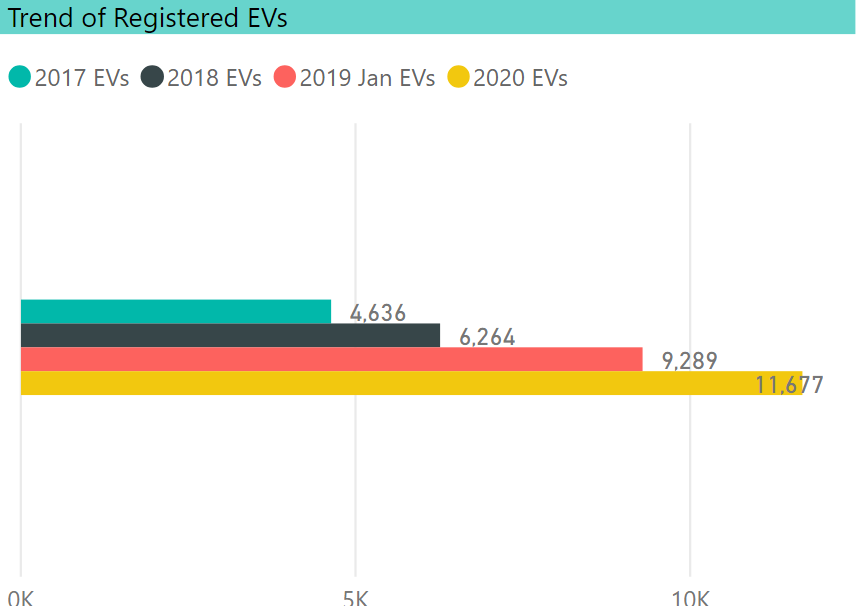

EV Dashboard Update – Jan 2020 Data

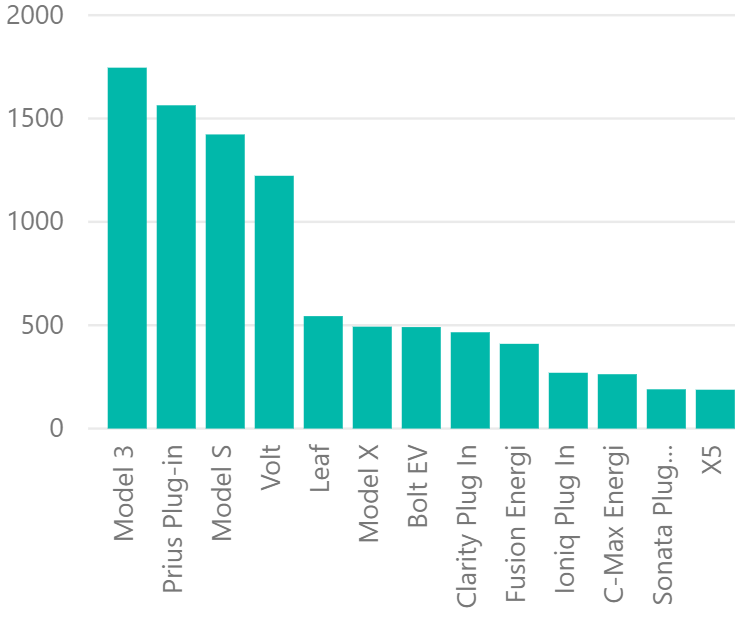

BEV Registrations Move Ahead; PHEV Growth Soft In response to our standing Freedom of Information Act Request, the CT Department of Motor Vehicles has provided the EV Club with an updated file of EV registrations … Read more