PURA and United Illuminating to Review New EV Charging Incentives with Club

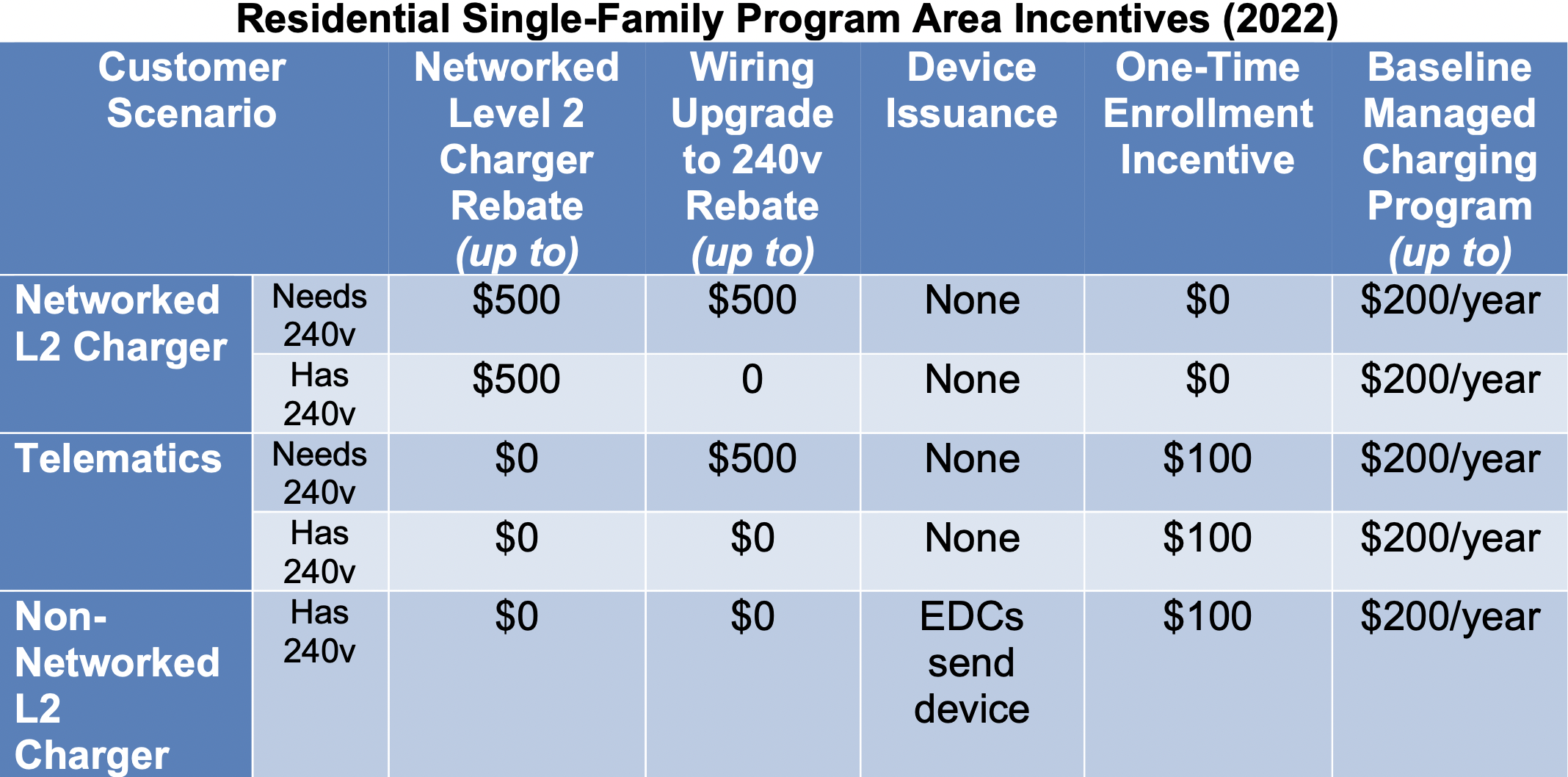

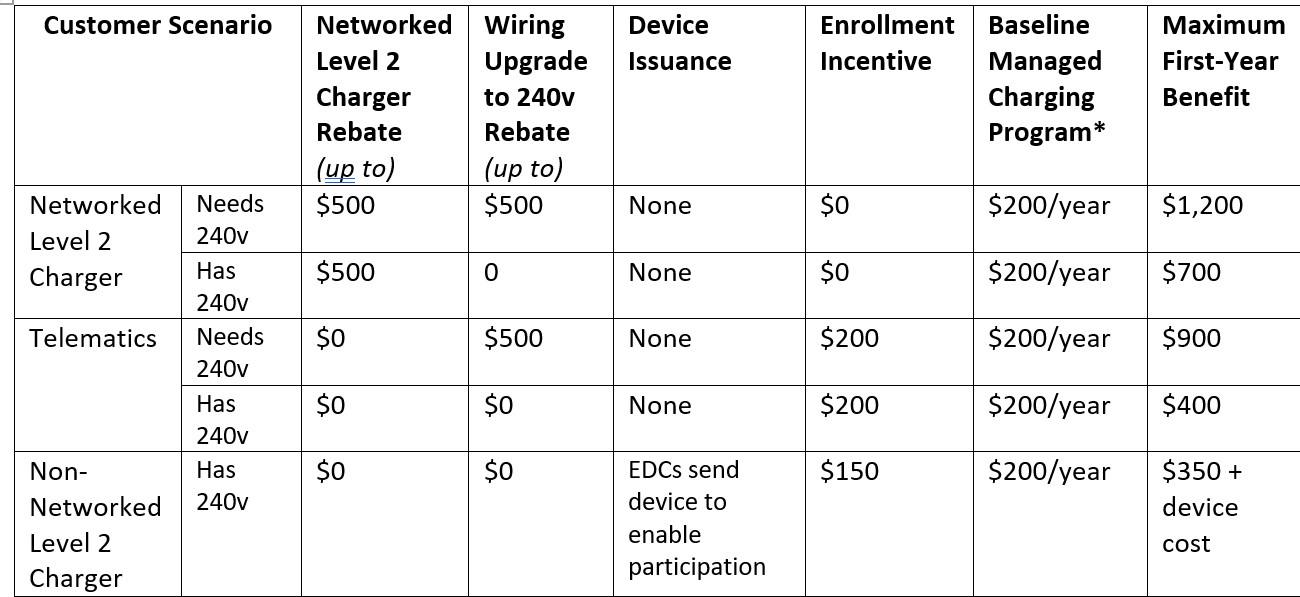

Post by Barry Kresch All are welcome to our virtual meeting on January 25th at 7 PM to hear and ask questions about the new incentive program for EV charging to be offered by the … Read more